2021 in review: Boom time

Cheap debt and a desire for assets that deliver technology-driven growth have propelled Asia private equity investment to new highs and supported a resurgence in exits. But fundraising still fails to convince

Investment: Crossing the $300b threshold

Regulatory-driven angst in China's tech sector didn't deter dealmakers, with markets across the region flourishing

Private equity investment in Asia has surpassed $300 billion for the first time, spurred by persistent low-interest rates and ample liquidity on a global basis. Over $317 billion had been deployed in the region by mid-December, approximately $100 billion more than the previous record annual high set in 2017. It was as recently as 2015 that investment reached the $150 billion mark.

China, India, Australia, Japan, South Korea, and Southeast Asia has seen more capital deployed than ever before, with growth-stage technology and large buyouts the principal drivers.

This outcome is even more surprising given one of the forces that has powered Asia deal flow in recent years – China technology – was muted. The COVID-19 rebound in late 2020 was all about China, as investors sought access to businesses that have benefited from the switch to remote consumption, from e-commerce and logistics to telemedicine and online education.

With 2021 came regulations, culminating in a sweeping crackdown that spread from the technology sector into various consumer-facing segments of China's economy. Commercial guidelines for private education have been redrawn, comprehensive data privacy rules have been introduced, and it has become much harder for companies that collect a lot of personal information to list overseas.

Common prosperity is the thread that connects these regulatory interventions and gives them political context. Reining in anti-competitive technology companies, curbing excesses in education, and policing the use of personal information are seen as part of efforts to create a society that is more equitable for consumers and a marketplace that is kinder to small businesses.

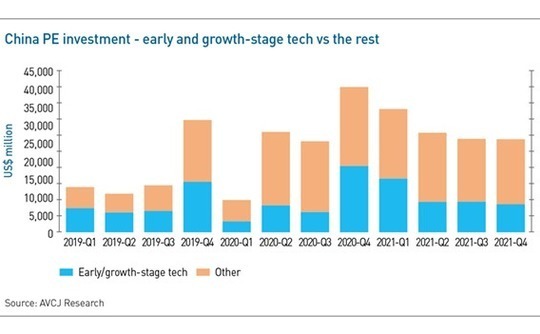

Amid the uncertainty, early and growth-stage investment in the technology sector slumped from $14.8 billion in the first quarter to $8.4 billion in the second, remained there in the third and looks like doing the same in the fourth. In the final three months of 2020, it was at a record high.

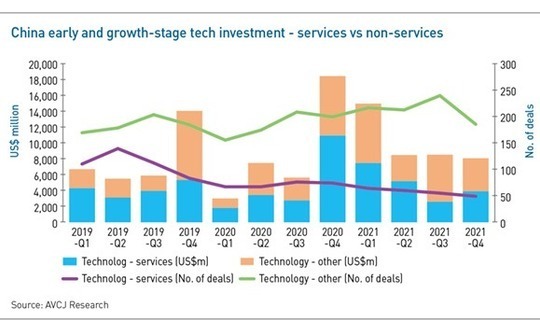

Capital is not deserting the sector, rather it is moving from consumer-facing to enterprise-facing businesses. This trend became apparent in early-stage activity toward the end of 2019 as the number of technology deals that didn't involve content or services started rising and those that did begin to fall. It is now impacting headline investment numbers as well.

There is much talk of deploying capital in line with government policy, which means more money for pure technology-driven businesses in areas like semiconductors, artificial intelligence, and cloud computing, where Beijing is keen to promote innovation. It crosses into new energy and sustainability as well, with investments in the electric vehicle supply chain and battery technologies.

Other Asian markets, meanwhile, remain firmly in the grip of consumer-internet. Early and growth-stage technology investment in India, Southeast Asia, and Korea has tripled in 2021. The origins of the surge are broadly the same as in China – a desire for exposure to assets that have emerged from the pandemic in stronger market positions – but there have yet to be any regulatory headwinds.

The transformation is most striking in India, where sentiment is also buoyed by clearer sightlines to liquidity as domestic IPOs emerge as an option for pre-profit businesses and plentiful opportunities in the global software-as-a-service (SaaS) industry. The country's unicorn population has doubled in size over the past year, with about 40 start-ups hitting valuations of $1 billion or more.

Early and growth-stage technology activity had risen from $10.3 billion last year to $34.7 billion as of mid-December, propelling overall private equity investment in the country from $43.2 billion to $57.5 billion. India may not overtake China's technology sector total in 2021, but it has made up ground quickly. For every $1 put to work in China in the third quarter, $1.50 went into India.

