2022 preview: Macro & buyout

Will the bullish investment environment persist through 2022? Most Asia-based private equity players expect to remain busy, although they acknowledge a lack of visibility around macro and geopolitical risk

"Inflation is everywhere in the system. We own a chemical company and shipping rates for our products are up 300% since May. In China, the cost of labor is up 20-30%," says Mark Chiba, a partner and group chairman at The Longreach Group, a North Asia-focused buyout firm.

"It's like when a disease hits and you have a temperature spike – that's the inflationary effect we are now seeing. It will abate, but there will still be higher inflation going forward."

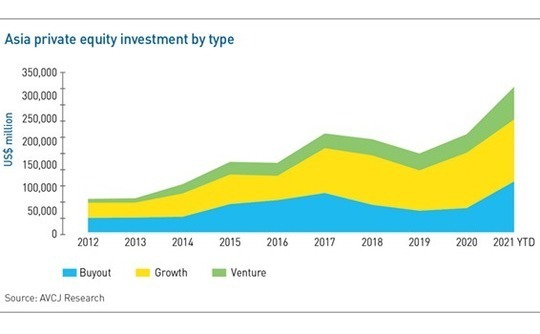

The prospects for inflation globally, and the extent to which central banks take action to bring it under control, are top of mind for many investors. In 2014, private equity deployment in Asia cleared $100 billion for the first time. The 2021 total is already at $317 billion – $100 billion more than what was invested last year. Every major market in the region is seeing record levels of activity.

Increased velocity of deployment has intensified competition for deals, especially at the top end of the market, with numerous industry participants observing that "20x is the new 15x" in reference to escalating enterprise value-to-EBITDA multiples ever higher.

"That said, while a lot of GPs I talk to are wary about valuations, the markets have never been busier and deal flow is pretty much unprecedented – but with much more focus on the value creation plan."

While few investors or advisors expect 2022 to be any less frenetic than 2021, but they recognize that a meaningful interest rate hike by the US Federal Reserve as a counter inflation measure would have a detrimental impact on liquidity and the availability of financing. However, it is just one ingredient in a murky macroeconomic cocktail.

"The visibility on 2022 is not great. It's going to be a function of interest rates, what happens with inflation, what happens with liquidity, and what happens with bond purchases. Monetary policy on a global level is a very big part of it," says Brian Hong, a managing partner at CVC Capital Partners.

"Then there is COVID itself, with new variants emerging, what that means for opening up, and secondary impacts like the supply chain. It makes it hard to say what will happen to the fundamentals and what will happen to market valuations."

Asia GDP growth sagged in the second half of 2021 in response to suppression measures, supply shocks, a power crunch, and deleveraging and regulatory tightening in China. Natixis expects it to stabilize next year as economies re-open, easing supply shocks, and governments weigh in with supportive fiscal policy. Monetary conditions are also likely to remain accommodative, even if a bit tighter.

"Right now, inflation is a mixture of pent-up demand in 2021, which will abate naturally. It was a reaction to the lockdown," says Alicia García-Herrero, chief economist for Asia Pacific at Natixis.

"The most important part is supply chain disruption. Costs of raw materials and basic inputs rose because investment collapsed during the pandemic and there wasn't enough supply. Ports were closed because of lockdowns – Ningbo, the second-largest port in the world, was closed for a month – and then with air cargo, pilots must sit there for a month in quarantine, which increases transportation costs."

She expects inflation to be higher than before the supply chain shocks, though not enough to prompt significant shifts in 10-year Treasury rates. This is largely based on a low-growth, moderate inflation outlook for the US economy, which will discourage any thoughts of aggressive tapering.

The International Monetary Fund (IMF) came to the same conclusion in its latest world economic outlook regarding a demand-supply rebalancing and an easing of inflationary pressure. However, it was uncertain about future inflation prospects, suggesting that the emergence of new variants before widespread vaccination could create further supply chain disruption.

The IMF has downgraded its global growth projection for 2022 to 4.9% and 3.3% over the medium term, with emerging economies likely to be troubled by output losses. "The fault lines opened up by COVID-19 are looking more persistent – near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps," it said.

García-Herrero echoes this point, referring to "the scars of COVID" in terms of countries struggling to repay their debts. In her view, the biggest risks are geopolitical. For example, perceived instability arising from Pakistan forging closer ties with China could lead to a negative review of its IMF debt programs, which may filter through to Sri Lanka, and suddenly all frontier markets are running into trouble.

"I don't like saying this is the year of inflation or the year of chaos. It's just a year where geopolitical risk will be at the max," García-Herrero adds. "It will extend well beyond China and the US because countries are being asked to pick sides. Complications around US-China strategic competition is pulling on strings all over the world. We don't know which one will be pulled next and what problems will emerge."

Chiba links this back to inflation, arguing that the US has experienced disinflation since the end of the Cold War thanks to the rise of China and accelerating globalization. US-China decoupling and bisection of the world into two competing power bases erodes those price efficiencies, which means inflation is part transitory and part structural.

"It's like a chainsaw carving through all of the globalization assumptions we've had and it's just going to cost a lot more money to make things," he says.

Decoupling does create opportunities for investors, but as to how private equity should address the potential consequences of these geopolitical risks, one response is to play safe: pay attention to capital structures, don't over-lever assets based on a benign interest rate environment, focus on businesses that are defensible and have pricing power.

This is not necessarily conducive to deploying capital in a climate of robust valuations and aggressive deal-making. According to Andrew Li, a managing director and head of Greater China at Advent International, investors must develop conviction around assets based on unique insights.

"Since COVID-19, we've had to adapt in terms of our view of the future, and how we see the exit markets," he says. "This has led to an increased focus on how we can differentiate our angles, how we can accelerate businesses."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.