China secondaries: Liquidity play

Under pressure to generate returns amid a challenging fundraising environment, Chinese GPs are beginning to revise pricing expectations to get traction with continuation funds

For Indian private equity managers, the breakthrough came in 2016 when fundraising topped USD 6bn for the first time in six years. It was widely interpreted as a sign that LP sentiment on country-focused funds had finally turned, ending a protracted period of bitterness over an investment narrative that didn't live up to its billing.

India fundraising tracked a rapid ascent to a 2008 peak, when USD 23.5bn was raised in the space of three years, followed by a deep trough. Managers that were able to ride out tough times have since flourished – annual average fundraising for the six years to 2020 was USD 6.6bn, twice the average for the six years before that – but plenty didn't live to tell the tale.

Some came to represent Asia's most prominent cohort of zombie GPs: managers that stagger on, feeding on an ever-dwindling legacy fee base, unable to raise new capital or retain talent.

The question occupying the minds of numerous industry participants is whether the same story will play out in China. Geopolitical tensions, regulatory uncertainty, and pandemic-related lockdowns have together thrust the country into a capital winter, the severity of which US dollar-denominated fund managers have never experienced.

There is a general reluctance to draw parallels between India 2010-2014 and expectations for China 2021-2025. "China is not India. Second and third-tier managers will struggle, so they might have zombie-like tendencies, but I expect the market to bounce back and do so relatively quickly," said Niklas Amundsson, a partner at placement agent Monument Group.

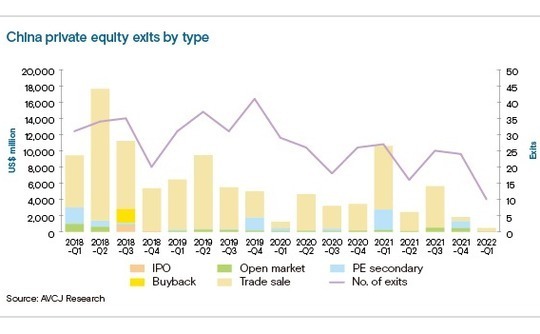

Still, the tough fundraising climate has placed a premium on liquidity. Local GPs recognise that distributions are their best chance of sweetening the mood among LPs, and they are considering all options. Consequently, compromise has crept into previously rigid negotiations on pricing for secondary continuation funds, with 40% discounts to net asset value (NAV) routinely cited.

"We are in a situation that is a bit like 2008-2009 in terms of secondaries in China. It should be a big opportunity," said Paul Robine, CEO of Asia-focused secondaries investor TR Capital. While he sees valuations starting to correct, Robine expects a sharper drop once the full impact of the recent lockdowns is reflected in second-quarter reports to LPs.

Sticking points

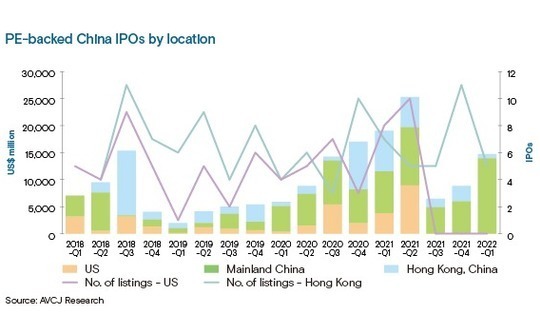

The root cause of India's problems was a lack of exits: the fundraising frenzy of 2006-2008 delivered just USD 12.1bn in exits between 2011 and 2013. China's exit issue is more nuanced. Midway through last year, regulatory action by Beijing cast uncertainty over offshore IPOs, adding to existing unease about the future of US-listed Chinese companies over a longstanding tax assessment dispute.

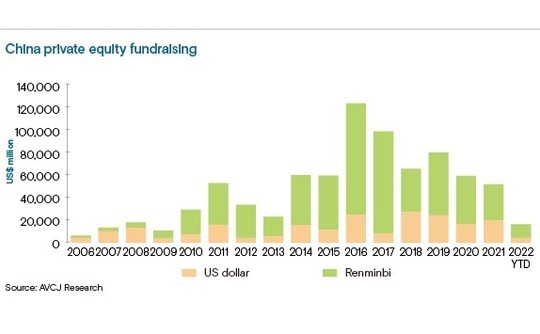

Certainly, the decline in China fundraising started around the same time. A total of USD 20.1bn was committed to US dollar vehicles last year, consistent with the average for the previous five years. However, more than 70% of the capital was raised before the end of June. Fundraising for 2022 to date is a paltry USD 4.5bn, according to AVCJ Research.

