HNWIs & private equity: The road to retail

From B2C aggregation platforms to nascent blockchain-based products, solutions that bring alternatives to the mass market are emerging. Providers prefer to be labeled enablers than disrupters

Artivest was arguably the first technology platform to deliver private markets exposure on a B2C basis, breaking down traditional fund commitments into smaller pieces and offering them directly to high net worth individuals (HNWIs) and other retail investors. The company was acquired last year by iCapital Network, cementing the latter's dominant position in this distribution segment in North America.

There are two major HNWI pain points, one B2C and the other B2B: connecting with a broad enough universe of small-scale investors to justify participation in funds on an aggregated basis; and onboarding and managing those relationships in a cost-effective way.

ICapital has resolved to target the second, which led to Artivest's B2C operation being shuttered, and its technology repurposed. Now with $94 billion in assets, iCapital is aggressively pushing upstream to serve banks and wealth managers that serve the HNWIs.

"This is no longer just a business opportunity for them, it's also a responsibility to create access for their clients to participate in the value creation that's increasingly happening in the private markets," says Marco Bizzozero, head of international at iCapital.

"To do that at scale, with efficiency and a significantly better client experience, you must eliminate the historical barriers between private investors and the private markets, which you can achieve by partnering with a fintech company and implementing its technology platforms. In the past, this kind of outsourcing decision was mostly based on cost reductions – now it's mostly about time to market, achieving a better client experience and a responsibility."

The obstacles that stand between HNWIs and a role in the global shift toward private markets are multifarious: regulation, liquidity and minimum threshold issues, concerns about insufficient market knowledge and data access, poor network connections, and complex or voluminous administrative paperwork for both managers and investors, just to name a few.

No one service provider could address them all. ICapital focuses on the administration part, working with wealth managers on jurisdictional compliance, reporting, capital calls, and subsequent distributions. The company sets up and manages feeder funds, but it does not aggregate HNWIs. It therefore considers itself an enabler of bank-led private markets programs rather than a disrupter.

Coaching client banks about how to properly explain private equity is essential to scaling this model by attracting more public interest, as is building a network of partner banks. ICapital entered Asia this year with regional headquarters in Hong Kong and eyes on Japan, Australia, and mainland China. A Singapore presence is already being established.

B2B vs B2C

For GPs, the B2B approach will have shortcomings in terms of opening private markets to untapped populations of HNWIs because much of that work will be left to less informed intermediaries. But the scaling advantages are manifest. For example, Germany-based Moonfare, the leading player in the B2C space, has only around EUR1 billion ($1.2 billion) in assets under management (AUM).

Still, B2C does appear more in line with the trend's democratization ideals. Yuri Narciss, a managing director at Moonfare, acknowledges that the number of banks with their own private markets offerings has expanded rapidly in recent years, but they are targeting the well-heeled elite. Meanwhile, access to aggregators associated with family offices is limited by personal connections and buy-in ability.

"We're talking about millionaires and billionaires there," says Narciss, making his case that there is a huge market in the lower tiers for B2C platforms. Moonfare's minimum ticket size is EUR50,000. It charges clients a one-off origination fee of 1% of the commitment and an annual trailing fee of 0.5%. This is in addition to the management fees and carried interest received by underlying managers.

Moonfare was set up in 2018 by Steffan Pauls, a former managing director of KKR, and entered Asia the following year. The company claims differentiation in a strong private equity background, which supports a quality-over-quantity thesis. It makes commitments to funds managed by The Carlyle Group, EQT, General Atlantic, and Khosla Ventures. Its first Asian fund was KKR's latest vintage in the region.

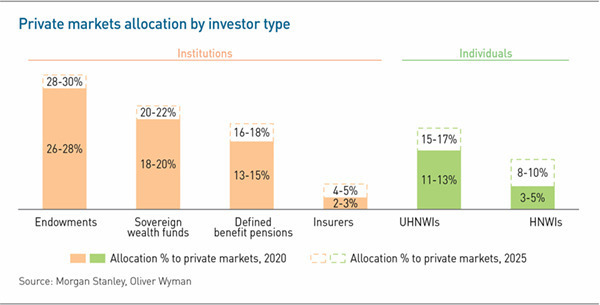

A rise in demand for this kind of service can be extrapolated from individual investors' increasing appetite for private markets in general. HNWIs, defined as having financial investable wealth of $1-50 million, allocated no more than 5% of their assets under management to alternatives in 2020. That figure that is set to reach as high as 10% in 2025, according to Morgan Stanley.

