Portfolio: Mandala Capital and EFRAC

Mandala Capital is helping Indian food and pharma testing laboratory EFRAC distinguish itself against a field of ragtag competitors. Personnel, networks, and technology are the critical inputs

When Balwinder Bajwa set up Edward Food Research & Analysis Centre (EFRAC) in 2011, he knew that fishmongers were faking freshness by coloring gills with carcinogenic formaldehyde and green peas were getting mysteriously greener with equally suspect supplements. As India's massive consumer market began to raise an eyebrow, a unique angle for monetizing its modernization came into focus.

The idea behind the testing laboratory was to tap growing sensitivity about quality in the food space. Concerns about shelf life and nutritional labelling were becoming more prevalent with the proliferation of formal supermarkets, and the education process was being accelerated by new social media channels. The food and beverage (F&B) and packaged foods industries had to catch up with their audience.

At the same time, regulators were starting to push the issue; the Food Safety & Standards Authority of India (FSSAI), which had not been established until 2006, finally enforced regulation in 2011. In the following years, this has been pursued aggressively, even at the street food level. In 2020 alone, F&B platforms likes Zomato and Swiggy were asked to delist some 5,000 restaurants that were not FSSAI compliant.

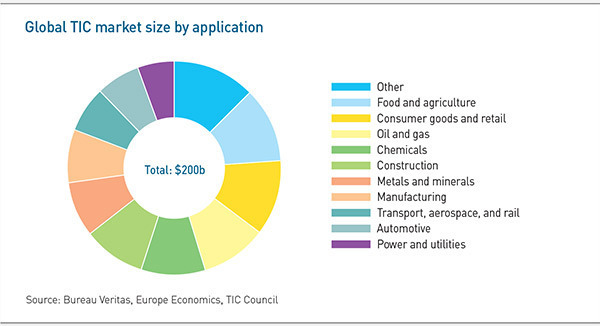

Globally, the testing, inspection, and certification (TIC) sector is worth around $200 billion and set to hit $260 billion by 2025, according to a report by Europe Economics and TIC Council that was issued immediately prior to the pandemic. Food and consumer goods are the largest categories, with each currently estimated at $23 billion. Independent labs, currently one-third of the market, are gradually displacing in-house operations and government incumbents.

Much of the growth is being driven by advances in food testing science and instrumentation. The essential outcome of this progress is that toxins are not only more detectable, they are also being identified as long-term health risks even in trace quantities. All this appears to set up India as a prime jurisdiction for developing a TIC business, but a persistent lack of confidence in local methodologies has kept the vision in check.

"We knew from day one that there were a lot of challenges facing the analytical industry in India," says Bajwa, who is also EFRAC's CEO. "This is a domain that has never been taken very seriously in Asia compared to Europe and the US, where the labs are thought to be more credible. Most of the high-end testing was therefore being offshored, so we knew we had to invest significantly in technology."

Enter Mandala

This is where private equity comes in. Mandala Capital, a specialist in food-related industries that invests across India and Southeast Asia, took a 51% stake in EFRAC in 2016 for $10 million, comprising equity and debt. The GP invested via its second Agribusiness Fund, which closed at $165 million that year. The debt was publicly listed to help ensure overall governance, but Mandala remains its sole owner. The equity is private.

Mandala invested an additional $10 million in the following years but has maintained 51% ownership. The other 49% is held by a silent individual investor, who is not involved in the business, giving Mandala and Bajwa full operational control. Mandala receives dividends from EFRAC in the form of regular interest payments. There are no plans to exit as yet, although a strategic acquisition in the coming years is considered most likely.

In addition to the macro drivers behind the food testing thesis, the private equity firm saw an uncommon level of professionalism at EFRAC. Although not fully automated, the company was well ahead of its manual labor-reliant competitors and had signaled ambitions to take things to the next level in both food and a budding pharma business. This would be necessary to play alongside government-connected institutions and encroaching global TIC operators.

