Portfolio: GL Capital & SciClone Pharmaceuticals

GL Capital has helped China’s SciClone Pharmaceuticals position itself for the future while continuing to monetize its key legacy drug. A Hong Kong listing was the reward

SciClone Pharmaceuticals takes a counterintuitive approach to China biotech. While many of its peers are developing innovative drugs based on molecules newly-licensed from the US, SciClone's core product – a treatment that stimulates the immune system to fight diseases – emerged in America 20 years ago.

Jeffrey Li, the founder of GL Capital, is wary of the risks presented by unproven drugs. A biotech company's competitive edge is not built on R&D alone, he argues. Strong commercialization credentials and steady cash flow are also important.

"If you have exceptionally good capabilities in one of these three aspects, you can potentially realize the other two," Li explains. "The current market environment has led to a valuation bubble around innovative drug developers. Investors need to go through a full cycle to really understand the risks of innovation. A mature enterprise is much more stable from an investment perspective."

GL Capital has benefited from its involvement with SciClone. The PE firm – which focuses on buyout and growth opportunities in China healthcare – led a consortium that privatized US-listed SciClone in 2017 at a valuation of $605 million. The company went public in Hong Kong in early March with a market capitalization of HK$12.7 billion ($1.64 billion).

GL Capital invested in SciClone through its first and second US dollar-denominated funds, achieving returns – on paper – of 10x and 5x, respectively. This reflects a combination of multiple arbitrage, leveraged financing, and operational improvement. The GP remains the largest shareholder with a 28.8% interest. It has no exit plan, with Li expecting more growth to come.

Enduring sales

SciClone is exceptional in one of the aspects previously cited: commercialization. The patent on its core product, Zadaxin, has long since expired and the company faces competition from generic thymalfasin drugs that sell for one-fifth of the price. Yet its market share, in revenue terms, rose from 44.1% in 2015 to 57.5% in 2019, according to Frost & Sullivan.

The key player in this growth story is Hong Zhao, who Li recommended the board appoint as CEO in 2013, not long after GL Capital first invested in the business. Li was China country president for Novartis before entering private equity and Zhao was a senior vice president at the company.

Zhao tells AVCJ that the secret to Zadaxin's longevity is careful lifecycle management. The drug was approved in China in 1996 and used to treat chronic hepatitis B before healthcare professionals recognized a potentially broader application during the SARS pandemic. The drug strengthened immune systems, which helped prevent infection.

"As a non-specific immunomodulatory drug, the rise of immunotherapy as a means of treating cancer has given Zadaxin a new lease of life," says Zhao.

Whenever a new use case is identified, SciClone can apply to have its patent extended by a further six years. In theory, this shuts out generics, but Zhao isn't necessarily worried about that kind of competition. "Once positive research results come out, the pie gets much bigger, and about 20% of patients will choose Zadaxin over generics," he says. "That's our target market."

Order amid chaos

While SciClone has proved effective in prolonging monetization of its core product, this wasn't the only issue confronting Zhao when he arrived. The company was in chaos.

More than 90% of revenue came from China, but all the core management team members were in the US. Relations between the two geographies were poor. When the US-based managers made an external appointment as China sales head with a view to replacing the whole local team, tensions broke out into the open.

Dozens of sales executives were under investigation, and many staff were working part-time. Compliance incidents were commonplace. In addition, SciClone had acquired NovaMed, a Shanghai-based contract sales organization in 2011, but integration was incomplete. Revenue fell 19% year-on-year in 2013 to $127 million.

Zhao was appointed China CEO responsible for commercial sales. While he reported to the global CEO, a certain degree of autonomy was permitted on sales strategy. Zhao's duties did not extend to manufacturing Zadaxin or building a more diversified product pipeline, which remained within the purview of the global team.

