Portfolio: Welkin Capital and Shawya

Shawya is a fast-rising Chinese direct-to-consumer brand that takes a technology-driven approach to skincare. Welkin Capital is helping it address growing pains around talent and omnichannel capabilities

The Body Shop, a beauty, bath, and skincare products retailer, has been a fixture on British high streets for nearly 50 years. It is an unusual starting point for a China-based direct-to-consumer (D2C) brand, but then Jackie Shi is an unusual entrepreneur: the scientist who sought to build market share through product quality and repeat customers rather than by purchasing social media traffic.

Shi's 10-year-old start-up, Shawya, owns three skincare brands underpinned by in-house R&D and manufacturing as well as a technology platform that collects user data and feeds it into personalised product development. The company, which closed a CNY 150m (USD 22.4m) Series C round at the end of 2021, expects to be profitable this year and achieve CNY 5bn in revenue within five years.

The Body Shop was a part-time job Shi undertook while pursuing a PhD in pharmacy at Nottingham University in between 2007 and 2009. A chemistry graduate from Peking University, he envisaged going into cosmetics or pharmacy, while his PhD research focused on anti-cancer drugs. The Body Shop offered insights into skincare, and from that, another route materialised.

"I wanted to understand cosmetics and skincare. Cosmetics didn't appeal because the formulas aren't especially high-tech, but I thought I could do a better job than The Body Shop in skincare by using more natural ingredients," Shi recalled. "Before graduation, I had decided to return to China and start my own company."

Shawya's debut brand, released in 2012, was Genuine Namir, a mid-range offering that quickly gained traction with younger demographics through e-commerce channels. There was an emphasis on quality and affordability. Shi describes the objective of being a skincare version of Chinese consumer electronics brand Xiaomi – matching foreign rivals in capability but beating them on price.

This was most ably demonstrated through the success of a Genuine Namir facial toner that was widely ranked as equal or superior to a similar product released by Proctor & Gamble-owned SK-II but was 10x cheaper at CNY 150 per unit. This made Welkin Capital sit up and take notice.

Brand on the run

The private equity firm, which was established by the scions of several prominent business-owning families in Greater China, targets mid-market growth-stage investments across consumer, enterprise solutions, and advanced manufacturing in China. Consumer coverage focuses on sustainable brands in healthy foods, personal care, maternity and baby, and smart household.

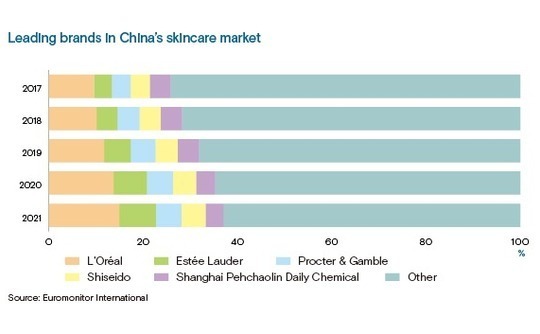

Deal sourcing typically involves looking for opportunities in verticals driven by compelling long-term trends such as premiumisation. Skincare appealed as a domain for discerning consumers who care about ingredients, which translates into higher brand loyalty than in segments like colour cosmetics.

"We were scanning market share changes and found that Shawya was growing very quickly in specific categories – in some cases they were challenging global brands and beating them," said Johnny Kong, a managing director and CEO at Welkin. "They were based in Shanghai, so we got an introduction, and it went from there."

Shawya received seed and Series A rounds of CNY 3m and CNY 25m in 2015 and 2016 from local investors, and a CNY 15m pre-Series B from Korea Investment Partners (KIP) three years later. Welkin participated in a CNY 85m Series B alongside KIP in early 2021. The subsequent Series C featured CICC Capital, a Haitong Securities investment platform, and Korea's SKS Private Equity, among others.

Nevertheless, the company was soon contemplating other brands, driven in part by a recognition that consumers in China were placing a higher value on ingredient-centric brands, much like their US and European peers before them. This dovetailed with the need for a different approach to breach the 30% online re-purchase rate ceiling that was frustrating Genuine Namir.

