2022 preview: India tech

As India’s technology sector balloons, investors are balancing confidence about fundamentals with expectations of pushback. Both will play out in 2022 to some extent

Putting numbers on the technology investment boom in India is both impossible and easy. Tech as a sprawling horizontal category cannot be pinned down with any neat statistics, but in its more defined markets, the upswings have come clearly into focus.

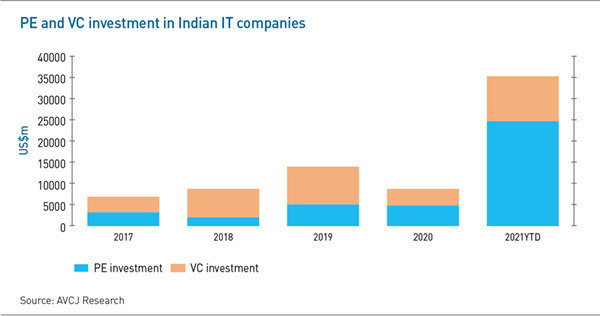

For example, PE and VC investment in companies categorized as IT providers rose 300% during 2021 to $35.1 billion, roughly equal to the previous four years combined according to AVCJ Research. Similar patterns are playing out in areas such as online sports gaming, software-as-a-service, and crypto. There is every expectation the momentum will continue to play out in the coming years, even as cooler heads become wary of the heat.

Confidence is largely underpinned by a recent influx of global investors into the late-stage tech space, which signals that the digital economy has reached not only critical mass in terms of total addressable market but also an internationally attractive level of unit economics maturity.

Strategies for playing in this space in the years to come will be shaped by the trajectory of the growth. As digitization and investment bleeds increasingly into lower-tier cities, investment will be more about recognizing India's significant diversity in terms of consumer culture and business needs. Social commerce will come to the fore, as will themes around vernacular languages and affordability.

"India is about to see what China saw 10 years ago. India is in the process of de-hyphenating itself from emerging markets," says Gopal Jain, a managing director at Gaja Capital.

"Outperformance in China and the US has been driven by tech, which his playing a bigger role in Indian growth capital now. So, India will be seen more like some of these larger global markets as opposed to a niche market where you need to be a pundit to operate, and Indian private equity will very soon stand as an independent asset class."

The long-awaited materialization of a tech exit market is supporting this narrative, but with an asterisk. Following Walmart's acquisition of Flipkart in 2018 for $16 billion, strategic M&A was expected to validate the Indian tech market to global investors. Instead that role is now being played by domestic IPOs, sometimes for companies that are unsustainable without fresh financing events.

A disappointing IPO by local fintech leader Paytm in November – shares crashed 40% in the first two days – hints that pricing will come under more scrutiny in 2022. This is not to say IPOs will slow down, but there is likely to be more tension among investors and founders about the gap that has formed between some private and public market valuations.

"CAC [customer acquisition costs] and cash burn could go through the roof with all the cash that's been raised, and that could result in unit economic getting out of whack," says Anand Prasanna, a managing partner at Iron Pillar.

"I think 2022 will start off as another crazy year, but at some point, there will be a reality check, when people start looking at things like CAC numbers and it sinks in. If it's a great company at a higher valuation, there's incentive to put money to work, and they can't stop playing. That's the dynamic today. But that will tip over at some point – hopefully next year – which will be a sensible thing."

More cautious IPO pricing is not expected to slow the proliferation of Indian unicorns; 2021's crop is usually pegged at around 45, representing a parabolic increase. Investors in the country are already working under the assumption there will be a correction in market multiples, although no one dares to call the timing.

The unicorn phenomenon's relevance on market outlook is twofold. First, it indicates that a ready supply of cheap money and questionable valuations will remain fixtures of Indian tech in the near future. Second, it suggests the sector will continue to enjoy positive traction in terms of consumer adoption, foreign investor attention, and the creation independent companies.

"We are entering 2022 with a very different mood than we entered 2021, when the world was working overtime to save the global economy from deflation and contraction. But after spending like crazy, we are now worried about inflation," Jain observes.

"The valuation trend is a product of what's happening in the financial markets, but the consumption trend is what's happening in the real economy. It's not that the two are completely uncorrelated, but I have greater confidence in some of the underlying consumption trends than in the sustainability of current multiples."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.