Logistics: Machinery machinations

As private equity goes deeper downstream in the e-commerce supply chain, technology has emerged as a prerequisite and stumbling block

The march of e-commerce, bolstered by COVID-19, is a powerful but not always intuitive driver of the logistics real estate space and private equity's participation therein. Vacancies are down, rents are up, and the fundamentals are strong, yet the "if you build it, they will come" approach to warehousing appears increasingly misguided.

There are various overlapping reasons for this, the most noticeable of which may be that the tenants have changed. Established but recently digitized brick-and-mortar retailers with reputations to uphold and grocers with strict product handling requirements are moving in – but only if the facilities are up to snuff in terms of functionality and sustainability standards.

At the same time, a wider set of investors has recognized the opportunity, leading to concerns that rising capital inflows could lead to the creation of non-optimal capacity. The scope for error here is implied by the supply-side flood. JLL has charted an apparent parabola in Asian logistics fundraising in recent years, with the total jumping 43% during 2019 to $7.3 billion, followed by a 70% hike in 2020 to $12.4 billion. It is set to hit $18 billion this year.

Historically, mistakes in this space can be mitigated with local knowledge. Negotiating location-specific obstacles can be as deceptively simple as avoiding a warehouse on the wrong side of a motorway, which would require trucks to take an exit a few kilometers down and double back through a residential area, stoking community protests. But the nature of the current boom has added a precarious new ripple to this risk in the form of technology.

The impatience that colors consumer demand for swift deliveries, the high-volume throughputs, and the thin operating margins involved make tech-driven efficiencies indispensable in this space. However, there are no magic bullets. Effective tech integrations take the form of small changes, rather than one big fix, requiring a detailed understanding of warehouse occupier pain points.

"So much capital has acknowledged this sector, but the challenge is creating the right product," says Ralf Wessel, managing director of fund management at GLP. "The specialists with 20 years' experience have the expertise and knowledge to deliver that product, but a lot of less experienced investors coming into the sector do not. Leasing times and leasing efforts have definitely reduced significantly in the last three years, but the product needs to be right – and that's where the rubber hits the road."

Know your customer

GLP's case that logistics real estate specialists are best positioned should not be taken as discouragement for diversified private equity – especially since the firm is increasingly defining itself in those terms. Indeed, GLP sees its vertically integrated model – combining PE, logistics real estate, renewables, and data centers – as an important advantage in navigating tech integration issues in e-commerce supply chains.

Wessel notes that the PE arm, which has invested more than $2 billion in some 100 technology companies globally, is instrumental in optimizing the functionality of assets on the warehousing side of the business, where many investees are incubated. Standout examples include Japanese robotics supplier +Automation, which has leased around 1,000 robots across GLP and third party-owned warehouses. Its sorting systems are said to increase space use efficiency by 50%.

This brand of start-up ecosystem development and participation is becoming all the more essential as the tech inputs in warehousing increase in complexity. In addition to robotics, which spans a range of sorting and inventory organization applications, sub-disciplines are splintering in data analytics, automated clearance systems, digital loading docks, telematics, fleet-management systems, and the internet-of-things (IoT).

"The technology is changing so regularly you're almost outdated if you buy today's tech – you have to buy tomorrow's tech. So the equipment and the technology that goes into it is causing significant pause for thought," says Tom Woolhouse, head of logistics and industrial for Asia at JLL.

"This takes a huge amount of time to factor into decisions because, depending on throughput, a fully automated warehouse can take up to 10 years to pay back. You have to be certain that you're investing in the latest equipment that is most suitable for your business function. If you get that wrong, it's significant."

Getting the right technology for a warehouse development project means understanding the targeted users beyond their identity as e-commerce players. While many occupiers fit neatly in the most straightforward online shopping paradigm, there will be other tenants with modified needs, including third-party logistics companies (3PLs), food specialists, and community group buying platforms.

Although cost reductions, handling efficiencies, and sustainability are common goals, each occupier segment has its own technological priorities. Grocery players, for example, naturally value cold chain and may require more speed and flexibility in vehicle dispatch. Group buying platforms and 3PLs, meanwhile, might prioritize greater automation in parcel sorting since they will be managing a more complex and varied rollcall of suppliers.

