Taiwan start-ups: Leaving the factory

Taiwan’s industrials-focused venture capital and start-up ecosystem has tilted noticeably toward consumer software in the past year. Nevertheless, the traditional heavyweights are indispensable

Jamie Lin set up his first start-up, a Taiwanese e-commerce company called Hotcool, in 1999 when he was 21. Unfortunately, funding prospects dried up in the wake of the dotcom bust. Lin knew he was on the right track, however, and with the advent of the smart phone a few years later, he switched to venture capital.

Recognizing that most of the value in the smart phone concept was in software rather than the handset itself, Lin established AppWorks, an early to growth-stage VC and accelerator, in 2009. The goal was to help Taiwan's manufacturing-focused technology sector get a bigger piece of the boom.

"[The experience with Hotcool] planted a seed in me to prove that yes, we're an industrial island, but it's possible to build consumer-facing internet services that will scale here," he says. "All the things I'm doing now are to prove that the 21-year-old me was right. At first, people thought we were crazy – they didn't understand what we were doing."

AppWorks is now considered the chief architect of Taiwan's consumer-facing start-up scene with an ecosystem of more than 400 companies, 80% of which are either Taiwanese or have a significant Taiwan element in their operations. It closed its third fund in August at $150 million, beating a target of $100 million. Assets under management now stand at $212 million.

The firm's standout success to date is omnichannel commerce services provider 91App, sometimes called Taiwan's first homegrown unicorn, which listed on the Taipei Exchange in May. A price-to-earnings multiple of 20-30x, comparable to local semiconductor giant TSMC, was widely expected. Instead, 91App surpassed 100x on its first day of trading. The stock closed up 153% and continues to perform strongly. The company currently has a market capitalization of NT$36.2 billion ($1.3 billion).

"Seeing 91App's performance makes me both happy and slightly frightened; I believe this is a new era in Taiwan where markets are starting to understand the software industry and other new innovative sectors," Matt Cheng, founder of Cherubic Ventures, said at the time. "As I watched [the stock trade higher], I became extremely excited at the sight of what will begin a change in Taiwanese markets."

Founder factory

91App also helps demonstrate the ecosystem's maturation in terms of talent. The start-up's founder, Steven Ho, previously established e-commerce site Monday Tech, which was acquired by Yahoo in 2008 for $55 million. Around that time, smart phone hardware giant HTC had recruited and quickly released thousands of software developers when a plan to create apps in-house fizzled. The ensuring talent redistribution has been described as a kind of PayPal Mafia effect.

The phenomenon has extended to investors as well. For example, T.P. Lin and Brandon Chiang, formerly associates at AppWorks, set up Cornerstone Ventures in 2018. The firm raised $13 million for its debut fund from the likes of Chunghwa Telecom and PCHome. Fund II is planned to launch next year.

The thesis is focused on a perceived gap around the Series B stage, where international support is needed to take local start-ups to the next level. Cornerstone is unable to write checks of this size, but it can help companies position themselves with regional footprints, thereby demonstrating scaling potential and facilitating connections with regional or global VCs.

"When I came to Cornerstone, I wanted to make a bridge between Taiwan and Southeast Asia, and other countries," says Chiang, whose investments and post-management deals include regional unicorns Lalamove and Carousell. "Start-ups are trapped in Taiwan, but if you can introduce them to higher level investors in other markets, they can meet the challenge."

Chiang observes that the industrials-to-consumer evolution doesn't preclude B2B models, which can be easier to take into foreign markets on a limited budget. Its standout investee to date is GoFreight, a logistics software-as-a-service (SaaS) provider with a predominantly Taiwan-based team that generates 95% of revenue in the US. Cornerstone made the expansion possible, largely by connecting the company with California-based Mucker Capital.

The strongest proof-of-concept for the B2B approach is advertising technology provider Appier, which raised $271 million in a Tokyo IPO in April, making it the first Taiwanese start-up to go public in Japan since 1998. It had secured about $160 million in private funding from the likes of Qualgro Partners, WI Haper Group, EDBI, TransLink Capital, Jafco, Sequoia Capital India, Line, and Naver.

"As there's no physical boundaries nowadays for SaaS companies, from day one we decided to build Appier into a global business. Although our R&D is headquartered in Taipei, our goal is to serve customers internationally. This is why our business language is English despite being based out of Taiwan," says Winnie Lee, COO of Appier.

"It's definitely feasible for Taiwan's start-up companies to be attractive to the international investors as long as they can demonstrate their abilities to build differentiating products and services that are proving good values to customers, as well as abilities to operate and scale their businesses internationally."

