China beauty: Traffic jam

The impact of China’s internet-oriented emerging consumer brands is arguably more pronounced in beauty than anywhere else. Gaining a foothold is one challenge, keeping it is another

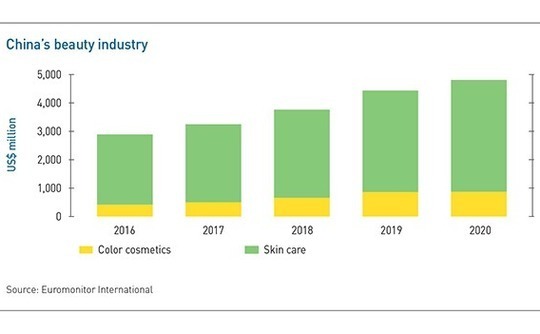

Sixty minutes into pre-sales for China's June 18 shopping festival, seven of the top 10 sellers on Alibaba Group's Tmall platform were beauty brands. It underlines the significance of an industry that has grown by two-thirds in the last five years and is expected to do much the same over the next five. This new spending will be driven by a younger, internet-oriented demographic whose consumption preferences are shaping how products are designed and distributed.

A greater shift towards online sales is a given. It remains to be seen which brands dominate the selling. The top sellers on Tmall last month were all international names, but they will be challenged by online marketplaces and social influencers who leverage their traffic to launch white-label brands.

Ravi Thakran, previously of L Catterton and LVMH and now founder of Aspirational Capital, puts beauty at the heart of the Chinese middle-class consumer story, noting that LVMH made its breakthrough in the country with Dior, not Louis Vuitton. "The bulk of the industry is in the mid-price segment. You can buy a nice fragrance, for $80-100, whereas a nice bag costs $2,000," he says. "Anything that focuses on the middle class in China is going to multiply 8-10x in the next 10 years."

Thakran is adamant that a Chinese equivalent to L'Oreal will emerge, but he is wary of predicting where it might come from. Local direct-to-consumer brands will shake up the established order, which means incumbents must adapt or risk losing market share. "If they don't gear up and bring influencers into its own world, they will face a major threat," he adds.

Online agenda

Beauty is very much the low-hanging fruit when it comes to online conversion. Skincare and makeup products are among the categories with the highest online penetration rates, according to Bain & Company's China shopper report. Meanwhile, those capable of launching a direct-to-consumer brand can tap into an efficient supply chain. It is far easier and faster to outsource manufacturing to a professional foundry and deliver products to customers in China than in most other markets.

"In the past, the standard practice when creating new brands was to refine products in the first year, and do marketing and channel deployment in the second year. It then took 8-10 years to achieve RMB2 billion ($309 million) in annual sales. But the mobile internet era has accelerated this process. A start-up can reach RMB1-2 billion in sales in the third year," Eagle Zhang, a partner at Sinovation Ventures, noted in an article published on the firm's WeChat account in April.

This is perhaps best exemplified by the rise of Yatsen Holding, parent company of beauty brand Perfect Diary. Launched in 2017, its revenue increased from RMB635.3 million in 2018 to RMB3 billion in 2019 and to RMB5.2 billion in 2020. Yatsen – which received substantial PE funding prior to a US listing last year – now has a market capitalization of $6 billion and a string of its own brands.

The company has already changed the local-foreign competitive dynamic. It entered China's color cosmetics top 10 in 2017 with a 0.3% market share, according to Euromonitor International. By 2020, it was second with 6.7%, behind L'Oréal's Maybelline New York. Prior to Perfect Diary's emergence, Maybelline was the clear market leader with a 15.7% share. This became 6.8% in 2020.

There are other fast risers in the local ranks. Florasis, which appeals to domestic consumers by emphasizing oriental aesthetics, achieved a 5.1% market share in 2020. It has yet to receive any VC or PE funding. These start-ups share another key characteristic in addition to developing products that resonate with target customers and using online channels – talent.

"Proctor & Gamble (P&G), L'Oréal and Unilever all entered China more than 20 years ago and they have trained up a lot of talent. Most start-up teams come from those large multinational companies. The talent pool in the beauty industry is the most complete, and the emerge of this talent is the primary reason why China's beauty industry has developed so fast," says Wei Sun, a partner at Meridian Capital.

P&G alone can claim to have nurtured Perfect Diary founder Jinfeng Huang as well as HomeFacialPro's (HFP) Bojun Lü, Simpcare's Jeffrey Liu, and PMPM's Shuo Shan. All three start-ups have received VC funding.

Makeup vs skincare

Beauty splits into two broad categories: color cosmetics, where China sales have risen from $4.1 billion in 2016 to $8.6 billion last year; and skincare, which has grown from $24.6 billion to $39.1 billion over the same period. The likes of Perfect Diary and Florasis have found success in cosmetics, while established brands continue to dominate skincare, buoyed by stronger customer loyalty.

