Private wealth: Talent war

A shortage of fundraisers familiar with the high-net-worth segment is being keenly felt in Asia as global GPs look to raise more capital through private bank channels

Markus Egloff joined KKR last year with a brief to build out the firm's coverage of Asia's private wealth segment. He has assembled a team of nine so far in Hong Kong, Singapore, Japan, and mainland China, with several roles still open. Finding the right people in the right places is not easy.

"I've been very active myself, activating my network, and most people I've found were in one or two degrees of separation. The pond we are fishing in is small," said Egloff, a managing director and head of Asia wealth at KKR.

"We want people who understand the asset class, understand asset management distribution, and understand private banks, maybe from the inside. I'm excited by what I've found, but it's rare to find all three criteria in one person. You must build teams that bring these skillsets together."

Typically, investor relations executives are organised by geography rather than by client type: coverage of private banks in Singapore, for example, falls to those responsible for institutional LPs in that market. KKR brought in Egloff as part of a push to develop the family office and high net worth individual (HNWI) segment, including having dedicated people in this area.

An early win came with the firm's fourth pan-regional fund, which closed on USD 15bn last year. Half of the 85 investors that had not previously committed to KKR's Asian private equity strategy were private wealth clients, many based within the region. Their participation helped drive the overall LP count to 290, higher than any other vehicle the firm had raised globally at that point.

Ultimately, KKR and its peers will be pitching more than just traditional drawdown funds to Asia's HNWIs. Semi-liquid products, arguably better equipped to address client concerns around liquidity, transparency, and minimum cheque sizes, are seen as a potential game-changer in the relationship between private equity and private wealth. Most global GPs are looking for people to sell them.

"Demand has spiked across IR capital formation, capital raising, and business development. It applies to the multi-strategy asset management platforms and the alternative asset management platforms," said Arthur Leung, a consultant in the Asia Pacific financial services practice at Egon Zehnder.

"Clients want a more permanent presence in Asia because they recognise that covering the region from outside is challenging. The wealth and family office space is a particular area of focus."

Early movers?

Egloff came to KKR from UBS, where he spent 25 years in wealth management and asset management. Other senior hires include Edward Moon, who Apollo Global Management brought in from HSBC Private Banking to perform a similar private wealth coverage buildout. Apollo wants to have a team of six by year-end as overall Asia IR headcount doubles to 25-plus.

Herbert Suen made the transition from wealth management at Barclays to The Blackstone Group six years ago, reflecting his firm's status as an early mover among the global firms. Blackstone now has USD 192bn in private wealth assets under management (AUM) – 20% of the total – and most of that comes from HNWIs. Its dedicated HNWI headcount is more than 200 globally, including 20 in Asia.

Blackstone was also among the first to gain meaningful traction with semi-liquid products that account for the bulk of HNWI money. They resemble mutual funds and can be sold directly into the US retail market as opposed to just accredited investors. BREIT and BCRED, which focus on real estate and private credit, respectively, had USD 100bn and USD 37.8bn in total asset value as of March.

"More than 10 years ago, we asked ourselves at Blackstone: how can we diversify our client base for the long-term?" said Suen, the firm's head of private wealth solutions in Asia.

"We were committed to the private wealth space since day one. It's not just about the products, but awareness of certain concepts, which is why we've centred our approach on education, product development and services. We have dedicated teams in the private wealth solutions group to design educational resources to assist investors in understanding more about alternative investments."

In the US, Blackstone started out focusing on the larger private banks or wirehouses and then created specific coverage teams, which led to the cultivation of a network of registered investment advisors (RIAs). Asia, which the firm began targeting in earnest seven years ago, doesn't boast the same kind of infrastructure. HNWI distribution is essentially about working with private banks.

"We are seeing more private equity firms talking to private banks as intermediaries," said Michael Di Cicco, a senior client partner at Korn Ferry. "I think Asia is a step or two behind Europe, where most of the big global firms are looking to build coverage of HNWIs directly as well as through intermediaries. That's an indication of where things are likely to go."

