Australia PE: Brave new world

As Australia contemplates opening its tightly controlled borders and finding a way to live with COVID-19, private equity probes an opportunity set in transition yet surprisingly stable

Having rebounded strongly from severe lockdowns last year, Australia appeared on track to be the first market in Asia Pacific that could be truly described as a post-pandemic economy. The subsequent outbreak of the Delta variant of COVID-19, which has prompted a re-shuttering of much of the country, has tempered that bullish sentiment but not snuffed it out.

Private equity investors claim to have more visibility on business outlooks in the current environment, with vaccination rates expected to hit 80% within weeks. Meeting that threshold should result in an opening up of domestic and international borders – and therefore the broader economy – to a significant degree. Pipelines are therefore said to be full and deal flow steady.

Throughout the pandemic, this optimism has come with a sectorial caveat. B2B businesses are more insulated than B2C. Non-discretionary spending is generally safer than discretionary. Non-essential services where digitalization is unfeasible or impossible are to be avoided.

To some extent, this logic remains a valid guide as Australia moves into a more open style of virus management. But when the country relinquishes the comforts and predictability of being a pandemic hermit state, the relevant uncertainty variables might be harder to calculate.

Pacific Equity Partners (PEP), for example, counts itself lucky that its portfolio was largely in resilient categories such as non-discretionary consumer staples and medical services when COVID-19 hit. Fund VI is 30% deployed with deal flow tracking normally during recent lockdowns – but the mix of target areas is changing.

Three diligence questions have come to the fore: First, are inflated valuations justified for companies that have benefited from the pandemic to date? Second, will struggling companies hoping to tap pent-up consumer demand be able to realize those projections? Third, to what extent will recent changes in consumer behavior prove permanent in a post-pandemic Australia?

"It looks as though the new normal is a great opportunity for the informed investor, but that has to be qualified with a fair degree of significant risk," says Tim Sims, a co-founder and managing director at PEP.

"There is no doubt there will be a rush where people assert their right to do things they've been starved of, but a vast majority of them have also found that some aspects of life in lockdown quite acceptable. The question is, how will that settle into a long-term sustainable mix. Will people do as much of activity A or activity B as they did before? Nobody knows."

Damage contained?

The persistent willingness to invest in this uncertainty is underpinned by the long-range picture and the idea that, even in the short term, the damage has been contained. On the bullish side, the Reserve Bank of Australia (RBA) expects GDP to grow 4.7% in 2021 and 5% in 2022. National Australia Bank (NAB) is more conservative, forecasting 3.3% and 2.9%.

The worst fears were assuaged earlier this year when one of the government's key business-support stimulus programs, JobKeeper, was terminated and an expected wave of insolvencies failed to materialize. Government data indicates that the business closure rate has held steady around 12%, although a delayed effect is still possible.

Anil Hargovan, a professor at the University of New South Wales specializing in insolvency law, believes the country is yet to see the full result of any fallout, noting that "history shows us that you can expect at least a four-year gap between crisis and impact." However, this aftershock could simply be a matter of tallying up the so-called zombie businesses, which are no longer viable but still to be restructured or formally closed.

"We feel good about the investment environment over the next four years, but we are cautious about investments right now. While we must think about how a business will manage in the new world, we aren't trading on a month-by-month basis. As a 10-year fund, we are positive," says Mark Jago, a partner at Advent Partners.

"The Australian economy is in a good spot relative to the rest of the world, and we like the sectors we are investing in. It's just been a challenging 18 months, dealing with the on-off situation regarding JobKeeper and helping portfolio companies that have been impacted. But generally, we've been fortunate in the businesses we have backed."

Advent demonstrated long-term confidence in discretionary offline spending as recently as last month with the acquisition of Zero Latency VR, a Melbourne-based virtual gaming company that manages warehouse-sized venues where customers congregate in person. Still, the lower middle-market investor's overall activity has been conservative; it pulled out of two deals in 2020 because the outlook was uncertain, one in healthcare, one in consumer.

