Sport investment: Into the value chain

Investors are increasingly drawn to the structural nuances, sticky customer bases, and long tail of ancillary opportunities that exist around professional sports. Asia’s role is small but growing

Gujarat Titans won the Indian Premier League (IPL) at their first attempt in May as a commanding all-round display from captain Hardik Pandya helped thwart Rajasthan Royals in the final of cricket's most lucrative tournament. In addition to INR 200m (USD 2.4m) in prize money, they accrued significant brand equity – invaluable to an expansion team.

For CVC Capital Partners, which bought the Titans last year for INR 56.3bn (then USD 700m), the real payoff came a month after the final, when IPL announced the media contracts for 2023-2027. Disney Star and Viacom18 secured the television and streaming rights, respectively, for a combined USD 6.2bn. It was twice the size of the previous five-year contract.

"In IPL, like a couple of US sports, most of the revenues derive from a central pool comprising media rights that are auctioned off by the league," said a source close to the investment. "As a result, on-pitch performance doesn't drive outsize volatility in financial performance the following year. This means that owning a franchise is much closer to having a share in the league itself."

The private equity firm – which declined to comment publicly on IPL – has emerged as a prolific investor in the organisations that hold commercial rights to sports leagues, with exposure to rugby, football, and volleyball, chiefly in Europe.

IPL is the exception to the rule by virtue of its structural qualities, but CVC was also sold on the growth story. This sporting property is unique in Asia for offering emerging markets fundamentals and Western-style commercial viability: IPL has more than 230m TV viewers, an estimated 10m-plus subscribing streamers, and its media rights are worth more than those of the English Premier League (EPL).

Asia accounts for a tiny portion of global sports investment, which Pitchbook put at USD 50.9bn in 2021, up 56% year-on-year. An appreciation for the industry's resilience, as well as some pandemic-driven buying opportunities, have led global firms like Dyal Capital Partners and Ares Management to launch dedicated sports funds, while sector specialists grow in number and in assets.

"I can't think of a sport that isn't looking for capital right now. Wherever there is an opportunity to own a stake in the league will be very exciting to a private equity group," said Adam Sommerfeld, a managing partner at UK-based Certus Capital Partners, which advises on sports deals. Football takes up most of his time, but enquiries stretch from swimming to athletics to paddle tennis.

Lurking in the shadow cast by deals involving high-profile leagues and franchises, there is a long value chain extending from sport through media and entertainment. It is increasingly entwined with technology as franchises think about how to develop their fanbases and explore the full gamut of commercial opportunities. Investors of all types are getting involved.

"Barcelona love to say they have 800m fans globally, but they don't know who these people are and so they cannot monetise them," said Nikhil Bahel, a managing partner at Elysian Park Ventures.

"This is the evolution that is still to come – understanding your fan base, where they reside, the socioeconomic, age, and gender profiles. Maybe they aren't going to sell [Robert] Lewandowski shirts at USD 90 a pop to some of these, but they could start a small game for them."

Entry points

Elysian Park completes the loop that connects mainstream franchises, venture capital, and technology. It was originally the in-house accelerator of the LA Dodgers, a Major League Baseball (MLB) franchise controlled by a consortium with roots in finance and entertainment, and – together or separately – interests across basketball and football.

The firm divides its strategy into four categories – culture, health, technology, and commerce – which encompass the likes of content, esports, data analytics for training, sports betting, and financial technology. It can take ideas directly to different levels of Dodgers management.

Opportunities in this value chain are increasingly evident in Asia, where appetite for direct investment in sport is often constrained by limited scale in developed markets and governance and access issues in emerging economies.

"When I started looking at these trends, India was so nascent in terms of sports. You couldn't invest in the same way as people were investing in the US and Europe," said Anand Krishnan, founder of FidelisWorld, who previously worked on sports franchise deals as CEO of Dubai International Capital.

