India IPOs: A pleasant surprise

The lack of a reliable IPO channel is a longstanding exit obstacle for venture capital investors in India. Domestic listings may, unexpectedly, prove to be the answer

Even as Paytm's valuation rose, LPs fretted about a lack of distributions. SAIF India – now known as Elevation Capital – was the digital payments provider's first institutional investor, participating in a round alongside Saama Capital in 2007. As of early 2018, the VC had built up a $1.3 billion position across three funds, while locking in realizations of $360 million, or 5x its invested cost.

But LPs wanted to see more, as several readily indicated to AVCJ over the next couple of years. They had witnessed Nexus Venture Partners resist calls to sell Snapdeal, only for the e-commerce platform to plunge in value. Saama, which made a timely exit from Snapdeal, sold its position in Paytm in 2017 at a reported valuation of $6 billion. SAIF was unwilling to let go of its winner completely.

Paytm secured $1 billion in Series G funding at a valuation of $16 billion in late 2019. Assuming this was the company's most recent private round, Elevation emerged with a 17.6% stake, trailing only Alibaba Group (partly via Ant Group) and SoftBank Vision Fund. And now it may have the last laugh, with Paytm set to raise INR166 billion ($2.2 billion) through a domestic IPO. Elevation is one of five investors that together will sell INR83 billion worth of shares.

Three Indian consumer internet businesses have announced plans to go public in the past three months: Paytm, fellow fintech player Mobikwik, and online food services platform Zomato. None are profitable, having subsidized their way to market-leading positions, but this didn't dampen enthusiasm for Zomato. The company has a market capitalization of INR1.1 trillion, more than three times the valuation of its last private round, following a listing last week.

Various others – Lenskart, PolicyBazaar, Delhivery, Ola, Flipkart, Nykaa – are expected to follow, making pre-IPO investors as trigger-happy as their IPO and secondary market-focused brethren.

Not everyone is willing to buy into the euphoria. When asked if Elevation was now vindicated, one LP that previously expressed frustration with the manager over Paytm, responds: "Way too early to say, but I certainly hope so." It reflects a general mood of restrained optimism in an institutional investor community that has spent years waiting for India's technology sector to deliver. Among the trickle of secondary sales and promise of US listings, domestic IPOs were not expected to be the answer.

"For a long time, it didn't seem plausible to list an unprofitable business on Indian stock exchanges – Indian equity markets historically have been very profit-focused," says Sunil Mishra, a partner at Adams Street Partners. "If there is an appetite today, that's a good thing for everyone, but is the market mature enough to understand these businesses which could remain unprofitable for several years? The growth and digital disruption they are valuing is pretty real. The question is whether it can be sustained."

Tipping point needed

Technology ecosystems follow similar patterns. Business models that worked in the US have been transplanted – with various tweaks – to China, and from there to India and Southeast Asia. Perhaps the same can be said of tipping points.

Since 2000, PE and VC investors have plowed about $280 billion into early and growth-stage technology deals in China. More than 90% of that capital was put to work from 2014, the year that financial sponsor-backed tech IPOs generated $28.9 billion. It amounted to roughly double what was raised in the previous 10 years combined, with Alibaba and JD.com the primary contributors. A steady stream of IPOs has continued, including $16.4 billion in the first seven months of 2021 alone.

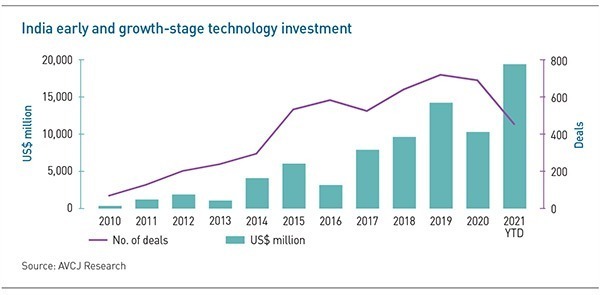

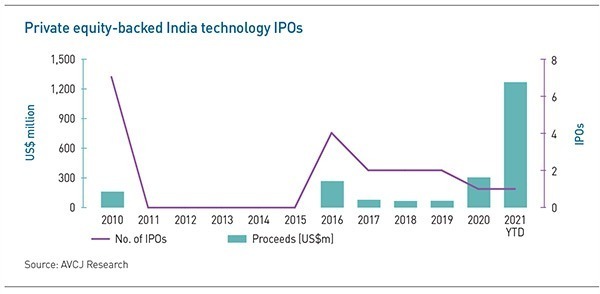

India's total is more modest. Approximately $83 billion has been invested over the past two decades, more than half of it from 2019 onwards. The $19.3 billion deployed in 2021 to date represents the closest India has come to China in percentage terms since 2002. The country has seen fewer than 50 private equity-backed tech IPOs over the same two decades – China has registered six times as many and raised 25 times as much. But maybe, finally, India is about to deliver.

For many investors, the key dates were 12-13 years ago, when the current batch of IPO candidates were founded. They aren't rushing to market and their cap tables have become bloated. Moreover, India now has 52 unicorns – 16 added since the start of 2021 – and the average time it takes to reach a $1 billion valuation has shrunk to seven years.