In China, where the group buying phenomenon is most developed, robotic "bin picking" systems, have become a venture capital hotbed. AVCJ Research has records of at least five Chinese start-ups raising sizeable rounds in the past year by touting advancements in this domain, which involves the use of sensors and cameras to identify and retrieve specific objects positioned at random in a bin.

"Warehouse owners are very much concerned about successful projects and customer cases when deciding to choose their robot supplier," Chris Hu, a marketing manager at China's Hai Robotics, which raised $200 million in September from the likes of 5Y Capital and Sequoia Capital China.

"The factors operators are looking for are flexibility – mixed picking and different sizes of cartons and bins – stability, operation efficiency, good integration with its own warehouse management system, and customization capability."

On the wish list

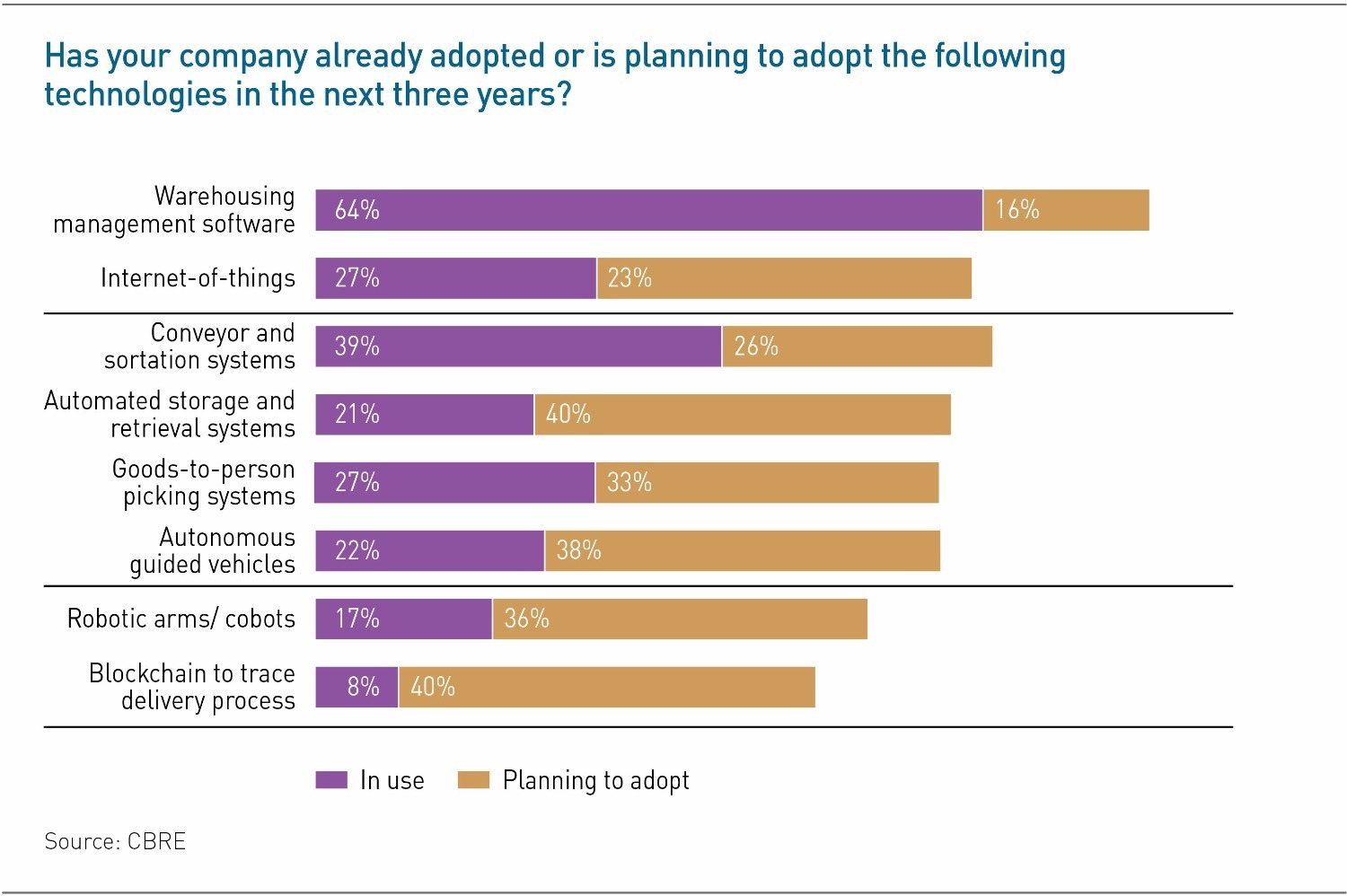

According to a recent survey of warehouse occupiers by CBRE, the biggest expansion areas in terms of technology uptake in the coming years will be automated storage and retrieval systems and blockchain for tracking the movement of goods. The next most in-demand upgrades include autonomous vehicles, IoT, robotic arms, and goods-to-person picking.

For investors on the warehouse development side of the equation, the question remains how exactly to leverage this information. In most circumstances, it is the occupier that invests in installing technology, not the owner-developer. However, the facility must be amenable to technology integration. For example, pallet-dragging robots require absolutely flat concrete floors; any joints or imperfections can make the facility uneconomic from the occupier's standpoint.

Greenfield or demolished-then-rebuilt projects, rather than refurbished, are therefore usually believed to promise the better return on investment. This view holds regionwide but especially in less developed markets.

It also reflects the e-commerce industry's demand for "modern" warehousing, which is loosely defined as having broad column spacing, internal clear heights suitable for automation, sufficient truck maneuvering space, and back-up power supply in addition to super-flat floors. In high-density markets such as Japan, Hong Kong, and Singapore, these will invariable be multi-story facilities with slightly lower but still robot-ready ceiling heights.

