Hong Kong vs Singapore: No zero-sum game

Pandemic-related restrictions have dented confidence in Hong Kong as a private equity hub, while Singapore is on a roll. But gains for one don’t necessarily translate into losses for the other

When Apollo Global Management tasked Matt Michelini with overseeing its growing Asian business, internal discussions were held as to where the regional head should sit: Hong Kong or Singapore?

Speaking at the AVCJ Forum last year, Marc Rowan, the firm's co-founder and CEO, wryly noted that he advocated for Singapore – only for Michelini to choose Hong Kong. Today, though, Michelini runs Asian operations out of Singapore, having concluded that Hong Kong's pandemic-related entry requirements were not conducive to a role that involves regular intra-regional travel.

"Doing three weeks of hotel quarantine every time you return to Hong Kong just didn't make sense. He couldn't just sit there while everyone else was travelling," said a source close to Apollo.

This should not be read as a firm-wide commitment to Singapore at the expense of Hong Kong, the source added, noting that Apollo recently signed a new lease that doubles its office space in Hong Kong. It operates under a dual hub system, with more than 30 people in Hong Kong and around 25 in Singapore. Apollo didn't respond to a request for comment.

Hong Kong's supposed fall from grace as a financial centre has been widely documented, punctuated by the largest annual population contraction on record and widespread frustration – not least within the business community – at protracted travel and distancing restrictions. In Singapore, meanwhile, a sharp influx of monied migrants has ramped up the cost of living as well as the city-state's profile.

Studying these dynamics in the context of Asia's private equity industry invites binary interpretations but they often fall short, not least because events are shaped by an assortment of contributing factors. Moreover, decisions to relocate (or not) are often personal, rather than the result of top-down corporate diktats, and explanations can be meandering, defensive, and emotional.

Hong Kong's pandemic-related policies have tested the patience of private equity players, but ultimately, they are the by-product of a broader business concern: whether mainland China, with its commitment to "dynamic zero COVID" and rising geopolitical issues, is accessible and desirable.

Dwindling deal activity in China is already prompting career reassessments. "We are getting inquiries from people who have been let go or whose strategies have changed, or who see the writing on the wall amid a slowdown in the deals they are able. They are asking about opportunities in Singapore," said Michael Di Cicco, a senior client partner at recruitment consultant Korn Ferry.

Another factor is a shift towards localisation – opening more satellite offices and redeploying headcount from regional hubs or making additional hires – that emerged as a trend several years ago and has been accelerated by the pandemic, according to one Hong Kong-based LP.

"Ten years ago, a new entrant would choose Hong Kong, it was a no-brainer, an obvious first office location. Today, you are at least going to ask the question. Maybe Hong Kong still makes sense. It depends on who you are, how big your team is, and what you're actually doing," the LP said.

"One thing we can say for sure is that everyone wants to decentralise more. It's not just Singapore. People might beef up their team in Sydney or add headcount in Seoul and Tokyo. That's the reality."

Staffing up

Private equity industry participants moving or expanding into Singapore fall into three broad categories. First, numerous China-focused managers are responding to challenges at home by trying to do more China-relevant deals overseas, with Southeast Asia typically high on the agenda.

This is not restricted to venture capital. Primavera Capital Group opened a Singapore office at the end of last year, while Hillhouse Capital Group has moved senior professionals into local premises it has retained for some time, according to two sources familiar with the situation.

FountainVest Partners is also thinking about establishing a base in the city-state. A source close to the firm observed that "China nexus" has always been part of the investment mandate and cross-border transactions are becoming increasingly prominent in overall deal flow. The FountainVest portfolio stretches from New Zealand to Europe and some companies have a presence in Singapore.

Second, some global and pan-regional managers that already have a presence in Singapore are adding more resources. Emphasis varies markedly. Bain Capital currently has no PE investment professionals in Singapore, though there are some under the credit strategy, and CVC Capital Partners has a larger headcount in Southeast Asia and Australia than in Greater China.

It is worth noting that Southeast Asia features less prominently in Bain's portfolio than other geographies, while the region has produced some of CVC's biggest recent wins. The Asia heads or co-heads of CVC, TPG Capital, and Permira all sit in Singapore, unlike most of their regional peers. In each case, choice of location is said to have been driven by individual preference.

