Asia fundraising: Fortune favors the bold?

LPs cannot survive indefinitely on re-ups and new commitments to managers they know well. Questions are being asked internally as to what it would take to back an Asian GP sight unseen

Axiom Asia opened its Shanghai office in the fourth quarter of 2020, in time for the resurgence in Chinese private equity and venture capital activity. While a permanent mainland presence had long been on the agenda, the pan-regional fund-of-funds accelerated its schedule because of COVID-19.

"We have offices in Taiwan and Singapore, so before the travel restrictions, we were flying in all the time. We had staff in China every week of the year," says Edmond Ng, a managing partner at the firm. "With COVID, we felt it was important to have a local presence. As soon as the pandemic spread to Europe and the US, we guessed it would be two years before normal travel routines returned."

The expansion was timely not only because it roughly coincided with the beginning of Axiom's busiest-ever six months, with plenty to do across primary fund commitments, secondaries, and co-investments. It also came a few weeks after the firm closed its sixth fund at $1.8 billion.

The fundraising process took seven months, nearly twice as fast as the previous vintage. Ng is reluctant to correlate speed with the impact of COVID-19; no LP said explicitly that they were putting more money with fund-of-funds because travel restrictions meant they were unwilling or unable to back new GPs they've never met. Other industry participants are blunter in their assessments.

"The fund-of-funds model is dead, long live the fund-of-funds – that's very much what is happening in this environment," says Niklas Amundsson, a partner at placement agent Monument Group, who has worked on an Asia fund-of-funds in the past year. "LPs that have hard requirements about face-to-face meetings may recognize the value of the fund-of-funds model."

These sentiments are endorsed by another fund-of-funds LP currently raising its latest Asia vehicle. Demand already far outstrips supply, which means the final corpus is likely to be 75% larger than the original target. "COVID-19 has made it easier to fundraise," the LP says. "The key is local connectivity and having offices across the region. Without it, I don't know how we would function."

The persistence of this phenomenon rests on broader considerations about business travel. An LP that hands over its entire Asia allocation to a fund-of-funds may go back to an even split between fund-of-funds and direct commitments next time as physical meetings resume. Alternatively, investors will have to adapt to a new normal, which will involve answering tough questions about their desire for Asian exposure, backing managers sight unseen, and relying on third parties.

Comfort zones

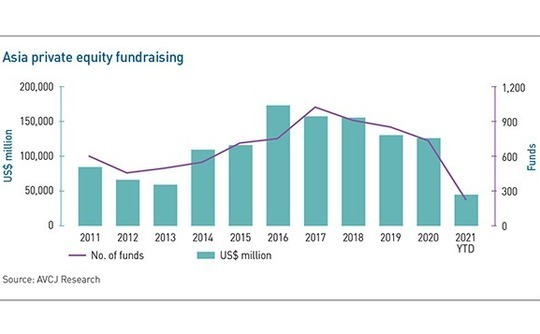

Most groups have yet to reach this point of reckoning. Asia fundraising has recovered from a low point in the first quarter of 2020, when there was uncertainty as to how protracted and far-reaching the economic impact of COVID-19 would be, but the market remains highly polarized. Capital is gravitating towards familiar names – approximately 220 PE and VC firms achieved partial or final closes in the first half of 2021, less than half the total for the same period in 2019.

Replenishing the reserves of brand names and perceived elite local performers that – in certain strategies – are deploying rapidly and generating distributions is keeping LPs busy.

Moreover, nearly 60% of respondents in Coller Capital's most recent private equity industry barometer survey said they have seen no let-up in the pace at which they add managers since the onset of the pandemic and 45% expect to accelerate these new commitments over the next 18 months. But what happens when the pipeline of managers they've been tracking is exhausted and there is a need for new capacity in the middle market, beyond the global brand names?

"Re-ups continue to be the focus. When those run out – and we will start to see that more in the second half of this year – they consider new relationships. Last year, new relationships were with the mega-funds. It's about risk mitigation. They have more understanding and familiarity with these guys. This year, LPs are getting back to being more open-minded for new relationships," says Thomas Yu, head of Asia at placement agent Eaton Partners.

"Even in a normal year, most of our capital goes to existing managers," says a portfolio manager with a US pension plan, which has deployed $1.2 per annum in private equity over the past five years. "We have added a few new names during the pandemic. All those names are managers we have met before or have been tracking for a while. We would be comfortable adding managers we have only met via Zoom, but we haven't needed to do that so far."

Sam Robinson, a managing partner at North East Private Equity Asia, part of a Europe-headquartered family office that has around 20 GP relationships in Asia, has reached the point where a lack of physical interaction is an obstacle. Re-ups and new additions to the pipeline – it takes about three years to get to the front of the queue – are not a concern. Rather, borderline decisions on managers that are already under consideration are most heavily influenced by the pandemic.

"In the last six months or so, I've started saying no to some managers I might have gone with had it not been for COVID," Robinson explains. "If we had another two years, or we had three or four meetings over the last 18 months, we could have got there. But I don't want to waste people's time."