"Achieving a 30% re-purchase rate in the first three months was great, but we weren't exceeding it – even with a market-leading product that costs less than others," said Shi. "That's because everyone has their own skin condition. It's impossible to have one product that pleases everyone, but we wanted to produce something that was more customised. That's why we created EVM."

Made to measure

There were two primary challenges to customisation. The first was regulatory: licensing for new products in China is a laborious process and manufacturers are barred from mixing ingredients on site. Shawya's solution was to create 40 base formulas in the first year – 2018 – that become the building blocks for 900 different solutions.

Second, the technology required to collect data and deliver accurate diagnoses of skin conditions that could, in turn, make customisation meaningful was not advanced. According to Shi, this was where multinational brands stumbled earlier on with similar efforts in China.

Data capture involves photographing the face in three different types of light. Those images are analysed, skin conditions are identified, and the customer is matched to a specific solution – for example, they might need an anti-ageing or a skin whitening remedy. The first-generation solution saw customers visit offline stores to be photographed in large head-encompassing devices.

The next step was taking the analysis process online, so customers could check the results and communicate with stores remotely. But the key breakthrough came at the start of this year when Shawya's collaboration with a domestic artificial intelligence (AI) developer resulted in an entirely mobile solution: photos are taken by cell phone and analysis is executed by algorithm in the cloud.

"Between 2018 and 2021, we collected data for about 100,000 people online. Now, in just one month, we can collect more than 10,000 data points, without any large-scale marketing," said Shi. "With more data, we have a better understanding of different skin issues and that informs product development. We can also do it across different product types – toner, shampoo, and cream."

The company claims that EVM is the first skincare brand in China to employ a truly personalised model. It wants to consolidate this position over the next three years, taking revenue past the CNY 1bn mark. This will help drive Shawya's overall revenue from around CNY 200m at present to CNY 5bn by 2027. Genuine Namir, EVM, and new addition Whiteeasy will remain the core brands.

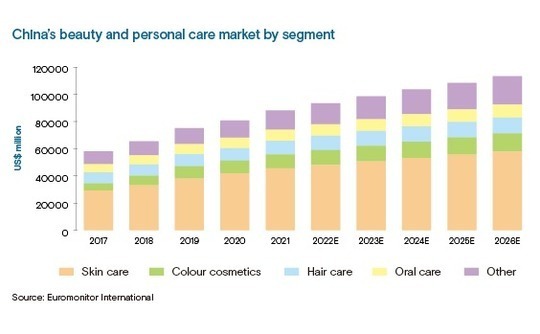

The market was worth USD 45.6bn last year, accounting for half the overall beauty and personal care industry. By comparison, colour cosmetics and haircare barely scraped past USD 10bn. Skincare is projected to hit USD 57.9bn by 2026, by which point local brands might be more prominent.

"There are many consumer verticals that were previously dominated by foreign brands, but local competitors have arrived and they're closer to the market," said Kong. "Tastes are evolving very quickly and they're better able to adapt and integrate technology into their business models."

Shawya stood out from other homegrown skincare brands because it backed up the localisation narrative with technology and numbers. Ahead of the Series B, the re-purchasing rate for EVM among online consumers was above 80%.

"A lot of companies talk about skin testing devices, but they don't do anything with it, it's just a gimmick. You must create an integrated ecosystem around it – a platform that enables you to understand customers and engage with them," Kong added. "That's how you build customer loyalty."

Sustainable strategies

Another key consideration was Shawya's strategy of conducting R&D and manufacturing in-house. Most D2C brands are asset-light, leveraging technology-enabled solutions for marketing and distribution while outsourcing the manufacturing part. This doesn't work for Shawya, with its emphasis on product quality and accurate, technology-driven insights into consumer needs.