"You had to go stage-by-stage, and the best target was the value chain – companies that were supporting these teams and leagues – because you could create value regardless of what happened to the sports. We thought the space would grow and that's exactly what happened. Now, we are seeing large private equity players have started investing in teams in Asia and India as well."

Krishnan questions the valuations paid for assets like IPL franchises, not because he doubts the upside being created by a rising middle class, but because he's uncertain how long it will take for expectations to meet reality. FidelisWorld invests in India-centric, digitally-enabled businesses. Of the six Fund I investments, three were directly related to sports; each was exited to a private equity buyer.

They include Sportz Interactive, a Mumbai-based sports data specialist picked up in 2016 after its US-based parent was acquired by Vista Equity Partners. The company provides data analytics and visualisations – and related social media products – to the likes of FIFA, Bundesliga, Facebook, and Fox Sports, leveraging local technical expertise and a lower delivery cost than in the US and Europe.

FidelisWorld is currently in the market, seeking up to USD 300m for its second fund. Australia-based XT Ventures, established last year by Craig Lambert, who previously ran local accelerator Slingshot, is raising AUD 50m (USD 32m) for its first. XT's strategy involves using the sports ecosystem as a proving ground for fitness and wellness technologies that are then taken into the consumer realm.

"At Slingshot, we worked with corporates looking for innovation in product development. Sports franchises want to innovate in how they connect with fans and support athletes. We are looking for investments that are aligned to solving those problems and then we drag them out of sport and bring them to consumers," said Lambert. "We look at sport as a laboratory, like the new NASA."

Follow the money

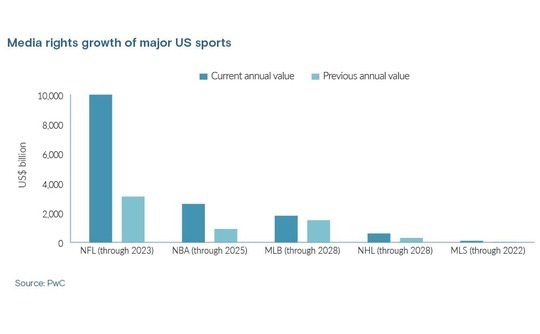

The starting point for private equity investors in sports franchises remains media rights – and they echo the sentiment about drawing comfort in revenue streams that will not fluctuate wildly based on on-field performance. In this respect, US franchises are a good fit: popular across cycles, robust distributions from centralised media rights pools, and no threat of relegation.

Ian Charles, co-founder and managing partner of Arctos Sports Partners, which takes minority stakes in sports franchises across the major US sports leagues – basketball (NBA), baseball (MLB), American football (NFL), hockey (NHL) and football (MLS) – previously established secondaries advisory business Cogent Partners. He got into sports with a view to providing liquidity for franchise owners.

Charles describes sports franchises as a blend of core infrastructure, core real estate, and growth equity – so stable that he wouldn't be surprised if some pension funds eventually make direct investments. For now, they use Arctos as a proxy. The firm closed its debut fund on USD 2.1bn last year (USD 3bn, including parallel vehicles) and is said to be targeting USD 2.5bn for its second.

Unlike Europe, there are strict rules on leverage levels and ownership. It is only in the last three years that NBA, MLB, NHL, and MLS have allowed private equity into franchises. Jeff Moorad, CEO of MSP Sports Capital, which invests in sports teams and leagues on a deal-by-deal basis, notes there is still a preference for individual ownership and NFL remains off limits to funds and institutional investors.

Investors link the regulatory shift in the US to a transition towards more sophisticated ownership – characterised by a surge in new owners from the technology and finance sectors – that has swelled asset value and a recognition of the need for growth capital and liquidity.

European football is viewed in a different context. Capital has poured into clubs, but not necessarily from private equity. AC Milan, which Elliott Management acquired from a distressed seller in 2018 and exited to RedBird Capital Partners in August, is an unusual case.