Regional platforms

COVID-19, with its border closures and hamstrung lifestyles, has accelerated the internationalization of the ecosystem. During the worst of the lockdowns, Taiwan gained a reputation as a virus-free place where business continued as normal, inspiring the likes of DCM Ventures and GSR Ventures to ramp up local activities. 500 Global went as far as setting up a permanent base and team.

This effect extended to start-up talent. Victor Tseng, CFO of tour package vendor KKday who recently worked for Pinduoduo and Trip.com in Shanghai, counts himself among a wave of Taiwanese professionals who have returned home during this time. He joined KKday in October 2020, noting that not all the incoming skills were returnees. "An influx of foreign talent because of COVID certainly helped us," he says.

The talent point is crucial because international late-stage investors seeking exposure to Taiwan's next regional success will be looking at management as much as initial overseas traction. Put simply, a CFO experienced with regulations in other markets is required to IPO overseas and therefore to attract regional funding and achieve escape velocity.

"There's more and more capital looking at Taiwan, and I think it's kind of a chicken-and-egg process," says Tseng, flagging Appier's IPO and a $2.3 billion special purpose acquisition company (SPAC) merger for electric scooter maker Gogoro. "But with more of these exits, institutional investors can see tangible returns within a certain time period."

KKday, which is backed by AppWorks, is one of the leading candidates for Taiwan's next major IPO because it continued to grow despite grounded international flights by transitioning to a domestic tourism model and introducing several pandemic-related safety features. It didn't hurt that AirBnB realized a monster debut on NASDAQ in December 2020 and has since scaled up to a market capitalization of $114 million.

Japan has been critical to KKday's positioning and growth story to date. Regional investors like MindWorks Capital and Monk's Hill Ventures signed up early on the strength of the founder's track record; KKday was his fourth travel start-up. But the breakthrough came in 2018, when HIS, one of Japan's biggest travel agencies opened the door to a massive neighboring market. Other Japanese players such as Line Ventures and Cool Japan Fund quickly followed suit.

17 Live, a media platform operator with several regional investors including Temasek Holdings-owned Vertex Ventures, has followed a similar path. The company's Japan business is several times the size of its Taiwan operations and is tipped to be readying a Tokyo IPO that would rival that of Mercari, the flea market app that legitimized the Japan start-up for most investors with its $1.2 billion float in 2018.

"Their financial metrics and footprint are far stronger than Mercari's was when it was preparing to go public. In the next 1-2 years, M17 is going to be a landmark IPO in Japan," says one investor in the company.

It's worth noting that M17 has been here before, having canceled plans for a New York Stock Exchange IPO in 2018, citing unspecified difficulties with some investors.

This was a matter of some controversy. M17 priced the offering – below the indicative range – on June 7 of that year with stated intention of trading later the same month. But the ticker never went up and no explanation was given. Within days, the company confirmed a $35 million round from some of its existing VC backers.

The usual suspects

In a reality check for the industrials-versus-consumer narrative of VC and start-up activity in Taiwan, M17 raised $26.5 million in its latest round last year with participation from local semiconductor giant ASE Group. And naturally, this is not in the least uncommon.

The industrial giants have proven sophisticated and ambitious venture investors and ecosystem builders in recent years, consumer-facing software included. Indeed, electronics manufacturer Wistron is one of AppWorks' oldest LPs and key corporate partners. The two organizations have jointly launched an accelerator blending disciplines as diverse as education, corporate services, internet-of-things (IoT), and healthcare.

"I strongly believe Taiwan has an edge in entertainment and the arts – but is that where the capital will be most efficiently deployed?" says Yan Lee, co-founder of Hive Ventures, which closed its debut fund at $13.5 million in June with support from Wistron and fellow manufacturers Mitac-Synnex, Unitech Electronics, GMI Technology, and Foxconn.

"Start-ups and investors survive by knowing how to pick our fights and finding the most efficient routes for getting things done. In Taiwan, the local industrial giants represent the low hanging fruit and the shoulders you can stand on to go global."

Hive believes manufacturing is a unique opportunity for Taiwanese start-ups to realize cross-border expansion ambitions in part because – unlike sectors such as healthcare and finance – there are few barriers in terms of adapting to unfamiliar regulations. It aims to bridge its corporate partners with its start-up network via "executive briefing" sessions, one of which featured Foxconn founder Terry Gou. Target sectors include retail.

Marshalling Taiwan's traditional industrial muscle to promote the consumer tech boom is especially essential in light of challenges scaling up the overall ecosystem. In addition to a funding gap in the early-growth stages and a small domestic market as a springboard, the existing talent pool is already geared to be sandboxed, piloted, iterated, and commercialized by the corporate incumbents.