"In makeup, it is easy to attack and difficult to defend. New brands will have opportunities because customers are always ready to switch from big-name brands to try new things. Interesting designs, as well as different colors and smells, can be used to draw customers away from the big brands, but at the same time, it is difficult to retain those customers. Long-term stickiness and brand loyalty are weaker than in skincare," says James Wang, a partner at Vision Plus Capital.

HFP's tendency to name products after molecules draws comparisons with Canada's Ordinary, a brand under DeCiem that lists all its ingredients and the concentration levels. Both companies distribute products in transparent containers with a minimalist design aesthetic.

Simpcare – which has completed six rounds of funding in the past 18 months from the likes of ZhenFund, Hony Capital, and Coatue Management – uses cannabidiol (CBD) as its selling point. However, the company eschewed ingredient development processes favored by global brands like Origins and Kiehl's. Simpcare claims its proprietary extraction method is more cost-effective and results in products that are better suited to Asian skin types.

PMPM is arguably less original, given its strategy of seeking out the best ingredients from around the world is well-established in the global beauty industry. Its differentiator is the experiential element, bringing customers closer to these far-flung locations – and building an emotional link with the brand – by, for example, live-streaming the French coastal scenery in marketing campaigns. PMPM has received four rounds of funding. Its backers include Source Code Capital and BA Capital.

While these brands have quickly gained traction, Bruno Lannes, a partner in Bain & Company's Shanghai office and previously head of the firm's China consumer products and retail practice, preaches caution. "China is a land of entrepreneurs and lots of businesses are being created. But at the same time, the mortality rate is high," he says. "Many of those start-ups don't make it through the second year or third year."

These sentiments are echoed by one investor who tells AVCJ that Chinese start-ups are good at conceptual innovation, but often lacking in scientific innovation. Concepts are easy to copy. Early movers create barriers to entry through the speed and scale of implementation.

A common tactic is to create a new sub-category and trumpet record monthly sales figures to attract investors. The initial impact might be short-lived, but the primary objective is to accumulate capital that can be used to buy traffic and market share. It is straight out of the consumer internet playbook, whereby investors prioritize scale over the path to long-term profitability.

Makeup brand Into You is said to have taken this approach, rising to prominence by creating a category called "lip mud," which is much like lip glaze but has a mud texture. The company recently received angel funding from GSR Ventures and Fosun RZ Capital.

Buying market share

The significance of traffic cannot be overestimated. Perfect Diary's success is inextricably linked to the convergence of social media and e-commerce and the growth of platforms like Little Red Book, ByteDance's Douyin, and Alibaba's Taobao Live.

"Perfect Diary is extremely sensitive to the migration of internet traffic and its operation is extremely meticulous. In this model, the brand must quickly maximize its scale. Whoever can establish this barrier to entry and squeeze out other players within a limited window of opportunity will continue to raise capital," explains Meridian's Sun.

Florasis, meanwhile, went into business with Jiaqi Li, a livestream broadcaster known as Lipstick Brother, who sells more lipstick online than anyone else. Li and Ya Wei – China's top two livestream broadcasters – generated combined sales of RMB53 billion in 2020, according to iiMedia Research, a local research provider. However, exposure to Li comes at a price. Online influencers may bring traffic to a brand, but they are said to take most of the profit on products sold through their channels.

Few know the power of Li better than Qianfei Liu, founder of Zhuben, currently the top-selling makeup removal oil on Tmall. She is generally recognized as a founder who prioritizes product quality, with Vision Plus' Wang describing her as a rarity in the consumer goods space.

"Most CEOs say, ‘I realized there was an opportunity, so I decided to get in,' but Qianfei Liu's initial motivation was based on passion more than opportunity. She prepared for a long time before starting the business, whereas most CEOs get in quickly, develop a product quickly, and sell quickly. I prefer founders who are patient and spend time on the product," Wang explains.

However, slow sales left Zhuben on the verge of bankruptcy until Li's team showcased the product in early 2019. Within minutes, sales had reached the thousands, the beginning of a sharp growth trajectory. Zhuben has featured in 34 of Li's shows – clearing a record 50,000 in one minute during one show – and recorded sales of RMB200 million in 2020, up 450% year-on-year. Vision Plus, 5Y, and Genesis Capital recently participated in a $50 million funding round for the company.

A natural consequence of the emergence of more internet-oriented brands, and the shift in marketing to online channels, is increased traffic costs. Again, Perfect Diary makes for an instructive example. Despite recording RMB5.2 billion in revenue in 2020, up 72.6% year-on-year, the company swung from a net profit of RMB75.4 million to a net loss of RMB2.7 billion. Sales and marketing expenses amounted to RMB3.4 billion, or approximately two-thirds of revenue. In 2019, it was 41%.

The trend became increasingly exacerbated as the year wore on. In the fourth quarter alone, sales and marketing spend reached RMB1.38 billion, or 70.3% of revenue. The company posted a net loss for the period of RMB1.53 billion, more than the previous three quarters combined. Cost items include payments made to 15,000 online influencers, as well as to the likes of Weibo, Little Red Book, Douyin, Bilibili, and various e-commerce platforms.

