Secondaries: Straight outta Asia

The growing secondaries opportunity in Asia is attracting more global capital, but managers with strategies dedicated to the region are few. This is changing, albeit gradually

Ion Pacific has already begun deployment of its third fund, investing in venture capital fund interests and direct positions in early to growth-stage start-ups across technology and life sciences. The vehicle, which is still in the market, is expected to exceed $100 million-plus – three times larger than Fund II. Yet Ion Pacific is already struggling to reconcile size with opportunity set.

"Every transaction we've done in the past 12 months has included co-investment because it was too big for the fund," says Michael Joseph, the firm's co-CEO. "Deal flow has picked up massively, and it's all predicated on the underlying asset class growing."

Ion Pacific pursues highly structured transactions – typically a form of preferred equity – where economic interests in funds and companies are reassigned, but the names on LP rosters and cap tables don't change. Coverage has also expanded beyond Asia. But ultimately, the firm's proposition is based on a simple premise: growth in Asia primaries leads to growth in Asia secondaries.

In Southeast Asia, for example, a geography of interest to Ion Pacific, VC managers raised $900 million between 2005 and 2009, and then $1.9 billion and $8.8 billion over the two subsequent five-year periods. While liquidity concerns are now being addressed via the capital markets, this is expected to drive more capital into the region, increasing potential secondary deal flow.

Local leaders

A similar story is playing out across the region. The primary market is getting deeper, and secondaries are increasingly recognized as a useful liquidity management tool. Managers with dedicated Asia secondary strategies are benefiting.

AB Value Capital is targeting $350 million for its latest vehicle, up from $100 million in the previous vintage. At $1 billion and $350 million, respectively, the most recent funds raised by NewQuest Capital Partners and TR Capital are roughly twice the size of their predecessors. Everyone claims to be seeing more deals and deploying capital faster than expected.

This has attracted some newcomers to the space: Foundation Private Equity, led by Jason Sambanju, formerly Asia co-head at Paul Capital, recently reached a first close on its debut fund; India-focused Stratford House Advisors and Japan's Bee Alternatives spun out from CDC Group and Ant Capital; and Singapore-based Aquilius Investment Partners is targeting secondaries as part of broader mandates.

Yet the regional incumbents are still relatively few, and Foundation is the only one with a fund currently in the market.

"It's hard at the best of times to set up a new manager," says Damian Jacobs, a partner at Kirkland & Ellis. "While secondaries is becoming more mainstream, it is still making that transition from a niche strategy. If you put that on top of being a start-up manager, on top of being an Asia-based manager, it's difficult to get something new going."

The most visible entrants recently have been at a global level, with several multi-strategy firms acquiring existing secondary platforms or announcing plans to build their own. This may have a knock-on effect in Asia above and beyond TPG Capital's purchase of NewQuest in terms of people moves within the region – and perhaps, ultimately, regional spinouts from global platforms.

Foundation's Sambanju ties it all together and describes Asia secondaries as moving from infancy into toddler years. "We're seeing more deal flow that justifies global firms having larger teams and we're starting to see a small cadre of local firms emerge," he says. "There will be more of this."

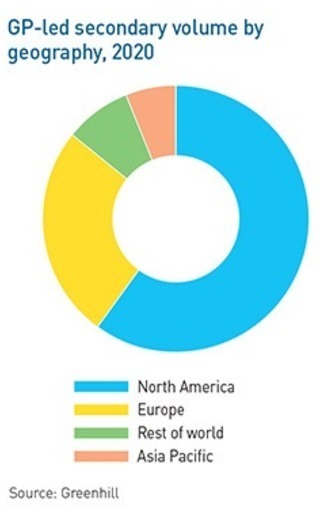

The Asia share of annual global secondaries volume shifts up and down, as the number of large-cap deals flits between zero and barely a handful. But an increasing number of investors are placing resources in the region, or more actively looking for opportunities, at all levels.

Lloyd Bradbury, a principal at advisory firm Greenhill, estimates there are about a dozen groups likely to be interested in leading mid-size transactions of sub-$75 million in Asia, with more open to participating as syndicate members. However, other advisors claim the market is undercapitalized. "There is more deal flow than there is money available to do the deals," one observes.

The first generation

The juxtaposition of views may reflect gaps in specific segments, geographies, or deal types. At the local level, this is a function of how markets have evolved. Each of the incumbents has a very different origin story.

Ant Capital came first, setting up in 2003 as a liquidity solution for investors at a time when Japan's VC industry was in difficulty. More than 70% of the early deal flow was direct. "It was hard because the Japanese like to buy and hold. They don't think the secondary market is important until they run into trouble and have to sell down," says Shunsa Hayashi, who was part of the original team.