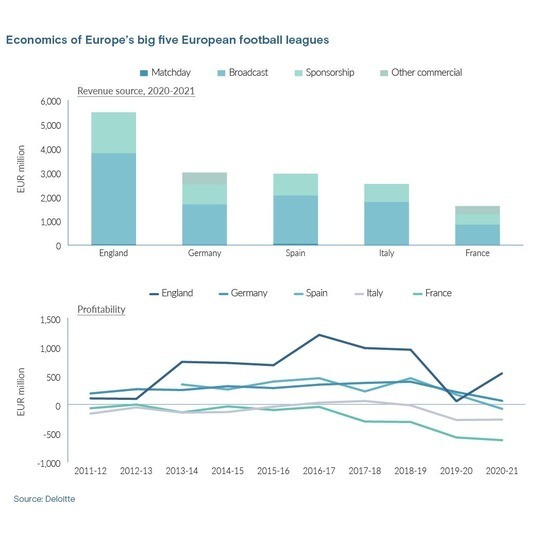

"A lot of clubs are cash flow negative, and I don't think they are suited to the private equity model. Leagues are almost the complete opposite. You invest them in them because you believe in the value of the broadcasting rights and those are much more predictable, profitable, and cash generative," said Nikos Stathopoulos, a partner and chairman of Europe at BC Partners.

Since the start of this year, the Spanish and French leagues have closed deals with CVC, while their counterparts in Germany and Italy are said to have revived talks with private equity investors in recent months. This activity comes as many clubs are still struggling to repair the financial damage wrought by COVID-19 when stadiums were closed to spectators for months on end.

Systemic flaws?

There are ways to address the risks that come with investments in clubs. Sommerfeld of Certus Capital notes that when PE firms do participate, deals are highly structured. "There might be a tiny slug of equity, but the rest is preferred equity or debt," he said. "Otherwise, they say it's too risky."

Second, investors can target multi-club platforms with diversified revenue streams. Fenway Sports Group, owner of MLB's Boston Red Sox, EPL's Liverpool, and NHL's Pittsburgh Penguins, and City Football Group, a series of football clubs built around the Manchester City brand, are among the best-known platforms. Their backers include Arctos and Silver Lake, respectively.

MSP Sports Capital is doing something similar in collaboration with David Blitzer, head of The Blackstone Group's tactical opportunities group and a minority owner of a string of US franchises. They have accumulated controlling stakes in four mid-size clubs in Germany, Spain, Portugal, and Belgium, with a view to realising sharing talent and resources.

"It's a Manchester City-like model but one we think makes extraordinary sense. We have already seen advantages through cost synergies. For example, instead of four sporting directors overseeing the clubs, we could have two," said MSP's Moorad.

This trend extends into Asia as well. Hiroyuki Ono, a Singapore-based partner at ACA Investments, which is part of Japan's ACA Group, led the acquisition of Belgium's KMSK Deinze earlier this year with a view to creating a multi-club platform and cultivating a Southeast Asian fanbase. For reasons of cost, he is looking beyond the big five leagues of France, Italy, Germany, Spain, and England.

There are opportunities to buy into clubs and leagues within Asia, but challenges abound. An explosion of activity in China several years ago came to nothing as assets proved hard to monetise. Investors claim the domestic industry has since become so politicised it is virtually inaccessible.

Krishnan of FidelisWorld notes that "every league in India has come to my office at one stage," but business models are often flawed. He believes kabaddi has huge potential, but Disney Star has a majority interest in the local league, which would create conflicts around media rights. Other sports have been compromised by feuds between rival administrative bodies and multiple products.

Meanwhile, a tennis league went bankrupt because the operator agreed to underwrite the risk for each of the four franchises, according to a source close to the situation. It was called upon to cover the shortfall when the franchises were unable to pay the players' appearance fees.

In Australia, questions about governance and transparency are few, but investment upside can be influenced by market size. Supercars Championship, which is responsible for a series of domestic touring car events around the country, spent 10 years in the Archer Capital portfolio before it was eventually sold to a strategic buyer late last year at a discount to the GP's entry valuation.

