Diversity & inclusion: Acting with intent

GPs are looking to build teams representing different genders, ethnicities, and backgrounds as stakeholders call for more diversity and studies suggest it leads to better decision making

"In Europe, we've seen a focus on diversity for some time. Fifteen years ago, when we first had these conversations, GPs said they would hire junior people, so that within 10 years, these people would be at the top. When you look at those markets today, they haven't progressed much," Alicia Gregory, head of private equity at Australia's Future Fund, told the AVCJ Diversity & Inclusion Forum.

"What we focus on now is the how – how do we get these people to come through? Because the strategy of hiring at the junior levels just hasn't worked."

Gregory is not completely downbeat, comparing diversity, equity, and inclusion (DEI) to where the broader environment, social, and governance (ESG) space was five years ago. Since then, those who disputed the impact of ESG on returns and risk mitigation have largely faded from view. Most managers now have policies and programs, as well as internal infrastructure to handle reporting.

Meanwhile, the notion that teams exhibiting diversity in terms of gender, ethnicity, lifestyle, and cultural, education, and professional background contribute to better investment decision-making is increasingly recognized. There is a growing body of supporting evidence, not only academic studies, but also practical experience of due diligence and value creation efforts that have gone awry.

Conditions vary by geography, with some manages working from a very low base across certain DEI criteria. LPs accept change takes time in an apprentice-style industry like private equity, but they want GPs to put in place plans and set targets against which they can be held accountable.

"We are in the process of surveying all our GPs, focusing on gender diversity across the investment teams. We had one manager come back with zero females. Unless that GP puts in a policy to address the fact they have no gender diversity in its firm, we are unlikely to invest with them again," Liza McDonald, head of responsible investments at Aware Super, said at the AVCJ ESG Forum.

Strategic priority

Industry respondents in EY's 2021 global private equity survey identified talent management as their second-highest strategic priority. The importance of increasing gender and ethnic minority representation across the front and back offices was also highlighted, with 70% of respondents claiming to have documented or informal DEI initiatives underway.

These initiatives often include requirements that diverse candidates are interviewed for every vacancy, targets for female representation in each incoming associate or analyst class, and a broadening of traditional recruitment channels.

Adamantem Capital is one of numerous firms that specifically ask recruiters to submit gender-balanced candidate lists and restarts processes if there isn't sufficient diversity in the pool. Steps are also taken to eliminate unconscious bias by redacting names, schools, and universities from resumes that are put forward for consideration.

"This has been very helpful and gets us to the sort of outcome you expect – a reasonably balanced set of final round candidates including people of different genders and cultural backgrounds," Rob Koczkar, a managing director at the Australian GP told the AVCJ Private Equity & Venture Forum.

"It is incumbent on us to ensure we don't end up with cohorts that are biased in any particular way because that will become difficult for us to work out over time. We don't have quotas or targets; we try to remove unconscious bias and make the context as attractive as it can be for everyone."

Another tactic is introducing skill-based tests at an early stage as an additional filter. The Blackstone Group, for example, asks candidates to complete 12 online games, from memorizing sequences of digits to recognizing the emotions conveyed in a person's face. Developer Pymetrics claims its artificial intelligence-enabled analytics can assess 91 cognitive, social, and behavioural traits.

Blackstone and other global firms also endeavour to look beyond the top-tier universities that continue to dominate private equity. This is supported by partnerships with non-profits that promote social mobility and offer access to candidates from underrepresented minorities, non-traditional schools, and the armed forces, as well as first-generation colleges students.

"Looking at race or gender is a stand-in for looking at all different types of mobility or obstacles people face. As we become more expert at understanding demographics, populations, and talent, we will be able to recruit being more mindful around having greater sensitivity on social mobility," Victoria Budson, global head of DEI at Bain Capital, said at the Diversity & Inclusion Forum.

Recruitment to retention

Yet even on gender, it remains to be seen whether GPs in Asia – regardless of size – can make diversity initiatives implemented in the junior ranks filter through to senior level.

Younger private equity firms that choose to make this a priority can be at an advantage because diversity is ingrained into recruitment from the outset, so they aren't trying to redress a balance. Adamantem is only five years old, and half the investment team is now female. The five managing directors are white men, but there is female representation in the tier below.

While global firms have more resources at their disposal, driving change in large, less wieldy organisations is arguably harder. They try to establish relationships with potential female candidates early on, running educational programs for the likes of university sophomore students to explain the range of career options within private equity and address misperceptions about the asset class.