Advent's experience also helps explain industry confidence in a short-term recovery. For example, Frosty Boy, an ice cream company in the portfolio, saw revenue fall 80% in the second quarter last year, but this has since rebounded to record, higher-than-pre-pandemic levels.

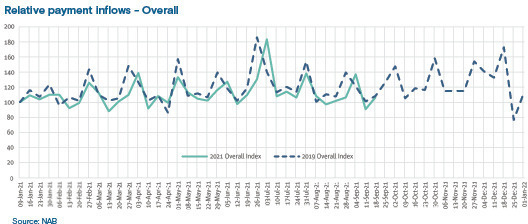

NAB observes that GDP growth fell by eight percentage points year-on-year in the first half of 2020, but then staged a seven-percentage-point recovery in the second half. Still, the bank, which serves about 30% of the local retail sector, has tracked only a marginal decrease in the cashflows from its merchants when comparing 2019 and 2021, suggesting less scope for a rollercoaster swing this time around. It expects this year's post-lockdown bounce to be about half as big as that of 2020.

"We think activity will come back quite strongly but nowhere near as strongly as it did last year because it's nowhere near as negative as it was last year, and we don't think consumers have huge amounts of money they can spend," says Alan Oster, chief economist at NAB.

"Also, we're slightly nervous that, last year, everyone went out [after the lockdowns] and didn't even think about catching the virus. This time, they might not be as keen to go out. So, we aren't as confident as the RBA – we're still optimistic the economy will come back, but it won't be supercharged."

Deal roadblocks

For some investors, the end of lockdowns will mean more than a boost in consumerism – it will mean a chance to meet founders. Axle Equity Partners, a deal-by-deal private equity firm targeting the local small and medium-sized enterprise (SME) space, has not made any investments during the pandemic, citing due diligence challenges more than macro gloom.

One of Axle's key investments, Star Car Wash, has seen 110 of 170 nationwide locations forced to close by government order in the latest lockdowns, but a strong balance sheet and faith in an imminent reopening have kept morale high. The bigger problem is that interstate travel is once again at a virtual standstill and even within Axle's home base of Sydney, people are prohibited from getting together regardless of whether they're masked and vaccinated.

"A few businesses we've been looking at have been very positively impacted by the lockdowns and the pandemic. The challenge we're facing is meeting people face-to-face – that's not been possible with the opportunities coming to us," says Marcus Lim, a managing director at Axle. "There are plenty of investors who don't need to do that, but for me personally, I certainly find it very difficult to go 50% or 60% alongside the founders of a business without having gotten to know my partners."

For those comfortable with video-based relationships, several due diligence roadblocks remain, especially in terms of pricing assets based on expectations of a post-lockdown surge in business. As a result, big auctions are out (a $1 billion process for grocer Harris Farm Markets notwithstanding) and exhaustive debates about theoretical operating metrics between small groups of buyers and sellers are in.

David Willis, head of private equity at KPMG Australia, observes that while triangulating future earnings inputs has become more art than science, a record level of dry powder in the market – including domestic, Asian, and notional allocations from global funds – has helped maintain deal flow. The hottest areas include defensive technologies, healthcare, and B2B services, as well as climate and sustainability thematics.

Exits have arguably lagged investment somewhat, although the relative stagnation is less directly attributable to the macro environment. PE-backed IPOs have run cold as the market has digested everything from reporting irregularities at cosmetics retailer Adore Beauty to murmurs about insider trading at software provider Nuix. But strategic M&A has continued to tick along, albeit with some diligence-related difficulty.

"We've certainly seen a couple of deals where they've gone a long way down the path and a trade buyer has been spooked somewhat by lockdowns and said, ‘Let's put this on hold and come back when we get back to things being open again,'" Willis says.

"I would describe it as similar to 2011-2012, after the GFC [global financial crisis]. There weren't a lot of exits through IPOs, so you had to do a lot of work bilaterally. That's all part of the pricing challenge, but high-quality deals are pressing ahead."