Supercars remained profitable throughout the ownership period, but Archer invested in the expectation that the media rights would continue to appreciate every time they came up for renewal. This didn't happen because of a shift in consumption habits, according to Tim Miles, a managing director at Miles Advisory Partners, who advised on both Archer's entry and exit.

"There was a move from free-to-air TV to streaming services, which meant the free-to-air package wasn't as valuable as before because there were fewer eyeballs and therefore less sponsorship," he explained. "There was still more value in free-to-air, so it didn't rebalance, and Archer couldn't move it to a service like Amazon because the reduced profile would have been damaging to the sport."

Miles contrasts the Supercars situation with Dorna Sports-owned Moto GP, which is a global series of racing events. He contends that Dorna could transition to a low-price streaming model, given its audience is in the tens of millions; Supercars wouldn't have the critical mass to follow suit.

The issue has broader contemporary relevance following investments in New Zealand Rugby and Rugby Australia by Silver Lake and Ares Management, respectively. Silver Lake subscribed to a perpetual convertible security for NZD 200m (USD 117m), while Ares extended a AUD 40m (USD 26m) loan. Neither body is profitable, partly because they have relatively small domestic audiences.

"What they are buying is great global brands that generate enormous amounts of content valuable for consumption through multiple media channels," said Lambert of XT Ventures. "Media deals drive growth, but content is untapped in terms of the types of material you can monetise."

Modes of engagement

This is where franchises and sports technology meet. Building more touch points with consumers is an established theme, but COVID-19 is thought to have pushed it up the agenda.

"The world is becoming increasingly digital, enabling more people to engage with sports, and growing the value and monetisation opportunities," said Stathopoulos of BC Partners. "It used to be the only way you made money was by having people attend a match in a stadium. Now, you can engage with them 24 hours a day however you want."

ACA's efforts to generate interest in KMSK Deinze among Southeast Asian football fans necessitate heavy use of different media channels. Last weekend, a documentary-style programme ran on national television in Vietnam – a key target market – that tracked the progress of some youth players recruited from a local academy to spend time in the KMSK Deinze academy system in Belgium.

ACA would like a portion of this intake to graduate to the first team, having noted the social media surge experienced by other European clubs that have signed Asian players. Capturing the "journey" is part of the story. The firm has also established its own short video platform that runs five-minute packages, in English, Vietnamese, Japanese, and Dutch, comprising highlights and other footage.

"We need new revenue streams and audiences," explains Ono, who wants to reach 10m subscribers within five years. "We are installing web3 content as well because web3 and NFTs [non-fungible tokens] are everywhere in Southeast Asia. YouTube users can pay a subscription to remove advertising; clicking on ads on our platform gives you the chance to win some crypto."

Danny Cortenraede, managing partner of the sports tech business at US-based early-stage investor Venturerock, advocates shorter-form content and centralised platforms as part of a digital media transformation strategy. This is based on a recognition that the younger generations targeted in most fan engagement initiatives would much rather watch highlights than an entire 90-minute match.

"Fan engagement and data are hot topics in the industry," he said. "There are a lot of solutions around fan engagement, we're looking into which ones really create value. Manchester United has 1bn fans across different channels, and they are leaning on Facebook and Instagram. How can they build one channel for themselves? They want to own the content and the distribution platform."

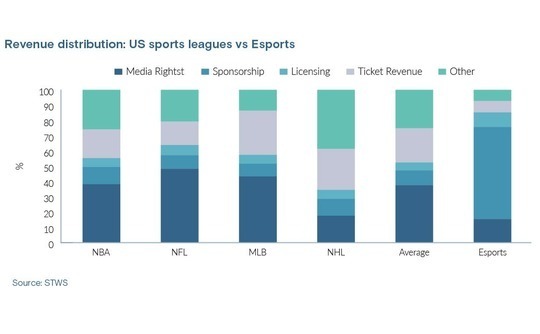

The 2022 edition of PwC's North America sports outlook report, which tracks key industry trends, is littered with references to data analysis, differentiated content, NFTs and digital assets, sports betting, and virtual realty (VR). Each one is, to some extent, rooted in fan engagement, although some are so nascent it isn't necessarily clear how they can be monetised on a stand-alone basis.

