Australia private wealth: Choosing channels

The swelling bank balances of Australia’s high net worth individuals and family offices are an attractive target for private equity. Access is becoming increasingly formalized across the spectrum

Australia is, by one measure, the richest country in the world. Median wealth per adult is $238,070, according to Credit Suisse's 2021 global wealth report. Even in terms of mean rather than median – median favors markets with lower levels of wealth inequality – Australia still ranks fourth globally.

The number of millionaires resident in the country totaled 1.8 million in 2020, trailing only China and Japan in Asia Pacific. By 2025, there are expected to be more than three million. While there's no question that private equity firms are trying to tap into this growth, it is unclear how best to access Australia's affluent and to structure their exposure.

"Global GPs and allocators have realized that private wealth is an important part of the market. If they are targeting family offices or individuals that can tolerate minimum commitment requirements, that's fine," says Martin Randall, head of alternatives at Crestone Wealth Management.

"But if you've got a wealthy client with $20 million in investable assets, a GP can't approach them, even with a minimum commitment as low as $1 million. That's just too much exposure to an individual GP if the client is running a diversified portfolio."

Crestone is among the beneficiaries of the rise of the mass affluent. Formed in 2015 through a spinout from UBS, the firm has grown from A$250 million ($184 million) to A$2.5 billion in assets under advisory for high net worth individual (HNWI) clients. Approximately 11% of these assets are in alternatives – private markets, unlisted real assets, and hedge funds – against a target of 20%.

It and fellow insurgents like Koda Capital and Escala Partners are battling for market share with incumbents such as Morgan Stanley, JBWere, and Macquarie. Online platforms such as iPartners and iCapital Network also form part of the landscape, as competitors or service providers to local wealth managers. Much depends on how one slices and dices a market that varies considerably in terms of the size, sophistication, and needs of end-user clients.

Nevertheless, within the wholesale investor segment – where target customers must have at least A$2.5 million in net assets – the broad distinction, between larger family offices that go into funds directly and HNWIs that do not, rings true. And, historically, the latter have been underserved when it comes to accessing private equity.

"Australia is a bit behind the rest of the world, but the market is evolving quickly. Some clients are larger than the smallest superannuation funds and running institutional-style portfolios," says Phil Cummins, a venture partner at Greenspring Associates, which advises institutional LPs on VC exposure. "With self-managed super and personal savings, it's going to be a A$1 trillion opportunity."

Pain points

Minimum commitment levels are one of several obstacles when bringing HNWIs into products structured for institutional players. Ensuring investors are comfortable with the illiquidity that comes with a closed-end fund and helping them manage capital calls are among the most pressing.

Capital calls have been an industry pain point for years, specifically the need to draw down the full commitment upfront, which creates a massive cash drag. Under a typical incremental drawdown structure, no more than 70% of a commitment would be called at any one time because distributions normally begin to trickle in before the end of the investment period.

"It is cash drag on cash drag, which leads to diminished returns based on what you might otherwise get on the underlying," says one advisor, who previously addressed the problem. "We tried a three-tranche structure, with the second called when the first was 70% drawn. Sometimes, we obtained leverage, didn't have to call from the client, and could mimic the return profile of the underlying."

Australia is said to be moving towards more progressive structures. Wealth management platforms generally need an allocation of at least A$50 million to justify the administration and custodian costs of establishing a feeder vehicle that aggregates HNWIs under a single fund commitment. Randall says Crestone is now able to break down capital calls into 20% chunks.

Three years ago, the firm went a step further by establishing a A$100 million separate account with Roc Partners, a local fund-of-funds, to target Australia's middle market. Requirements included staggering capital calls over a set timeline, reducing the minimum commitment size to A$100,000, and deploying half the corpus in secondaries and co-investments to minimize the j-curve effect.

A portion of capital was called upfront, so the cash drag wasn't eliminated, but Crestone maintains that it has given clients exposure to a set of managers and assets that would have otherwise been beyond reach. A second iteration is expected to launch later this year. A similar structure was established with Brookfield Asset Management for real assets.

Horses for courses

The net worth of Crestone clients ranges from A$2 million to A$1 billion, with an average of A$8 million. Koda typically starts at A$5 million, reasoning this is the minimum required for a diversified portfolio. Not all clients, therefore, are suited to fund feeders or separate accounts. While there are smaller local fund-of-funds that cater to HNWIs, open-ended structures are increasingly popular.

Partners Group made the key breakthrough in 2011 with the launch of an Australia feeder for its Global Value Fund, which is invested across direct deals, primary fund commitments, and secondaries. It is semi-liquid, accommodating monthly applications and redemptions through a 20% allocation to liquid assets. This creates a drag on returns, but the advisor argues that a net return of 11-14% compares favorably with 17-20% on a closed-end fund, given the monthly dealing dates.

There is always the risk of liquidity not being available when investors need it the most – Partners Group can gate redemptions if insufficient liquidity is available – but this hasn't stopped a rush of similar products. Hamilton Lane launched an Australia feeder for its Global Private Assets Fund in 2019, followed more recently by similar offerings from Schroder Adveq and LGT Capital Partners.

Crestone is invested in Partners Group and seeded Hamilton Lane's vehicle. Koda uses Partners Group as its core private equity offering and then creates feeders to access specialist strategies.