What distress?

One of the most difficult wildcards in the idea of pent-up demand as a post-lockdown panacea is the China factor. Trade tensions between the two countries have made headlines in high-visibility categories such as wine, where political beefs have translated into tariffs of more than 200%. But by and large, Australian exports to China have continued to boom.

In terms of PE exposure, China tensions are mostly an indirect supply chain issue, but there could also be direct long-term impacts in sectors such education and tourism. Education in Australia is best analyzed as an export product, one which uniquely recycles money back into the selling country while benefiting from multiplier effects around accommodation and other services. Closed borders have hammered this space at the university level, which depends on overseas students, especially those from China.

Australia's expected reopening later this year will involve special dispensation for foreign students, but there is uncertainty about whether the program will recognize Chinese vaccines. BGH Capital is among the more exposed private equity investors in this area, having led an acquisition of higher education business Navitas for A$2.3 billion ($1.8 billion) in 2019.

"If you're in the right part of education and have the right response, it's a very positive story," says one investor with experience in the sector. "But if you're losing a significant portion of overseas students or if you're a university with huge fixed costs, you really have a hemorrhage on your hands – particularly if you have your own accommodation and you haven't put it into a different system."

Perhaps the most surprising aspect of the macro environment on Australia's deal market is the relative lack of distress opportunities. Credit and turnaround specialists contacted by AVCJ have described the current landscape as strangely yet understandably quiet, with sellers holding on for the promised rebound and traditional banks continuing to accommodate them.

For investors such as FC Capital, credit activities have therefore leaned disproportionately toward growth financing. This has been especially true in categories benefiting from government infrastructure spending such as mining and construction, as well as healthcare, renewables, and data centers.

In some cases, companies are experiencing some stress due to COVID-19, but they're seeking private credit to maximize their post-pandemic bump rather than to stay afloat. FC's transactions usually fall in a range of A$2-20 million, although there are plans to target a growing class of deals as big as $60 million via syndicates.

"There's no shortage of opportunities, and now we can see the end. Vaccination rates are fantastic. There's just an extra facet of the due diligence that you have to do – what are the likely timeframes of the economy opening up again," says Damian Speziali, an executive director at FC.

"We have a good view on when that's going to happen, so we can consider those opportunities. We have an additional lens of diligence around COVID-19 and the China trade situation, but we just continue to target businesses that are performing strongly."

Waiting to explode

Macro-influenced strategic pivots also dovetail into this area of deal flow. Corporates are less incentivized to generate cash through traditional carve-outs in Australia due to the ready availability of low-cost debt. However, pandemic and geopolitical conditions have created underperforming subsidiaries in attractive segments that cannot be separated from their parents without complex restructuring.

Turnaround investor Allegro Funds was a beneficiary of this theme in April, when it acquired the express delivery division of local logistics giant Toll Group. The private equity firm secured A$500 million in funding to complete the separation and drive a business transformation. The consolidated book value of the target company was A$820 million, even though operating revenue reached A$2.97 billion in the 12 months ended March 2020. The operating loss was A$100 million.

Underperformance was attributed to a general decline in Australia's economy and rising supply chain costs, offering a neat example of how the macro backdrop is creating both pain and promise in an apparently stable environment. Chester Moynihan, a managing partner at Allegro, like many investors, is quick to point out the anecdotal signs that shocks to the system remain on the horizon. As such, while opportunities abound, the idea of a post-pandemic economy may still be premature.

"We're not seeing a lot of deep distress right now, but waves are brewing that are going to hit us. The knock-on effects of the pandemic as government stimulus starts tailing off will ripple through, and the whole geopolitical situation with China as a massive trading partner is not healthy. Also, there is a chronic labor shortage that has gotten worse with closed borders and created wage pressure on businesses," Moynihan says.

"All these stresses have not filtered through that much yet, but they will going forward."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.