Japanese LPs: Expectation vs reality

Japan’s LP community is an alluring target for global private equity managers, even as currency depreciation and a cultural aversion to risk remain obstacles in the short and long term

Japanese LPs, like many of their global peers, have been overwhelmed by re-ups. Several managers and placement agents recall visiting investors as early as May, barely two months into the current Japanese financial year, only to be told there was no capacity. "We're now angling for allocations in 2023-2024," said one placement agent, who is about to accompany some international GPs to Tokyo.

A free-falling yen has only intensified the pressure. As recently as March, LPs were paying JPY 115 for each US dollar they put to work. Since then, international private equity exposure has become much more expensive, with the yen depreciating by one-fifth to reach JPY 144 in early October.

Tadashi Nishizawa, a managing director in the private equity department at Japan Post Bank (JPB), noted that the glut of re-ups created by fundraising cycles shortening from 24 to 18 months resulted in his firm overrunning its budget. Not wanting to cut managers from the programme, JPB reduced cheque sizes instead.

"More recently, yen depreciation has progressed. We still didn't have sufficient commitment amounts, and so we struggled," he added. "When it comes to the existing portfolio, about 70% of the foreign exchange is hedged, so it doesn't impact us so much. We haven't suffered an overallocation and we haven't had to sell. But what we do have trouble with is new commitments."

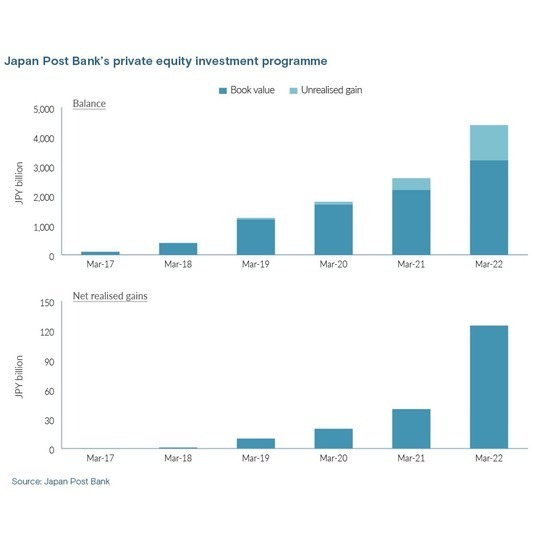

JPB has built up a PE portfolio of JPY 4.4trn (USD 30.8bn), including unrealised gains, over seven years – old enough and broad enough for shorter fund cycles to present a problem. Orix Life entered global alternatives in 2020, but recent events have still played havoc with its JPY 50bn annual budget.

Some managers from the 2020 vintage confounded expectations that they would return to market in 2023 by coming back as early as late 2021. Although the overall number of commitments were as planned, a sizeable portion of the budget was allocated to re-ups rather than to new relationships. Moreover, much of what Orix Life had left was wiped out by yen depreciation.

"What we had planned is already finished for this year, so we've had to reduce the commitment amounts," said Noriko Hayashi, the firm's private equity head. "We are trying to understand which managers will be patient and wait until next spring and which ones want to have capital this year."

Industry participants ascribe shorter fund cycles to a US-driven technology sector expansion, and they expect it to be short-lived. However, the consensus view among economists is that the yen will not rally significantly while the US continues to raise interest rates and Japan doesn't do the same.

Unless Japanese LPs allocate more capital to alternatives, the purchasing power of their yen-denominated budgets will be lessened. Moreover, the situation could be exacerbated by dwindling distributions, with less incoming cash to fund ongoing capital calls that are inflated by the currency effect. It is suggested some investors might sell down portfolios to support future commitments.

"Next year will be harder because yen depreciation and the likely slowdown in distributions means there will be less capital to redeploy," said Kazushige Kobayashi, a managing director at MCP Asset Management, an Asia-focused alternative asset manager with fund-of-funds in Japan. "Japanese investors are concerned about the macroeconomic situation in general."

On the radar

This may turn out to be a bump in the road on Japan's journey to becoming a more significant source of capital for private markets globally. Yet the timing is unhelpful. One LP with a local insurer expressed frustration at the limited capacity to back new managers, noting that some hard-to-access US mid-market GPs are looking to Asia with a view to diversifying their LP bases.

A second placement agent added: "We have been busy in Asia partly because US pension funds don't have much money and people are coming out here in search of new sources of capital. China is closed, so it's mainly Japan, Australia, Korea, and Singapore."

Bullishness on Japan as a fundraising location for alternatives began in earnest around 2017. For years, the country had been a reliable source of relatively small cheques from banks and insurers. But the arrival of big beasts like Government Pension Investment Fund (GPIF) and the Japan Post entities – JPB and Japan Post Insurance (JPI) – stoked expectations of much larger commitments.

"If you had asked me 15 years ago whether GPIF would allocate to private equity, I would have said never in my life. They did, but it took a long time to implement. JPB moved faster and now they are dealing with the challenges of a mature programme, with faster re-ups, smaller cheque sizes, and a smaller budget," said one investor relations professional with a global GP.