"Operators really want to focus on automated storage and retrieval systems, but they haven't been focused, and the money hasn't been spent. That's going to have to change going forward due to labor shortages and costs. Labor costs have increased substantially during COVID-19, and these companies are already operating on thin margins," says Henry Chin, global head of investor thought leadership and head of Asia Pacific research at CBRE.

"The logistics assets that will outperform will be closer to transportation hubs because of surges in energy prices and have state-of-the-art technology. My advice for investors is to really understand your end-users and try to partner with them in the planning stages. Occupiers have specific needs, and they're more selective, so you have to build to suit their needs."

The notion of being built-to-suit is somewhat flexible. Facilities that are highly tailored to a specific occupier risk reducing their re-rentability. Instead, best practice in terms of anticipating occupier technology needs involves proceeding with a relatively generic development plan that can accommodate specific modernization features as necessary when leasing discussions begin.

There are two possible scenarios for a developer installing advanced technologies before leasing. If there is an oversupply situation in the market, asset upgrading with technology can be a worthwhile tactic for attracting tenants. Also, if an asset is dated, the value-add investment could allow the developer to attract tenants and boost rents.

What constitutes advanced technology is constantly in flux, however. According to JLL, the average cost of an industrial robot has fallen from about $68,700 in 2005 to $27,100 in 2017 and is set to hit $10,900 in 2025.

In from the cold

The best example of the normalization of specialized equipment is cold chain. Once a niche area that required occupiers to contract a dedicated service provider, cold chain equipment is increasingly becoming a quasi-standard pre-leasing feature for developers.

GLP considers cold storage a standard feature that it builds into buildings on a speculative basis before leasing but also a specialist tech enhancement service area in certain situations. As such, it has a portfolio of units ready for conversion to refrigerated use as well as capacity to provide bespoke installations for customers that have complex requirements.

The firm provided a pharmaceutical customer at GLP Park Beijing Airport with a temperature-controlled sorting and automatic conveying system supplied by G2Link, one of its PE portfolio companies. The facility is said to require 30% less labor than a traditional warehouse while doubling order picking efficiency and achieving an accuracy rate of 99.9%.

