Asia credit fundraising: Middle muddle

Various structural tailwinds are driving the development of Asia’s middle-market private credit space. This doesn’t necessarily make it any easier to raise funds for the strategy

Leaving his role as head of Asia structured credit at The Carlyle Group in 2016, Gregory Park took some time assessing when, where, and how the next chapter of his more than two-decade career in private debt might evolve.

"I had about six months to kiss a lot of frogs. I was fortunate that interest in private credit was starting to grow, but chemistry is important, so I didn't want to rush into things," he recalls. "There are many elements to a joint venture – it's like getting married. You're not an employee who can walk out the door. There are embedded fiduciary responsibilities to LPs as well as to the platform, and there's the integration of strategy, administration, and operations. Everything has to be in sync."

Park ended up joining CLSA, an institutional brokerage and investment group controlled by China's CITIC Securities, as head of the firm's debut private debt fund. Last year, Lending Ark Asia raised $226 million – rising to $626 million when separately managed accounts are included – for a small and medium-sized enterprise (SME) loan and trade receivables asset-backed private credit strategy. Most of the capital came from third-party investors, with CLSA providing an anchor commitment.

The management team is the majority shareholder in the fund holding company, with CLSA in a minority position. Lending Ark operates independently of the parent, but Park points to the trickle of local macro insights that come through CITIC and CLSA's combined networks. Meanwhile, the full complement of middle office, back office, legal and compliance, and human resources competencies were available from day one. There was no need to build standalone infrastructure.

Plenty of managers are targeting middle-market credit in Asia, looking to serve corporate borrowers that have either been overlooked by banks or are looking for new sources of capital as traditional lenders retreat. But fundraising for newcomers was tough even before COVID-19 made LPs reluctant to establish new GP relationships. Aligning with a larger platform – while retaining a degree of operational autonomy – might be preferable to going it alone.

"Most people know that if you have a chunk of cash sitting in a commercial bank savings account, at the end of the year you could probably buy a few Starbucks coffees. But if you are making 10-12% that really changes lives," says Park. "The market interest in private credit has been blazing hot. The challenge is whether one can get LPs to commit. It's an educational process and it always takes time to build trusting relationships."

Getting comfortable

There are currently 46 Asia-focused private credit funds in the market, seeking an aggregate $15.9 billion, according to Preqin. Average annual fundraising over the past 10 years is $6.5 billion, with no consistent pattern of expansion in terms of fund size.

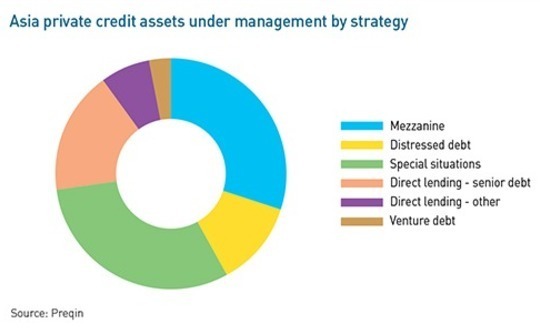

Most of the $57.5 billion in assets under management (AUM) in the region are in mezzanine and special situations strategies, yet direct lending is best represented among the vehicles on the fundraising trail. It accounts for nearly half of the market, in terms of funds being raised and the amount being targeted. This suggests more diversity is being added to a traditionally plain vanilla menu, but it remains to be seen whether investors are ready.

"Asia is just 7% of the global private debt market, which is incredibly low given the size of the economy, and the majority of it is in NPLs [non-performing loans] and special situations," says Tor Trivers, head of the structured credit group at CDIB Capital. "Not a lot of investors are getting comfortable with performing credit. It will come as LPs get more experienced, but there must be some external factor that makes people want to do it. Right now, it's still a push."

A local team with experience of multiple credit cycles is a prerequisite – ideally including members who went through the Asian financial crisis. He also wants to see evidence of an integrated platform, specifically in-house workout expertise "where they have learned to go about that messy business long before our capital arrives." If meeting these criteria puts a manager on par with the foundation's US relationships, then something extra is required to persuade them to come all the way to Asia.

