2022 preview: Japan VC

Japanese VC is growing up fast and looking a little less homogenous in the process. A longstanding growth-stage gap is about to disappear as new actors file in

SoftBank Vision Fund is scarcely a Japanese operation, but there is still a fair amount of local pride in the investor. This came into focus in recent weeks with a JPY6.8 billion ($60 million) Series A investment in Aculys Pharma and a Series D for streetwear platform Soda at a valuation of JPY38 billion.

"Vision Fund never invested in its home market until the fourth quarter of this year, and now they're looking at Japan more closely," say Hiroshi Shimazu, a partner at Global Brain. "I think that's a pretty good signal for next year and beyond – that more international investors are coming to the ecosystem."

Global attention is set to continue expanding the local start-up space in the coming year, with most investors pointing to recent traction in the form of PayPal's acquisition of financial technology provider Paidy for JPY300 billion and robust IPOs for unicorns such as Freee and Sansan. Total VC investment in the country comes to $3.5 billion to date, the highest year on record and up 50% on 2020, according to AVCJ Research.

The market's internationalization in the coming year may be as much about talent osmosis as capital injection, however.

Digital transformation, invariably branded "DX" by local businesses, has become the mantra of Japan's post-pandemic economic game plan. This has translated into moves to loosen immigration rules for digital professionals and policy support for diversifying the ecosystem through various cross-border connections.

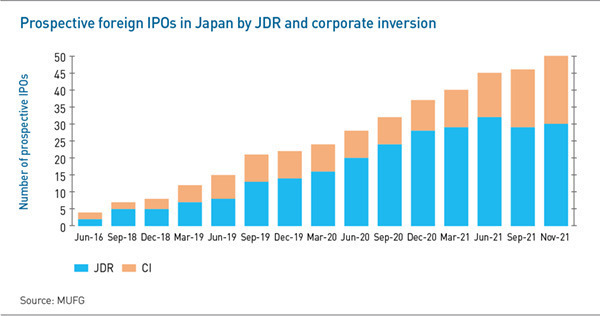

Some of the most conspicuous progress on this front is happening on the Tokyo Stock Exchange (TSE), where a trickle of foreign companies exploiting the new Japanese Depositary Receipts (JDRs) scheme is expected to escalate rapidly. Mitsubishi UFJ Trust and Banking Corporation, the first bank to provide JDR services, currently has a pipeline of 30 JDR IPO candidates.

The standout cross-border listing to date is Appier, a Taiwan-founded advertising technology company that received significant global VC investment before raising $271 million in a Tokyo IPO in May. Appier listed via corporate inversion (CI), effectively becoming a Japanese company. Three foreign IPOs are tipped to come to market in 2022, two JDRs and one CI, one of which is a unicorn.

"No one promoted cross-border IPOs in Japan before. The TSE was averaging 100 IPOs a year, but I don't know if that can continue," says Atsushi Takahashi, manager of the corporate business planning division at Mitsubishi UFJ Trust. "With the aging society, the population is decreasing, including the aggressive, younger [demographics]. Now, I think it's better to buy excellent companies from overseas. It's better for TSE and for the economy."

As global tech comes to Japan and Japanese tech goes global, the ecosystem shows no signs that runaway valuations will stabilize. The anecdotal observation is that a Series A averaged $1 million as recently as five years ago. Now, $10 million is the norm.

At the same time, global late-stage investors will continue to flood in, and local buyout investors will press deeper into pre-profit tech. The Carlyle Group's Japan presaged this trend in September providing the cornerstone of a JPY24.4 billion round for biomaterials developer Spiber. Private equity firm Advantage Partners has begun looking at minority opportunities as early as Series A.

"Keep your eye on that growth-stage space, which is currently filled by Mothers [TSE's tech board]," says Yusuke Suzuki, a director at Global Brain.

"Whether the funding is coming from more local managers and global names, that space is getting covered rapidly and will get filled in the next 2-3 years. Right now, the competition and valuations are still not that bad, but it could get a lot more intense. This change will mature the Japan VC market and foster the creation of more unicorns."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.