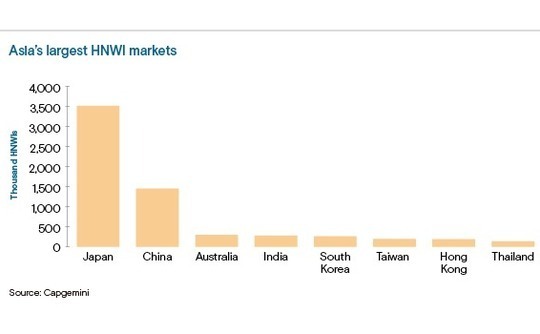

The emphasis on private banks as conduits means that Hong Kong and Singapore are the regional fundraising hubs. The former is a staging point for Greater China, notably the nearly 1.5m mainland Chinese individuals who reached the HNWI watershed of having at least USD 1m in investable assets in 2020, according to Capgemini. The latter serves Southeast Asia and non-resident Indians (NRIs).

Local nuance

While private equity specialists are being recruited in mainland China as well, they primarily function as educational nodes for business that takes place offshore. Some GPs are looking at the qualified domestic limited partnership (QDLP) program as a means of bringing the entire process onshore, but progress is limited.

Australia and Taiwan are also named as places where it helps to have on-the-ground IR talent, but the biggest coverage gap is Japan.

With more than 3.5m HNWIs, Japan is the second-largest private wealth market globally after the US, yet it remains underpenetrated by the alternative investment industry. This is typically blamed on local regulatory and licensing requirements, complications around tax and creating fully hedged yen-denominated products, and a need for concerted educational efforts in Japanese.

Luca, a digital platform launched by a former Blackstone fundraiser in Japan to tap local investors below the top-tier institutions, estimates there are 1.3m HNWIs with at least JPY 100m (USD 768,000) in assets. Together, they are responsible for JPY 333bn, of which 30% is held by approximately 87,000 households in the JPY 500m and above category.

Japan wants to increase onshore investment options, in part to stem the flow of wealth offshore, and lowering the qualified investor threshold from the current level of JPY 300m is said to be under consideration. Nevertheless, Keiko Sydenham, Luca's CEO, noted that global private equity firms struggle to access the market because there are relatively few private banks.

There are independent financial advisors, much like RIAs in the US, that work through local securities houses. Private equity firms must establish partnerships with securities houses and trust banks, but these effective gatekeepers often lack the resources for end-to-end coverage, Sydenham added.

"You need the right product and branding to succeed in Japan," said Leung of Egon Zehnder. "You also need the right distribution partners, and there aren't many of them. There are a lot of post-investment demands around reporting, valuation, and liquidity, and the local talent pool is small."

Layer by layer

Outside of Japan, a lack of sophistication in Asia's local private banks remains a challenge. Global GPs work reasonably seamlessly with the major international wirehouses, often establishing lines of dialogue in the US, switching to Asia for product launches, and then relying on US-based colleagues to handle due diligence and onboarding. After-sales duties are normally fulfilled in Asia.

Within the region, Blackstone is pushing below the private banking tier into priority banking channels, regulations permitting. However, most global GPs are currently focused on Asian private banks and some wealth management platforms, citing limited bandwidth and the heavy lifting required when venturing beyond a small set of local champions.

Private bank relationships, at the global and regional level, are expected to account for the bulk of private wealth commitments out of Asia in the near term. Digital channels, which are being actively cultivated, are regarded as more of a long-term play.

One phenomenon noted by several industry participants is that leading private banks have become more demanding. In some cases, the number of feeder vehicles launched each year has doubled to nearly a dozen. They have a clearer understanding of what resonates with their clients and what they want from private equity firms in terms of marketing support and reporting.

This adds weight to the argument for dedicated IR resources on the GP side, although these individuals are not necessarily recruited from private banks. Talent is also found in rival private equity firms and broader asset managers, often with an emphasis on product specialists who can interact with relationship managers at banks rather than salespeople.

"There is a balance to be struck between a subject matter expert, who knows about the product we are delivering, and the salesperson, who can convince the distributor and end clients that the solution makes sense," said one IR executive at a large-cap private equity firm. "I wish there were more people with both qualities."