"There has been systematic pressure on Indian GPs to say when exits are going to materialize," says Karthik Reddy, co-founder of Blume Ventures. "You might get a hit here or there from a secondary sale, LPs ask when the next one is coming, and you have no idea how to predict it. Unless you put yourself on an IPO calendar, I don't think there is a definitive path to liquidity. For more than 10 years, the answer was that we were building towards exits, but no one had a plan."

Blume knows all too well that M&A is not a panacea for early-stage investors. An acquisition by a larger tech company usually delivers shares rather than cash, and a wait for someone else's IPO. Getting taken out when SoftBank or DST Global comes into a growth round is possible, but it might require a big check and founders often prioritize primary capital over facilitating secondary exits.

In 2015, ride-hailing giant Ola bought TaxiForSure, a smaller peer for $200 million, one-quarter of it in cash and the rest in stock. Blume, an investor in TaxiForSure, received some cash but then faced a long wait for further liquidity. Much the same happened with Runnr, a logistics business acquired by Zomato in 2017 through an all-stock deal.

If something had to give, it wasn't going to be IPOs in the US. Travel start-up MakeMyTrip became a lodestar for every ambitious technology company when it listed on NASDAQ in 2010, based on an assumption that nowhere else had the same understanding of business models or offered comparable valuations. Years of regulatory uncertainty ensued as to when and how an India-domiciled company could follow suit.

"Earlier this year, the government was supposed to permit Indian companies to list directly in the US and many are waiting for that regulation to take shape," says Sandip Khetan, a partner at EY. "But in the meantime, they have realized that the Indian market has become more mature in understanding and rewarding technology businesses."

In from the cold

India's growing blessing of unicorns in software-as-a-service (SaaS) are still expected to target the US: they tend to be domiciled in the US, have many clients in the US, and generate US dollar-denominated revenue. But a consumer internet company is in the opposite position: its brand, customers, and revenue are rooted in India. There is a logic to listing domestically – and regulators have taken steps to make doing that easier.

"Change has come in three main categories: they allowed differential voting rights on founder shares; they eased rules for minimum dilution and application size for retail investors; and most importantly, they have become more accommodating on profitability track record requirements, leaving it up to the market to decide whether a loss-making company is worth backing," says Pranav Pai, founding partner and CIO at 3one4 Capital.

"All this has reduced friction for the growth-stage investors in India's tech ecosystem, allowing them to accelerate their paths to IPO."

The Innovator Growth Platform (IGP) – previously known as the Institutional Trading Platform – was established as a home for VC-backed companies and sophisticated investors. Earlier this year, the Securities & Exchange Board of India (SEBI) made it more accessible for start-ups and smoothed the path for those looking to transition to the mainboard.

But the new batch of tech IPOs is going straight to the mainboard. There is a requirement that three-quarters of an offering made by an unprofitable company goes to qualified institutional buyers (QIBs) deemed sophisticated enough to understand the risks. Of the remainder, 15% is allocated to high net worth individuals (HNWIs) and 10% to retail investors. For businesses with three years of profitability – the standard threshold – the split is 50-15-35.

At INR93.7 billion, the Zomato IPO was India's fifth-largest PE-backed offering. The retail portion was 7.5 times oversubscribed, but this pales in comparison to the other two tranches, with HNWIs and QIBs oversubscribed 33 times and 52 times, respectively. This was chiefly because 60% of the QIB pot – or INR41.9 billion – went to 186 anchor investors, including GIC, Abu Dhabi Investment Authority, Canada Pension Plan Investment Board, and a string of domestic mutual funds and insurers.

It fits a broader pattern of institutional acceptance. According to Reddy, investment banks are holding demo days for Indian technology companies that are unicorns or on the cusp of that status every three or four months. This is a response to demand from investors that recognize that the value of these businesses, might have some exposure to them in overseas markets, and want to know why they can't get the same domestically. Meanwhile, the start-ups are better prepared.

"It's not like flicking a switch and your CFO who has done Series A, B and C raises becomes a public company CFO. You spend years prepping for an IPO, making the right hires," Reddy adds. "India doesn't have a history of loss-making companies going public, so you have to sell the narrative, the path to profitability. Ringing the bell is just the beginning of the journey."

Confluence of events

COVID-19 has played a role as well. India's strong consumer technology fundamentals are no secret: the internet economy is expected to more than double in size to $180 billion by 2025, spurred by high mobile internet penetration (it is higher than household electricity penetration), relatively low-cost data, and rapid growth in app usage across all categories. But the pandemic reinforced the opportunity set, with the IPO candidates emerging even stronger.

These companies were being primed for listings at the tail-end of 2019. However, multiple industry participants suggest that Zomato wouldn't have been as well-received had it tested the market before COVID-19, which saw business contract and then rapidly rebound with better unit economics. The low-interest environment is also a factor, driving capital into higher risk, higher return assets.

The combination of companies in need of liquidity events, domestic regulators becoming more willing to accommodate them, rising interest from institutional investors, and COVID-19 fueled fundamentals has created a series of knock-on effects. Notably, institutional vindication of these business models has encouraged participation from HNWIs and retail investors.

