Japan VC: Late-stage crossroads

Japan’s late-stage technology start-ups are finally beginning to attract meaningful attention from global investors. They should not pop open the champagne

Cross-border schmoozing is not a strong suit for Japanese venture capital investors. Even industry leaders with bases overseas are often described as having strongly domestic-focused agendas. Insularism is held up as one of the core explanations for a lack of global investor attention and consequently a persistent funding gap for late-stage start-ups.

Japan and US-based crossover investor World Innovation Lab (WiL) believes it has made meaningful progress on this front in recent years. Co-founder and CEO Gen Isayama, who has been based in Silicon Valley for 22 years, claims extensive connections in the global VC community and has helped the likes of Sequoia Capital and Light Street Capital make inroads in Japan.

Evidence that this bridge-building is working came in May when DST Global and WiL co-led a JPY 15bn (USD 115m) Series C for corporate credit card issuer Upsider. This was the first time DST had taken a lead role in a Japan deal. Two weeks earlier, SoftBank Vision Fund led a JPY 8bn Series C for smart endoscopic imaging developer AI Medical Service, with support from WiL.

Isayama isn't forecasting a flood of foreign capital, however. Viewed through a certain lens, Japan has never been more attractive: a normalisation in valuations following a feverish two years means a Series C or D for a B2B software-as-a-service (SaaS) company is priced at 6-8x annual recurring revenue, down from 10-20x. But this is symptomatic of a broader malaise, a global correction.

The cultural context is uniquely Japanese: this is an environment where flat-rounds and down-rounds are not merely embarrassing suggestions of stagnation – they're impolite.

Delayed IPOs have left start-ups needing to reconstruct their budgets, but cultural pressures to maintain the heady valuations of 2021 have often proven overwhelming. If a potential incoming investor proposes a flat or lower buy-in price, existing backers may also balk, claiming a new normal run by new technologies requires new approaches to valuing companies.

"This has happened so many times in the past. People say it's a bargain deal because it's a flat-round, but the company is better than it was before. If I put last November's environment around me, yeah everything looks like a bargain today. But right now, we're seeing a major adjustment," Isayama said.

"Some later-stage companies are still a bit too optimistic, and we know that things are going down. People say it will be much better at the end of the year, but when you see this massive inflation pressure in the overall economy, I fear the worst for 2023 and at least 2-3 years of recession."

Selling a story

Nevertheless, the campaign to bring foreign VC into Japan is in full swing. Coral Capital, formerly 500 Startups Japan, considers this a matter of awareness and changing the perceptions of global institutional investors who see poor upside in a dearth of unicorns.

By Coral's count, there are only 10 unicorns in Japan, but another 41 so-called hidden unicorns reside on the Tokyo Stock Exchange. These are start-ups that were forced to IPO at sub-unicorn valuations due to a lack of access to private late-stage funding but that went on to meet the USD 1bn threshold as public companies within 10 years.

The essential message of the research is that the talent and markets are here – but Japanese start-ups grow differently.

"When you're looking at Japan, you have to understand the background. You can't use the same logic as in the US, where there's plenty of capital and there's no need to IPO," Tiffany Kayo, an analyst at Coral, said. "It's important to get out of that mindset of applying the global benchmark, where we don't consider an IPO as a fundraising round. Really, it's just another fundraising round."

Coral is tracking some successes in this charm offensive, having closed its third flagship fund on JPY 14bn last year with 30% of the capital coming from global investors across the US, Asia, and Europe. This came shortly after a JPY 15.6bn Series D for the jewel of its portfolio, enterprise software supplier SmartHR, led by Light Street. SmartHR has also received backing from WiL and Sequoia.

Similar traction is being charted by Incubate Fund, a local early-stage investor that raised JPY 16bn for its first pre-IPO fund last year with 47% of the capital coming from institutional overseas LPs. Incubate co-founder Masahiko Honma has been meaning to raise such a vehicle for years but needed to wait for the geopolitical stars to align.

"There is an oversupply of money in the growth and later stage in the US on one side, and on the other, we're seeing a slowdown in the China tech scene based on tightening regulation," Honma said. "For a lot of the money seeking Asian growth, the allocation for China is going to Japan."

The fund invests exclusively in existing portfolio companies; one of its first moves was taking the lead in a JPY 5.1bn Series C for lunar exploration technology developer iSpace. This precipitated an investment from fund-of-funds Axiom Asia, possibly the start-up's first non-Japanese investor other than foreign space agencies.

Honma observes that there is also a sector lens to the idea of global capital coming into late-stage VC in Japan. Although Mercari, a flea market app that raised USD 1.2bn in Japan's first major tech IPO in 2018, is widely credited with initially stoking unicorn ambitions locally, consumer is not the predominant theme.

Deep tech in domains such as space, materials, and medical science plays better here than in most markets, but B2B SaaS is the main draw. Incubate's other late-stage portfolio companies include Wovn, an IT provider that helps companies localise websites, and marketing technology supplier Bellface.

Policy permutations

The government has been pressing this agenda in earnest for about a decade with mixed results, which could be instructive to private players now getting involved. There is a sense that government investors like INCJ, which is mandated to support late-stage start-ups, have given companies underserved runway. To some extent, lingering demand for high valuations has been attributed to this effect.

But private sector sentiment for policy support has been largely positive – and still improving. INCJ, for example, has been reborn as Japan Investment Corporation (JIC) with what is perceived to be a more properly incentivised investment team. Last year, it backed a USD 230m Series F for media unicorn SmartNews that featured US-based Princeville Capital and Woodline Partners.

