China take-privates: Holding pattern

Pressure is mounting on Chinese companies listed in New York, from domestic and US regulators. Is another wave of PE-backed take-privates imminent?

In the turbulent weeks following its IPO at the end of June, as its stock traded at a more than 40% discount to the offering price, ride hailing giant Didi considered returning to private ownership.

The Chinese company had pressed ahead with plans for a US listing even as regulators called for patience. Two days after Didi's debut, the Cyberspace Administration of China (CAC) blocked new user registrations and downloads, saying the company had violated rules on data collection. Within a week, Didi's market capitalization was at or just below its peak valuation as a private business.

Didi denied reports that a take-private was discussed as a means of appeasing regulators and compensating investors, but two sources familiar with the situation claim the option was on the table. "In the end, it was determined that the investors would probably sue everyone involved, and nobody wanted to inherit a lawsuit or many lawsuits," one source explains.

Based on its current market capitalization of around $43 billion, a Didi take-private would be more than four times the size of any similar deal involving a US-listed Chinese company and willing private equity backers. But businesses big and small are said to be having these conversations as they feel squeezed on both sides of the Pacific.

US regulators are threatening to kick them off the New York bourses if they don't comply with accounting rules that are rejected by Chinese regulators. Meanwhile, Beijing has developed multiple agendas for reining in big tech, including a requirement that companies collecting large amounts of consumer data must obtain approval to list overseas.

"In a lot of boardrooms, they are discussing whether they should consider take-private transactions as a contingency plan. It might be in the best interests of shareholders to be cashed out rather than have deal with all the uncertainty and potential losses," says James Lu, a partner at law firm Cooley. "If they aren't having this discussion, they might be failing in their duties as board members."

Moving from theoretical discussion to practical application is far from straightforward, he adds. Before running a watertight process that minimizes the scope for legal challenges to US take-privates by minority shareholders and securing cross-border debt financing, private equity support is often required to bankroll the transaction. Investors are generally unwilling to talk publicly, citing live situations or sensitivities around regulations, but they agree it pays to be selective.

"Just because you want to delist, that doesn't mean you can. Most companies cannot," one fund manager, who has worked on a US take-private in the past 12 months, observes. "The universe is not as big as people think. To find a buyer that wants to work with you, the stock price must be right, the cash flow must be right, and they have to like your business."

History lessons

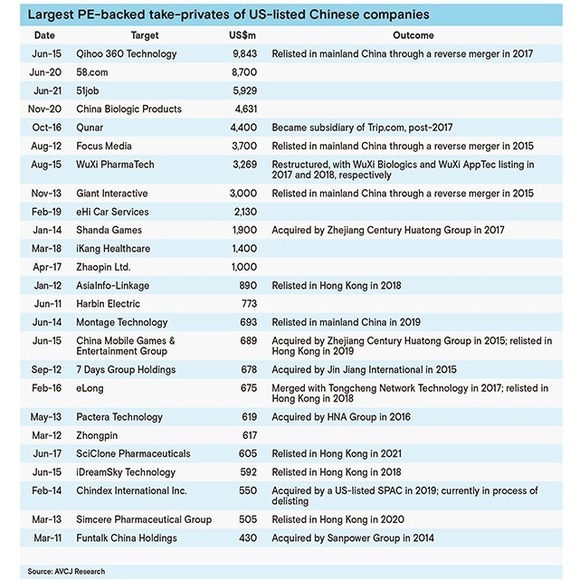

In the past decade, there have been two discernable waves of take-privates involving US-listed Chinese companies. The first came in the wake of a handful of accounting scandals that eroded valuations across the board. AVCJ Research has records of 20 processes launched by founders in conjunction with PE backers during 2012 and 2013, a threefold increase on the previous two years.

At least the same number again were announced and didn't complete or were completed without the assistance of private equity. In some cases, it is difficult to distinguish between genuine third-party PE players and investment vehicles established by founders and high-net-worth associates.

Activity slowed for a couple of years before rebounding in 2015, with 10 PE-backed deals announced and ultimately closing. This was driven by robust local markets, which accentuated the multiple arbitrage opportunity of relisting in the mainland or Hong Kong. Moreover, Focus Media showed this could be done at speed and scale, and by a slate of big-name investors. The company relisted in Shenzhen via a reverse merger 30 months after leaving the US.

Since the beginning of 2020, five PE-backed deals have been announced, and two have closed. Only three of the five are of significant size: online classifieds platform 58.com and biopharmaceuticals player China Biologic Products Holdings were taken private at valuations of $8.7 billion and $4.6 billion, respectively. A $5.7 billion deal for online recruitment platform 51job was agreed in June.

