China cleantech: Policy tailwinds

Private equity investment in China cleantech and renewables is at record levels, spurred by robust government support for the industry and a recognition that this time the boom might be sustainable

Sporadic power rationing is a fact of life across China's 31 provinces and a pain point for factory owners in key manufacturing areas such as Guangdong, Jiangsu, and Zhejiang. A recent spate of rationing – to varying degrees – across 20 provinces simultaneously is highly unusual.

High coal prices and unpredictable weather patterns contributed to the curbs imposed from October. However, in the likes of Jiangsu and Zhejiang, they were introduced to meet local government's energy-saving targets, which reach all the way down to country level. These are likely to be enforced more readily as the country works towards its target of carbon neutrality by 2060.

China and India were criticized at the COP26 climate summit for demanding weaker language in a commitment to reduce fossil fuel use. It reflects their continued dependence on coal – which is responsible for 56% of energy generation in China – and the challenges involved in replacing it with renewable alternatives while supporting robust economic growth.

Writing in the People's Daily last month, Vice Premier He Liu warned of the "broad and profound economic and social systemic transformation" involved in embracing green and low-carbon solutions. The private equity industry is already envisaging how tougher a policy line translates into greater investment opportunities and positioning itself accordingly.

Among the most recent visible examples are a pair of RMB10 billion ($1.6 billion) carbon neutrality funds, one launched by Sequoia Capital China and Envision Technology Group, and the other by CICC Capital with GCL Energy Technology. But the notion of aligning with government policy on cleantech is wide-reaching, encompassing renewables, electric vehicles (EV), battery technologies, and beyond.

"Since last year, many large investment institutions such as CICC, Hillhouse Capital, SAIC Capital, Oriza Partners, and Matrix Partners have asked us about our portfolio companies," says Peter Yin, founding partner of Inspiration Capital, a cleantech-focused spinout from Qiming Venture Partners.

"They are willing to back Series A or even pre-Series A start-ups. Because we have sifted through the technology first, once order volumes start to increase, they have the confidence to get on board."

Lessons learned

These sentiments – endorsed by Li Zhang, a partner responsible for Cathay Capital's smart energy strategy, who compares it to being at the center of a whirlwind – point to a level of activity that has yet to be fully reflected in the headline investment numbers.

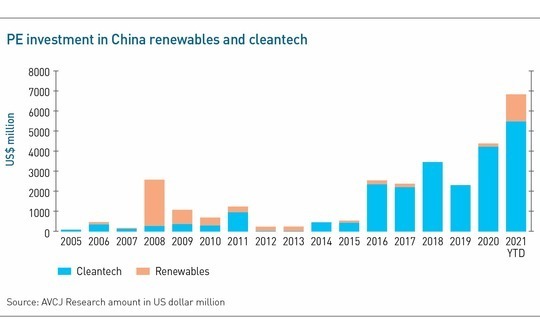

Private equity investment in China cleantech (including EV manufacturers) is $5.4 billion year-to-date, while another $1.3 billion has gone into renewables, according to AVCJ Research. The overall total of $6.8 billion represents a record high, surpassing the previous two years combined. As recently as 2015, the year before private equity got into EVs in earnest, it was less than $550 million.

Much of the capital has focused on a handful of companies, such as EV battery manufacturer Svolt Energy Technology, EV makers LeapMotor and Hozon New Energy, and Envision, which has interests spanning batteries and wind turbines. Yet the appetite for early-stage deals suggests investors are looking for emerging leaders that will require more capital as cleantech gains momentum.

Between 2007 and 2011, investors plowed $5.7 billion into the space, mainly targeting solar panel and wind turbine manufacturers that were taking advantage of subsidies in developed markets and China's relatively low costs. When subsidies were rolled back, investment slumped, with $1.5 billion deployed over the next four years. Renewables specifically only really recovered this year.

This time around, investors can point to demand that is both more robust and domestic in nature. "The era of power parity for solar and wind energy has arrived. Their cost has reached the same level or be even lower than that of traditional energy," says William Wang, a founding partner at Primavera Capital Group.

The price of solar power in China has dropped from RMB20 to RMB0.3 per kilowatt-hour in the past two decades, thanks to generations of evolution in the materials space, which has forced down production costs. In June, the National Development and Reform Commission (NDRC) announced an end to government subsidies for new solar and wind power projects.

In October, Affinity Equity Partners invested $360 million in the China unit of Hong Kong & China Gas, supporting a transition into an integrated clean energy platform that will install solar panels on the rooftops of industrial park facilities. A source close to the situation makes two observations to AVCJ: the cost of solar power will be the same or lower than gas; and industrial parks account for 60% of China's carbon emissions, so park operators and tenants are under pressure to change.