Hayashi established a Taiwan subsidiary of Ant Capital in 2006 and bought it out 10 years later, renaming the business AB Value. The firm now has a broader geographic focus, and 80% of transactions in recent funds have involved LP positions in funds, half of those being GP-led deals.

TR emerged at the beginning of the global financial crisis and made its early running by picking up LP interests from highly motivated sellers. From 2014, the firm moved away from traditional secondaries – having decided the space was too commoditized and price-driven – towards more complex transactions involving fund restructuring and direct interests in companies.

NewQuest is a product of the crisis, formed in 2011 through a spinout of Bank of America Merrill Lynch's Asia private equity team and assets drawn from different parts of the bank. The team had been focused on primaries, but it developed a hybrid strategy – direct secondaries, and more recently, LP deals where there is extensive engagement with the manager – based on its experiences with the bank portfolio and a recognition these could be applied elsewhere in Asia.

"Unlike a traditional spinout, we were asked to manage a large portfolio of investments we did not make. We had no relationship with underlying management teams, no real knowledge of the assets, and typically zero transition time," recalls Darren Massara, a managing partner at NewQuest. "It was a challenging task, but ultimately it prepared us well for the early days of NewQuest."

Ion Pacific and Indies Capital Partners entered the space more recently, as expansions to existing credit or special situations strategies. Both got their first taste of secondaries almost by accident.

In 2015, Ion Pacific was approached by an Israeli VC looking to replace a Chinese LP that was unable to move money offshore. Three similar opportunities arrived in 2017, two of them involving Asia-based managers, convincing Joseph and co-founder Itamar Har-Even that there was scope to do more.

The partners at Indies used their own money to spin out a portfolio of early-stage Southeast Asia technology assets and did well on the deal. In 2018, they teamed up with Harold Ong, formerly of The Carlyle Group, to launch a VC-focused secondary strategy. Fund I closed at $73 million in 2019 and a successor vehicle reached a first close in July at 70% of its $80 million target.

Indies only takes direct positions in start-ups, typically facilitating partial exits for early investors by providing secondary capital as a component of a larger primary funding round. "I thought the market needed help with intermediate liquidity needs, but had I done this five years ago, there wouldn't have been anyone to buy from," says Ong. "The first generation of Southeast Asia VC funds are only now hitting year six, seven and eight, so LPs are asking about distributions."

Ion Pacific and Indies are unusual in the region for introducing secondaries as a complementary strategy. Though global private equity firms are now doing this, none of the large-cap Asia-based players have followed suit, even as some enter new verticals.

Devil in the detail

Asked why there haven't been more spinouts, NewQuest's Massara observes that such actions are driven by personal circumstances rather than market conditions. The better question, he contends, is why more primary firms in Asia haven't launched secondaries strategies.

"Perhaps they feel direct secondaries are within the mandates of their existing funds since they look and feel closer to ‘regular' private equity," he says. "But GP-led transactions and LP secondaries require a fundamentally different mindset."

In this context, it is worth noting that others have tried and failed to establish themselves. Two India-focused firms targeted secondaries after abandoning efforts to raise traditional blind pool PE funds. They reasoned that it might be easier to find the assets first and then approach LPs about funding, according to industry participants. There are similar examples in the renminbi space in China.

One aspect that might be underestimated by new entrants is the structural complexity that Asia-centric, and generally smaller, secondaries players have turned into their hallmark. Two advisors argue that some deals could be more accurately categorized as special situations, with higher levels of risk, more downside protection, and a much greater say over what the underlying manager can do – via strict governance rights – than typical secondaries buyers in developed markets would want.

As a structured credit investor turned secondaries investor, Joseph of Ion Pacific concurs with this assessment. While an LP stake transaction presents new challenges – the counterparty is a portfolio of assets rather than a company, so there is less control over management, leakage in the form of management fees and carried interest, and uncertainty regarding liquidity – it is familiar territory.

"In a structured credit deal, we are senior in the cap structure, we understand how everything works, and we understand how we can enforce our rights on the company," he says. "In a secondaries deal, we are creating a lookalike cap structure at the LP stake level. We must think about structuring from a tax perspective and a security perspective to get comfortable with the counterparty risk, but we are using the same lessons and instruments, just applying them in a different way."

Preferred equity is idiosyncratic and not for all investors. However, Foundation's Sambanju agrees with the notion of complexity.