"By the time Zomato's retail placement started, it was clear the institutional portion was oversubscribed, and that gave confidence to retail investors," says Rahul Chandra, a partner at Arkam Ventures. "When I talk to HNWIs in India, they want to buy a piece of a late-stage tech company. This will be accelerated by the Zomato oversubscription because people recognize that targeting the IPO means they are going in too late. They will look for pre-IPO entry points."

It is classic momentum-driven activity. Investor fervor spreads from the IPO anchor allocation to the IPO itself, into the secondary market – Zomato is still trading at an 82% premium to its IPO price – and then back into the later-stage private rounds. Various domestic financial services companies have launched pre-IPO funds under their wealth management units, including IIFL Holdings, Axis Bank, Kotak Mahindra Bank, HDFC Bank, and Edelweiss Group.

Earlier this month, Kotak Investment Advisors achieved a first close of INR13.9 billion on its pre-IPO vehicle, surpassing the initial target of INR10 billion in three months. It will focus on technology-enabled companies on track to go public within two years. Most of the commitments came from HNWIs, ultra HNWIs (UHNWIs), and family offices.

"It's been very progressive in terms of demand. Three years ago, it was only family offices that had their own teams or a sophisticated way of investing. More recently – in the last 18 months – demand has moved to the HNWI and mass affluent segments," explains Srikanth Subramanian, the firm's CEO for private wealth investment advisory.

"There has been a turning point in India's stock market with the recent listing of some of these tech-enabled firms, and it will manifest itself in interest from a wider base of investors."

Within the family office community, this growing interest in technology has been accompanied by a more structured approach to investment. High net worth families are recruiting internal teams or establishing formalized outsourcing arrangements with multi-family offices rather than trying to play the market by ear. Meanwhile, start-up founders see the value in having them in the cap table – as a source of long-term capital and an advisor with industry networks and domain expertise.

"In 2014, when I started my family office journey, we found out about deals from people with the funds and investment banks. Now the idea of the family office as a serious capital provider has gained momentum, and most family offices are making clear allocations to private markets," says Munish Randev, founder and CEO of Cervin Family Office. "Before, it was arbitrary."

Like many industry participants, Randev reserves judgment as to whether more consistent family office participation can help sustain the current excitement around pre-IPO rounds and IPOs.

A sustainable trend?

More than 60% of the capital deployed in India's tech sector this year has gone into growth deals – a consequence of investors believing there is a clear line of sight to a liquidity event. But is this faith well-founded? The public markets may quickly lose patience with companies if their losses deepen in the near term; smaller tech IPOs might fail to find favor with brand-conscious retail investors; or a challenging macro event could force global institutional players to retreat to their home markets.

Some investors express concerns about unhealthy knock-on effects further down the chain as founders seek higher early-stage valuations based on public market signals. "If you raise a seed round at $50 million, the pressure to keep going – for revenue to catch up and the multiples to make sense – is always going to be against you," says 3one4's Pai. "We have to stay long-term focused and account for cycles but adapt when there is IPO fever."

Valuation inflation is already happening to some extent. Chandra of Arkam notes that Series A rounds for in-demand start-ups have risen from $10 million to $20 million, with an increase of similar magnitude happening at the Series B. He blames it on later-stage investors pushing into earlier rounds in search of value, more than anything else. This is bearable, at least for now, provided start-ups still have compelling business models and strong founders.

Bigger tickets mean larger venture capital funds and there is evidence of managers revising their targets upwards. Some are launching dedicated growth-stage strategies or raising top-up funds that will participate in follow-on rounds for existing portfolio companies and make new investments in late-stage and pre-IPO rounds. Orios Venture Partners closed a $30 million top-up vehicle last month.

"It was important for us to have an enabling environment to know that the pre-IPO opportunity in 2021 was not a one-off," says Anup Jain, a managing partner at Orios, who estimates that $1.5 billion has been raised for India pre-IPO funds over the past nine months.

"With the IGP and more public market-like transparency in the supply of capital, we're seeing a shift in mindset across government, companies, HNWIs, retail investors and institutions – all the participants in the stock market. That augurs well for the system and shows it's here to stay, and that's why we jumped in as fund managers."

If the domestic technology IPO phenomenon is indeed here to stay then it will be transformative for India venture capital exits, more so than Walmart's $16 billion acquisition of a majority stake in Flipkart in 2018. There is even the prospect of LPs calling up managers that – unlike Elevation with Paytm – sold in full via a secondary transaction and telling them they exited too early.

3one4 made an early decision to hold on to its top performers, and it remains the second or third-largest shareholder in the likes of digital bank Jupiter and fresh meat delivery platform Licious. Pai suggests that the rise of IPOs will prompt managers to alter their thinking on the merits of early liquidity and change how they align exit schedules.

Mishra of Adams Street takes a more conciliatory line, noting that investors do not control the liquidity window in an illiquid asset class. "When opportunities arise, you should weigh your options carefully. Indian venture capital has typically been low on liquidity given fewer exit avenues, so if you can deliver liquidity no one will really complain. LPs are more critical of downside than missing some upside surprises."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.