"But if people were expecting a tsunami of new investors to pop up, they should have managed their expectations. It just doesn't happen in Japan. We do see other pension funds are going into alternatives, but they aren't necessarily doing private equity."

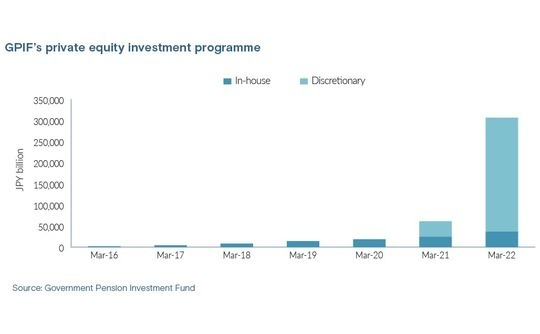

GPIF can invest up to 5% of its assets in alternatives. As of March, the allocation was 1.07%, or JPY 2.15trn out of JPY 196.6trn. Private equity accounted for only JPY 306.6bn, although that represents a fivefold increase from the 2021 financial year.

JPB had JPY 232.9trn in total assets and a risk asset investment portfolio – which excludes Japanese government bonds – of JPY 94.9trn. Private equity and real estate funds comprised JPY 3.2trn and JPY 2.6trn, respectively. The goal is to accumulate JPY 10trn across all alternatives by 2026.

New blood

A more aggressive approach is expected from Japan Science & Technology Agency (JST), a JPY 10trn university endowment that is in the process of selecting gatekeepers and fund-of-funds managers for private equity. Tadasu Matsuo, formerly of JPI and HarbourVest Partners, and Yasuyuki Tomita, who previously worked for DBJ Asset Management, have been recruited to lead the alternatives push.

No details have been given on asset allocation, but alternatives are expected to feature prominently in the pursuit of a target return of 3% plus inflation, or 8% by current standards. GPIF's target return is 1.7%. Two sources that have met JST said that an alternatives allocation of 10% was suggested.

Matsuo said that the first step is to establish a basic portfolio and generate a return. He is interested in secondaries to mitigate the j-curve effect, but core infrastructure and core real estate are likely to be early priorities. Higher risk-return asset classes will come later. However, a private equity and private debt-focused team is already in place, and it will be 12-strong by year-end.

"We will look to gatekeepers and fund-of-funds and work with them to create our initial portfolio," Matsuo added. "Once we have the team set up, we will start to make direct fund investments. When that time comes, we will have need for additional staff."

GPIF uses Neuberger Berman and Hamilton Lane as fund-of-funds managers for global private equity and added Mitsubishi UFJ Trust and Alternative Investment Capital for domestic coverage earlier this year. Nevertheless, the pension fund is already talking about making direct commitments, according to three sources that were briefed by the private equity team.

One of the sources added that GPIF has already registered as a qualified institutional investor (QII), which would exempt it from the requirement to make commitments through a gatekeeper – putting it on an equal footing with banks and insurers. "This is unusual for a pension fund," the source said.

Further evidence of Japan's commitment to private equity, especially in a global context, is seen in the emergence of Japan Investment Corporation (JIC) and the post-pandemic willingness of Japanese insurers to locate investment professionals overseas.

JIC serves as a JPY 3trn government support programme for the domestic technology sector, but it has scope to back non-Japanese funds, chiefly as part of efforts to encourage foreign GPs to do more in Japan. Toshiyuki Kumura and Yuka Hata, who previously led private equity at Tokio Marine Asset Management and Nissay Asset Management, respectively, are CIO and head of fund investments.

Of the insurers, Nippon Life has used its New York and London offices as conduits for private equity fund research and manager engagement for several years. Local staff are said to enjoy a reasonable degree of autonomy. More recently, Dai-ichi Life and Meiji Yasuda Life have followed suit. The latter has moved the bulk of its PE team to New York, according to the IR professional with a global GP.

"They have established investment teams overseas and now they are expanding," said MCP's Kobayashi. "They are allocating more to private equity, and they recognise the importance of being local. Also, with COVID-19 and travel restrictions, it was hard to access good managers, so they decided to locate people outside of Japan."

On the hit list

Dai-ichi and Meiji Yasuda are two of several local LPs that have upsized single fund commitments of USD 20m to around USD 50m, at least prior to the recent volatility, according to multiple sources. At the same time, gatekeepers are still aggregating cheques from corporate pension plans into sizeable overall commitments.

"In some cases, the ticket sizes are small, but it's a steady inflow of capital and it has become more meaningful in size because a larger number of clients are participating. Many haven't done this before," said Joji Takeuchi, head of private asset investments at Asset Management One, which serves as a gatekeeper to government and corporate pensions.

Eight more government pension funds, each one holding at least USD 30bn in assets, sit below GPIF. They have issued requests of proposals (RFPs) covering alternatives in the last seven years. Only the largest, the USD 248bn Pension Fund Association for Local Government Officials (Chikyoren), is known to have backed single private equity funds as opposed to award fund-of-funds mandates.