These efforts are already bearing fruit, with a higher proportion of women in incoming analyst classes. At Blackstone, nearly half of the latest US intake is female and one third in Asia; other firms report similar numbers.

One-quarter of women said they are likely to leave their current positions in the near-to-medium term, compared to 16% of men. Fifteen percent of women would consider moving to another sector.

"We have no problem recruiting junior level staff, but when it comes to vice president and director, we become vulnerable," Amy Fong, COO of China-focused FountainVest Partners, told the forum. The attrition isn't purely driven by people stepping back to focus on family; up-and-coming investment professionals are increasingly drawn to entrepreneurial roles.

Fong noted that private equity firms can benefit from the skills and experience accrued in the corporate sector – if those individuals can be convinced to return. This view was echoed by Bain's Budson, who observed that women in Asia switch out of private equity more swiftly than in other geographies when they see opportunities for faster advancement or better balance elsewhere.

Chasing rainbows?

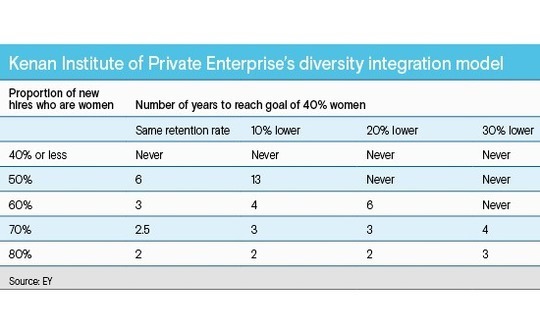

According to a diversity integration model created by the Kenan Institute of Private Enterprise, an affiliate of the University of North Carolina's business school, it would take six years for a GP to achieve 40% female representation if 50% of new hires each year are women, assuming the same retention rate for each gender. When females account for 80% of recruits, it falls to two years.

Running the numbers again, based on the assumption that the retention rate for women is 20% lower than for men, the model concludes that women will never make up 40% of the workforce at a GP with a gender-balanced intake. If 60% of new hires are female, it would take six years.

PAG is aiming for a 70-30 female-male split, and the pan-Asian manager claims its recent hiring efforts are on track. This target arose from a two-year process during which PAG recognized it had a diversity problem, started mandating that recruitment processes include diverse candidates, took steps to ensure this wasn't treated as a box-checking exercise, and then ramped up its ambitions.

"The only way to shift diversity in this industry is by over-indexing hiring at the junior levels. If we can produce four or five talented professionals out of each analyst class, whether they stay with us or go to other firms, we can tip the balance," Lincoln Pan, co-head of private equity at PAG, told the forum. "Having female candidates rotate around in the mid or senior levels is just not good enough."

Top-level buy-in

Embracing the notion that 50-50 is insufficient, PAG is also conducting more mid-recruitment process reviews – one of which flagged the exclusion of a qualified female candidate who was pregnant. This was a senior-level intervention. Pan stressed that cultural change must be top-down and have teeth, with those who don't accept the need for diversity getting "hit in the pocketbook."

Other private equity firms are thinking along similar lines, making advancement conditional on reflecting internal cultural values as well as delivering in terms of financial performance.

At The Carlyle Group, for example, anyone nominated for promotion to managing director of partner is assessed on inclusive leadership and management through a 360-degree review process. Prior to becoming chief DEI officer in 2018, Kara Helander interviewed Carlyle's CEO – whose compensation is partly linked to achieving diversity goals – to find out what kind of buy-in she could expect.

"We have to help leaders understand and articulate why this is important," Helander told the forum. "It's our strong belief that the best investment teams are diverse and inclusive. In a complex global environment, with disruptions happening all the time, you need that diversity of perspective and view to help you challenge the status quo and see around corners."

The firm's senior management added emphasis by introducing a DEI leadership award whereby Carlyle employees can nominate peers for contributing to a diverse and inclusive culture. Just over USD 2m has been distributed to 50 individuals so far.

Top-level participation is also integral to the success of other initiatives that make up the fabric of retention efforts: attending affinity groups so they listen – and are seen to be listening – to staff at all levels; playing host at DEI events featuring external speakers; and participating in mentoring programs where they help more junior professionals define a career action plan, identify relevant opportunities, and then advocate on their behalf.

Intent is further emboldened by formal human resources policies around equal compensation, the length of parental leave and whether it applies to both primary and secondary carers, plan-oriented return-to-work schemes, and executive coaching on managing work-life balance.