"One tech feature that can drive cost downs for cold storage is IoT and machine learning which requires a high spec technology infrastructure," observes JLL's Woolhouse.

"The primary factors driving demand for frozen and chilled products are population growth, income and consumption. With these factors, the opportunity is large across most regions globally, but particularly in Asia Pacific. It is anticipated that the model will move away from owner-occupier towards leasing. Another new trend includes the increase of speculatively-built cold storage space, which will shift occupier trends to more leasing instead of owning."

Modern essentials are also increasingly being defined by environmental, social, and governance (ESG) factors rather than speed and cost considerations. The worker wellness aspect is largely non-tech, including cafeterias, lounges for staff, green areas, and amenities. Environmental features, such as solar panels and water recycling systems, will be more involved.

In Europe, global developers tend to lead their leasing campaigns with sustainability, but they don't do so in Asia. Many of their LPs, especially global sovereigns and pension funds, have mandates that prohibit investment in non-ESG-compliant buildings. But in Asia, it's still not the norm for one building to command a lower cap rate than the next one based on sustainability issues. It's a liquidity point, not a pricing point, and that is expected to continue in the foreseeable future.

Nevertheless, ESR has made ESG a core part of its strategy, blending it with significant technological innovations. The Hong Kong-listed warehousing platform has at least 18 logistics parks across the region with various green building certifications and a formalized sustainability agenda including targets to increase in solar power generation by 50% and increase its number of buildings with green certifications by 50% by 2025.

ESR became the largest logistics company in Asia earlier this year, when it acquired ARA Asset Management for $5.2 billion, expanding its assets under management to $129 billion, including $50 billion in new economy real estate. The company was seeded by Warburg Pincus in 2011 and attracted several private equity investors prior to its 2019 IPO. Warburg Pincus recently reinvested as part of the ARA merger and a go-forward growth plan focused on e-commerce.

"We see that these companies [e-commerce and supporting 3PL players] are looking for larger, more efficient facilities in which to have their diverse operations, which include not only the storage of goods, but also returns, repairs, repacking and back-office functions," says Stuart Gibson, co-founder and co-CEO at ESR.

Automation acme?

At the same time, ESR has seen growing demand among e-commerce players for last-mile facilities in densely populated areas, but it faces resistance in the form of municipal restrictions on industrial projects. One of the company's standout solutions to this dilemma is the nine-story Higashi Ogishima Distribution Centre in Japan, which is set to be the world's first cargo drone facility upon competition in 2023.

"We see now a growing trend to look at conversion of older retail or office space to last-mile logistics space, and even to have such space designed into new mixed-use developments. With the arrival of new delivery technologies such as drones, we could see a change in decision making regarding logistics operators' preferred location," says Gibson.

This level of automation is far removed from the typical situation on the ground, especially in Asia. As a rule of thumb, an "automated warehouse" can be more accurately profiled as semi-automated with no more than about one-third of the facility leveraging robotics systems or smart conveyors.

In the short term, fully automated capacity supply is expected to come fastest in China and Singapore, where government subsidies are supporting investment. Autonomous mobile robots (AMRs) for moving boxes and pallets are seeing some of the most momentum so far because they don't require heavy upfront investment and are relatively easy to install.

As with bin picking, China has proven a leader in this area, with local start-ups such as Hai Robotics, Geek+, and Galaxis all raising significant funding in recent months. In Singapore, the leading AMR player is GreyOrange, which has raised $270 million from the likes of Tiger Global Management, Mythril Capital, and Blume Ventures.

Only the largest occupiers and developers with global and regional networks have implemented these technologies to any meaningful capacity to date. As deployment costs fall and pressure to maximize efficiencies increases, accelerated proliferation among smaller and less experienced players is inevitable – along with miscalculations in adoption.

"Fully robotic warehouses are an increasing component of our portfolio because the technology makes buildings and parks both cost efficient and functionally efficient," says GLP's Wessel. "But at the end of day, if the building is in the wrong location or doesn't have the right accessibility, you can put all the technology you want in it and it's still not going to work."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.