"The sorts of deals we look at generally have more hair on them, for reasons around the portfolio or the GP, and we might do some special structuring to protect the downside," he says. "As a GP focused on mid-market deals, you accept that you often take more risk, and you need to manage that risk. If you price things correctly, you can be rewarded for taking risk."

Differentiated offerings

The market dynamics are changing. As secondaries become more widely accepted, higher quality GPs are launching competitive processes in which they are less likely to compromise on governance rights or structure. Activity in Asia is also increasingly intermediated – though not to the same extent as the US and Europe – leading prebaked fund continuation transactions that require less tinkering.

"That means it becomes more of a ‘yes or no,' rather than ‘let's work together for six months and see if something happens,'" says Bradbury of Greenhill. "When you have that yes or no, plus heavy syndication, it's like raising a new fund, but you know what the assets are and the GP can figure out a price that works. You need price discovery and other things to make LPs comfortable, but a lot of deals in Asia involve older assets, so there is more flexibility on price from the selling LPs."

Arjun Bawa, a partner at Fairview Capital Group, another advisory firm, adds that increased comfort with Asia-based GP-led transactions among global investors is reflected in a willingness to back managers that have little or no brand-name recognition outside the region. "People are willing to roll up their sleeves and do something different where they see higher return potential," he observes.

Nonetheless, other industry participants maintain there are lines that most global players will not cross. Smaller renminbi-to-US-dollar fund restructurings – which touch on various pain points around negotiating with less sophisticated investors, currency conversion, and governance – are often cited as an example. However, any strategy that involves addressing legal, regulatory, and cultural issues across multiple markets might also qualify.

"Our investment committee is independent and within the region. We don't have to reexplain certain characteristics of the China market to someone based in London or New York who makes decisions on this and other markets in Asia despite never operating in them," says Paul Robine, CEO of TR.

Robine has spent 14 years building what he believes is a high barrier to entry: a track record comprising more than 40 deals and a team of 25 working out of offices in Hong Kong, Shanghai, Shenzhen, and Mumbai. A presence in Hong Kong or Singapore is insufficient for sourcing and executing direct transactions or fund restructurings, and then playing an active role on the board in post-deal management, he argues.

Stratford House makes the same case from a single-country perspective. The firm is led by Alagappan Murugappan and Piyush Jhawar, who previously ran CDC's fund-of-funds program and established a $300 million private equity secondaries program for the country with Coller.

"We initially set up Stratford House as an advisory platform, providing services to LPs, and to some extent to GPs, that have assets in India. But the ultimate aim – and CDC encouraged us to do this as well – is to build a secondaries business focused on India, using our networks and experience having managed what is by far the largest LP portfolio in India," says Murugappan.

Slow spin?

Spinning out with a previous employer's blessing, and ongoing advisory relationships regarding certain assets, is rare in private equity. Indeed, it may have imbued Stratford House to move with a sense of conviction and speed some regard as counterintuitive in Asian secondaries.

Foundation is a spinout, but Sambanju contemplated going alone as early as 2014, just before Paul Capital shuttered its global operations and when the NewQuest deal – which he led – was still top of mind. He decided the market wasn't mature enough to support a full-fledged regional business.

When industry participants are invited to identify other potential spinouts in Asia, the same couple of names come up every time, followed quickly by an assertion that those individuals are unlikely to leave their current roles. There are two schools of thought: the pickings are slim because talent is relatively scarce in Asia; and secondary investors are more conservative than their primary peers, and therefore less inclined to set up their own shops.

TR is among those trying to address the talent issue. The firm created an academy five years ago that puts candidates – typically aged 25-30 and from a direct investment or consulting background – through a 24-month secondaries training program. Every year, four are retained as associates or vice presidents. There were over 1,800 applicants for the current intake, up from 50 first time around.

This feeds the ecosystem, but it will take time for talent to percolate. Similarly, global firms cannot establish or add to their on-the-ground expertise immediately, unless they absorb teams readymade.

Meanwhile, the opportunity set will continue to evolve, but more comprehensively and intractably. The first set of Asia-focused secondaries firms emerged by virtue of localized phenomena, indirect decision making, and happenstance. The next will have very different origin stories.

"It's more pan-Asian because it is more intermediary-driven, rather than organic and influenced by what is happening in each market. It is also the result of a top-down approach. People are flying in, seeing gaps in the market, and trying to invest in those gaps," says Sambanju, who brought in multi-strategy player Tikehau Capital as majority owner of Foundation and as an anchor investor in Fund I.

"Intermediaries move first, then you get global firms investing in secondaries platforms, which is much like what Tikehau did with us."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.