Technology is the key factor in growth and venture capital investment Asia-wide passing $200 billion, compared to $160 billion in 2020. But the buyout space has been busy as well with deal flow more than doubling to $110 billion. Control deals of $1 billion-plus have risen from fewer than one dozen to more than two dozen.

Ten of these deals were in Australia, but the top three – including the two largest in the region – are in the infrastructure space. They make up half the national total. Another trend in Australia is infrastructure funds outbidding PE for operating businesses with real assets exposure because they underwrite to lower returns. EQT's acquisition of radiology chain Icon Group is a case in point.

Among the other standout transactions are Bain Capital's announced $7.5 billion carve-out of Hitachi Metals, which looks set to be the second-largest private equity buyout ever seen in Japan, and a $5.7 billion take-private of US-listed Chinese online recruitment platform 51job.

Fundraising: Slim pickings

Private equity fundraising has yet to fully rebound, with a flight to familiarity widening the gap between haves and have nots

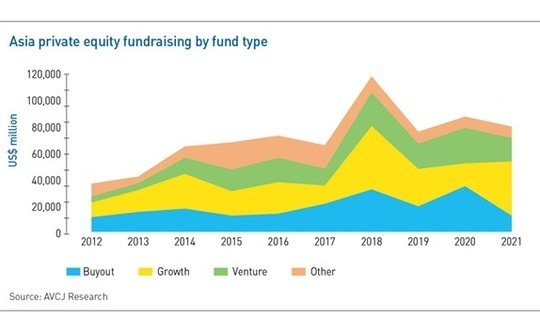

KKR set a new high watermark for private equity fundraising in 2021, closing its fourth pan-Asian vehicle at $15 billion. Nevertheless, as of mid-December, LP commitments to funds based in the region were on course for a seven-year low of $103.6 billion.

This incongruity – which flies in the face of global trends, with managers in North America and Europe raising record sums – can be traced back to several factors.

First, the headline number for Asia is heavily impacted by how many large-cap players are in the market. Two-thirds of KKR's $15 billion was accumulated by the first close in mid-2020. There have only been two other final closes above $2 billion, with Boyu Capital speedily collecting $6 billion for its fifth China fund and Hillhouse Investment closing its Asia mid-market fund on $5.2 billion.

Meanwhile, Baring Private Equity Asia and The Blackstone Group both recorded incremental closes on their latest pan-regional vehicles with commitments of $8.5 billion and $3.1 billion, respectively.

Second, renminbi fundraising has been incredibly weak. The regulatory boundaries were redrawn in 2018 with the introduction of restrictions on how domestic financial institutions could participate in the asset class. Since then, government guidance vehicles have been the major force in local currency fundraising in China, but large-scale players have been relatively scarce in 2021.

Strip out the renminbi total – which has fallen from $42 billion in 2020 to $24.3 billion this year – and the picture for US dollar-denominated funds region-wide doesn't look so gloomy. Approximately $79.3 billion has been raised, down from $86.8 billion a year earlier, but an improvement on the $75.4 billion from the year before that.

Third, the China factor. The country's regulatory barrage has worried LPs, causing new commitments to China managers – and even some re-ups – to be put on hold. Venture capital has been most heavily impacted, but the negative sentiment has penetrated private equity as well. Progress is generally slow, with some GPs extending their fundraising periods, according to anecdotal evidence.

Commitments to US dollar China funds stand at $19.5 billion as of mid-December, versus $16.5 billion in 2020, but nearly three-quarters of the capital raised went into closes completed in the first half of the year. Moreover, Boyu alone accounts for 30% of the total, having raised the largest-ever US dollar China fund and completed the process before the end of July.

Fourth – and harder to ascertain definitively – COVID-19 might be impacting Asia more than North America and Europe because of relatively higher reliance on funding from outside the region.

For much of 2020, LPs exhausted pipeline commitments to managers where there is a preexisting relationship, or some level of due diligence had already been completed. Moving into 2021, many have become sufficiently comfortable working remotely that commitments to GPs beyond the global blue-chip names will be considered, but they remain picky.

Fundraising in the region has long been characterized by a flight to perceived quality, given track records can be sparse. COVID-19 added a flight to familiarity, and in the absence of a compelling reason to add a relationship in Asia, it becomes that much harder to make a case with little or no in-person contact. Opportunities closer to home are safer and easier to address.