His first order of business was to establish standard operating procedures and a clear compliance system. "What can and cannot be done? What are the norms of my budget allocation? I launched a project called TCC – for transparency, control, and compliance – and our finance and compliance team received full training so they knew what constituted appropriate sales conduct," Zhao recalls.

This was followed by a sales force effectiveness review to re-determine the layout of the market and the structure of the sales team. The head of sales was let go.

China has introduced various policies in recent years to make healthcare affordable, among them issuing a list of drugs that qualify for reimbursement under government-backed insurance plans. It prompted a swathe of enforced price cuts.

In 2015, the Zhejiang provincial authorities mandated a 15% reduction for Zadaxin. A year later, Fujian reclassified it at non-core medication, opening up price competition with generic drugs for the first time through a centralized tender process. SciClone gave up bidding and pulled out of hospitals in the province, previously an important distribution channel.

"The changes in the Chinese pharmaceutical market led to unease among the US board directors regarding the company's future. Selling to an entity that better understood the Chinese market – at a time when the performance had reached a relatively high level [in 2016, revenue and net profit reached $160.1 million and $30.7 million] – seemed to be the best way of realizing the interests of American investors," says Zhao.

Direct to consumer

SciClone fought back against the new pricing system. With hospitals in several provinces off-limits, the company developed a "go-to-patient" (GTP) sales model. This meant patients could purchase Zadaxin in pharmacies, although this wasn't covered by the reimbursement scheme.

Sinopharm's pharmacy network was essential in reaching patients. The GTP project has been through five increasingly sophisticated iterations, from a hotline that answered patients' questions to an online ordering joint venture called Sinopharm Care to a WeChat public account platform known as Immune Online.

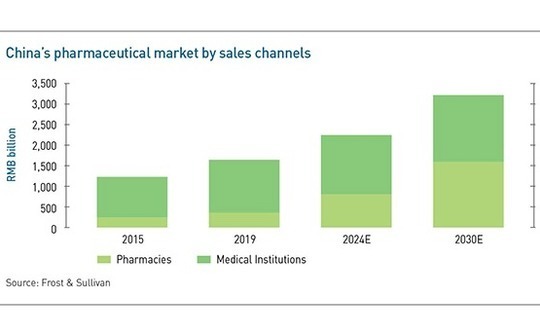

Pharmacies have replaced hospitals as SciClone's primary distribution channel, accounting for 60% of the overall sales. Price cuts and tender processes remain a threat, but GL Capital's Li is not unduly concerned: "I am pretty relaxed now, our most difficult time is passed. Our team has proved its capability."

On deciding to proceed with a sale, the board appointed Lazard to run the process. It sent teasers to a large pool of financial and strategic investors and multiple offers were submitted. GL Capital was selected as the preferred bidder, and as negotiations entered the final stages, SciClone's stock price popped. It rose higher than the offer price and Li decided to pull the plug, even though the board was willing to proceed.

"I didn't want the shareholder class-action lawsuits," he explains. "The board didn't think there was much of a risk, but I wanted an outcome that satisfied everyone. I didn't want to do something that could upset a large number of small shareholders."

A year later, once the stock price had stabilized, GL Capital reinitiated the process. The offer received 97% shareholder approval.

The deal was supported by $220 million in debt from China Minsheng Bank as well as cash from SciClone's account. This left an equity contribution of around $300 million and so GL Capital brought in CDH Investments, Ascendent Capital Partners, and two of its LPs, Bank of China and Zhujiang Life Insurance.

On completion of the acquisition, SciClone was redomiciled from the US to the Cayman Islands, thereby avoiding the 30% withholding tax levied on dividends that pass through the US. Meanwhile, the US office was closed and a staff incentive program was set up, giving management and other key team members equity in the business. SciClone also formed an 80-person clinical development team.

More importantly, the company honed its strategic focus in terms of geography and clinical specialties. "Our advantage lies in China, and our best opportunity is in China, so we must seize that opportunity. Those so-called overseas opportunities – helping Chinese companies to internationalize – are generally not the best," Li observes.

