Crypto: Something for everyone?

Traditional VCs are becoming more active in Asia’s blockchain and web3 space, despite structural and philosophical obstacles to participation. Can they withstand the crypto winter?

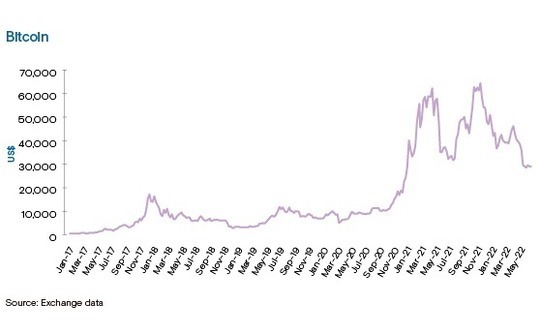

When making very early-stage investments, Indonesia-focused VC firm Intudo Ventures likes to confound the consensus view. Few bets seemed more contrarian in autumn 2018 than a cryptocurrency trading platform. Bitcoin was trading around USD 6,500, down two-thirds on its late 2017 peak; by year-end, it was languishing below USD 3,800.

Nevertheless, Intudo persevered with its due diligence on Pintu and announced a pre-Series A round at Harvard Business School's Asia business conference in March 2019.

"We got in at a time when most other VCs were running for the hills. Some founders were running for the hills as well, but Pintu's founder was all-in. For our early-stage investments, where we focus on out-of-favour areas, we are looking for founders who really believe in something that isn't commonly believed," said Eddy Chan, a founding partner at Intudo.

Investing amid a crypto winter had its advantages: Intudo wasn't bidding against others for access and Pintu was able to retain talent because technology unicorns were not recruiting heavily. The company received its license to operate crypto wallet and trading platform services in 2020, augmented its technical talent and forged distributor partnerships, and went from zero to over 4m downloads.

Pintu's mass-market offering resonated in a market where crypto investors have doubled over the past year and now exceed public equities investors. Meanwhile, fundraising continued: a USD 6m Series A closed in May 2021, a USD 35m extension in August, and a USD 133m Series B earlier this month.

The shareholder register has evolved as well. Initially, Intudo was accompanied by specialist crypto investors such as Pantera Capital, Coinbase Ventures, and Castle Island Ventures. Lightspeed Venture Partners, a generalist with deep domain expertise, led the Series A extension, and then Southeast Asia-focused PE firm Northstar Group came into the Series B, making its first-ever crypto investment.

Paradigm shift

Pintu is not an isolated case. As crypto and blockchain technology-related use cases proliferate across the region, traditional GPs are either dipping a toe in the water or plunging in with dedicated funds or strategies. A return of the crypto winter – bitcoin has halved in the past seven months and is currently trading below USD 30,000 – has dampened sentiment but it won't dissuade everyone.

"We've seen Sequoia Capital doing more out of China, India, and Singapore, Lightspeed and Play Ventures are very active, and AirTree Ventures launched its first crypto vehicle in Australia. Then, in later-stage rounds, we see the likes of Tiger Global and Coatue [Management]," said Nawaz Ahmed, a general partner at New Zealand-based VC firm Global From Day One (GD1).

"Some of these firms have hired crypto specialists, they understand how markets move, and they aren't going to get scared because we are entering a bear market. If there's less hype, the next 6-12 months could be the best time for people to build interesting things."

It follows AirTree closing a AUD 50m (USD 35m) crypto vehicle alongside its latest Australia and New Zealand seed and venture capital funds. Southeast Asia-focused Openspace Ventures is targeting USD 30m for a crypto fund, while Taiwan's AppWorks created a web3 sleeve that sits alongside the main fund and allows LPs to double down on certain deals.

AppWorks made its first investment in the space in 2018 and has gone on to back 20 start-ups. BAI Capital, a spinout from Bertelsmann, started the same year as an extension of its existing financial technology and web2 coverage. Crypto doesn't get its own fund, but it is expected to account for 20% of the main fund corpus. Two lead partners already spend over 40% of their time focused on the area.