"Institutional investors are in a holding pattern – they are not looking to commit more to China, but neither are they looking to dial down their China exposure in a significant way," said Edmond Ng, a managing partner at fund-of-funds Axiom Asia. "It's not that there's no longer any interest. China is the second-largest market in the world."

No manager is immune to the impact. Sequoia Capital China has set a target of USD 7.1bn for its latest set of funds, nearly twice what was raised in the previous vintage. The firm typically adds relatively few names each time and many existing investors see their allocations cut back.

One source close to the situation told AVCJ in April that efforts were being made to diversify the LP base, which has historically been US-heavy and populated by endowments and foundations. As a result, new investors are getting access, and allocations for others are not being so severely reduced.

Ng observes that GPs with funds above USD 3bn can rely on re-ups from large institutional investors that need to write cheques of at least USD 300m to maintain their pace of deployment. At the other end of the spectrum, new private equity and venture capital firms, including spinouts from established players, are likely going to have a hard time fundraising.

Routinely reaching or breaching hard caps is also likely a thing of the past. FountainVest Partners, for example, took about six months to hit the hard cap on each of its second and third funds. Fund IV is nearing a final close, having spent over 20 months in the market, said a separate source close to the situation. It may reach the USD 2.8bn target, but not the USD 3.2bn hard cap.

"It's China. Any respectable manager hits the hard cap – but not so much anymore," Monument's Amundsson noted wryly. "We've had several opportunities to work on top-ups for brand-name managers that have already done a first close and need help crossing the finish line. We used to jump on situations like that, but not in today's market."

Monument is working with one China GP that launched its fund in early 2021 and was 20% short of its hard cap by mid-year. Then the regulatory blitz intensified, LPs halted their processes, and nothing happened until Chinese New Year. That brief renaissance ended with the lockdown in April as LPs backed away again. The manager is above target and less than 10% below a revised hard cap.

It is among the more fortunate. "There will be GPs that struggle to raise US dollars and go back to renminbi funds. There will be GPs that cease to exist," said Lloyd Bradbury, a managing director at boutique advisor Greenhill. "A huge amount of money was raised between 2013 and 2017, and a portion of those GPs that haven't done well won't be fundraising again."

Alternative solution

A significant proportion of the inbound inquiries received by secondaries investors are from managers looking to complete renminbi-to-US dollar restructurings. It is one of three categories in which TR Capital sees the most deal flow, alongside managers seeking extensions for funds nearing end of life and hedge funds selling pockets of private investments to facilitate redemptions.

Foundation Private Equity led a syndicate that backed a USD 82m cross-currency restructuring involving Bright Capital in January. The discount to NAV was not disclosed but it is said to be not far removed from the 40% cited for other deals. Progress was slowed by last year's regulatory upheavals as investors figured out what it meant for liquidity profiles.

"Deals are getting priced at levels you wouldn't have seen 12-18 months ago. Whether they close at those prices remains to be seen," said Jason Sambanju, a partner and CEO at Foundation, who claims to be receiving four inquiries per month from Chinese GPs, twice as many as six months ago.

"Pricing started softening last summer when IPOs that were meant to go out in the US got pulled and reoriented towards Hong Kong. Sentiment around Chinese venture cooled significantly, and then the lockdown has further dampened sentiment."

Sambanju notes that prudent GPs are already thinking about markdowns, based on the burn rate of individual portfolio companies. It comes down to whether there is enough runway to outlast the current downturn and avoid raising capital at a time of falling valuations, and then how much cost can be cut to extend this runway before it eats into revenue and valuation multiples.

The answer varies by segment, with high-cash-burn consumer-facing internet start-ups in a less favourable position than hard-tech or deep-tech players. Many of the latter can still raise capital at elevated valuations because they are popular policy plays in the renminbi space with strong domestic IPO prospects. Moreover, investors may place a high value on the technology even if revenue is low.

"Some GPs – across Asia and globally – think this will be worked out as companies grow into their valuations. After 12 months, the company performance metrics may have improved, but the fundraising will be in line with the old valuations," said Will Yea, a principal at Coller Capital. "

"However, there is a difference between businesses that have stable unit economics and some measure of profitability or path to profitability and those that do not."