North East has yet to back a manager the team hasn't met in person, and Robinson is wary about the prospect of doing so. It hints at broader skepticism within the industry as to how easily LPs can make the transition to purely virtual – especially those that are based outside of Asia and have access to managers of longer standing, and perhaps equal or better performance, closer to home.

"While new commitments happen, with no previous interaction between GP and LP, there is a visibly higher bar," one placement agent observes. "Less well-known managers face a double hurdle. First, the number of LPs looking at new relationships has reduced. Second, even if GPs are prepared to travel, we haven't seen much evidence of LPs being willing or able to take meetings in person."

Crossing the Rubicon

Certain LPs have demonstrated an ability to get comfortable with remote diligence in situations where gaining exposure to a strategy fulfilled longer-term strategic goals. Only two mainstream strategies within Asian private equity attracted more capital in 2020 than they did a year earlier – Japan buyout and US dollar-denominated China venture capital. In each case, there are examples of investors backing managers they had previously never met.

Last year, a local advisor told AVCJ that he had provided counsel to the Harvard endowment on opportunities in Japan's middle market. Harvard ended up participating in T Capital Partners' sixth fund, which launched in February 2020 and closed at the hard cap of JPY81 billion ($773 million) in January. This was the first commitment the endowment had made to a GP globally without first meeting with the team in person, according to a source close to the situation.

T Capital broke new ground with Fund VI by bringing in international investors, which account for 40% of the corpus. It helped that the team spun out from local insurer Tokio Marine in 2019, which meant bans on backing captive GPs no longer applied. But it was difficult for these LPs to get over the line because there were no existing foreign peers to act as reference points or lay the ground for others by making early re-ups. Japanese investors are often reluctant to step up, the source adds.

Instead, lines of dialogue were established between the prospective LPs – only a handful went in sight unseen, others had previously met the team – and the group self-reinforced.

Amundsson at Monument is in a similar position with a China venture capital mandate. The manager was previously a captive and has never even reached out to third-party investors before. Beyond hearing the managing partner speak at a conference, engagement has been minimal; no one has seen the track record or had any access to the second layer of the investment team. Yet there is interest from the institutional investor community.

"They are doing reference calls as they would do for anything else – with other LPs, former employees, portfolio companies, the corporate parent," Amundsson says. "The investors are not circumventing their own processes or looking for shortcuts. They want to commit, so they are trying hard to commit. They are having to bend over backward and adapt, but they are doing it."

It isn't necessarily difficult to find pools of unsated demand for China VC; what's lacking is capacity among top-tier managers. Last year, $9.6 billion was spread across fewer than 20 funds, while roughly the same amount went to more than 30 managers in 2018. Six months into 2021, $5.6 billion has been committed to about a dozen GPs. Accessing the top managers is increasingly difficult, hence the willingness to adapt due diligence to a virtual world.

One US-based insurance firm has made new commitments to two Asia venture capital funds in the past year, relying almost entirely on virtual due diligence. In one instance, it had previously met the manager casually, without performing due diligence. In the other, there was no previous contact. The opportunity came through an introduction by another LP.

"We have been talking for three years about wanting to get into top VC funds in Asia. We've built the concept; we've talked to the board. The decision that we were going to do it, even though we would have to do it virtually, was driven by the fact that it is a strategic area we want to get into," says the insurance firm's head of private equity.

Ancillary support

In addition to the standard reference calls, the LP relied on input from a fund-of-funds that has been operating in Asia for two decades and maintains an office in the region.

The Dietrich Foundation, which has substantial VC and growth equity exposure in the region, also uses local fund-of-funds to supplement its diligence work done in-house. The LP normally adds a handful of new relationships every year and has backed two managers where there was no prior in-person contact and due diligence was entirely virtual. One of these managers is China-based.

"When we see an exciting opportunity and feel like we can't completely wrap our arms around it without some ancillary diligence support, we look to our fund-of-funds partners. Our commitment to the China GP we've never met was anchored in the deep conviction our fund-of-funds had in the firm's founders," says Edward J. Grefenstette, the foundation's president and CIO. "We did what work we could do remotely, but we couldn't have gotten across the line without their insight."

Some managers are already preparing the ground for future virtual fundraising processes. Ocean Link, a China-focused PE firm, closed its second fund at $580 million in January after securing a nine-month extension because new LPs were gun-shy in the first half of 2020. While every investor had previously met the team, some did the bulk of their work virtually – and a few more were unable to come in because they couldn't get comfortable signing off without a final face-to-face meeting.

Tony Jiang, a partner at Ocean Link, is mindful of these dynamics as he considers Fund II, which is likely to launch in 2022. As such, the firm is maintaining lines of communication. This involves providing regular activity updates and market insight documents to LPs in far-flung locations, either directly or via placement agents. "It increases their exposure to us, their awareness of us, so we aren't a complete stranger to them next year," Jiang says.