"In the end there needs to be a premium," Stern explained. "For anyone who goes further afield, logistically it is harder. We are a small team, so we need to make it worthwhile. It is a combination of the right group, the right experience, and then seeing that the opportunity set is maybe greater in this particular niche than what we see in our traditional investments. That's what got us comfortable and interested in making that first fund investment in Asia."

The Asia premium is a thorny issue. The consensus view is that LPs want 300-500 basis points on top of what they get domestically, which means a 10-12% return in the US becomes anything up to 17% in Asia. Several managers claim to have met with investors who said they wouldn't consider making an allocation to Asia unless the return was 20%.

For performing credit investment, that is a big ask, although some say it is achievable. Niklas Amundsson, a partner at placement agent Monument Group who has worked on private credit mandates in the region, suggests the relatively high bar might explain why the managers that have gained traction in Asia are those that targeted higher, private equity-style returns. "That is interesting to investors because it outperforms what they see in other regions," he says.

The question is, outside of the special situations space, how much risk must be taken on to deliver these returns? One GP describes it as equity disguised as debt or venture capital debt, characterized by small-scale borrowers and little or no security.

Contrasting environments

LPs might also be deterred by the differences in deal structure and legal framework in Asia's emerging economies versus developed markets. Moreover, some are once bitten, twice shy, having entered Asia prior to the global financial crisis and found themselves with no recourse once things turned bad. At least in the US, an investor in secured or senior debt can feel confident there is some degree of recourse and therefore the hope of some level of recovery.

On the flip side, direct comparisons between Asia and the US or Europe might be flawed when considered in the broader context of debt exposure. First, the US middle market can be accessed via a range of products from high-yield bonds to collateralized loan obligation (CLO) funds. A global investor targeting Asia through public channels is largely limited to the US dollar high-yield bond market, which is skewed towards Chinese companies that issue debt offshore against onshore assets.

Private instruments might be the only way to address certain parts of the middle market, and then the level of intermediation within the space is lower than elsewhere. Chris Mikosh, a partner and co-founder at Hong Kong-based Tor Investment Management, observes that a typical US corporate looking to borrow $150 million has multiple options. Should it choose private debt, a request for proposal (RFP) will be sent to several different lenders, each of which responds with a term sheet.

"In Asia, our borrowers rarely take the RFP route. When we get engaged, we tend to have an exclusive dialogue. The borrower might also be considering an equity transaction or a public solution. We win out because we are more customized. The borrow will accept higher pricing in exchange for specific structures that usually entail shorter tenor and flexibility on repayment. They are willing to trade security and stringent covenants in exchange for loan customization," he says. "They generally don't want to sell equity, they don't want to be diluted, and they want to be able to repay on their timeframe."

Tor was established in 2013 and now has more than $2 billion in AUM. The firm started off investing via an open-ended vehicle and switched to private debt funds in 2018. It is now investing its second. Fundraising was initially a challenge, with Tor overcoming the classic LP concerns by devising a specific mandate: it focuses on senior secured instruments with no more than a three-year tenor.

The goal is to minimize risks surrounding borrower quality, structural disruption, and macro or regulatory issues within individual jurisdictions. It also means the firm is comfortable operating as a relatively senior team based out of Hong Kong and Singapore rather than dispersed across the region.

Boots on the ground

The importance of local knowledge and networks, given the variety within Asia in terms of language, business practices, and law, is emphasized time and again by LPs. One family office investor based in the region notes that he has been approached by several managers raising first-time pan-regional credit funds in the past year. He passed on them all because COVID-19-related travel restrictions placed question marks against their ability to underwrite deals outside of Hong Kong or Singapore.

While having offices across multiple jurisdictions is beyond the means of most first-time managers, some teams have demonstrated an ability to source and execute transactions on a fly-in-fly-out basis by targeting certain opportunity sets. For Lending Ark, it is SME loans and trade receivables. Others carve out specializations in terms of geography or client type.