China aside, no major jurisdiction in Asia has attracted more capital in 2021 than it did in 2020. There have been fewer than 500 partial or final closes, excluding renminbi funds, compared to more than 670 in 2020. This represents a six-year low.

Public markets: Of SPACs and other IPOs

Weak trading has seen SPACs lose some of their shine, but traditional IPOs are on a roll – unless you're in China

Grab's transformation into a US-listed company with a market capitalization of more than $25 billion represents a landmark liquidity event for a Southeast Asia's start-up scene. But the ride-hailing platform turned super app has traded weakly since its debut earlier this month – another reminder of how special purpose acquisition companies (SPACs) have lost their earlier luster.

At an enterprise valuation of $30.4 billion, Grab's SPAC merger is the largest completely globally. It was announced in April, when investor sentiment on the structure was still bullish. Most of the nearly 600 SPACs that have raised $158.3 billion as of mid-December – compared to $83.4 billion from about 250 offerings in 2020 and $13.6 billion from 59 in 2019 – got it done earlier in the year.

This includes a cluster of Asia-based GPs driven by opportunism or a desire to diversify their product offerings. SPACs were launched by executives from the likes of Primavera Capital Group, Ascendent Capital Partners, Olympus Capital, Vickers Venture Partners, Hopu Investment, and B Capital Group. In some cases, the SPAC sponsor is a fund portfolio company rather than controlled by an individual.

Since then, regulatory intervention has blunted activity. At the same time, there is a growing sense that the market is bloated by oversupply, with SPACs competing furiously for a relatively limited number of assets that are IPO-ready but don't want to do a traditional IPO. Recruiting investors to participate in private placements that accompany de-SPAC processes has become harder.

Most existing SPACs are trading below their IPO prices, including those that have completed mergers this year. Two other Southeast Asia-based targets remain in the pipeline: real estate portal PropertyGuru and Indonesia buy now-pay later platform Kredivo.

Elsewhere in Asia, coffee-and-donut chain Tim Hortons China, Hong Kong genetic testing player Prenetics, China-focused direct-to-consumer brand DayDayCook, and Taiwan scooter battery-swapping platform Gogoro have agreed on SPAC mergers, putting PE investors on track for exits. Plus, a China-based autonomous driving technology developer, abandoned its merger in November.

There continue to be plenty of advocates who point to SPACs as a more efficient alternative to a traditional IPO and a welcome additional liquidity channel for private investors. The reality is they are not suitable for all companies.

It remains to be seen how much traction Singapore and Hong Kong achieve with their own SPAC regimes. The former, which is said to have a workable structure, was pushing to get the first batch of listings through before the end of 2021. The latter is taking an ultra-conservative approach that industry participants believe will severely restrict sponsor uptake.

Southeast Asia also saw a coming of age in terms of traditional IPOs, with local bourses recognizing that they must embrace the technology companies. This involves some regulatory adjustments, a loosening of listing requirements, and above all, overcoming a longstanding aversion to pre-profit business models and basing valuations on future growth and long-term scope for monetization.

Indonesian e-commerce platform Bukalapak was the test case, raising IDR21.9 trillion ($1.5 billion) in the country's largest-ever private equity-backed IPO. A spike on debut was followed by a gradual decline in the stock price, which has fallen below the offering level, but industry participants suggest that it is part of a natural learning curve.

Other start-ups may follow different paths. GoTo, the product of a merger between Gojek and Tokopedia earlier in the year, has delayed its Jakarta listing in anticipation of further regulatory changes. It is expected to list in the US as well. Malaysia-based used car marketplace Carsome is said to be eyeing a US IPO and hotel booking start-up RedDoorz is considering a listing in Southeast Asia.

Nevertheless, Bukalapak has helped propel IPOs by private equity-backed Southeast Asian companies to a record level as of mid-December 2021.

India's markets have also entered uncharted territory on the back of a technology-driven renaissance, with companies supported by financial sponsors raising more than $7.4 billion year-to-date. Digital payments player Paytm raised INR183 billion ($2.47 billion) in the country's largest-ever IPO and proceeded to tank on debut as the euphoria finally spooked investors.

Online insurance start-up PolicyBazaar is trading below its offering price as well, but the likes of beauty e-commerce platform Nykaa and food delivery business Zomato have performed slightly better. A string of other technology-enabled businesses, from e-commerce logistics provider Delhivery to budget hotel platform Oyo have filed for listings.