Sharing upside

Even then, a 40% discount can be deceptive given the amount of structuring that tends to go into these secondary deals. Whereas 2021 was a very active year characterised by cash transactions, preferred equity and earnouts have become the flavour of 2022. They help address buyers' concerns about market uncertainty and sweeten the pill for sellers and GPs swallowing steep discounts.

Foundation took a different approach with Bright Capital. The secondary component was accompanied by a separate commitment to a primary sleeve by the same investors. The manager's ability to take compensation out of that vehicle is tied to the performance of the continuation fund. The intended impact is like that of other structuring: creating alignment between stakeholders.

"The headline price might be at a 40-50% discount to NAV and that can look scary to GPs and the selling LPs," said Nicole Su, a managing partner at China-based placement agent Jadehouse Capital. "But what you don't see are the earnouts, which happen in 2-3 years if benchmarks are hit. In certain deals, there needs to be some structuring to incentivise sellers."

Not all investors are sold on 40% discounts, structured or not. Robine of TR Capital questions whether any of the assets currently available are worth buying. He would prefer to wait until later in the year, by which point private market valuations will have corrected sufficiently to reflect both China's slower economic growth and the recent public markets fallout.

"You may find huge discounts, but these are average quality companies, and they are value traps – you will have trouble exiting them," Robine said. "We focus on high-quality companies, and we don't really see any discounts, or at best single digits. It will be different in the second half of 2022."

This view is echoed by Martin Yung, a principal at HarbourVest Partners, who observes that "a number of transactions come to market and never cross the finish line because of a large bid-ask spread." This gap between public and private market valuations is only expected to close once sellers adjust their expectations and GPs make markdowns a feature of their latest quarterly reports.

In the renminbi space, a host of secondary funds have been launched in the past 18 months by government-linked sponsors and independents such as Gopher Asset Management, Shenzhen Capital Group, Huagai Capital, and China Grand Prosperity Investment. The latter has executed transactions involving Qiming Venture Partners, Summit View Capital, and Green Pine Capital.

"Secondary funds will be more frequently needed by GPs and local governments are becoming the main force behind this. The reason is simple: Government guidance funds are the biggest LP constituency for renminbi funds, they want to see liquidity events, but these aren't happening. As such, they need secondary funds to secure exits," one local manager told AVCJ.

As for transactions involving US dollar vehicles or cross-currency restructurings, pickings remain slim. Investors and advisors claim that only about half a dozen formal processes for continuation funds are currently in the market. Hundreds more prospective situations never get going at all, according to Greenhill's Bradbury.

Pressing needs

While he sees plenty of turning to secondaries after exhausting every other option, Bradbury cautions against using continuation funds as a tool of last resort. The best outcomes tend to arise from GPs reaching out early, explaining what they want, and entertaining different proposals.

Some managers still offer up their entire portfolios for inspection, essentially inviting secondaries investors to select assets. If a proposal makes sense in terms of time, money, and opportunity, they approach LPs in tandem with the investor. However, in the past 12 months, proposals have started crossing the desks of investors already partially formed.

"More groups are coming to us with pre-packaged deals that have been blessed in principle by key LPs. They are looking for a secondary investor that can take the lead and unlock the deal, handling the pricing and structuring," said Foundation's Sambanju.

There are several contributing factors. Without question, Chinese managers are more familiar with secondary solutions, having seen peers execute such transactions, while the advisors are increasing their penetration of the GP community. In addition, it may demonstrate either a rising level of desperation or recognition of an impending point of reckoning.

It remains to be seen how this develops against a backdrop of declining valuations, delayed exits, and challenging fundraising conditions. Assorted industry participants highlight China's ability to rebound – "There is some short-term pain, but we remain cautiously optimistic about the country's prospects," said Yung of HarbourVest – but this won't necessarily fit the timeline of some GPs.

Few would bet on Western institutional investors reengaging with China this year, regardless of lifted lockdowns. And there is no guarantee that secondary solutions will be a panacea. A rise in zombie GPs is seen as inevitable in the renminbi fund space; the extent to which the same happens to US dollar managers depends on how macroeconomic conditions impact that rebound.

"What we've seen in the past 15 years is that every correction was followed by a rapid and stronger bounce back. Entrepreneurs will try to control their burn and delay raising new money until market conditions improve. For GPs, investment pace will be slow," said Axiom's Ng.

"But unless the US Federal Reserve reverses course and decides against tapering and hiking interest rate further, I think the market is going to stay down."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.