The flip side is that LPs looking to establish relationships in competitive areas like China venture capital must make themselves attractive to GPs. This is especially difficult if the two sides have never met face-to-face.

"Unless you are an LP name that is very well known and sought after, it can be hard to get into a fund or get the allocation you want," says Brian Lim, a partner at fund-of-funds Pantheon. "You must make sure you are relevant to GPs. In this context, there are things that institutions based locally are better adapted to do than those based elsewhere that have different governance processes."

That desire to be seen as a value additive LP is one of the reasons many investors are keen to get back on the road. While they may have adapted to remote diligence, it is not viewed as ideal. Giving candid feedback on strategy and discussing how to retain and develop mid-level talent – areas where LPs can draw on their years of experience backing managers across different geographies – is easier done in person than over Zoom.

It is not only those sensitive topics that can be more appropriately addressed in informal settings. LPs continually emphasize the soft side of due diligence, being able to read the body language of team members when they give answers to these questions. This operates at an individual level and a group level as investors look for evidence of complementary qualities and chemistry within teams.

Process evolution

A year ago, there was skepticism about how much could be achieved remotely, with concerns raised about everything from the overly structured nature of diligence sessions to the reliability of technology. To some extent, this has dissipated.

Huai Fong Chew, regional lead for East Asia and the Pacific funds at the International Finance Corporation (IFC), notes that teams responsible for investment diligence and environment, social and governance (ESG) diligence have become more reliant on third-party validation – typically colleagues based in the World Bank's global network of offices – and ramped up the number of video calls. The main challenge is building up sufficient rapport via Zoom to justify proceeding with full diligence.

"We would usually meet up with managers more times before we take a serious look at diligence," That process would take time because they only come to Singapore every few months and give us updates. But you can't reject a Zoom call, so the pace of follow-up is quicker," Chew says. She has yet to commit to a fund without having previously met the manager, but it wouldn't be a deal-breaker.

Where there are hard requirements for face-to-face meetings prior to making commitments, some LPs have been able to tweak them. The US-based insurance firm already had approval for remote re-ups and had this extended to cover new relationships. Reassurance comes through conducting more background checks than in the past. The firm's private equity head notes that technology has made this much easier, with checks now routinely delving into social media accounts.

Cambridge Associates works with institutional investors on private equity allocations in two ways, regardless of the level of discretion attached to the advisory mandate: running parallel diligence to LPs with substantial in-house resources and providing secondary opinions; and delivering a full-service package comprising manager interaction, investment and operational due diligence, and reference checking. Some clients in the latter category like to finish off by meeting the GP.

Vish Ramaswami, a managing director at Cambridge, describes a three to six-month period of uncertainty. "Clients and their decision-making bodies were figuring out how they invest in a manager without ever physically meeting them and when Cambridge is doing the due diligence and we haven't met with them either," he says. "We worked through that and answered the questions, because it doesn't seem like travel is going to become unconstrained any time in the future."

The term "haven't met" requires some contextual clarification. For Cambridge, it means there has been no physical contact during the round of diligence culminating in a recommendation to clients. This is preceded by a three-year process during which there are face-to-face meetings. Clients are not being asked to stray well beyond their comfort zone. There is an expectation this will change in the industry generally in 2021 and 2022, and the battle will not be easily won.

Time to be bold?

North East's Robinson draws comparisons with the post-global financial crisis period, which saw numerous LPs retrench to their home markets and access Asia via global GPs. This implies the market could become more polarized – potentially creating opportunities for investors that are willing to be more intrepid. Two themes crop up in conversations with investors: greater availability of co-investment and increased discipline on fund size.

"There is less capital refilling the tank in Asia and fewer groups are capturing most of that, typically large funds and established platforms with strong track records," says Pantheon's Lim. "For many, fundraising is harder and so they are taking more time with existing funds, waiting for their numbers to pop before coming back to market. Part of that strategy could be preserving capital in the fund and giving out more co-investment."

As to fund size, it depends on how intrepid investors want to be. IFC backed a record number of funds in the 12 months ended June, according to Chew. This wasn't necessarily driven by rapid re-ups in mainstream strategies, given the organization's tendency to back first-time managers in less proven geographies. Rather, IFC recognized that GPs might require more assistance than usual during the pandemic, with its presence in a fund often serving as an integrity check for other LPs.

Even fund-of-funds with offices across the region admit that more frontier-like markets could get overlooked in the age of Zoom. There is a difference between stunted growth in nascent geographies and what Ramaswami describes as healthy shakeouts in jurisdictions that have arguably become over-funded, with capital flowing to mediocre managers that do not contribute to market efficiency in terms of price discovery or backing the right entrepreneurs.

Grefenstette of the Dietrich Foundation is hoping for more of the latter. "If you were looking at exciting, emerging managers in recent years, they were likely to be swamped by LP demand. That has happened less during the pandemic because many LPs have required face-to-face diligence," he says. "We believe if we can get past that challenge of remote diligence, we'll be invested with exciting funds that are, for a change, properly sized, which usually equates to better ultimate returns."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.