Many emerging GPs will be keen to tap this growing and increasingly accessible pool of capital via various platforms, which also represent a chance to minimize LP pushback on fees. But this approach entails some risk in the form of less discerning aggregators matchmaking poorly informed investors with unpromising funds. Meanwhile, for managers already boasting oversubscribed funds, the question remains how deep into the retail space they're interested in going.

"For them, it's typically a strategic decision to diversify their investor bases, and they're obviously very conscious about their reputations and compliance, so they want to have a quality perspective to it," Narciss says. "Getting access to the top 10% of VC funds in the US was not easy, but they were interested because their LP base is very US-centric. They wanted our access to new LPs in Europe and Asia, and thought we had all the KYC [know-your-customer] compliance checks in place."

For platforms connecting with brand-name GPs, reporting is part translation, part gatekeeping. Technical information must be translated and interpreted for a retail readership, and some of it needs to be omitted to avoid public dissemination of sensitive materials. The information shared with individual LPs can be as basic as a general outlook update and the fund's net asset value.

Interestingly, the most inclusive end of the retail spectrum can have the fewest privacy complications. simply because everything is scaled down and the stakes are lower. Australia's iPartners plugs investors with gross annual income as low as A$250,000 ($185,000) into single-asset funds as small as A$500,000, with a preference for strategies where the target asset is already identified. Sectoral strengths have developed in lending businesses, healthcare, and hospitality.

"Our process is very transparent," says Mark Sherwood, director of capital markets at iPartners. "All the documents are visible, and all registered investors can click through them. If they have any questions, they can speak with an iPartners representative. All relevant information around the deal, the managers, the term sheet or anything else we think is important gets placed in the data room – and that's updated along the way."

Getting tokenized

Any conversation about using technology to streamline administration and democratize financial inclusion inevitably leads to blockchain. In theory, tokenization of a private equity fund completely erases any minimum entry barriers, makes every transaction instantaneous, and allows individual investors to buy in or sell out whenever they want, at least on the secondary market.

"Five guys in a room with a phone can be a distributor. It's not that hard to set up a shell vehicle and aggregate individuals. The hard part is fractionalizing," says Oi Yee Choo, chief commercial officer of Singapore's ADDX. "By providing an exchange, we're actually solving the pain points of individuals investing in private equity. It may not be fully liquid like a public market, but we are providing more liquidity. That's a key difference from the aggregators out there."

Founded as iStox in 2017, ADDX raised a $50 million Series A round earlier this year from the likes of Tokai Tokyo Financial Holdings, Hanwha Asset Management, and Heliconia Capital Management, a subsidiary of Temasek Holdings. In September, it tokenized an open-ended fund from Partners Group, the first such move for a major PE firm. Earlier this month, it did the same for a cryptocurrency fund from Trovio Group, a firm set up by former JP Morgan and UBS executives.

ADDX can create a feeder fund in situations where multiple capital calls will be required, but it prefers direct tokenization where possible. In a tokenization process, the company does not play the role of a single LP for individual investors, but it does provide a single distribution and reporting point. Commitments as low as $10,000 are called upfront. ADDX does not undertake a credit risk review and does not take fiduciary responsibility for the underlying investors.

This model is strongly associated with themes around the redistribution of wealth and social consciousness. Retail investment in cleantech, for example, is almost impossible to properly express without access to highly speculative private markets. Tokenization can make that happen.

There is also growing interest in this idea on the GP side, perhaps for corporate citizenship reasons. Choo notes that managers of the caliber of Partners Group have begun approaching her company this year, asking specifically about fractionalization and democratization. She expects it to be a major trend in 2022.

At the same time, however socially conscious it may be, the tokenization approach is also a buyer beware model. ADDX legitimizes it with a strong commitment to governance, undoubtedly monitored by Singapore Exchange, one of the Series A investors. But it is inevitable that less legitimate followers will move into this space, posing risks for both the retail investors and tech-driven retail access to private equity as an acceptable concept.

"There's a proliferation of digital platforms, and I'm a bit worried that some of the smaller guys trying to compete may not move up to the gold standard of governance and diligence," Choo says. "One day, one of them might crash and burn, run away with money, and put all digital platforms at risk."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.