Third, LPs are staffing up in Singapore, from fund-of-funds to pension funds. Some of this is strategic – Ontario Teachers' Pension Plan (OTPP) said last month that it expects Singapore headcount to exceed Hong Kong; Alberta Investment Management Corporation (AIMCo) said in June that geopolitical concerns led it to choose Singapore – and some personal.

Often, in the absence of a senior hire or a new office opening, transitions are gradual or barely noticeable. "A year ago, people would turn up, get a serviced apartment, and say they were staying for a couple of months. As time went by, they bought cars, started renting apartments, and brought their kids over," noted Thomas Lanyi, a Singapore-based managing director at CDH Investments.

Kyle Shaw, a managing director at ShawKwei & Partners, to some extent fits this profile. Overseeing an industrial manufacturing portfolio that has become increasingly Southeast Asia-centric, he gravitated towards Singapore as Hong Kong's pandemic policies persisted. A temporary move subsequently became permanent. ShawKwei retains a Hong Kong office.

"I lived in Hong Kong for 30 years, but I have no reason to be there," Shaw told AVCJ in September. "I've not enjoyed it the last couple of years. I have more business to do outside of Hong Kong and it is easier running things from Singapore."

Structural dynamics

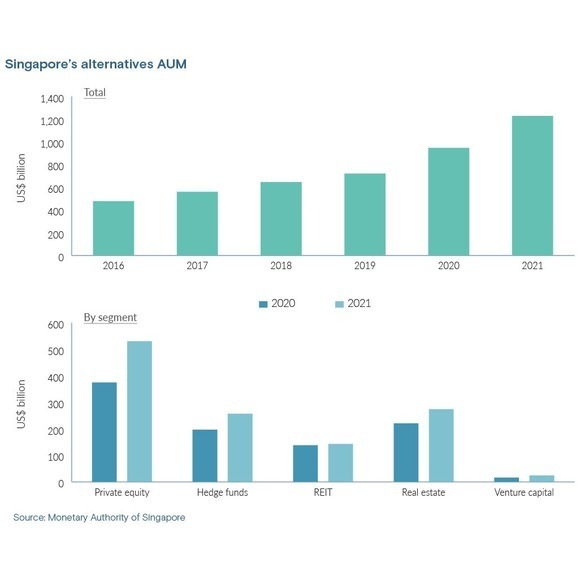

In the past three years, alternative assets under management (AUM) in Singapore have nearly doubled, reaching SGD 1.23trn (USD 877bn) in 2021, according to the Monetary Authority of Singapore (MAS). AUM for private equity alone was SGD 541bn last year, up from SGD 375m in 2021, while the venture capital total rose from SGD 16bn to SGD 24bn.

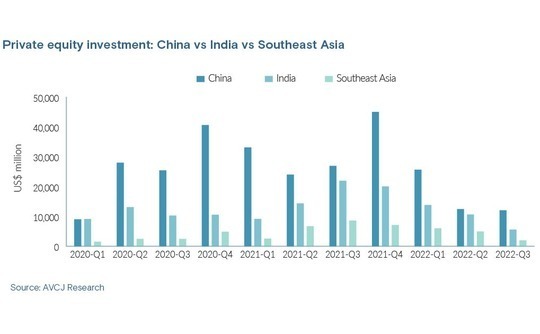

Much of this is tied to the growing popularity of Southeast Asia as an investment destination – and, to some extent, appetite for India as well, given Singapore's role as a nexus for South Asia.

More than 40% of capital deployed in Asia over the past decade went to China, but Southeast Asia and India are growing faster, albeit from much from lower bases. Investment in Singapore and India was 2.25x and 3.5x greater 2017 and 2021 than in the five years prior.

"

Investor relations and family office professionals are also in demand – the former to cover Southeast Asia's growing LP universe and the latter to serve the influx of wealth. Leung estimates that Singapore has seen twice as many family office setups as Hong Kong in the past 24 months.

These sentiments are echoed by Nainesh Jaisingh, Singapore-based CEO of Affirma Capital, who claims to have "never seen proliferation like it." He notes that Singapore worked hard to create a private banking hub, which now appears to be paying off, but private equity is the bigger catch.