The role US markets play in the India IPO story has yet to be resolved. Freshworks laid down a marker for local software-as-a-service (SaaS) companies with a $912 million offering in New York. Many of its peers will likely follow suit, given they tend to be domiciled in the US. Regulatory approval for direct listings in the US by domestic companies, while much anticipated, is still pending.

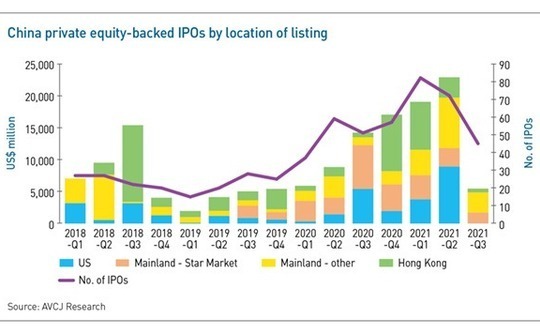

PE-backed Chinese companies raised $12.7 billion in New York in the first half of 2021 – compared to $9.1 billion in the entirety of 2020 – as IPO activity surged globally. Then Didi was targeted by regulators for violating data collection rules within days of its US debut, and Beijing later stated that companies holding large amounts of consumer data must obtain approval to list overseas.

The intervention eroded investor sentiment and closed the US listing route for all bar a handful of smaller companies operating in less sensitive areas.

New York's loss is expected to be Hong Kong's gain, but this has yet to be reflected in IPO activity because regulatory action has undermined investor sentiment regardless of location. PE-backed China offerings across all markets have already surpassed the 2020 total, with $47.3 billion raised versus $45.9 billion, thanks to the first-half surge. Since then, activity has been muted.

This applies to Shanghai's Star Market as well, where aggregate proceeds are $8.3 billion, roughly half the 12-month total for 2020. Positioned as a haven for high-growth technology companies, with lighter-touch regulation, the reality is compliance and disclosure remain burdensome. Many start-ups have withdrawn their applications and fallen back on private funding.

Exits: A sponsor-to-sponsor surge

The trading of assets between private equity firms is becoming more prevalent in Asia as strategics adjust to the new normal

Warburg Pincus engineered the largest trade sale of 2021 to date, selling ARA Asset Management (an existing portfolio company) to ESR (a former portfolio company) for $5.2 billion.

The GP was reluctant to exit ESR in the first quarter of 2021, having grown the business into Asia Pacific's largest logistics real estate platform in less than 10 years. By bringing together ESR and ARA, it has returned to the former's shareholder register as part of the cash-and-stock deal. The goal is to create a new-economy powerhouse with exposure ranging from e-commerce logistics to data centers.

The ESR-ARA deal taps into several key themes within Asian private equity, including a desire to build ever bigger businesses that command ever-higher valuation multiples and a willingness to trade in and out of these assets to other managers. Finding ways to extend holding periods through continuation vehicles or even trade back into assets that have been exited are actively considered.

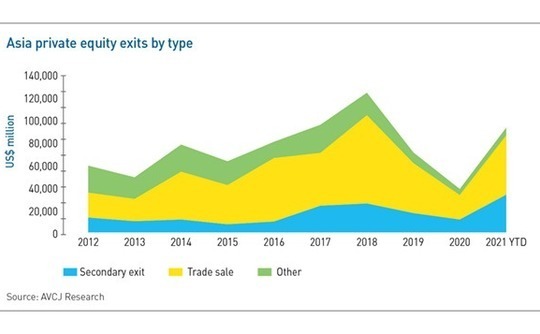

ARA sits atop a list of 26 exits of $1 billion or more announced this year. Only four crossed this threshold in 2020, suggesting that the challenges of COVID-19 – which saw many buyers take a step back to treat their own wounds and wait for conditions to normalize – are now past. Exit proceeds for the year stand at $92.5 billion, the third-highest annual total on record. In 2020, $38.3 billion was transacted.

Six of those $1 billion-plus exits are sponsor-to-sponsor deals, a large share by historical standards. While trade sales have doubled to $52.4 billion, the sponsor-to-sponsor segment has tripled to an all-time high of $33.2 billion. Activity has become more frenetic as the year has progressed, with $14.4 billion in assets traded between GPs in the fourth quarter, nearly twice the trade sale total.

This concentration effect is visible on the trade sale side as well, especially where strategic investors are venturing beyond their home continents. After ARA, the two largest trade sales are Billdesk and Paidy, reflecting a global M&A surge in the payments space as corporates aggressively pursue assets in expansion geographies for fear that someone else will get there first.