"The majors were already in India but were not yet dominating because they were still just scratching the surface of a huge, fragmented market," says Uday Garg, founder of Mandala. "We knew we needed to perform at a differentiated level to compete with them, but most of the Indian companies in this space are tiny, and there are a lot of dubious practices. We really struggled to find a company where we could be assured on governance, systems, and processes."

At the time, EFRAC was at the center of controversy involving its only large client, Nestle India, which had been flagged by regulators for distributing Maggi-branded noodles with excessive amounts of lead and monosodium glutamate. EFRAC was naturally drawn into the fray but consistently exonerated by industry watchdogs as having conducted accurate, state-of-the-art tests with the samples it had been given.

One of the clinchers for EFRAC as an investment prospect was geography. Based in the eastern state of West Bengal, the company has easy access to a massive seafood exporting industry as well as a burgeoning pharma hub in nearby Sikkim. However, mainstream perspectives on the region suggested it was too backward in terms of infrastructure and general development to be right for TIC.

"We constantly got feedback during our due diligence that this was doomed to fail because it was in the wrong geography, and we couldn't figure out why that was such a big negative," Garg says. "So, we were able to get a better deal, and now we're doing international business from a lab in east India, taking market share away from companies in all these other geographies."

Process upgrades

Investing in new technology, improved certification credentials, modernized customer acquisition processes, and more transparent aftersales services were Mandala's value-add priorities. This included a strong focus on speeding up the turnaround time in providing test results on client samples. Most operators in India take 2-4 weeks to deliver a sample result; EFRAC has gotten it down to 2-5 days.

Sourcing equipment from brand-name manufacturers was a big part of achieving this goal, and EFRAC now claims to have the latest mass spectrometry and liquid chromatography gear in almost every food and pharma testing category. While most local TIC players measure in parts-per-billion, EFRAC's best machines go to parts-per-quadrillion, which is needed to read some carcinogens.

In 2019, the company established Asia's only facility with technology accredited for gas testing. Previously, carbonated beverage suppliers in the region had to send their samples to one of two gas-testing players in the US, extending turnaround timeframes and adding expense.

Top-shelf equipment also greased the wheels with regulators. EFRAC is now one of only three independent TIC players in India to achieve National Reference Laboratory status, a designation that necessarily translates into government contracts.

Tech-enablement likewise helped the company sail through its US Food & Drug Administration (FDA) certification in a single audit in 2017. Bajwa estimates offhandedly this milestone immediately set EFRAC apart from 70% of its competition and opened up significant international sales channels.

"We're seeing more competition as the sector grows, but in terms of technology, it's very minimal," he says. "Most of the labs in India do not buy the latest software and data-integrated systems because those things can be 30% of your infrastructure costs. They are happy just buying cheaper versions of that technology and just serving the local market."

Mandala also helped internationalize the business through its broad network of contacts. Most importantly, this included synergies with existing portfolio companies Godavari Biorefineries and Jain FarmFresh, both major suppliers to Coca-Cola. The client base has grown from around 150 in 2016 to 650 currently. At the time of investment, Nestle was the only major customer; now there are around 200 multinationals from 25 countries in the mix, including Coca-Cola and General Mills.

Best practices

Sales support focused on pivoting from a generalist relationship-based approach to a more segment-targeted strategy that leveraged dedicated lead generators and lead qualifiers. Building out this team was a challenging process since there is high demand among customers for lab representatives to have technical knowledge in aftersales services.

The key value-add in the aftersales offering was to improve transparency about a sample's whereabouts and status during the actual testing and assessment process. It is a fixture of the industry that companies impatiently check in for updates on an ongoing sample test, so streamlining these interactions was seen as a crucial step in improving customer experience and securing repeat business.

"Supply chain traceability wins us a lot of business and has definitely been an important differentiator for our large customers because they don't get that visibility with anybody else," says Hiten Varia, a sector specialist for supply chain, sales, and technology at Mandala, who sits on the EFRAC board.