"Private equity can have a huge impact on Singapore in areas where it wants impact," Jaisingh explained. "Once you get private equity managers, you get accountants, lawyers, consultants, and investment bankers – exactly the sort of high-end professional jobs Singapore would like. The whole ecosystem is stimulated by private equity, and it becomes self-perpetuating."

The jurisdiction has become a popular destination for regional platforms that sit in between master or feeder funds and the special purpose vehicles (SPVs) used to make investments. Managers must incur costs to establish substance, but this leads to exemptions from tax at the fund level and access to the double taxation agreement (DTA) network.

A more recent addition is the variable capital company (VCC), a highly flexible version of the private equity limited partnership intended to encourage managers to domicile their funds in Singapore.

Sanjay Gujral, chief business officer at Everstone Group and chairman of the Singapore Venture Capital & Private Equity Association (SVCA), believes strong regulation and local infrastructure, political stability, and geopolitical neutrality have all contributed to Singapore's rising private equity AUM. But he also highlights the role of structures that are tax efficient and internationally accepted.

"There have been concerns around tax arrangements in certain jurisdictions, and with that, there has been an increasing transition to legitimate jurisdictions that enable people to have an onshore presence," he said. "That has been a trend over the last decade and Singapore has benefited."

Hong Kong has been playing catchup in almost every respect – extending a fund-level tax exemption to include private equity, updating limited partnership legislation, and addressing fears that carried interest could be taxed as income rather than capital gain – yet there are still holes in the system.

For example, carried interest is subject to a 0% levy, but few GPs are taking advantage of it. Darren Bowdern, a tax partner at KPMG, offers three explanations. First, the Inland Revenue Department insists that carried interest must flow through Hong Kong to qualify and most PE firms aren't set up in this way. Second, some investment instruments – such as debt – are excluded. Third, uncertainty over qualification makes managers question whether the high level of disclosure is worth it.

"Even before COVID, we saw larger managers start to consolidate their investment holdings in Singapore – usually with a Cayman fund and a Singapore platform. There is a cost to doing this, with the minimum spend and a minimum amount of capital at the SPV level, but you know what is required to comply. Hong Kong isn't providing that certainty," Bowdern said.

"A lot of the compliance and reporting obligations, and the supporting infrastructure that goes with them, is increasingly being put in Singapore rather than here."

Message received?

The government recognises industry concerns, according to Duncan Chiu, member of the Hong Kong Legislative Council (LegCo) for the technology and innovation functional constituency. However, addressing them takes longer than in Singapore because the process is stakeholder driven.

"The Singapore government can push through legislation top-down and take more of a trial-and-error approach. In Hong Kong, when we talk about legislation it is bottom-up. We see a problem, raise it, the government does a consultation to see whether legislative change is necessary, and we discuss it in LegCo," he said. "Maybe there is more balance in the process."

Nevertheless, Chiu admits that Hong Kong can be too bureaucratic and would be helped by being "more willing to serve rather than see everything as black and white."

The need to reengage a disaffected international business community appears to have hit home. John Lee, the territory's chief executive, made several overtures to business in his annual policy address last month, and this was followed by financial technology event at which proposals were made to allow retail trading of crypto assets and a financial forum that saw mainland regulators reaffirm the importance of Hong Kong as their preferred international hub.

Senior PE executives who attended the forum offered mixed feedback. Andrew Li, head of Greater China at Advent International, said the tone was positive and there was a "clear message that Hong Kong is back." Another dealmaker, visiting from Singapore, noted that it's all very well trumpeting a Hong Kong rebound, but "I can still nearly hear a pin drop when I walk through Exchange Square."

Measures announced in Lee's policy address included the establishment of designated units to coordinate efforts to attract foreign companies and talent to Hong Kong, an HKD 30bn (USD 3.8bn) fund to co-invest in companies that set up local operations, work permit waivers for professionals who meet financial and academic criteria, and relaxed immigration policies for certain industries.

To Vincent Ng, a Hong Kong-based partner at placement agent Atlantic Pacific Capital, these measures demonstrate how the government has been "put on notice that it cannot just rely on the goodwill of China but must step up and win additional business." He expects more policies to follow.