Even in the institutional space, proven fundraisers are a relative scarcity in Asia. Di Cicco of Korn Ferry claims the market is shaped like a barbell: a handful of senior professionals have built up track records raising capital across strategies and geographies; a reasonably deep base of unproven up-and-comers sits below; and there is little in between.

"Within private wealth, supply is thinner," he added. "For years, private banks have employed alternatives specialists who could speak to clients. But not many; maybe one or two in any geography. If you want people who understand private banking and private wealth and who understand private equity or illiquid strategies, it is thinner still."

Distribution dynamics

These people are prized not only because there is more demand for alternatives exposure from the private wealth clients, like most LP constituencies. The nature of distribution is changing as well – to the point that, in global multi-strategy firms, products and modes of engagement in the private wealth and institutional segments might be fundamentally diverging.

HNWIs in Asia are chiefly accessed through feeders, typically established by private banks to enter specific fund products. To some GPs, however, these structures are suboptimal: too complex, cumbersome, and costly, with multiple parties involved and multiple layers of fees.

Should feeders be supplanted by semi-liquid products – and for now, only a handful of large-cap managers are offering these – approaches to IR may shift. Rather than work on feeders within specific timeframes, and then reverting to core institutional coverage until the next vintage, fundraisers would be talking to private banks on a continual basis.

As one placement agent puts it: "The Holy Grail is integrating products into a strategic asset allocation. You get onboarded and capital just flows semi-automatically into client portfolios."

In this context, private equity firms don't see themselves competing against each other for private wealth money as much as the dozens of mutual fund products currently offered to HNWIs. When Blackstone brought its semi-liquid real estate strategy to Asia three years ago, some private banks were more focused on public markets, but China's property crunch proved a rude awakening.

"In the US, retail investors can invest in listed REITs if they want exposure and income from income-oriented real estate assets, such as warehouses. However, listed REITs are exposed to equity market volatility in addition to real estate risks. Private or non-traded REITs on the other hand can provide more stability, typically generate regular income and have the potential to appreciate," said Suen.

"Non-traded REITs are generally less liquid than daily mutual funds, but they typically can provide access to real assets with some liquidity. You also generally have transparency on the underlying assets – you may see who the tenants are and can see the rental income coming through."

The equivalent credit strategy launched in Asia last year and met with a generally positive response. Blackstone was able to highlight the performance of public market fixed income products and make the case that they were not as uncorrelated to liquid equities as advertised. Private credit was positioned as a truly uncorrelated alternative.

Others are making similar pitches. Apollo's yield business, which accounts for more than 70% of the firm's approximately USD 500bn in AUM and spans corporate credit, structured credit, and direct lending, is marketed as an effective fixed income replacement.

"Whether you are a sovereign wealth fund or an individual, the hunt for yield continues. Interest rates are rising, there is increasing volatility, and most wealth clients don't have enough exposure to private markets. They are seeking diversification, downside protection, and alpha – and we are providing solutions that deliver this," said Moon, Apollo's head of Asia Pacific global wealth management.

A broader suite

Real estate and credit have traditionally accounted for a significant portion of HNWI portfolios in Asia. Semi-liquid products, whether as interval funds, business development companies (BDCs) or REITs, are intended to facilitate a transition from public to private markets.

It remains to be seen whether private equity and infrastructure are embraced as readily. KKR is preparing to find out as it develops a semi-liquid product range that will soak up much of the additional volume as the private wealth share of annual fundraising rises from 10-20% to a planned 30-50% in the next several years.

The expectation is that private wealth-focused IR professionals will work on a combination of drawdown funds and semi-liquid products over the next three years, with the latter growing in importance and share of commitments. In the long term, Egloff doesn't anticipate much HNWI demand for drawdown funds outside of private equity in certain situations or geographies.

"The product landscape is changing so quickly. I think the unexpected winner could be infrastructure, which could be a fixed income alternative," he added. "Why would a client access core-plus infrastructure through a 10-year drawdown fund with a j-curve when there are semi-liquid products with good yields, a total return expectation, and some liquidity?"

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.