As to clinical specialties, oncology and severe infections were prioritized. It meant stripping out the cardiovascular product line, which mainly addresses chronic diseases. The thinking was that affordable generic drugs will do better in this area.

"SciClone is focusing on severe diseases, that's where people will pay a premium for original drugs," Zhao says. "Chronic disease is not an immediate threat to human life, so it is difficult to differentiate in price. We are currently negotiating a licensing deal for a life-saving antibiotic treatment – that's our strategy."

A diversified pipeline

Four new drugs will be launched at scale this year. These include Zometa, which was developed by Novartis at a treatment for bone marrow cancer or where cancer cells have spread into the bone. SciClone took over the drug in September of last year and it has already reversed a previous decline in sales, according to Cecile Pan, the company's CFO.

The goal is to reduce Zadaxin's share of overall sales to less than 50%. Momentum achieved in 2019 – the contribution fell to 79% from 91.7% in 2017 – was undone last year when Zadaxin was added to a list of drugs for prevention and treatment of COVID-19. The solution is to build a large pipeline through in-licensing.

"Right now, there are many good overseas innovative drug developers that lack commercial capabilities in China. Companies like SciClone can be highly complementary to them – it is a win-win situation through cooperation," says Li.

There are three key components to successful in-licensing, he adds. First, the local partner must choose targets carefully, based on assessments of the technology and the scope for innovation. Second, the two parties need to establish strong mutual understanding and trust, underpinned by adherence to international standards and a high level of transparency. Third, a strong local sales team.

In addition to commercializing drugs that have already been approved overseas, SciClone will target treatments in late-stage clinical trials. It recently in-licensed a small molecule immunotherapy from San Diego-based EpicentRx that is in phase-three trials in the US for small cell lung cancer. EpicentRx will receive an undisclosed upfront payment plus up to $120 million linked to certain development milestones.

"We look for differentiation. While most CD47 treatments [which inhibit ‘don't eat me' signals sent by cancer cells to immune system cells] are big molecule antibodies, ours is a very safe small molecule, safer than any antibody. Large molecule antibodies may focus on hematomas, and we focus on solid tumors," says Xiaoning Guo, SciClone's chief medical officer.

The company's negotiating position was supported by its network of oncology departments in some of China's largest hospitals. EpicentRx was expecting the phase-three trials to take about three years because small cell lung cancer is not that prevalent in the US. Under the in-licensing agreement, SciClone will launch a trial in China, where the cancer is prevalent, and leverage its patient access.

"The entire process can be shortened by half with our participation. This drug can potentially be on the market 18 months earlier than originally planned," says Guo. He adds that SciClone will account for 80% of the patients in the overall trial.

The company's other priorities include acquisitions, especially small and mid-sized labs overseas. It will not compete against foreign pharmaceutical players, but target areas they overlook, notably specific cancers with high incidence rates in China. In-licensing and equity investment agreements could happen simultaneously.

Control case study

Privatizing US-listed Chinese companies with a view to pursuing IPOs in Hong Kong is a popular private equity strategy, though the founders usually retain their controlling stakes. For GL Capital, SciClone is a strong case study of a full leveraged buyout followed by post-deal value creation and then a relisting.

"When we speak to LPs about our buyout strategy in healthcare, we often get asked whether there are enough opportunities in China to support it," says Shirley Lin, a managing director at GL Capital. "As China's healthcare industry continues to consolidate and mature, minority growth deals will likely decline. GPs will have to invest at an earlier stage or create value with buyouts."

The private equity firm has $2.2 billion in assets under management and closed its third US dollar fund at $480 million last year. It is in the process of closing its seventh buyout transaction, with deals of this type expected to account for 70% of Fund III.

"We hope that in the long run, we can have different platforms across different fields," Li adds. "This will enable us gradually to form our own ecosystem, which can, in turn, lead to better value creation at the portfolio company level."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.