"There was a huge batch of companies that shouldn't have been public in the first place, and the last two waves cleared out a lot of those," says Paul Boltz, a partner at law firm Gibson Dunn, on why we have yet to see the makings of a third wave. "We are left with larger, better-known companies, and many of them are happy to give people peace of mind by doing a dual listing in Hong Kong."

Three categories

As of May, there were still 248 Chinese businesses listed on US exchanges, many relatively small in scale. Private equity investors divide them into three groups: the unachievable, the unwanted, and the potential targets. The latter is the smallest of the three.

Didi would typically be placed among the unachievable by virtue of its size. The same applies to the likes of Alibaba Group, Pinduoduo, JD.com, NetEase, Baidu, and perhaps a dozen or so others with market capitalizations above $15 billion. State-owned enterprises are completely off-limits.

It is not inconceivable that some of these independently held companies fall within range, given the amount of private equity dry powder in the market, the availability of debt financing, and the prospect of existing investors rolling over. SoftBank Vision Fund, for example, owns 20.1% of Didi. However, Cooley's Lu warns that any take-private with a substantial rollover and perceived price discount – Didi still trades 35% below its IPO price – could be fraught with legal risk.

"You would need to ensure the special committee of the board is fully independent and the process of seeking a market check is solid to avoid any subsequent litigation," he says. "It's almost guaranteed someone will sue you after a take private. If the price is a premium to market but below the IPO price, dissenting investors would say it could be higher. It's not hard to make an argument that the board didn't follow the correct process and investors have incurred damages."

Even then, Didi is arguably an anomaly among the technology players that make up most of the largest US-listed Chinese contingent. The CSI China Overseas China Internet Index is trading well below its February peak, but losses incurred over the past six weeks as regulators took aim at several companies regarding data privacy and the entire online education industry have largely been clawed back. The index is roughly where it was in May 2020.

The unwanted constitute companies that are fundamentally unattractive for governance or business model reasons – there are fears that education businesses, previously hot commodities, will be relegated to this category. Unprofitability can also be a turnoff because it means there is no cash flow to pay down debt used to finance the acquisition and perhaps a need to put in more capital if the company is burning cash. Investors must be confident in their ability to engineer a turnaround.

"Companies that aren't profitable on an EBITDA basis are not suitable for take-privates. The ones we've seen targeted, like 58.com and 51job, are more mature and have positive cash flow," the first fund manager asserts. "Companies that are high growth but losing money are for venture capital, not private equity. You don't need fast growth to generate returns from a take private."

This leaves category three. A second fund manager, pondering the relative scarcity of attractive targets, observes: "Mid-cap companies with attractive growth prospects are ideal for private equity, but there aren't many listed in the US. More are going public in China and Hong Kong nowadays."

That said, the lines between the categories can blur, depending on the prevailing valuations. Ultimately, there is a price at which the unwanted will find buyers and the unachievable might move into reach. One key factor is that US regulatory action, a long-time lingering threat, has yet to be properly implemented.

Slow to act

For years, Beijing has resisted attempts by the Public Company Accounting Oversight Board (PCAOB) to inspect audit documents for US-listed Chinese companies. At the end of last year, the Holding Foreign Companies Accountable Act (HFCAA) passed into law¬¬, giving the PCAOB more teeth – to the point that non-compliance could result in enforced delisting.

Specifically, the Securities & Exchange Commission (SEC) must draw up a list of foreign companies whose audited financial reports are prepared by accounting firms the PCAOB is unable to inspect. If inspection is blocked for three consecutive years, US-based trading of a company's securities will be prohibited. Companies must also disclose more information, such as foreign government ownership and the names of board members who are Chinese Community Party officials.

The list has yet to materialize; even a framework for identifying who should be on the list is unavailable. According to Boltz of Gibson Dunn, the timeline states that right now companies should be disclosing whether they have been included, but no one is doing anything. Rather, lawyers are telling companies calling up to ask if they are on the list that implementation could be years away.

"The three-year clock hasn't started yet, and there is some idea that we could see a compromise," says Marcia Ellis, a partner at law firm Morrison & Foerster. "Once the clock finally sets off, people will look at what is happening between the US and Chinese administrations, studying for any signals of a compromise – and they will jump in when they think it has reached the point of no return. It will be an interesting process to follow."

Alibaba led the way in late 2019 and it was followed by the likes of Baidu, JD.com, Bilibili, Trip.com, NetEase, Yum China, and ZTO Express. The post-Alibaba flood has slowed to a trickle because relatively few companies are eligible.