"We are very active in fintech, so we see crypto as a new form of asset class across banking, lending, asset management, security, exchanges, and custodian services," said William Zhao, a partner at the firm. In web3, we see blockchain being used to build a new internet. We've invested a lot in web2, especially social networking and content, and we believe web3 applications represent a paradigm shift."

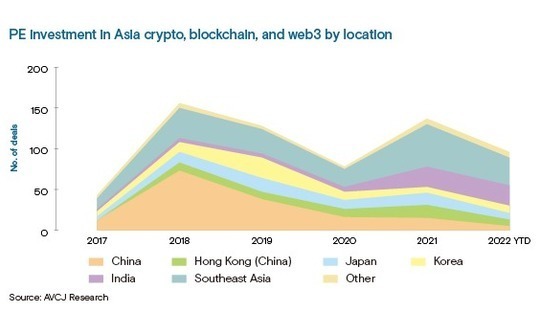

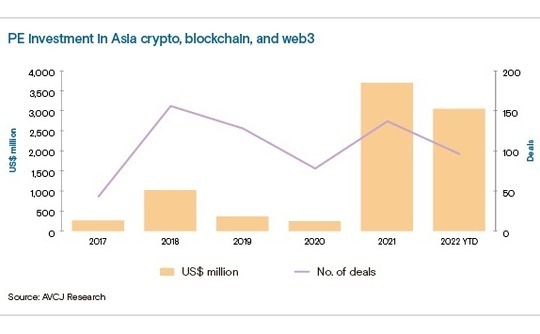

Investment activity region-wide across crypto, blockchain, and web3 roughly tracks fluctuations in bitcoin, with peaks in 2018 and 2021, according to AVCJ Research. However, the quantum of capital deployed has grown exponentially, from USD 1bn in 2018 to USD 3.7bn in 2021. Despite the recent volatility, investment in 2022 to date is just over USD 3bn.

Repeated regulatory crackdowns, culminating last autumn in bans on blockchain mining and all crypto-related transactions, have curtailed mainland China's share of deal flow. Singapore was the main hub of activity in 2021, accounting for 38% of transactions. India was next on 18%.

Going all-in

The logic behind establishing a dedicated crypto fund is both strategic and structural. On a strategic level, the opportunity is arguably so big that it cannot be ignored. Web3 represents the third era of the modern internet, and a reversion to the decentralised, community-governed ethos that defined the first era but was lost in the second as platform internet companies came to dominate traffic and fee streams.

"A new generation of internet services and products can be built so that the value of what is being created can be shared by the builders, creators, and users of the services directly with each other, rather than going to the platform middleman," Ariana Simpson, a general partner at Andreesen Horowitz, noted last October on backing Vietnam-based non-fungible token (NFT) gaming start-up Axie Infinity.

As for structuring, by engaging with business models where ownership is decentralised by design, VC firms might be stretching the risk profiles of traditional funds. Moreover, investing in tokens rather than equity may test the limits of what is permitted under the terms and conditions of those funds.

There is a generational aspect too. Early proponents of crypto investments are often younger team members whose interest in the space is both personal and professional. Openspace is a case in point, where a small group made investment proposals even as the crypto winter extended into 2019.

A combination of the climate thawing and internal education efforts helped change mindsets. Additional evidence came from within the existing portfolio. Pluang, an Indonesian micro-savings and micro-investment app, was initially a gold-trading platform but expanded quickly into new asset classes. Its crypto service grew 20-fold in six months, enjoying the same tailwinds that propelled Pintu.

"From early 2020, it became clear where the market was going and if we wanted to build a strategy that was sizeable in 10 years we needed to start immediately," said Dennis Le, a senior associate at Openspace and an investment committee member for Ocular, the firm's dedicated crypto strategy.

"The partners encouraged us to raise a separate vehicle that is more flexible in terms of investing in equity or tokens and outside of Southeast Asia. I remember one opportunity didn't fit into our existing funds and Hian [Goh, the firm's co-founder] said, ‘If you have high conviction on this, shouldn't we create a structure to make it work rather than find things that fit into the main strategy?'"

Ocular is led by Amy Zhao, one of the early crypto advocates internally who switched from a role in investor relations. At AppWorks, Ching Tseng, a younger team member who drove many of the initial crypto investments, was promoted to principal and put in charge of the web3 unit.

