2022 preview: ESG

Keeping tabs on sustainability credentials at the portfolio and company level will become more data-driven and collaborative. Eventually, getting results will require greater sacrifices

Industry think-tanks tackling the challenges of environmental, social, and governance (ESG) policy uptake in recent months have made much of the idea that the pandemic has brought the S to the fore. It’s well understood that everything is connected in the complex enviro-social systems that surround everything in business and investment. But S got the spotlight anyway.

“My clients are increasingly looking at a very different way of considering ESG. There have been some conversations, for example, around coal. It’s a very dirty asset, but if you shut it down, you can lose thousands of jobs. Is that green?” says Eric Chng, head of alternatives at State Street.

“That’s one way that people will be applying a social lens going forward. Can we rehabilitate assets as an ESG strategy, rather than blindly shutting them down?”

This is a positive sign of more thoughtful engagement on ESG. But it also hints that being green, clean, or sustainable could be a more difficult and nuanced game of compromises than stakeholders have anticipated to date.

More GP-LP collaborations via platforms such as Initiative Climat International, Carbon Disclosure Project, and the Science Based Targets initiative are therefore on the agenda.

These programs have made significant strides in terms of establishing measurement standards, but performance scoring remains a struggle. How investors can aggregate data into one overall figure and whether they can act on ratings in an impactful way will be among the key near-term discussion points.

The galaxy of third-party service providers hoping to answer these questions for investors will continue to expand. GPs and LPs will have to choose carefully. Many will be trend chasers with little real passion for ESG outcomes. There is also a tendency for one side to dictate to the other when a proper two-way partnership is needed.

With more fingers in the pie, data and cybersecurity issues will also begin to shape the ESG conversation.

A wave of regulations around data reporting and transparency remains pending in the US and Europe. There has been some light guidance in Asia, notably from Monetary Authority of Singapore. There will be more in 2022, but pan-regional and global investors will continue to find it difficult to juggle the different rules. A debate around a convergence of regimes is expected to intensify.

On a behavioral level, 2022 will be about moving from headline promises to detailed action plans. Carbon credits will loom large in this process. Increasingly water and plastics credits will too. Biodiversity credit markets are being developed. Nature-related topics such as deforestation are expected to begin featuring in LP questionnaires to GPs in 2022, but formal terms are years away.

“This year, people were saying, ‘These are the targets we want to commit to,’ and in the coming years, it’s going to be, ‘How are you doing with that? What have you achieved?’ Many stakeholders will be asking these questions – not just LPs. It’s going to be regulators and the general public,” says Adam Black, head of ESG and sustainability at Coller Capital.

“These are challenging issues in terms of outcomes, and the focus should be on making sure commitments aren’t platitudes. There will have to be a route map and justifications for decisions made.”

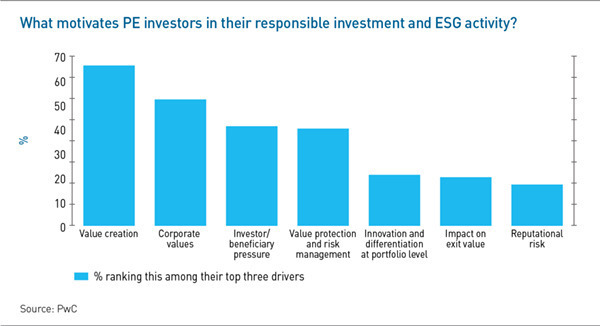

Motivations for playing this game are multiplying. Even in Asia, where regulatory pressure is lighter, global standards will increasingly need to be assured to access global fundraising resources. According to a survey of GPs and LPs by PwC, only 17% said reputational risk was a primary driver of their ESG policy, versus 66% for value creation. It’s worth noting that about 80% of the survey respondents were in Europe.

“We’re coming up on a point where there will be a trade-off if you really want to make an impact, and everyone will have to get their hands dirty making businesses cleaner. If you’re serious about carbon neutrality, you will no longer be able to just change your lightbulbs and say that’s your ESG. It will require something at a much higher cost such as converting to electric fleets,” says Carmela Mondino, head of ESG and sustainability at Partners Group.

“I’m not sure if all investors are ready for that. But eventually, we’re going to run out of low-hanging fruit – and then what do you do? This is where the active ownership model in private markets can really make a difference, as it facilitates the implementation of significant, long-term initiatives that deliver positive stakeholder impact."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.