2022 preview: Blockchain

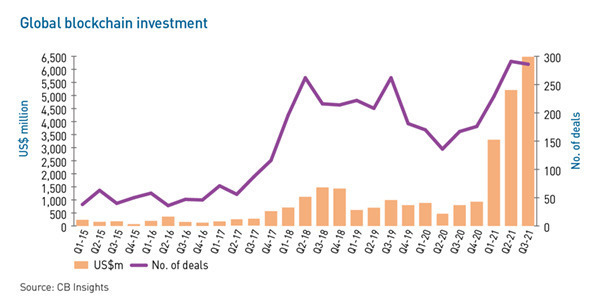

A broader range of investors will play in the blockchain space as new applications are normalized, although regulation remains the wildcard. Developing markets will punch above their weight

Few episodes illustrate the mainstreaming of blockchain and portend its next evolutionary steps as concisely as Facebook rebranding under the name Meta Platforms in October.

The essential takeaway is that Big Tech now believes in the metaverse, a blockchain-based world where crypto economies represent a new path of upward mobility for the masses and non-fungible tokens (NFTs) are the atoms of which everything is made.

"I think we're going to see a lot more in Web 3.0 and data and infrastructure investing in crypto in 2022," says Amy Wu, a partner at Lightspeed Venture Partners focused on blockchain.

"It's still hard to build on a blockchain. We may head into a world where almost every category you can invest in is going to be touched by blockchain in some way, whether it's NFTs in consumer and social networks or tokenization in finance and insurance. Investors will have to adapt."

The coming year will see increased investment in mechanisms that facilitate cross-chain transfers and communications. Ethereum will remain the creative origination and talent wellspring for much of the crypto industry, but it is not seen as practical for supporting emerging functions such as decentralized finance. Solana is the most namedropped platform in this area. There will be more.

Uptake from traditional organizations will follow on the heels of players such as Visa, which in the past year has launched a crypto advisory service, a crypto-friendly debit card, an NFT platform, and a service settling USD Coin transactions. USD Coin is a stablecoin, or fiat-pegged cryptocurrency, built on Ethereum.

Meanwhile, the likes of Hong Kong's New World Development have begun buying virtual real estate, effectively legitimizing the concept for the retail segment and opening the doors for a possible wave of meta land grabs in the near term.

The tokenization of asset management is also on the horizon. Partners Group established precedent in September with a fractionalized private equity fund giving individuals exposure to the asset class for as little as $10,000.

Real estate and infrastructure investors are also beginning to explore the concept as a way of distributing risk and reducing dependency on banks, but questions remain around the mechanics and regulations of valuing the underlying assets.

"Crypto is a new world, and to make things right, we will need regulation to protect to common users," says Jupiter Zheng, a research director at Hong Kong's HashKey Capital, one of the most prolific investors in the sector.

"In crypto exchanges, for example, Coinbase is demonstrating a model that gives a lot of transparency to users and regulators, which can generate value for individual investors but also taxes. That could be the way forward. But the thing is, the regulatory framework needs to keep pace with crypto itself, which is developing very fast – and regulators tend to be prudent."

Regulatory clarity has been an unexpected advantage for the developing world in this sector, which bodes well for an extension of a somewhat counterintuitive blockchain explosion in South and Southeast Asia. Axie Infinity, an NFT-based game, is globally recognized as a pioneer of the micro-economy-within-a-metaverse concept. It's based in Vietnam.

Developing Asia has therefore proven a driving force in crypto-related investment this year. PE and VC investment across the broader region amounted to $1.8 billion as of mid-October, when Axie raised a $152 million round led by Andreessen Horowitz. This compares to only $208 million regionwide in 2020 and does not include a $420 million investment in Hong Kong exchange operator FTX in late October.

The standout jurisdiction is India, where two blockchain unicorns have developed since the Supreme Court lifted a ban on crypto trading in March 2020. It is no coincidence that both of them – Coinswitch Kuber and CoinDCX – are exchanges that emphasize mass-market inclusion, education, and simplicity of use. These will be strong themes as new models begin to emerge in developing Asia.

"India cannot afford to miss out on the global crypto revolution. Our discussions with the government indicate there is broad agreement on ensuring customers are protected, financial system stability is reinforced, and India is able to take advantage of the crypto revolution," says Ashish Singhal, founder and CEO of CoinSwitch Kuber.

"Even as the industry is proactively communicating with all key stakeholders on regulating crypto assets, crypto exchanges in India are following self-regulatory practices, very similar to what the other regulated financial entities follow, to provide comfort and trust to regulators and users."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.