LegCo's Chiu points to the crypto consultation and tax concessions for family offices – another policy address announcement – as evidence of material progress, adding that the government must more actively promote what the territory has to offer. This includes highlighting Hong Kong's strategic positioning within the Greater Bay Area and how foreign investors can capitalise on it.

As to the longer-term implications of the national security law, and what it means for governance and civil liberties in Hong Kong, he believes the relatively narrow application of the legislation will eventually become clear. "The government saying this isn't enough. Once people see the existing court cases and details of the charges, they will get more comfortable," Chiu observed.

Several industry participants also downplayed the impact of the national security law on the ease of doing business in the territory.

Swings and roundabouts

Singapore also faces challenges as it looks to build upon its private equity momentum. SVCA has made the development of local talent one of its priorities. A long-term work visa scheme was introduced in August, aimed at high-income-earning foreigners, but Everstone's Gujral observes that more must be done to deepen talent pools at entry and junior levels as well.

However, the most immediate issue confronting residents is limited resources. New arrivals have put housing supply under pressure: rents for private apartments rose 31% year-on-year in September, extending the streak of consecutive increases to 21 months, according to real estate portals 99.co and SRX. Finding places for children in local schools is also proving difficult.

"Everything from premium apartments to houses is going for 2.5x more than any previous peak," said Affirma's Jaisingh. "I don't think it's sustainable."

Government intervention is one possibility, especially if disquiet among Singapore nationals grows. Alternatively, the inflows could abate. Some Southeast Asia-focused managers openly question whether the bullishness of Chinese managers targeting the region will persist, given deals are fewer and smaller than in China and geographies are fragmented.

"You can't just send someone down from Hong Kong and expect them to get much done," said CDH's Lanyi. "Southeast Asia has become so popular among our peers from North Asia. This will put pressure on valuations, especially if some investors want to do deals purely to demonstrate their capabilities vis-à-vis LPs or the banking community."

It is unclear how any kind of rebalancing in Singapore will impact Hong Kong. Conditions may stabilise as restrictions ease, but complications around access to mainland China, and the availability of deal flow, remain in place.

"It is harder to recruit people who are not already in Hong Kong," said Di Cicco of Korn Ferry. "You can make the argument that now it's easier to get into schools and rents are coming down, and Hong Kong is re-opening. But if I'm in Hong Kong, my job is focused on China and I can't get into China, there are questions. People are trying to figure out whether this speaks to their long-term needs."

Leung of Egon Zehnder has also found it tougher to fill positions in Hong Kong, but the nadir came in the last three months of 2021 and the first three months of 2022. Meanwhile, he is receiving more enquiries from mainland-based talent open to relocating to Hong Kong.

No one interviewed for this story was willing to say definitively that Singapore would supplant Hong Kong as Asia's leading private equity hub. It has too many incumbent advantages, while North Asia is too big a market to ignore and too difficult to cover adequately out of Singapore, even if China is avoided or deprioritised for a period.

"Once it gets back to a level playing field, all the benefits of Hong Kong continue. Geographically, it's more central – Beijing and Tokyo are a long way from Singapore," said one investor relations professional based in Hong Kong. "A year from now, Singapore versus Hong Kong will go back to what it was before: something Singapore likes to talk about, and Hong Kong doesn't really care about."

To other industry participants, it has never been a zero-sum game or even clearcut rivalry. Chiu of LegCo describes competition between the two financial centres as healthy, with each pushing the other to improve its financial offering.

The matter of which jurisdiction would be the preferred location for an overarching regional platform is open for debate, but that debate is arguably negated by the growth in Asian private equity and the need for more people, more offices, and more local resources. While Hong Kong's pre-eminence might be questioned, that doesn't mean necessarily result in Singapore's elevation to top spot.

Standard Chartered Private Equity used to have offices across the region, including teams in Hong Kong that focused on China and Southeast Asia. After Jaisingh led a spinout that resulted in the formation of Affirma, the China team moved to Shanghai and Southeast Asia was covered out of Singapore. The Hong Kong office closed.

"Even then, I used to go to Hong Kong a lot because so many LPs were based there," Jaisingh said. "Now, we see the big names opening offices in Singapore or thinking about it. I miss the commercial energy of Hong Kong and I want to go back, but Singapore has positioned itself well for LPs and GPs."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.