The most meaningful development on this front is arguably the idea that public VC entities can eventually seed the private sector with investment talent rather than the other way around. This happened in 2020, when Tokihiko Shimizu, previously head of a government-linked private equity program for Japan Post Bank, left to start his own growth-stage shop Fiducia.

Shimizu, a mathematician by training, initially made his mark in the industry by helping Government Pension Investment Fund (GPIF) diversify its portfolio into alternatives. In 2015, he moved to Japan Post Bank and later took the helm of Japan Post Investment Corporation, a direct investment unit that earmarked about JPY 36bn for direct growth-stage technology deals.

On the back of this experience, Shimizu convinced the recently retired Takumi Shibata, previously CEO of Nomura Asset Management and Nikko Asset Management, to be a co-founding partner of Fiducia. Their debut fund reached a first close of JPY 3.3bn in February with support from Pavilion Capital, Nanto Bank, and Tokyo University of Science Investment Management.

"An independent fund can provide very quick investment and operations decisions, respond to situations and be very flexible, which is especially important in hands-on investment in the growth stages," Shimizu said.

The fund is targeting JPY 10bn, 90% of which will be deployed in growth to pre-IPO-stage companies. There is a strong focus on deep tech, business digitisation, social impact through tech-driven economic growth, and meaningful ownership stakes. Four investments have been made to date, including the acquisition of a 30% stake for an undisclosed sum in advertising start-up Lightz.

Cheque sizes theoretically max out around USD 10m but significant co-investment from LPs, especially Pavilion, a subsidiary of Singapore's Temasek Holdings, is expected. The preference for sizeable positions is part of an operational involvement thesis that Fiducia sees as lacking in Japan's current growth-stage capital environment.

"Venture capital firms are good at employing 30 and 40-year olds and sending them to board meetings of the companies they invest in," said Shibata, whose experience since the 1980s includes roles as Nomura Group COO and Europe CEO of Nomura International.

"They participate every few months, write reports, and job done. The crucial importance of outside directors giving strategic advice and opportunities to build networks is completely missing."

The operational, B2B slant in Japan's late-stage opportunity set has resulted in significant diversity in terms of incoming actors. In addition to government entities, foreign VC firms, and local early-stage players expanding their remits, conglomerates trying to go digital with internal VC arms and traditional private equity firms are getting into the mix.

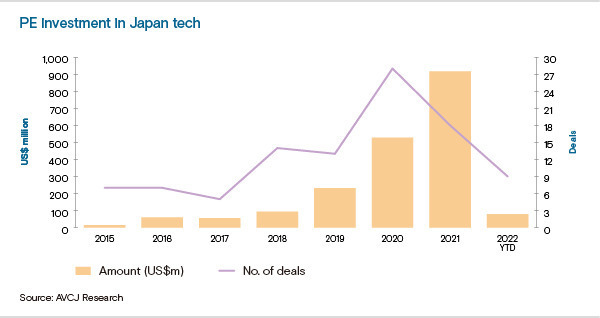

Growth-stage private equity investment, excluding VC, in Japanese technology companies increased exponentially between 2015 and 2021, when it hit USD 917m, according to AVCJ Research. This compares to USD 528m and USD 231m in the prior two years.

The Carlyle Group arguably led the standout deal in this theme, a JPY 24.4bn round for an advanced biomaterials developer called Spiber. Goldman Sachs and Bain Capital have made Series C investments in recent months, and Advantage Partners has explored minority, even early-stage, investments.

Prospects uncertain?

The phenomenon is partly about seeking pre-IPO returns and partly about recognising the zeitgeist in corporate Japan toward digital transformation via start-up service providers. But the question remains how far it can go when minimum cheque size requirements and stubbornly high valuations prevent global VCs from underwriting a larger population of private late-stage companies.

What's more, rightly or wrongly, there have been no signals from the Tokyo Stock Exchange that it intends to change the policies that have encouraged companies to go public before they achieve scale. Local VCs do not complain about the field of available late-stage investment targets, but from the private equity perspective, it's slim pickings.

"Many PE funds in Japan are emphasising technology-driven approaches. Investment theses incorporate additional value creation through digital transformation, and portfolio ops teams increasingly have a CDO [chief digital officer] or in-house analytics group," said Paul Ford, a Japan-based partner at KPMG.

"There is also increased appetite for growth capital investments, particularly in high-opportunity areas like B2B SaaS, but the relatively smaller late-stage tech market in Japan has severely limited such opportunities."

Layer on the current macro deterrents – rising interest rates, geopolitical tensions, public market volatility, rising inflation – and the horizon narrows even further. Growth stage PE investment in Japan tech amounts to only about USD 79m so far this year, putting 2022 on track for a 74% decline versus 2021.

Investors that AVCJ contacted for this story observed that Vision Fund, which recently posted an investment loss of JPY 3.5trn across both vintages for the 12 months ended March, has been quieter this year. Likewise, Tiger Global Management is said to have perceptibly decelerated amidst various challenges. The former has only recently begun to target Japan; the latter has yet to make a significant move, according to AVCJ Research.

Global VC woes are not expected to spook all late-stage investors interested in Japan, most of whom are a decidedly more conservative lot than the likes of Tiger and Vision Fund. Additional growth funding will be needed to create the unicorn breeding ground that existing participants in the market envision. But the fact that it must now come with renewed discipline around pacing, valuations, and governance suggests a continued, protracted expansion rather than a boom.

"I've seen a lot of people at late-stage funds changing jobs because we get job offers and they ask if we're hiring. Why? Did they invest heavily into later-stage companies which are big-time underwater," WiL's Isayama said. "There is always the market cycle, and it doesn't mean that late-stage growth opportunities are gone. We're just going back to normal."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.