Speed-to-market underpinned by supply chain internalisation – Shawya can move from concept to product within three months – was not part of the original blueprint. Shi is a researcher by training, and he prioritised establishing an R&D team that now numbers approximately 80. The plan was to concentrate resources on development and use an original equipment manufacturer (OEM).

"We found that most factories would only work with us if they could do ODM [original design manufacturing] as well because they make more money from that," said Shi. "In addition, some of our customised products are very targeted – one batch might be only 100 units. No one wants to do that for you; the only option is to have your own factory."

Shawya opened its factory in 2017, but it took several years to master manufacturing processes and make that part of the business profitable. Now, the company is not only meeting the needs of its own brands, but also serving as an ODM to the likes of Florasis, a local brand that is challenging D2C early-mover Perfect Diary in colour cosmetics and pushing into skincare.

On an overall basis, Shawya posted a profit in 2020 but this turned into a loss last year because of rising marketing costs. Customer acquisition through internet traffic – typically paid-for content on social media platforms like Little Red Book, Douyin, and Bilibili – has become the lifeblood of China's D2C brands as they adopt consumer-internet logic of prioritising scale over sustainability and profit.

Shi noted that traffic costs increased threefold in 2021 over the previous year. Perfect Diary, which rose to prominence largely based on traffic flow on Little Red Book, saw its sales and marketing expenses rise from 41% of revenue to 69%, yet revenue growth slowed from 73% to 11.6%. In the fourth quarter of 2021, the company reported its first-ever year-on-year retraction in revenue.

"We're seeing more companies use a differentiated line of attack, reducing their reliance on or circumventing that reliance on internet marketing and live streaming," said Kong. "Last year, advertising became so expensive in certain verticals, it just wasn't profitable anymore. Brands had healthy net margins early in the year, and then in the second half they just collapsed."

Shawya spends money on marketing – lower costs are expected to help it return to profit this year – but the company's budget is relatively small, given the focus on product and its high re-purchasing rate. In this sense, it fits squarely within Welkin's investment criteria: brands that have an edge that enables them to build enduring customer loyalty rather than just buy it in the short term.

Online to offline

There is typically an omnichannel element to these portfolio companies and Shawya is no exception. It has nearly 50 offline stores, concentrated in Shanghai and the neighbouring provinces of Jiangsu and Zhejiang, and it wants to reach 70 by year-end. The company is also preparing to open its second medi-spa, which occupies four times the space of a traditional store and focuses on services.

Medi-spas are a physical representation of Shawya's integrated model. Customers undergo skin testing on-site and are invited to sample the full menu of customised products and encouraged to sign up for treatment plans. The average basket size for an online customer is CNY 150. This rises to CNY 500 for traditional offline stores and CNY 5,000 when they visit a medi-spa.

At present, more than 90% of Shawya's sales are transacted online, but the offline share is expected to rise quickly. Coping with this kind of growth – as well as preparing for an IPO in the next few years – can be painful. Shawya has relied on its external investors for different kinds of input, with KIP offering a Korea-infused international perspective and Welkin making various practical contributions.

The private equity firm has made introductions to other portfolio companies with a view to supporting Shawya's offline advertising initiatives and assisted on government relations in markets like Shanghai. However, Shi suggests that Welkin's most significant value creation effort has been in recruitment, which he regards as the key potential impediment to growth.

"With EVM, we have the most advanced technology in the market and a unique model," said Shi. "Our main strategy is very clear, but whether we achieve depends on our team. Can we improve each day and embrace change?"

In the past year, Welkin has helped Shawya fill roles including chief marketing officer, senior brand manager, and sales head, in some cases hiring executives from multinationals that are often beyond the reach of smaller start-ups. The chief marketing officer, for example, previously worked at Johnson & Johnson, L'Oreal, and Unilever.

Kong endorsed the view that human resources is often a weak link for D2C brands: "What you sometimes see with consumer products is they hit a certain level and then get stuck, and often it's about people. You must upgrade your people to unlock that capability. You can have the best product in the world, but if you cannot reach customers, you aren't going to grow."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.