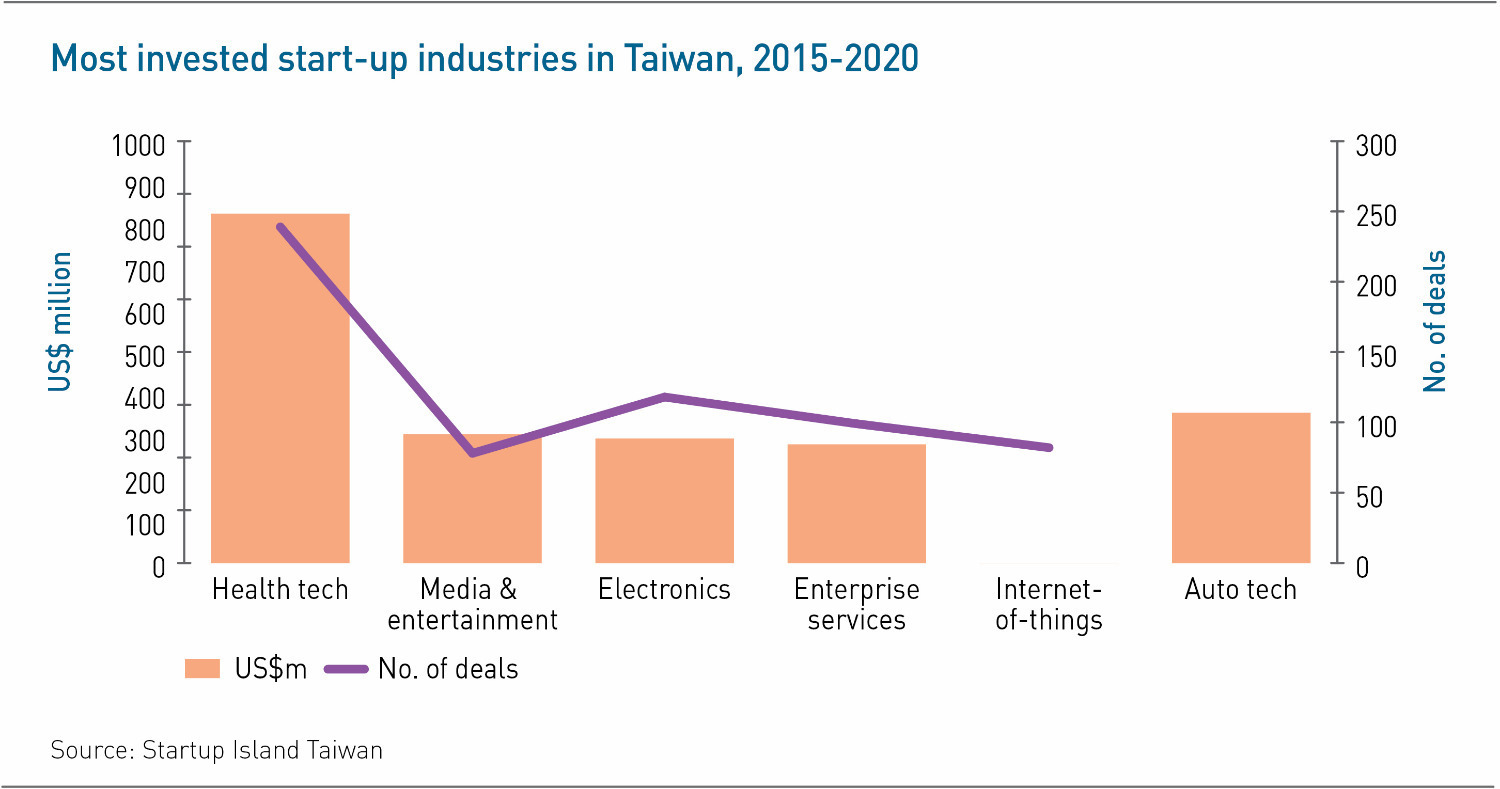

According to Startup Island Taiwan, electronics, enterprise services, IoT, and health tech were among the top four investment categories for start-ups in terms of deal volume between 2015 and 2020. During that period, there were 538 deals in those categories, compared to 78 in media and entertainment. In dollar terms, media and entertainment was on par with electronics but well behind automotive and health tech.

The presence of global new-economy tech giants is not expected to support regionalization to a great degree. IBM, Microsoft, Google, and Amazon have all set up various incubators, accelerators in-market, but the consensus view is that local start-ups are dealing with fringe units of those empires with little access to expansion networking resources.

"We're a little bit handicapped compared to our regional peers like Singapore," says AppWorks' Lin. "Then again, the valuations are much more reasonable. In Taiwan, you can cherry pick start-ups that have huge potential to grow regionally but their valuations are not fully reflective of that. For the next 2-3 years, I think there will still be an arbitrage to be made there."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.