"We do a lot of things to create a workplace that is flexible and inclusive for people with all sorts of responsibilities. People with young families have needs and pressures, but equally people with older parents want flexibility so they can work remotely or work strange hours for periods of time," said Adamantem's Koczkar. "We want to create a context where everyone feels they can be successful."

Flexibility first

To some extent, this runs contrary to the climate of extreme competitiveness that has been fostered in private equity and in financial services more broadly, whereby younger professionals are encouraged – implicitly or explicitly – to put work before life. But COVID-19 has challenged this notion.

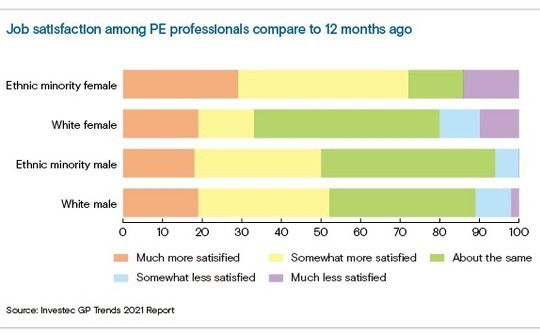

Nearly three-quarters of respondents in the Investec survey expect to spend 2-4 days working from the office post-pandemic, although 35% of female GPs said they would stick to five days, versus 20% of men. While this doesn't necessarily indicate a better balance – indeed, some women who are primary caregivers felt overburdened and isolated during lockdowns – it may offer more flexibility.

Pan of PAG added that conversations with junior colleagues increasingly focus on purpose, and what they can accomplish beyond financial gain, rather than promotion. He contended that private equity's compensation structure, which "pays people to be superhuman, pays people to pursue individual recognition for what they do," might be outdated and unsustainable.

Anecdotal evidence suggests this is more aspiration than reality, but it plays into the idea of helping women and other underrepresented talent move up the funnel by properly curating career paths.

And then the real payoff, in terms of societal gains and financial returns, comes as private equity firms advocate a proactive approach to DEI at the portfolio level. Boardroom diversity is already on the agenda for most GPs – an internal study by Carlyle found that annual average earnings growth is 12% higher at companies that have diverse boards than those that do not.

However, McKinsey & Company recently argued that the industry can do much more. It identified building DEI criteria into due diligence, linking compensation to diversity metrics, establishing diverse management teams, and removing structural racism from corporate policies as additional, and readily achievable next steps.

A 25-year veteran of public policy-focused academia, Budson hadn't considered moving into private equity prior to being approached about the Bain role. Her interest was piqued by calculating the potential DEI impact on a portfolio of more than 200 companies and the supply chains that feed into and out of it.

"Our ability to change the experience for employees and communities, to break down barriers to multi-generational wealth, is unparalleled," Budson said. "Private industry and in particular private equity can invest in the future with alacrity, which cannot be mirrored in the speed of governmental action. We have a role to play that perhaps other industries could not play."

Growing pains

At the GP or portfolio level, adjustments to the composition of teams and how members interact with one another is likely to cause tension. This is especially the case when teams are deliberately heterogenous and there is none of the familiarity in mode of communication and shared experience that comes from homogeneity. But this tension, if properly harnessed, can be constructive.

"Diverse teams are more accurate. The paradox is the individuals on diverse teams, when you survey them, feel less assertive and confident in their decisions. It doesn't feel as good, but they make better decisions," said Carlyle's Helander. "Creative tension comes from being around people who are different. It helps bring forward the best thinking."

The key is to focus on outcomes, rather than what it felt like to achieve those outcomes, and to accept that redefining a culture so that diversity is embedded in it takes time. Moreover, there are myriad incremental changes that can have a profound collective impact, particularly in day-to-day interactions that fall beyond the scope of formal policies.

While fewer deals are consummated by men on golf courses, there are still subtler forms of exclusion where individuals from underrepresented backgrounds lose out on opportunities or refrain from speaking out in meetings because they have different interests and social circles from the majority. It is incumbent on firms to help cultivate an inclusive environment.

Some changes are so straightforward that they don't necessarily register without prompting. Drawing on her experiences as an LP, Future Fund's Gregory observed that certain GPs address all their capital call notices to "sirs," a practice followed for so many years she barely noticed it.

"Some younger women in my team looked at me and said, ‘Doesn't that offend you?' I said, ‘What are you talking about?' and they explained that they found [the capital calls] offensive. I'm immune to it because I've been exposed to it for so long, but I turned around and said, ‘You're right, I see why you feel excluded by that,'" Gregory recalled.

"For GPs, there are many things about your workplace that might make people feel excluded, and they are so easy to fix."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.