"The pushback from older, more senior staff wasn't so much about a lack of faith in the concept. It was more about challenging younger colleagues to communicate and rationalise opportunities in real-world terms. The debates about whether to engage in crypto were part of our training," Tseng observed.

The LP angle

These communication efforts are also crucial when dealing with LPs that are less familiar with crypto. Interest in the space is certainly rising. In Coller Capital's most recent private equity barometer survey, 30% of LP respondents said they already invested in funds targeting crypto-enabling businesses and 13% expect to make commitments in the next two years.

In addition, the survey found that fewer than 20% of LPs have or want exposure to managers that invest using cryptocurrencies (a definition that may extend to tokens), while one-third are keen to back GPs active in metaverse-related services and products. The implications are clear: on one hand, there is a distrust of unorthodox modes of access; on the other, clear use-case scenarios offer more comfort.

Crypto assets have yet to feature prominently in secondary portfolios assessed by Coller, but Will Yea, a principal at the firm, highlights the importance of business type. "If it's an exchange, we need to think about what is being exchanged, how efficient it is, how it competes against others globally, and the regulatory situation. You can understand that in a way that lines up with what we do every day," he said.

By extension, most of the capital flowing into the space in Asia has targeted a handful of companies with more proven business models. Half the capital invested so far this year targeted five start-ups: crypto exchange operator FTX, which was valued at USD 25bn at the time; blockchain media and NFT developer Animoca Brands; Ethereum scaling platform Polygon; and exchange operator CoinDCX.

"You often get asked, ‘What if everything crashes?' or ‘We've been through cycles, people have made money, are we too late?' It is important to look at what is driving the current cycle," said Ocular's Zhao.

"Openspace has a lot of experience looking at smaller companies. Web3 and crypto business models are different, but they are trying to solve real-world problems. In that context, it helps to understand consumer behaviour, how to scale companies, and how technology works."

GD1 has also emphasized the similarities between traditional venture capital and crypto investing. It offers examples of existing portfolio companies, demonstrating legitimate business models, revenue-generation strategies, and user acquisition techniques. Then the GP addresses the logic of token investments, explaining that projects don't necessarily accrue value at the equity stake level.

"We can invest in tokens or equity. A lot of deals include token warrants so that if at some point the project decides to launch a token, VC investors get a pro-rata allocation. You still have traditional equity ownership and at some point, token ownership will come," said GD1's Ahmed. "You risk leaving a lot of value on the table if you are forced to choose between equity and tokens."

Not all investments are suited to tokens. Ocular organises its mandate into five main categories: decentralised finance (defi), gaming, NFTs and the metaverse, decentralised collaboration platforms, and web3 software-as-a-service (SaaS) tooling and infrastructure. There is also a small allocation for investments in other crypto managers to get access to deal flow, especially outside Southeast Asia.

Ocular's Zhao contends that tooling and infrastructure – the "picks and shovels" of crypto – are less appropriate for token issuance because companies are essentially employing web2 business models to serve web3 customers. This category is of particular interest to Ocular right now because it tends to offer more price stability than the others during downcycles.

Wisdom of the crowd

Investors identify several due diligence challenges specific to crypto: the best projects often don't need much capital and deals close quickly; the body of existing web3 companies is relatively small, which complicates comparison-based price discovery; and there are many anonymous project sponsors, who argue that the founding team is irrelevant in a decentralised world, but this stymies background checks.

However, arguably the most significant and pervasive is the decentralized autonomous organization (DAO) structure, which is designed to transfer ownership, governance rights, and decision-making responsibility to broad communities of users. While decentralisation goes to the heart of crypto philosophy, it is at odds with conventional VC expectations for a board seat and a 10% stake.

Ocular has completed eight investments, none of them defi projects. BAI Capital is also steering clear of such opportunities. "Investing in DAOs requires a breakthrough in internal compliance, and we are still on our way. We have yet to invest in any projects with fully decentralised governance because it means giving up protection mechanisms like liquidation preference," said BAI's Zhao. "But we are evolving."

