ESG in M&A: Eloquent exits

Private equity firms are increasingly presenting portfolio companies’ sustainability credentials in a prepared and formal way in trade sale situations. It appears to be worth the trouble

The best investors have a plan when it comes to communicating their environmental, social and governance (ESG) successes to the market. When the time comes to exit a portfolio company, a negative impression about ESG is more powerful than a positive one. Buyers are on alert for greenwashing, especially in Asia's less developed markets.

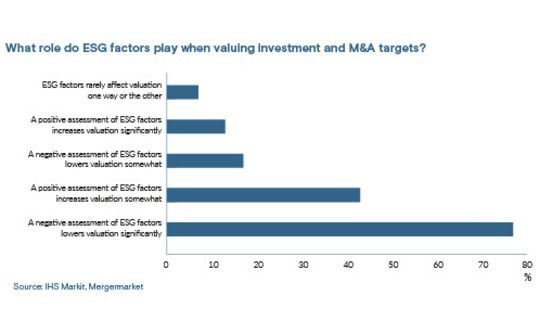

The notion is sketched out to some extent in a survey by Mergermarket, AVCJ's sister publication, and UK-based researcher IHS Markit. When asked how ESG would influence their valuation of an M&A target, only 13% of investors and corporations said a positive assessment would lift the valuation significantly. However, 77% said negative ESG would significantly lower the target valuation.

One widespread observation is that, if best practices are followed during the holding period, a company's ESG sales pitch writes itself. But there remains a lack of consensus on measurement and a lack of agreement on the extent to which some factors can be measured under current methodologies. Effective messaging with imperfect data is therefore increasingly recognised as part of the ESG skillset.

Many GPs engage third-party service providers to help on this front, while some are internalising the know-how. EQT was among the first in the latter camp, acquiring Hong Kong-based ESG and supply chain services advisor Elevate well ahead of the curve in early 2016. ESG and supply chain were identified not just as growth markets for service providers but as a growth area for private equity players themselves.

Elevate went on to inform EQT's ESG blueprints in the years to follow before being exited to LRQA, a global strategic in assurance and certification, in January this year. The internal transformation at EQT says much about the trajectory of broader industry policy.

"We only want to invest in companies that are supportive of our sustainability goals," said Hermann Rauch, a managing director at EQT. "It might be a perfectly good company and financial investment, but if it cannot completely articulate why it makes the world a better place, then EQT would stay away from that company."

The key word here could be "articulate." EQT sees communication as a bigger conundrum than complexity around any one particular sustainability topic. For PE-backed companies in exit mode, the challenge is about operationalising and communicating what they've been doing in terms of ESG with clarity and in a way that feels authentic and credible.

Other GPs bringing ESG skillsets in-house through investment include The Carlyle Group (PA Consulting), CVC Capital Partners (EcoVadis), and KKR (ERM). The latter – which claims to be the largest pure-play sustainability consultancy globally – was acquired last year at a reported valuation of USD 3bn.

Endgame agendas

These moves are as much about capital raising, allocation, and deployment, as they are about exit positioning. But the endgame is arguably the trickiest moment in the deal lifecycle in terms of demonstrating ESG credentials because there is more progress to prove and more variation in the level of sophistication among counterparties.

Siyao Jiang, a partner at ERM, begins every trade sale process by helping sellers identify due diligence blind spots and risk factors. This process reveals that some of the most commonly recurring gaps are around net zero strategies, carbon emissions, and carbon neutrality.

"That's an area where you must have a baseline of greenhouse gas inventories as well as future trajectories for a decarbonisation journey," Jiang said. "Every industry has its own ESG idiosyncrasies and topics, but we have seen an emphasis on climate change and sustainable supply chains across sectors."

First, climate concerns are pervasive across business models, but asset-light companies tend to be less under the microscope – not just in E, but in relevant S and G areas as well. Second, global buyers, especially those following European standards, are more thorough in their review processes. Third, regulators are working towards harmonisation, which will alleviate pressures on ESG messaging on exit.

Erika Leung Rodriguez, a vice president of sustainable investing and ESG for Asia Pacific at KKR, notes that most companies have material issues, usually pertaining to governance. In addition to reviewing industry guidelines such as the Sustainable Accounting Standards Board (SASB), these can be distilled by benchmarking a company against its peers and interviewing internal and external stakeholders.

"Materiality defines business-relevant ESG issues that have – or have the potential to have – a substantial effect on an organisation's ability to create, preserve, or erode economic, environmental and social value for itself and its stakeholders," Rodriguez said.

"In addition to management and governance, KKR focuses cross-portfolio topics, namely, climate change, human capital, and data responsibility that we believe generate significant risks and opportunities for companies today regardless of sector or geography."

Great expectations

Valuation is the focal point in any transaction, and ESG's role in improving valuation has become well understood in recent years. It is only in the more immediate term, however, that private equity firms are bringing ESG to the exit negotiating table.

"PE firms are experts at creating value in ESG, but they have historically tended to think of it in a very qualitative way in the sales process. That's changed in the past year, and we're seeing more ESG due diligence reports when they're packaging a company for exit," said Loretta Ng, a partner at PwC.

"Nowadays, if you don't have at least one or two pages on ESG in your exit materials, you are not speaking the language of the market. The company might not be in a brown industry, but you have to at least tell people you have a view on ESG. If you're not talking about it, your sales process may not meet everyone's expectations."