Frankie Fang, founding managing partner of local fund-of-funds manager Starquest Capital adds: "This round of cleantech investment has two characteristics. First, it is consistent with the development of cutting-edge technology. Second, it pays more attention to companies that have their own R&D capabilities rather than ‘assembly and optimization' businesses."

The previous boom emphasized environmental protection, with a focus on project contracting for solar and wind farms. These are more suited to state-owned enterprises (SOEs) that have capital and deal-sourcing advantages, says Innovation's Yin. "The current round is concentrated on high-end manufacturing and technology innovation," he asserts.

EV evolution

The pattern of technology breakthroughs leading to cost reductions and facilitating mass adoption and rapid commercialization is already in evidence in China's cleantech space.

Between 2016 and 2018, private equity investors committed $5.3 billion to local EV manufacturers, with nearly $3 billion put to work in 2018 alone. Investment dropped off the following year before rebounding in 2020, broadly tracking the fortunes of the industry.

Significant cuts in EV subsidies in 2019 left industry leaders like Nio floundering as sales plummeted. Fortunes turned around on the back of cost reductions in batteries, which have made the lifecycle expenditure of EVs superior to conventional fuel vehicles, according to Ian Zhu, a managing partner at Nio Capital, an independently operated private equity firm led by the founder of Nio.

EVs have evolved from being a fashionable choice to a viable economic option for the mainstream. The revival in sales and private equity investment coincided with IPOs for Xpeng and Li Auto, two of Nio's main rivals in the premium EV segment in China.

"The changes in the underlying technology have created real bottom-up market demand. EV sales are no longer driven by policy subsidies," adds Mingming Huang, founding partner of Future Capital.

Sales of new energy vehicles (NEV) have reached 4.4 million units so far this year, up 200% on 2020. The government wants NEVs to account for one in five new car sales by 2025, and few would dispute this target will be achieved ahead of time. In October, the NEV share was 18.8%, up from 5.8% for the whole of 2020, according to the China Passenger Car Association.

"Once this trend becomes established, the growth rate will accelerate," says Nio Capital's Zhu. "There is no doubt that passenger vehicles penetration rate in the new car market will exceed 90% in a few years."

Incorporating hard technology and clean energy, EV sits in a policy sweet spot. The Ministry of Industry & Information Technology estimates total investment in the industry to date exceeds RMB2 trillion. This is not limited to EV manufacturers. Many private equity investors in China have adopted a whole supply chain approach and are looking for opportunities upstream and downstream.

While it is readily argued that the industry has fast become overcrowded and overvalued, investors identify smart cockpits – and the semiconductors and sensors that enable them – as an area with great potential.

"From a VC perspective, investment in vehicles and batteries was laid out 5-7 years ago. The EV opportunity in the first period was driven by electrification. In the second, it is in-vehicle internet, computing power, and so-called informatization," says Future Capital's Huang. The VC firm has made investments in this area.

It is worth noting that China and the US are well-positioned to consolidate their preeminence in EV, supported by sizeable domestic markets, abundant capital, and deep talent pools.

"Europe can hardly support significant new companies in the EV space. China has a large domestic market, and the scale of fundraising reflects that – companies with high capital density can be successful," says Julien Mialaret, an operating partner at Eurazeo, a Europe-headquartered investor that participates in Asia new energy, mobility, and deep technology through smart city VC funds.

"In China, you can raise a $100 million Series A and achieve industrialization relatively quickly. In Europe, a Series A for a similar company is maybe EUR30 million ($34 million)."

Good guidance?

With industry leaders like Nio, Xpeng, and Li Auto now listed, attention has shifted to so-called second-tier EV players. They are well funded, with Hozon closing a RMB4 billion round in October and WM Motor and LeapMotor raising $300 million and RMB4.5 billion, respectively, in August.

However, there are differences – perhaps driven by the timing and the maturation of the industry – in the kinds of investors participating. While Nio, Xpeng, and Li Auto primarily relied on offshore backers with US dollar-denominated funds, the tier-two players have significant local currency support, notably from local government guidance funds.

"Ideally, you want to have a deal co-led by a government entity and reputable venture capital firm: you satisfy the government guidance funds and you have endorsement from the market. The guidance funds actually want you to get that market endorsement," explains a China-focused GP.

"If it's 100% government money you know it's the first time that they have sought market endorsement. This has an impact on terms. It also means no proper due diligence has been done on the company; it was previously all through relationships."

WM Motor's $300 million was a Series D extension led by Hong Kong's PCCW and Shun Tak Holdings. The company said it planned to raise another $200 million from global US dollar investors. The first tranche of the Series D, worth RMB10 billion, was led by SAIC Motor and featured several other SOEs plus an array of local government vehicles from the likes of Hubei, Anhui, Hunan, and Guangzhou.