Although the beauty industry is no stranger to high marketing costs, L'Oréal's allocation to this area has not exceeded 30% of revenue in recent years.

"Emerging brands are spending so much money to buy traffic and traffic costs are only getting more expensive. In the end, it may seem that these brands are just making money for Alibaba or ByteDance, rather than for themselves," says Meridian's Sun.

Other investors have become wary of start-ups that rely heavily on online influencers to drive growth. Allen Zhu, founding partner of GSR Ventures, said in a recent speech that the value of a brand is limited if most of its sales come through live broadcasts. "It is the influence of the broadcaster, not the name of the brand," he asserted.

Global paradigm

International brands are now contesting this battle for online traffic, and they come equipped with some innate advantages. Strong brands mean purchase conversion ratios are higher than for local brands, while higher unit prices deliver higher transaction fees to platforms. Partnerships with these major players is logical for local platforms that want to maximize gross merchandise value (GMV) even as traffic growth slows.

A spokesperson for German personal care products giant Beiersdorf tells AVCJ that brands in its skincare portfolio such as Nivea, Eucerin, La Prairie, and Hansaplast are well-represented on Tmall.

CITIC Capital acquired Hangzhou UCO Cosmetics, an e-commerce services provider specializing in beauty and personal care, in part to leverage this trend. The company helps brands build and manage online stores across platforms like Tmall and JD.com. Hanxi Zhao, a senior managing director at CITIC, previously told AVCJ that a dozen Estée Lauder executives stayed up until midnight in UCO's office on the eve of the Single's Day shopping festival, monitoring the latest data.

"International big brands have learned how to become more and more Chinese. That's why they are competing quite successfully with the local brands. The keywords of their 4D model are 'designed' for Chinese, ‘decided' in China, ‘delivered' at China speed, and finally in a ‘digital' way," says Bain's Lannes.

The combination of newfound online capabilities and mature offline distribution channels have helped global brands defend and grow market share in skincare. L'Oréal Paris controlled 5.1% of the market last year, up from 4.6% in 2016, while its sub-brand Lancôme has gone from 2.1% to 4.7%. Estee Lauder and sub-brand La Mer were on 4.4% and 1.7%, respectively, up from 2% and 0.5% four years earlier.

Much as established players must adapt to an online world, emerging brands launched by internet platforms or online influencers lack historical product knowledge and supporting infrastructure.

"It's not easy because you need to learn what the mainstream companies already know. There are 600-800 fragrances launched every year and only 6-8 make it, a 1% success rate globally. In skincare and make-up, it's the same. These new players must learn about branding, packaging, presentation, all that. Storytelling can get you so far, but if your product quality and packaging don't deliver value, it is difficult to sustain," says Aspirational's Thakran.

He believes these capability deficits in terms of product on one side and marketing on the other will lead to marriages, partnerships, and collaborations between global brands and local platforms and influencers.

Beiersdorf has signed an agreement with Tmall to co-incubate Chinese start-ups and the company plans to bring its global beauty accelerator, NX Nivea, to China this year. In addition, Beiersdorf has opened an innovation center in Shanghai – its second-largest such facility globally – and wants to use this resource to support start-ups in areas like R&D and business development.

"In recent years, we have witnessed unprecedented growth and outbreak in China's local beauty industry, so we hope to find like-minded start-ups and local indie skincare brands, and to provide comprehensive support and win-win opportunities," the spokesperson says in a written response. "By collaborating with Chinese beauty brands, Beiersdorf expects to gain insights of how to interact with the younger Chinese consumers."

Omnichannel awareness

Ultimately, any contender to become China's version of L'Oréal must master omnichannel retail. This is why the likes of Shanghai Jahwa and Marubi, the country's largest traditional beauty players, are said to be exploring opportunities with online influencers and direct-to-consumer businesses are expanding offline. An added incentive for the latter is that offline diversification is the only way to cut online traffic expenditure.

Perfect Diary had established 241 experience stores across 110 cities as of the end of 2020 and received 24 million visitors over the course of the year. Harmay, which started out as a Taobao store and moved offline in 2017, now has five large-format, high-concept outlets offering a combination of global and local cosmetics brands. Each one is reportedly valued at RMB1 billion. Hillhouse Capital, Eastern Bell Capital, and BA Capital are among Harmay's backers.

A second investor observes that the valuation placed on a business like this depends on how much commercial significance is attached to the stores. If classified primarily as an offline retailer, Harmay would not command a premium. If the offline presence serves as a honeypot for females with high spending power, and foot traffic can be turned into offline traffic, that's a different matter.

That might be what Harmay is thinking, as evidenced by how it offers sample products at low cost to walk-in customers and encourages people to take photos in its stores. It is unclear whether this can become a second growth curve for emerging domestic brands, but Thakran claims that Harmay is the company Sephora – which launched a successful offline expansion in China – most fears. "The quality of their offline play is off the charts," he says.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.