Generally, they do not feature on the list of should-visit Japanese LPs. In addition to GPIF, JPB, and JST, GPs and placement agents pick out longstanding allocators such as the Pension Fund Association (PFA) – which serves those who secede from employee pension funds – Nippon Life, Daido Life, Dai-ichi, and Meiji Yasuda, while cautioning that some have stuck largely to re-ups for years.

Newer additions include Orix Life and Norinchukin Zenkyoren Asset Management, a platform created by Norinchukin Bank, previously an active solo investor in private equity, and the National Mutual Insurance Federation of Agricultural Cooperatives (Zenkyoren). DBJ Asset Management also makes the list as gatekeeper of choice for Japan's regional banks, which are slowly moving into global PE.

"If they had the three elephants [GPIF, JPB, and JST] as existing clients, they see them on their own. If they didn't have them and wanted them, we would try to manage their expectations," said Taketo Furuya, founder and CEO of Ark Totan Alternative, a local placement agent and gatekeeper.

"If JPB is mostly doing re-ups, then everyone who missed out on them four or five years ago – maybe they weren't in the market at that time – stands little chance of getting them as an LP. But there are others you can talk to, like the gatekeepers who serve pensions and regional banks."

Despite the depth of the Japanese market and the presence of mature institutional investors, cheques of USD 100m for individual private equity funds are still relatively few. GPIF and JPB have the capacity, but apparently not the will, with commitments seldom exceeding USD 50m. JST remains an unknown quantity, but Matsuo emphasized the importance of diversification.

"The difference between raising a USD 5bn fund and a USD 25bn fund is basically zero in terms of cheque size. LPs in Japan don't write USD 500m cheques like GIC, CIC [China Investment Corporation] and KIC [Korea Investment Corporation]," said a second IR professional with a global private equity firm, noting that JPB's fund commitments are essentially capped by limits on single deal exposure.

One solution is to use strategic relationships to bypass gatekeepers and fund allocations. Apollo Global Management achieved this in July by securing a USD 1.5bn alternative co-investment programme commitment from Sumitomo Mitsui Trust Holdings. These arrangements are relevant only to a handful of global GPs and they tend to cut across asset classes rather than be specific to PE.

Striking a balance

It remains to be seen how quickly private equity allocations increase and whether this translates into larger cheque sizes. Several related structural obstacles remain. For example, while the talent pool is deepening, industry participants note that people with experience in alternatives are in short supply and retention can be difficult.

GPIF is credited with reforming its compensation system so that investment professionals were paid market rates instead of civil servant rates, which made it easier for other LPs to follow suit. JPB was among the first to dispense with the practice of rotating staff through different jobs every 3-5 years, although it remains the case in many financial institutions.

"Having seen senior people depart to start new programmes elsewhere, some groups recognised they needed to get rid of the rotation system if they wanted to hold on to talent. This is done by creating specialist job designations for experienced people," said the LP with a local insurer.

"Human resources departments are also very conscious about market-rate compensation. When I started in the industry, there was no such concept – people came from elite universities because of the brand – but the competitive environment has changed."

The notion is that stable, properly incentivised investment teams are more likely to entertain long-term commitments to private equity funds rather than skew towards lower-risk bets on infrastructure and credit that offer annuity-style income and in some cases more immediate returns.

However, there are deeper cultural issues too. The second placement agent observes that many Japanese LPs launched their alternatives programmes in the mid-2000s and took an immediate hit with the onset of the global financial crisis. Certain habits, such as an aversion for opportunistic real estate and distressed debt and a preference for diversification, appear to have become ingrained.

"The inclination is never to take risk, which is why you have tiny private equity allocations split across dozens of funds," the agent added. "Everyone follows the leader in Japan, and no one has shown leadership on this issue. Maybe institutions like JPB and JST will do that, and others will follow."

In June, JPB issued a report that offered deeper insights into its private equity programme. Nishizawa highlighted not only the increase in scale – the fair value of the portfolio has increased 11x over the past five years – but also the consistent returns. JPB realised net gains in each of those years, culminating in JPY 125bn for the 12 months ended March.

Nishizawa emphasised the role secondaries have played in delivering these realisations. He went on to suggest that credit and infrastructure, plus long-dated private equity, where "we might expect some kind of dividend as well," will be key to ensuring a stable future.

The focus on income is typical of Japanese investors. As to the implication that income-driven and capital gains-driven should work in tandem, it is debatable whether the broader LP ecosystem embraces this kind of balance.

"There has been a stronger preference for income-based alternatives products than I had expected. Demand for core infrastructure, core real estate, and private debt is stronger than for private equity, which is seen as a higher-risk product," reflected Takeuchi of Asset Management One.

"Are income-oriented portfolios safer than diversified private equity portfolios? LPs need to think about that. For a stable risk-return, it's better to mix up asset classes and not just go for income-oriented products."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.