GP profile: ShawKwei & Partners

Helping Asian manufacturers climb the product value chain and lock in multinational customers is a key part of the ShawKwei & Partners thesis. It sees no reason to change, even amid sector volatility

ShawKwei & Partners has owned Singapore-headquartered precision manufacturer Beyonics for over a decade and there is a reluctance to let go – not least because efforts to rationalise and reorient the factory footprint towards Southeast Asia have really started to pay off.

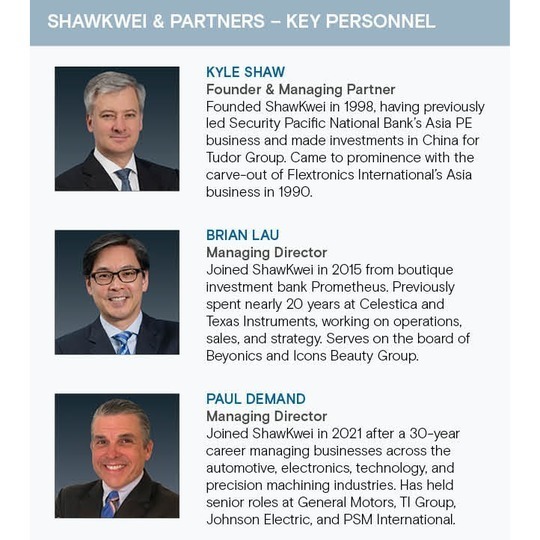

"I want to crystallise the return, but the last two years have been a great opportunity for Southeast Asia manufacturing," said Kyle Shaw, the private equity firm's founder and managing partner.

"It started in 2018 when tariffs were first imposed on China. Everyone said it would be temporary, but suddenly it was real with a 25% added cost for exports. Then we had COVID-19 and supply chain bottlenecks, everyone wanted to diversify their supply chain and Southeast Asia is an attractive place. Beyonics used to be 50% Southeast Asia and 50% China, but we changed it to 80-20."

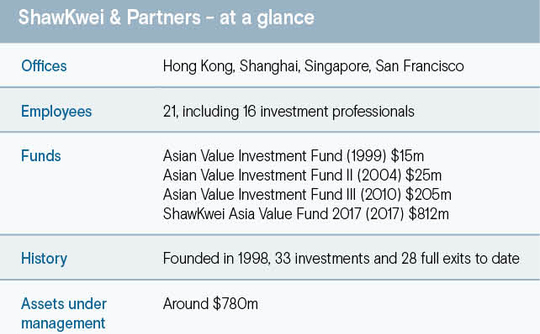

He adds that ShawKwei's LP base has remained relatively consistent over the years, despite the most recent fund closing on USD 812m in 2018, four times the size of its predecessor. The collection of insurers and family offices is keen on value creation and willing to wait for the right return. "There is no desire to get in and out quickly ahead of the next fundraise," Shaw said.

Besides, Beyonics is more than just a beneficiary of geopolitical crosswinds. ShawKwei took a loss-making company in a dying industry that was overly reliant on one customer – Beyonics sold hard-disk drive parts, mainly to Seagate – and refocused it on supplying higher-value components to multinationals in the automotive, industrial, and medical sectors.

This happened concurrently with a consolidation of the manufacturing base from 24 factories to five, of which two were new builds, without altering the overall square footage. The introduction of super-facilities allowed for equipment upgrades and economies of scale. Along the way, Beyonics was merged with Chosen, another precision manufacturer in the ShawKwei portfolio.

"It was Kyle's vision from the start. Building relationships with multinational customers is difficult and it takes time, that's why he's been involved for so long and that's why the value he will get out of the investment will be so large," said Lou Hughes, who has been CEO of Beyonics for the past four years. "He knows where he wants the business to go, and it will get there before he sells it."

Something special?

ShawKwei is one of few industrial manufacturing sector specialists in Asia; various other private equity firms have long since diversified their coverage. Shaw plans on sticking to his furrow, noting there is no reason to move away from what the firm, and Asia, do well.

"What Asia does best is manufacturing and industrial supply chains. There is a social media and e-commerce opportunity, but historically, services investments largely haven't played well for private equity in Asia, so I don't think we will change a lot," Shaw said.

"Once you get some experience and understand how an industry works, how people and customers think, it makes a difference. We often invest in companies that serve the same sorts of multinationals, like Bosch or Delphi, and once you get used to them, your risk analysis is sharper."