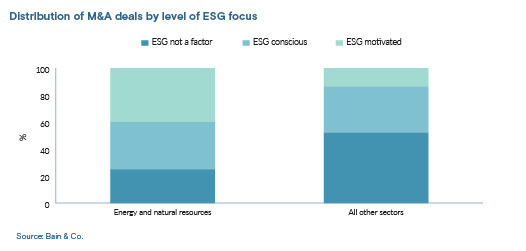

It's hard to pin down these expectations by industry or sector, although the industrials space appears to be taking a lead role. According to Bain & Company, on average 40% of energy and resources companies considered ESG a "motivating" factor in M&A versus 14% for all other sectors. Only 25% of energy and resources companies said ESG was not a factor versus 52% for the rest of the field.

"Historically, it's all been financially driven. The Holy Grail is non-financial as well, but the reality today is the industry isn't quite there," said Atiff Gill, a managing director at CVC. "Anecdotally, consultants like Bain can show you charts that say companies with a strong ESG footprint and capabilities, sustainability reporting have a higher valuation than companies weaker in ESG."

CVC is leveraging its investment in EcoVadis to delineate non-financial key performance indicators (KPIs) with portfolio companies, help them produce sustainability reports, and get accredited by Planet Mark, a net zero-focused certification company.

EcoVadis has rated 90 CVC portfolio companies to date – they've been partners since 2020 – and appears to be enhancing exit performance. For example, CVC sold Malaysia-based snack foods producer Munchy Food Industries to Philippines food company URC last November for about USD 450m. A year earlier, emissions, electricity consumption, and material costs were reduced by 57%, 44%, and 38%.

"It hasn't got to a point where a company has said your EcoVadis ESG score precludes you from exiting, and I don't think we will get there," Gill said. "Companies recognise that businesses in Asia are on a journey. As long as you are on it, that's okay. If you hadn't embarked on the journey at all and there was no visibility to your ESG footprint and KPIs, that would be bad."

Unfortunately, Asian leniency is a two-way street. ESG requirements are coming to stock exchanges in the region, which has done much to improve overall rigour. A strong presence of development finance institutions is likewise believed to have shifted mindsets, if not moved the needle on standards. And resource-rich jurisdictions such as Indonesia are seen as having developed some expertise in ESG.

But this is a work in relatively slow progress, which has prompted many international buyers to be relatively more suspicious of greenwashing in the region.

Bumps in the road

In private equity, the largest GPs have begun formalising ESG-specific due diligence processes, but this is less common among country-focused managers in developing markets, even where ESG concerns are mainstream. In China, for example, renminbi-denominated funds generally only conduct environmental, health, and safety (EHS) checks rather than more comprehensive ESG due diligence.

"We've seen many processes fall over because of governance issues or problems in supply chains. A company might not be doing anything illegal, but its practices can be a bit sharp and may not pass the ESG sniff test in an era of heightened awareness," said Andrew Thompson, head of Asia private equity and sovereign wealth at KPMG.

"This happens a lot in Asia because many family-operated businesses have historically placed less emphasis on regulatory compliance which can over time lead to operations that are not best practice."

Asian exit markets are also peppered with war stories about experienced M&A professionals using ESG issues to drive acquisition prices down in a decidedly cynical fashion. A typical episode might feature a couple of environmental lawyers flown in for the final stages of due diligence who demand to see some regionally uncommon documentation.

"They say, ‘Oh, you don't have that documentation. That's too bad. If you want to do this deal, the price is going down 30%,'" explains one industry professional. "It's like a game to them because oftentimes, the Asian company was swimming naked."

Problems on this front also arise when a company has stated an ESG-related ambition but is not able to showcase supporting data. In areas such as emissions, the robustness of the data is secondary to the signal of intent in compiling it. In cybersecurity and data privacy, things tighten up considerably.

"Cyber risk is very material in M&A. Prices are either coming down or significant players are walking away because they'll start seeing risk in their due diligence that they know they can't manage," said Melissa Brown, a director at Daobridge Capital, a China-focused direct investment and financial advisory firm.

"Either you have a player that has a supply chain that isn't going to pass muster from a cyber risk perspective or legacy computer systems that will be very costly to bring up to scratch."

Asset-light and data-focused businesses are also expected to be under increased pressure to demonstrate progress on social issues, with tech companies in particular seen as poorly balanced in terms of gender diversity.

Environmental scrutiny related to the water and electricity usage of data centres is also on the rise, as are policies around whistleblowing mechanisms at companies with significant stores of personal or otherwise sensitive data.

Get smart

GPs are advised to know how to address these issues before taking tech companies to market. Brand-name firms and domain specialists will take the lead. Others must follow. Best practice is not to position a company as 100% clean but rather to describe how previous breaches or transgressions were dealt with or rectified.

"As ESG becomes more common in exit processes, it will become increasingly important to be able to distinguish the depth and breadth of an ESG approach," said Natasha Morris, a director at Adamantem Capital, which sold its position in Australian data analytics consultancy Servian to a US strategic last year for an undisclosed sum.

"That means being able to differentiate between things that have been done over a significant period of time and that are embedded in a way that sets a business up for sustainability beyond the exit and things that have been done at a more superficial level."

EQT's initial step in its first year of ownership is to conduct a materiality assessment, making sure that the company is aware of all the ESG topics that are important to it. In terms of technology companies, this includes diversity, equity, and inclusion (DEI).

DEI is a point of contention among ESG professionals with widely varying views on how it can be quantified and illustrated in an exit process. In one school of thought, gender is only half of it; diversity by age, culture, experience, and perspective amplify the complexity and vagueness. There is also the idea that diversity without inclusion and the ability to express different opinions is meaningless.

"Setting an ambition from the top to say how the company thinks about diversity, equity and inclusion is a good idea because it gives you a north star," said Angela Jhanji, a managing director at EQT who leads the firm's sustainability integration function.

"The market gets clarity on exactly how you define it, and then you can put in the right procedures, controls and policies to collect data and ultimately measure it."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.