"We saw that model in semiconductors and electronics, but in fact the idea came to us from Uber. That visibility is what the Uber model has done to everything – you know where it is and whether it's coming or not. When we do innovation in an industry, we base it on our knowledge of other industries."

Global best practices were also incorporated in terms of accounting, cash flow management, and financial discipline. Training was intensive at first, and management found some of the data-based analytics difficult. But a pragmatic culture prevailed.

"Many good companies with the best technologies fail. The difference is the guidance at the early stage, but many times, people over-believe in themselves and do not seek any such guidance," Bajwa says. "That's one of the major problems with most start-ups."

The combination of financial guidance, networking support, technological buildouts, and improved accreditation has proven effective. On average, revenue and EBITDA grew by 28% and 191% per year, respectively, between 2016 and 2020. Scope for snowballing this momentum is implied by three acres of undeveloped landholdings; EFRAC currently has 30,000 square-feet of lab space across two acres.

Mandala claims annual growth rates have clipped as high as 40% and that strong cash generation has only recently been dented by COVID-19. The biggest TIC-specific impact of the pandemic has been simply the logistical challenge of getting in and out of the labs, which has had implications on procuring materials and samples, as well as physically receiving offsite service engineers.

Response measures included putting beds in the administrative area of the main lab for staff that need to be onsite. Around 35 employees and 10 support staff, including housekeeping and security, stayed in the lab for six months. A door pickup-and-drop facility was arranged. The head office was close for over a year. The sales staff worked from home.

"We pushed EFRAC very early during COVID to take a hard look at things, rationalize, and be prepared for a long, hard road, which of course turned out to be the right decision," Garg says. "The company has done fairly well in the past two years because of that."

A broader scope

Diversification has played a significant role in the company's resilience. At the time of investment, EFRAC was an overwhelmingly food-focused business with aspirations to branch into pharma but little traction to speak of. Pharma now represents 40% of the business, on par with food, which includes a sub-specialty in packaging materials.

Competencies in pharma span analysis of material ingredients, bulk drugs, prescription drugs, over-the-counter drugs, and medical devices. EFRAC also claims to serve several marquee pharmaceutical companies in the product formulation stage, effectively extending operations from routine testing into drug development support.

Meanwhile, an expansion into environmental services has seen the company embrace mega-projects beyond the scope of the lab. This area now accounts for about 20% of the business, encompassing field monitoring for agriculture and other industries, air quality tests, weather and noise monitoring, wastewater analysis, pollution measurement, and biological studies.

The environmental business – and where it intersects with food – also provided one of the best showcases for EFRAC's strides in organizational sophistication under Mandala. The company became the most active testing services provider in the government's Soil Health Card Scheme, an agricultural program aimed at diagnosing field fertility that has seen at least 55 million soil samples collected and tested since its launch in 2015.

"The magnitude of Soil Heath Card – mobilizing large numbers of people and testing millions of samples in a short period of time – was huge. When we took up the scheme, I thought we were going to be in deep trouble for a year because we wouldn't be able to do it all. But we pulled it off using both people and machines," Varia observes.

"In addition to being transformative for the farmers, it showed EFRAC's high execution skill and ability to ramp up quickly. Bringing speed into what they do is now a bigger part of the company's DNA."

The idea that company DNA evolves with more ambitious operations is well understood at EFRAC. As the company has become more diversified, more technocratic, and more international, as sense of direction and improved morale has continued to feed the momentum.

The next chapter of growth is expected to be underpinned to some extent by developing trends around food tech such as alternative proteins and genetically modified organisms. For its part, Mandala has hinted that although cash conservation has been a priority during the pandemic, it could mobilize additional capital for the company.

"Overnight, you become known to everyone, and credibility is established," Bajwa says, referring to Mandala's initial investment. "That helped us a lot in terms of culture because confidence has set in with the employees and management. That's most important during COVID-19, when companies are not doing so well and likely to go out of the market. If you have a sound and credible investor at your back, you will be able to overcome those challenges."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.