Hughes observes that Shaw is on top of the detail at Beyonics to an extent he has seen in relatively few senior PE executives. Moreover, he highlights a cultural acumen that means Shaw sits comfortably with Asian manufacturers and Western buyers: he was born in the US but travelled widely because of his father's work; he played high school football in Virginia but moved to Asia in his early 20s.

Prior to Beyonics, Hughes had only four or five years of experience in Asia. Shaw's ability to bridge East and West – to relate to Hughes as an American and to help him understand how to communicate with employees and customers in Asia – was critical in the early days.

Shaw arrived in Hong Kong in 1989 with a brief to establish Security Pacific National Bank's private equity business in Asia. An early opportunity emerged with a carve-out of the regional operation of contract electronics manufacturer Flextronics International. Looking for a co-investor, Shaw was put in touch with Randy Kwei, a US-educated Chinese entrepreneur who ran Asian Oceanic Group.

They completed a USD 51m leveraged buyout, supported by CEF Holdings, a joint venture between Cheung Kong Holdings and Canadian Imperial Bank of Commerce (CIBC). Flextronics listed on NASDAQ in 1995, by which point Shaw had moved to Shanghai in search of further deals. He ran a China-focused fund with US hedge fund manager Paul Tudor-Jones' Tudor Group as the sole LP.

Talks with Kwei about new collaborations came to fruition in 1998 with the formation of ShawKwei. Tudor-Jones was the founding LP in their debut fund, which closed on about USD 15m in 2000. ShawKwei pursued minority investments in fast-growing, export-oriented companies that needed funding to build factories, buy equipment, and boost reserves of working capital.

"All these companies were thinking about doing IPOs, so we would work with them on that, coming in as a financial advisor and helping them up their game on the CFO, improve financial reporting, and get lines of credit from banks," said Shaw. "We never charged for that. Our pitch was, ‘Bring us in as a shareholder, we'll sit on the board, help you with the things we know best, and ride up together.'"

Graduating to control

However, by the time the firm came to deploy its third fund of approximately USD 205m in 2010, the market was shifting. First, taking a company public became pricier, which deterred many small to mid-size companies. Second, the global financial crisis shook the established order and ShawKwei, having done a few special situations deals in the aftermath, saw more buyout opportunities.

The firm had dabbled in privatisations before, chiefly in Hong Kong, but it laid down a marker in Singapore with two deals in two months – Beyonics and adhesive tape supplier YongLe Tape – in 2012. Singapore-listed Plastic components maker Chosen was acquired three years later.

Even though these companies were listed, in most cases there was a founding shareholder looking to sell out. ShawKwei has also carved a niche helping US and European manufacturers realise Asian expansion ambitions, but succession is a consistent theme, as demonstrated through the purchase of privately-owned companies like Amos International, Icons Beauty Group, and CR3.

"These businesses are led by founder-entrepreneurs who have been there for 25-30 years, not by professional management, and that's where most of the diamonds can be found in Asia," said Paul DeMand, a managing director at the firm.

"We come in and professionalise everything: the management team, the IT systems, the ERP [enterprise resource planning] systems. There is a standard playbook but it's all about how well we execute and what's happening that is out of our control."

DeMand, who joined ShawKwei last year, is the latest in a string of recruits that characterise the firm's buyout era. DeMand previously spent 30 years in the automotive, electronics, technology, and precision machining industries, most recently running PSM International, a Greater China-focused fastener manufacturer that was owned by EQT until 2019.

Based in San Francisco, DeMand is tasked with finding deals in the US and Europe. He also serves as a CEO whisperer, spending much of his time ensuring there is alignment between portfolio company management teams, boards, and external advisors. Brian Lau, another managing director, is cut from a similar corporate cloth, having previously spent 20 years at Celestica and Texas Instruments.

"As our strategy evolved, we shifted from investment banker-type people who could write up nice presentations to people who could roll up their sleeves, dig into the numbers, and figure out what was going on," said Shaw. "We brought in more accountants, and then we've always had a group of advisors, including people with industry experience in Asia, who sit on the investment committee."

Of the three take-privates, YongLe was the first to be exited following a USD 300m acquisition by Avery Dennison in 2017. ShawKwei installed proper financial infrastructure, sold the factory and leased new premises, upgraded manufacturing equipment, and refocused on more complex products. EBITDA rose threefold in three years and the GP generated a 4.8x gross multiple.