In this sense, there is not necessarily opposition to the principle of decentralised governance, more an acceptance that adaption takes time. AirTree got there faster than most. Defi, DAOs, and NFTs are central to its web3 strategy; one of its first two investments, decentralised derivatives platform Zeta, was a subscription to tokens governed by DAO.

John Henderson, a partner at AirTree, stressed the importance of being an active player in communities by participating in governance votes and making governance proposals. Traditional VCs in the US have demonstrated an ability to be influential despite holding a smaller economic interest. It suggested GPs could help remove inefficiencies in Asian DAOs by performing the same role.

AppWorks also advocates for the structure, arguing that it changes the relationship between companies and stakeholders in a positive way, even if it means investors have smaller positions.

"GPs exert influence with smaller stakes by being indispensable in terms of networking with other blockchain companies. This is essential for ecosystem building," said Tseng. "In addition, blockchain start-ups tend to need lots of research, media and back-office advisory support. That can be offered in exchange for more exposure to future upside if not a greater percentage holding."

This points to how traditional VC investors can make operational contributions in a crypto context. Crypto-native value creation typically involves providing liquidity to tokens once they go live on marketplaces and validating operating nodes for decentralised blockchain applications. However, when companies are in fast-growth mode there are all kinds of practical needs as well.

"Crypto-native investors from trading backgrounds bring a certain skill set to projects. But these are often venture-style projects, with a long road and a valley of death," said AirTree's Henderson.

"Organisation building, team building and recruitment, setting up systems and processes, marketing, working with regulators, comms and PR support, governance participation, node operation – we had most of this set up already and have added to our capabilities to add value to our Web3 investments."

Work in progress

In Asia, especially, crypto is still in its nascent stages. Comparisons are readily drawn with internet-based technology in the late 1990s and early 2000s, given the rising user adoption, plethora of unproven ideas, uncertainty around regulation, and willingness to work around rules where they do exist. It is generally agreed that crypto will be very relevant 10 years from now, but little consensus as to exactly how.

Having taken a step into the unknown with Pintu, Intudo is now wary of an industry it believes has become bloated by an excess of capital and hype. Chan notes there are too many founders peddling copycat business models and too many "non-independent thinking VCs" chasing them. The firm has yet to make another crypto investment and it has resisted proposals to raise a dedicated crypto fund.

"It's good to see more firms leaning into this, but are they genuine investors or is it just a land grab?" Chan added. "If it's a pureplay strategy, I get it. If it's a generalist firm adding another item to the menu when they don't have the right people and expertise, I get nervous. Where were they in previous downturns? People launch vehicles when something is hot, and then it's not."

While expectations may have run ahead of reality, contributing to asset price bubbles, infrastructure and applications are being built in the background. Regulation remains an unknown, but Ocular's Zhao believes greater participation and innovation will see cycles moderate over time, resulting in an industry that is "more professional, more usable, and with a more acceptable risk-reward."

There is already evidence of global market leaders using M&A to create powerbases, with the likes of Coinbase, Crypto.com, and FTX making acquisitions and facilitating exits for early-stage investors. Coinbase, an exchange, made the jump to a public listing, and it remains to be seen what happens if – or when – NFT marketplaces, where tokens account for the bulk of balance sheets, try to do the same.

Peter Sanborn, a former managing partner of PayPal Ventures who recently joined Singapore-based fintech investor Arbor Ventures, disputes the notion that traditional VCs are moving too quickly into crypto. However, he admits that many start-ups have emerged on the back of a two-year bull market and now it is a question of how they think about branching out and achieving sustainability.

One solution, in a fintech context, is developing hybrid business models that serve both traditional and web3 clients. Taxbit, a PayPal Ventures portfolio company, achieved this by developing an automated tax reporting tool for crypto users and then repurposing it for mainstream financial institutions.

"It allows them to expand and diversify the addressable target market," Sanborn said. "I think you'll see more crossover players in fintech infrastructure where they essentially utilise crypto as a trojan horse or as a wedge to get back to helping reinvent traditional financial services architecture. If crypto is coming down or seeing pockets of volatility, this allows companies to build a more resilient business."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.