"Team dynamics and economics are difficult; in that sense, it's no different to owning a Formula One team," said Elysian Park's Bahel. "You need to build a lifestyle ecosystem around it because the fan base is rabid, but your monetisation must be beyond the game itself. It's about hoodies and t-shirts."

Elysian Park has exposure to the space through Gamurs, an Australia-headquartered gaming and esports news publishing platform that has managed to achieve profitability on the back of advertisers wanting to reach its hard-to-access audience of 18-34-year-old males in English-speaking countries. CEO Riad Chikhani insists that no one has cracked the traditional sports-esports crossover.

"Anyone who tells you they have an answer to that is not being honest. The esports industry is still in its infancy," he said. "One thing we do know is that under 13s and under 18s are not watching sports at anything like the level of 10-20 years ago. They follow influencers and gamers and streamers."

Much to prove

Early-stage investors are interested in customised streaming services around which they can build communities comprising people with similar interests, from gamers to gamblers. These would serve as natural platforms for highly targeted advertising campaigns.

VR also has significant potential across commercial and user applications. Sports franchises envisage a future in which they can sell seats at matches or access to training sessions hundreds of times over to fans around the world who, equipped with VR goggles, don't have to leave their homes.

"What I've seen in the last 6-12 months has been incredible, it's like you are in the game," said Lambert of XT Ventures. Earlier in his career, one of the premium packages Lambert sold to rugby league sponsors in Australia was a seat in the coach's dugout during games. The coach didn't like it, but the club got AUD 50,000 a time. Using VR technology, this could be achieved with little intrusion.

The lack of unicorns in the sports tech space underscores how the developmental journey is still at an early stage. Sports betting is the exception, where US fantasy sports platform DraftKings made it all the way to a public listing. The legalisation of sports betting – in 36 states and counting – was a key move.

SeventySix Capital was convinced enough on the opportunity set to make sports betting central to its technology-oriented strategy. "It's fascinating how fast the industry has grown in the last four years," said Wayne Kimmel, the firm's founder and managing partner, noting that some franchises now have betting partners as well as media partners, and direct partnerships with in-venue sports books.

Fantasy sports have taken hold in India as well, where RedBird followed up its minority investment in an IPL franchise last year by joining a funding round for Dream Sports. Like the US, critical mass was achieved on the back of a legal ruling, specifically that fantasy sports are games of skill and do not contravene bans on gambling.

Dream Sports and its direct rival, Mobile Premier League, raised capital aggressively during last year's boom and became unicorns. However, some investors are wary of renewed regulatory intervention.

It remains to be seen how aggressively sports franchises embrace technology as a means of driving fan engagement. Industry participants give mixed views on current progress. It is generally accepted that the US is ahead of Europe in terms of consumer tracking and data analytics.

Even in IPL where a generous media rights deal might invite complacency, there is a recognition that revenue sources will become more diversified as the sport – and India's economy – matures. The source close to CVC noted that the objective is to build the Titans not only as a force on the pitch but also as a consumer brand within Gujarat and nationally.

George Pyne, founder and CEO of Bruin Capital, which makes sports investments from a holding company structure and has exposure to Australia through marketing business TGI Sports, observes that new media will continue to grow even as old media players hold on as long as possible. Increasingly, the focus will be on depth and quality of engagement, not just the number of eyeballs.

"We always talk about the lifetime value of the consumer – that will be the tip of the spear for future growth in sport. You might have fewer people at the match, but the way you position products around them could generate a lot more value," he said.

"Data, technology, and mode of access are converging. Today, the way fans engage and form communities around a team might be streaming a match. Tomorrow, it could be differentiated content, gambling, or other services. It's all wrapped around an understanding of the consumer, which means proper management of data is very important."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.