"We want each strategy to deliver a unique risk profile in the context of the overall client portfolio. Partners Group gives overarching exposure that covers all the risk and diversification areas, so beyond that we are looking at niche areas like healthcare rather than multi-billion-dollar raises," says Paul Heath, founding partner and CEO of Koda.

"The best PE funds aren't domiciled here, so we must look globally, often at funds that primarily focus on institutional mandates. We spend some time knocking on doors asking to be let in."

Wealth management platforms use off-the-shelf products where they are applicable. Randall of Crestone believes semi-liquid funds will remain the go-to core offering because they deliver a combination of diversity and cost-efficiency to clients that cannot achieve the same by going direct. In addition, growth in global secondaries has facilitated more liquidity options for these funds.

"Previously, we never had funds that were in PDS [product disclosure statement] format that you could apply into with A$25,000 lots," he says. "If you can make the case for public equities, you should be able to make the case for private equity as a longstanding outperformer. The problem for things like self-managed super is they haven't been able to access it."

Solo operators

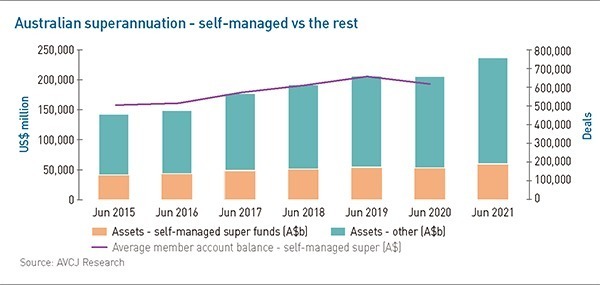

Self-managed super funds exist within an outside the HNWI community – they are vehicles through which investors might access private equity, alongside trust and corporate structures. There is more money in self-managed super funds than in retail super funds in Australia, the pool having grown from A$569 billion in 2015 to A$822 billion as of June. The average account balance was $637,000.

"A lot of these people have 5-10 blue chip Australian stocks and then property, they will buy a house as part of the super," says David Chan, a private equity portfolio manager at MLC, which has some self-managed super accounts come into its comingled superannuation funds.

"Private equity doesn't factor much into their thinking, although it's probably an underserved segment. It's also harder to market to. Most HNWIs have a financial advisor, but that upper tier of income earners using self-managed super do not. They just have an accountant, go to an online broker, and buy shares direct. There isn't much room in that equation to pitch other services."

Some investors opt for self-managed super because they want to avoid traditional fee-driven asset management space. As Ken Licence, a managing director at placement agent Principle Advisory Services, puts it: every self-managed super fund wants to be treated as an individual, but every aggregator wants to treat self-managed super funds with commonality and simplicity.

Pushing down costs by launching technology-enabled wrap platforms and broadening product choice within investment programs is one solution, but the watershed moment has yet to arrive. As it stands, a portion of self-managed super money – no one is quite sure how much – filters into private equity through existing wealth management channels and other aggregators, or just by chance.

"Self-managed super is a huge opportunity because it's vastly under-allocated to private equity," says Marcus Lim, a managing director at Axle Equity Partners. "We see some of that money, but you are effectively targeting an individual and they are using a self-managed super account to come in."

Family matters

Axle is part of a vanguard of deal-by-deal operators in the lower to middle reaches of Australian PE. They are supported by family offices and HNWIs, chiefly groups that eschew blind pool funds in favor of investing directly. Lim has spoken to wealth management platforms about investments, but there was deadlock on due diligence requirements and fees. More progress has been made with outsourced CIO groups that represent several family offices and bring them into deals.

The likes of Armitage Advisors and Proserpine Capital Partners have tweaked the deal-by-deal model, raising committed capital from individual groups so they have the resources to pursue opportunities. This capital covers some of the equity and they rely on family office networks for the rest. But Damian Berry, a director at Proserpine, notes that family offices are difficult to deal with "because they are experts in everything."

It is one of a number of observations from across the industry that capture the fragmented and informal nature of these networks. Cold calling is pointless, and even when introductions do open doors, they might be quickly closed because of differences over strategy or the level of involvement the family office seeks at the portfolio company level.

That said, once relationships are established, they tend to be sticky. "They say, ‘We trust you, you've done well for us in the past, we will back you to find opportunities.' It's like a blind pool approach even though it's not a fund," Lim explains.

The likes of Mercury Capital and Five V Capital have won support for blind pool funds from HNWI channels on this basis. Mercury has introduced institutional LPs over time, but Five V continues to rely on private wealth. GPs with deep enough networks can raise capital quickly and with minimal due diligence. Some Five V investors commit without even opening the data room, such is their faith in the manager, according to one source familiar with the situation.

Just as MLC's Chan argues that self-managed super participation in private equity won't become meaningful until more account holders appreciate the basics of portfolio management, family offices that go direct must institutionalize to complete the journey from informal to formal engagement. Licence of Principle Advisory believes this is already happening, albeit gradually.

"Most family offices have done a lot of direct investing and a certain amount of money has been lost. With that comes a realization that you can make money out of funds by getting into areas you previously couldn't access and getting the right level of exposure," he says. "Family offices are building up teams and experience, recruiting from consulting groups and asset allocators. As a result, they are getting more exposure to funds."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.