While there is an element of getting "in the government's good books," alignment with certain local authorities can bring access to land and other critical resources. Hozon is a case in point.

The company delivered 49,500 vehicles in the first 10 months of 2021, up 398% year-on-year, which propelled it to second place among the independent EV makers, trailing only Xpeng. However, the company is regarded as far behind the three market leaders in terms of brand recognition, technology, and product quality.

The answer may reside in a RMB3 billion Series B round completed in 2019, which resulted in two local governments – Jiangxi-based Yichun and Guangxi-based Nanning – becoming the largest shareholders. Yichun subsequently ordered 1,000 Hozon EVs for use as rental cars, while Nanning has allocated vehicles to the local police force, driving school, and airport shuttle providers.

"It is still necessary to run a project in a market-oriented way. While support from a certain shareholder or a certain local government can result in good performance in a short timeframe, this approach doesn't necessarily lead to success in the long run," cautions Inspiration's Yin.

The reality is that no EV company can exist without government support – the industry is underpinned by a combination of technology and policy – rather it is a case of balance. Future Capital's Huang observes that local governments prioritize bringing in cutting-edge technology to support local industry development over size of shareholding and investment return.

For example, Li Auto received assistance from the government of Changzhou in Jiangxi in setting up local production facilities. Then the Beijing government transferred Beijing Hyundai's production line and plant to Li-Auto as an incentive for the company to base its global flagship factory in the city. Beijing Hyundai is a joint venture between BAIC Motor and Hyundai Motor.

Batteries and beyond

Even with cost reductions, batteries can represent 35-40% of the overall cost of an EV. Inevitably, this has attracted private equity investors to the space. Series A and B rounds for Svolt, a spinout from Great Wall Motor, account for one-third of all cleantech and renewables investment in 2021 to date. One of Envision's key assets is a joint venture that makes batteries for the Nissan Leaf.

However, the battery opportunity stretches far beyond EVs, according to Kate Zhu, who leads Huaxing Growth Capital's EV and autonomous driving value chain coverage. Energy storage devices, such as batteries, are the basic unit of China's future energy ecosystem.

"When clean energy replaces traditional fossil fuel energy, the entire energy system will be reshaped. Solar and wind power generation are affected by natural conditions – sunlight, wind strength – and are therefore inherently uncertain. But downstream application scenarios require stable power. Batteries will become a major link in making supply and demand match up," she says.

Non-fossil fuels supported 15% of China's primary energy consumption needs in 2020, according to the International Energy Agency. Based on announced targets, this will rise to 23% in 2030 and 74% in 2060. Over the same period, the renewables share will increase from 18.5% to 59%, with solar and wind combined going from 8% to 38%. Coal consumption will peak in 2025 and fall thereafter.

Yang Lei, deputy dean of Peking University's energy research institute, claims that when renewables account for more than 10% of energy consumption, the boundary between supply and demand is increasingly blurred. Energy transition becomes two-way, much like the data underpinning it, and this causes fundamental change.

This gives context to private equity investors endorsing not only storage as a key opportunity within clean energy, but also energy dispatch and management systems.

Zhang includes hydrogen as well. While it is an option for energy storage, the most exciting application is in commercial vehicles. "After refueling once, it can run 1,000 kilometers, which solves the problem of inter-city long-distance transportation," she says.

Hydrogen energy is still nascent – only 9,006 hydrogen energy vehicles were sold globally in 2020, with 1,177 units were sold in China – but it has strong policy support. Pilot projects have been launched in Beijing, Shanghai, and Guangzhou, and there are plans to have 20,000 vehicles on the roads in four years. China Society of Automotive Engineers predicts it could reach 100,000 by 2025 and one million by 2035. Sinope is planning 1,000 hydrogen refueling stations by 2025.

The technology offers a snapshot of how government and private enterprise might work together and both benefit from policy-aligned investing, but it highlights the risks as well.

With SOEs laying the foundations for the industry and PE-backed companies providing the core technology, Starquest's Fang says he is optimistic that hydrogen battery company will emerge of the size of Contemporary Amperex Technology (CATL), a Shenzhen-listed EV supplier that has seen its market cap grow more than sixfold to RMB1.58 trillion in the past 24 months.

Wang of Primavera, on the other hand, claims that real commercialization of hydrogen energy needs more time. Other investors are still examining use-case scenarios, pondering what happens when government support is no longer so forthcoming. Not every cleantech segment will evolve like EV.

"We adopt so-called end-game thinking when considering this issue," explains a cleantech-focused GP. "The state is pushing hard on hydrogen development, offering subsidies. But in the end, it must still compete with other energy solutions, and prove it can be sustainable without subsidies."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.