Sales to strategics in the wake of COVID-19 have also been characterized by a handful of mega-deals. Proceeds slumped to a post-global financial crisis low of $2.6 billion from 58 deals in the first quarter of 2020 as activity froze with the onset of the pandemic. In the last three months of 2019, more than 70 transactions worth $9.5 billion were announced, according to AVCJ Research.

Strategic investors are adapting to a new normal, relying on third-party advisors and virtual site walk-throughs in place of physical due diligence, or sending smaller teams through quarantine to touch and feel assets. But any kind of compromise must be counterbalanced by a belief that they are competing for a must-have asset and writing an equity check of meaningful size.

Of the 26 exits of $1 billion or more, 18 were trade sales. Only six went to buyers from outside Asia and four – including Billdesk and Paidy – involved technology-oriented assets.

If some strategic investors are indeed still wary, then private equity is ready to step in. Enterprise value-to-EBITDA multiples are rising, especially where COVID-resilient assets with demonstrable growth prospects are on the block, and anecdotal evidence suggests financial sponsors are increasingly willing and able to outbid their strategic peers.

Secondaries: Continuation theory

An uptick in multi-asset and single-asset continuation funds is filtering through to Asia, with more GPs eyeing opportunities

Global secondaries volume is on track to surpass $100 billion for the first time, underlining the swiftness of the rebound from the COVID-19 induced lull of 2020 when $60 billion was transacted. Most industry participants have mapped out a trajectory whereby annual volumes reach $500 billion in the medium term; some are already eyeing $1 trillion.

For the present, it is very much a GP-led phenomenon, with transactions of this nature expected to account for more than half of total market volume this year. This compares to 30% in 2019 and 44% in 2020, when the second half of the year was punctuated by a slew of continuation funds, spinouts, strip sales, and LP tender offers.

Asia is very much part of this. While the $1 billion transactions of a few years ago have yet to return, the region has seen a steady stream of multi-asset continuation funds in 2021 as well as small but fast-rising array of single-asset continuation vehicles.

The likes of Buhuo Ventures and Ameba Capital closed debut US dollar-denominated funds, underpinned by cross-currency restructurings of existing renminbi vehicles. Navis Capital Partners, Olympus Capital, Legend Capital, and Huagai Capital were among those to spin out assets that require more time and capital into continuation funds.

The $450 million Olympus transaction was notable for the identity of the lead investor and the structure. Activist investor Elliott Management took out a profit participation loan held by Canada Pension Plan Investment Board and bought standard positions from other LPs. In addition, it agreed an extension on a tranche of senior debt held by the US Development Finance Corporation.

Coller Capital also demonstrated the widening variety of opportunities in Asia by leading the acquisition of interests in four global credit funds from China Ping An Insurance's overseas investment platform. The deal, worth $680 million, is said to be the world's largest-ever private credit secondaries transaction.

Meanwhile, Partners Group signed up as the anchor investor in Asia's largest-ever single-asset continuation deal, helping MBK Partners rollover a $500 million position in Korean fried chicken franchisor BHC. MBK backed the business in 2018 through a mezzanine debt instrument from its special situations fund, but then converted the position to equity at the end of last year.

It is estimated that fewer than 10 such transactions featuring secondary investors have closed in Asia to date, and a fraction of those achieved meaningful size. However, as of mid-2021, a handful of $500 million-plus deals were in the market, including Hopu Investment's position in warehousing giant GLP and Hahn & Company-owned Ssangyong Cement. BHC is the first of these to close.

Industry participants claim the biggest obstacle to increased single-asset continuation deal flow is finding investors who are willing and able to participate. Similar opportunities abound in North America and Europe, while it can be difficult to attract larger investors that want to write checks amounting to multiple hundred million dollars.

It feeds into a narrative that there is more deal flow in Asia secondaries, across every part of the market, than investors can address. Indeed, another theme of 2021 is an uptick in fundraising for Asia-dedicated strategies – by incumbents as well as new entrants.

TR Capital closed its fourth fund at $350 million in February, roughly twice the size of the previous vintage. NewQuest Capital Partners, fully owned by TPG as of March, doubled in size in 2020, and AB Value Capital wants to do the same in 2022.

Foundation Private Equity, led by Jason Sambanju, formerly Asia co-head at Paul Capital, reached a first close of $110 million on its debut fund in July, simultaneously announcing the sale of a majority interest in the GP to Tikehau Capital. Stratford House Advisors and Bee Alternatives, spinouts from CDC Group's India team and Japan's Ant Capital, respectively, are also on the fundraising trail.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.