Stern of Robert Wood Johnson, for example, drew comfort from his Asia-based manager relying on repeat borrowers for 50% of its origination. This also involved understanding and accepting the tangled webs of corporate ownership that underpin many businesses in the region. Many of those repeat borrowers are subsidiaries or affiliates of the same sprawling family conglomerates.

For all the virtues of highly focused mandates, some investors are wary of excessive focus, potentially leading to a lack of diversification or an inability to scale. "Some of the returns have been good because there is equity upside, but you aren't always getting the premium you need for the risk you want, and then country-specific credit funds can be too concentrated," says one fund-of-funds LP. "While there has been a lot of talk about NPLs in China and India, those opportunities come and go."

A dearth of talent is routinely cited as the biggest obstacle to the development of Asia's private debt markets. The region doesn't have a deep pool of experienced executives within investment banks, advisory firms, or local managers to satisfy the appetite of global GPs looking to establish a local presence or LPs keen to back spinouts.

However, Dong Hun Jang, CIO of Korea's Public Officials Benefit Association (POBA), believes there is sophistication and expertise among the newly created Asia-focused managers that have pitched to him. "Their track record and history in the business is longer than I had expected," he told the AVCJ Credit Forum. "Most of the key persons started in North America and came to Hong Kong or Singapore a couple of decades ago. They have experience."

What they sometimes lack, placement agents and fund formation counsel suggest, is connections to institutional players willing to support a platform from scratch. Asia might be an option if US investors are unwilling, but the market is thin. For example, Korean LPs are known for being credit-friendly, but POBA remains heavily weighted to North America and Europe. Efforts to develop exposure in Asia are relatively nascent.

Zerobridge Advisors and Sammasan Capital – both of which would claim to meet the experience criteria – are understood to have spoken to Asian family offices interested in anchoring their funds. In these situations, a manager's willingness to compromise on terms is key. The aforementioned family office investor countered an invitation to back a fund with an offer to bring the GP in-house about 18 months ago. The GP preferred to stay independent and pursue seed funding elsewhere.

Global asset managers have been known to support emerging managers in the expectation that they will find opportunities in the cracks or grow into larger platforms. Similarly, LPs of different kinds are open to co-investment arrangements, either as a zero-fee complement to fund commitments or on a deal-by-deal basis.

"A lot of global institutions say to us, ‘We are capital rich and ideas short, you guys are ideas rich and capital short, so let's work together.' We show deals to people who are notionally our competitors in the future," says Stephen Ezekiel, founder, chairman, and CEO of Sammasan.

Stick or twist?

Nevertheless, deal-by-deal cannot be sustained indefinitely and the transition from pipeline of opportunities to committed blind pool capital is fraught with difficulty. One manager recalls having dozens of LPs sitting on the sidelines waiting for more deals to get done before they would countenance backing the fund. Throughout this period, the pipeline came under intense scrutiny, almost as if the LPs were questioning whether, in the absence of committed capital, it was real.

In this context, the draw of an established platform – and the promise of capital to support deals ahead of a formal fundraise plus other synergies – is understandable. It is not a new phenomenon.

Leafgreen Capital Partners spun out from Austria's Raiffeisen Zentralbank to raise a Southeast Asia credit fund but found the fundraising environment challenging and ended up going in-house at KKR in 2014. More recently, Trivers and Park have aligned themselves with CDIB and CLSA, respectively. Meanwhile, the likes of Allianz and BlackRock, as well as US and European transplants Värde Partners and Muzinich & Co, have launched their own middle-market Asia platforms.

This may remain a feature of private credit until international investors are able to look beyond the risks and recognize Asia as a diversification play that doesn't have to come with a premium attached. Progress is in part contingent on LPs themselves putting down roots in the region.

"Certain large institutional LPs have a well-established presence in Asia, but they don't necessarily have dedicated credit desks in Asia. The strategy is still run out of North America or Europe," says Justin Dolling, a fund formation partner at Kirkland & Ellis.

"While they are interested and know the asset class, they haven't got dedicated resources on the ground here to focus on it, so the first step is generally to concentrate on GPs where they already have a relationship. Backing an independent manager – on top of not being able to travel right now – might be a step too far."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.