Once a secondary listing has been achieved, there is the possibility of shifting the location of primary listing and deregistering in the US – a process that involves inviting investors to migrate to Hong Kong rather than recruiting a private equity backer to help take out those holdings.

Deregistration in the US is conditional on having fewer than 300 shareholders in the US or having an average daily trading volume in the US that represents 5% or less of global trading volume. Hong Kong would treat an issuer as having a permanent dual primary listing if more than 55% of the worldwide trading volume by dollar value during the most recent financial year takes place on the local bourse.

"If the overwhelming amount of your trading volume is in a non-US market there is a very easy way to privatize, and you don't have to cash anyone out," says Boltz of Gibson Dunn. "It was designed for European companies that had dual listings in New York and Paris but the trading in New York was really small and they wanted to get out of the reporting system."

No US-listed Chinese company has made this transition. Alibaba and NetEase already have higher trading volumes in Hong Kong than in the US, but there is still a relatively large gap for most others.

There are various other circumstances under which a company may be delisted and deregistered in the US – typically because its number of shareholder or asset value falls below a certain level – without establishing a new primary listing. Lengthy compliance processes are tied to these actions. Otherwise, they must pursue take-private transactions, open-market purchases, or public tender offers, which require shareholder votes and fairness opinions on pricing.

Data dynamics

Several industry participants believe the US and China will resolve the audit issue, simply because there is so much money at stake for both sides. It is difficult at present, given tensions between the two countries encompass multiple issues and no one wants to be seen as giving up ground.

However, recent regulatory activity in China – and how it dovetails with the US agenda – has complicated matters. The government's stance on data privacy has yet to be fleshed out, leaving investors to fret that approval will be required not only for companies doing an initial share offering overseas, but any share offering. It would slow or sever a vital funding route for US-listed businesses.

"Right now, the CAC is focused on headline IPOs," says Cooley's Lu. "We don't really know how secondary issuance will be impacted. Could it be that every time you do a disclosure, you need regulatory approval in China?"

On one level, the PCAOB and data privacy issues are interrelated. Beijing's concern appears to be that, if the HFCAA makes it harder for Chinese companies to resist US regulatory scrutiny, this could effectively give an agency funded by a foreign government license to look beyond audit materials into sensitive consumer data. IPO approvals allow it to control who risks opening the kimono.

But based on current protocols, there is little chance of a PCAOB investigation getting into that level of detail. According to Ellis of Morrison & Foerster, this discrepancy underlines how China is thinking about data privacy on multiple fronts. In addition to a refusal to cede authority to US regulators, there are concerns that domestic companies could use data to create separate centers of power.

In this context, data privacy fits into the broader effort to bring big tech back into harness, alongside clampdowns on monopolistic or oligopolistic activity in multiple areas, curbing expansion into financial services, and restricting the use of data and algorithms to influence consumer choices.

The SEC responded to China's IPO approval measure by ramping up disclosure requirements for US-listed Chinese companies using variable interest entity (VIE) structures, which give overseas investors exposure to restricted sectors and form an integral part of most technology IPOs. "I look at this escalation and I wonder how often companies might be penalized for not doing something in the US because it would be considered a criminal offense in China," a third fund manager adds.

This scenario has yet to play out, but it could make the US a less attractive location even for companies that see logic in being listed there. It would, in turn, drive more take-private activity.

"It's been more opportunistic so far, but given the political headwinds in both directions, companies that can go private will strongly consider it," says Douglas Freeman, a partner at Goodwin Proctor. "For others, at least for now, it still makes sense to be in the US because of the analyst coverage or business model understanding. In healthcare, for example, there's no question that you get much better coverage in the US markets."

New challenges

Nevertheless, it would be unwise to assume that a new wave of take-private transactions will mirror its predecessors. Of the 35 largest PE-backed deals that have closed since 2010, four are less than three years old, four relisted in the mainland (three of them through reverse mergers), six relisted in Hong Kong, and nine were acquired. The rest are either current portfolio companies or unaccounted for, which could mean a quiet buyback by the founder.

Many of these deals were predicated on achieving a higher multiple on relisting closer to home – where companies have greater brand recognition and might be better understood by public market investors – than was available in the US. Now, not only is the arbitrage game less rewarding, but there is also less clarity that a relisting on the A-share market or in Hong Kong will be possible.

"It is so much more complicated because of the regulatory and policy pressure," says Morrison & Foerster's Ellis. "For a prudent PE fund, it must be a combination of trading multiples and being able to do something to make the company better, to make its profits higher."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.