It also changed the name of the company, from CHT Holdings to YongLe Tape, to underscore the corporate transformation. "I can't emphasise enough the importance of rebranding a business – not for the market, but for the staff," said Shaw. "It's about getting everyone on the same page and understanding what you are doing."

Transformation time

For Beyonics, like YongLe, taking on greater product complexity was high on the agenda. The goal was to centralise engineering services – metal stamping, fabrication, plastic injection moulding, die-casting, and sub-assembly – and reach out to a higher class of customer. Smart locks, on-body glucose monitors, and in-car sensors now feature in the product portfolio.

This required substantial investment in top-of-the-line equipment and the systematic elimination of low-value customers, even if it meant taking a near-term hit on revenue. The reward is signing long-term agreements to supply blue-chip customers that enjoy strong pricing power.

"These are precise, mechanical devices that are hard to assemble. You need automation, you need tight tolerance on metals and plastics. We can provide differentiated value to customers, and we try to work with innovative companies that look to us to provide insights, technology, and value through design," said Hughes. "When working with a low-cost provider, they just drive your price down."

CR3 is at a much earlier stage in its own transformation. The company mainly serves oil and gas and chemicals producers in Southeast Asia and India, but ShawKwei is driving expansion into low-carbon areas like liquefied natural gas and hydrogen. For example, CR3 already works on Reliance Industries refineries in Jamnagar, so why not pitch for the company's planned renewables facility as well?

The business was purchased from three family shareholders who were content with steady growth, taking out regular dividend payments but declining to support acquisitions or geographic expansion. Provided he operated within these confines, Stansfield was largely left to his own devices. He was also tasked with running the sale process when the families finally decided to exit.

There were four names on the final shortlist – three private equity firms and one strategic investor. ShawKwei stood out because "they had senior people involved from the beginning and they saw value in the company, they weren't just looking at a set of numbers," Stansfield said.

An emphasis on growth and cohesion with management evident in the due diligence process has carried through into ownership. CR3 posted record revenue of USD 179m last year and it was expected to surpass that in 2022, working towards a target of USD 400m by 2027. However, the first six months were beset by difficulties.

"With the old board, there would have been conversations about controlling cost and fixing the problem by downsizing. That hasn't happened with ShawKwei. If anything, they encouraged me to be more bullish on capital expenditure and investment," Stansfield explained.

At the same time, he cautions that the private equity firm's approach is not perfect. There is a lot more rigour around financial modelling, reporting, and accountability than under CR3's previous owners. Stansfield describes engagement as "dangerously close to micro-management at times," although he accepts that the two sides are still forging a relationship.

These sentiments are to a lesser extent echoed by Hughes, who is in contact with ShawKwei across different levels and functions multiple times each week. "We probably overcommunicate, but we don't have any misunderstandings about strategic direction," he said. "Understanding where you can and cannot add value is often the biggest struggle between management teams and owners."

External pressures

Across the private equity industry, these relationships have been tested in the past three years. For CEOs overseeing manufacturing and supply chains, it has been especially tough. First, COVID-19 took operations offline and created uncertainty as to when and how they would come back; then inflation kicked in, putting pressure on supply chains from a cost perspective.

For many, the rules that have underpinned career development to date are no longer as relevant, so they must learn new ones. Yet these leaders are being asked to make decisions without the ballast of experience-based conviction, which can leave them in a lonely and uncomfortable place.

"I talk to all our CEOs on a weekly basis about personal and professional status, and I also talk to other CEOs in my network. They've never seen so much stress – stakeholders are expecting them to pull rabbits from hats," DeMand said. "COVID has challenged all CEOs mentally and physically."

Nevertheless, he takes away two positives from the situation: it has forced investors and management teams to engage more frequently, and it has made clear which CEOs are not suited to the intensity of working for private equity.

Beyonics has been through several CEOs during its transformation. When DeMand was hired by EQT to run PSM, he was the fifth CEO in four years and ended up staying for seven years. Picking the right leader is the key decision owners and boards must get right – and in Asia, half the time, the first appointee is not the best one, he maintains.

Regardless of the tumult of recent years, ShawKwei follows the same three principles when sourcing deals: don't lose money, focus on opportunities where there is potential for a 3x return, and only participate in situations where some knowledge or expertise advantage can be brought to bear.

Similarly, Shaw believes the fundamental challenges presented by industrial manufacturing businesses are unchanged. "It always comes down to how you can transform a company and not break it – how you can move into the future without losing the best bits of the past, how you can move forward without first taking two or three steps back," he observed.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.