Ares & SSG: Scale proposition

The merger of Ares Management and SSG Capital is among the largest ever seen in Asian alternatives. They are now pushing into new markets and segments, leveraging the combination of size and local resources

Eric Vimont arrived in Asia five years ago with a brief to explore the market. His employer, Ares Management, was familiar with the big picture opportunity in Asia credit – characterized by economic growth, favorable demographics, modernizing capital markets, and banks scaling back lending – but it wanted specifics.

"I didn't come here necessarily with the intention to recommend that Ares acquire a platform," Vimont says. "My first six months were spent understanding the opportunity set in the region, meeting with private equity firms, investment banks, and consultants to get a sense of the flows. It soon became apparent to me that we had to acquire a platform because growing organically in Asia was far too difficult. You can do it, but it takes a long time. I had several platforms in mind, but SSG became a priority early on."

Ares agreed to purchase a majority stake in SSG Capital – a pan-regional firm established in 2009 by the Asia special situations team at Lehman Brothers – early last year. The transaction closed in July 2020. In terms of assets under management (AUM), the combination might seem somewhat insignificant; at the time, Ares had $144 billion to SSG's $6.2 billion. But it is one of the largest mergers attempted in Asia's alternatives space and has arguably been transformative for both firms.

For Ares, the deal filled an Asia-shaped hole in a credit portfolio that ranks among the largest in North America and Europe. For SSG, it has helped answer the question of what to do next. The team had often discussed how they could extend a platform focused on direct lending and special situations. Teaming up with Ares has brought in range strategic acquisition opportunities that would have tested the financial resources of the firm as an independent.

"When we think about the relationship we have with companies, there is a lot more we can do with them. We want to be able to provide a more complete set of solutions to our clients in the region," says Edwin Wong, managing partner of SSG and now a managing partner and CEO of Ares SSG. "Having the support of Ares could also help take our platform to the next level. Now, we are having dialogues with people who want to be part of our platform or have strategic tie-ups with us. The power of a platform as a $200 billion global manager is very different to being $7 billion at SSG."

Growth story

Wong established SSG alongside fellow Lehman alumni – and now Ares SSG partners – Shyam Maheshwari and Andreas Vourloumis. Peter Cairns joined them at an early stage as a partner and COO, a role he retains at Ares SSG. The founding team of seven raised a debut fund of $100 million.

From there, the firm scaled relatively quickly, closing Fund II at $400 million, Fund III at $915 million and Fund IV at $1.7 billion, including a $500 million sidecar. SSG also raised two secured lending funds of $325 million and $815 million, respectively. Fund V, which closed in 2019, comprised $1.9 billion in core equity and a $825 million sidecar. Pension funds and sovereign wealth funds accounted for nearly three-quarters of overall assets.

There are now offices in Hong Kong, Singapore, Shanghai, Mauritius, Bangkok, Jakarta, Mumbai, New Delhi, and Sydney, and more than 200 employees. Not everyone carries an Ares SSG name card, with some working for subsidiaries of the firm. For example, there are asset servicing businesses in Thailand and India that help manage portfolios held by third parties.

"In the last 12 months, with people being unable to travel, the benefit of having a local presence has become clear," says Wong. "It's not just investing and origination but also asset management. Being able to talk to the guy and hold is hand during crisis times is critical."

India has been SSG's most active market historically, with a suite of onshore licenses enabling the firm to target special situations and distress opportunities as well as provide direct lending solutions via non-banking finance companies (NBFCs). In addition, SSG has invested significant sums in China – where it has licenses to operate onshore but does more offshore – and Southeast Asia.

The team had been approached numerous times by global investment firms interested in an acquisition, but there was no burning desire to be bought. When Ares made its approach in 2019, initial discussions were respectful, with no real expectations of a conclusive outcome on the SSG side, Wong explains. This changed when they discovered the two firms were a good cultural fit.

Negotiations progressed to deal structure and coming up with an arrangement that met SSG's requirements in terms of retaining a high degree of autonomy.

"Edwin was naturally protective of what he had built. He wanted to make sure he could continue to invest as well as he had invested before and keep promises made to investors," says Vimont. "The only way he could be comfortable with that was by obtaining a good understanding of Ares and the way we think about integration, and so we set up many meetings with all key decision-makers of the firm."

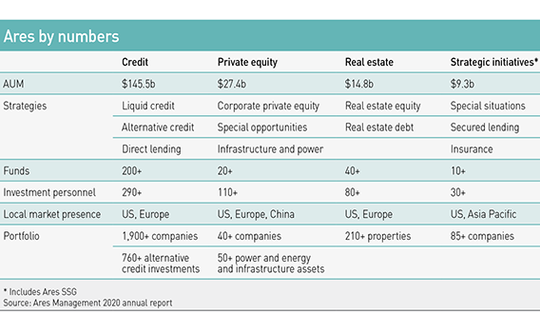

It helped that Ares had little in terms of pre-existing Asian exposure. Credit accounts for nearly three-quarters of the firm's global AUM, with 14% in private equity, 7.5% in real estate, and 5% in strategic initiatives (and Ares SSG makes up the bulk of that). In Asia, there are two private equity funds targeting growth-stage opportunities in China.

Both sides claim that post-deal integration has been smooth, across investment and the cross-fertilization of deals and deal flow and support functions such as IT, human resources, compliance, and fundraising. Wong notes that the outcome has been beyond his expectations, adding that "the collaborative culture they sold us on – it's all true."

The European experience

This is not the first time Ares has entered a new market and Vimont, who serves as a managing partner and head of strategy at Ares SSG, was not sent to Asia by chance. He joined Ares in 2007 as part of a three-person team that had previously led the middle-market leveraged financing business at Barclays. They were tasked with building out Ares in Europe.

It was a laborious process and Ares didn't pay off the money invested to establish a local operation until Fund III. This underlines the difficulties of growing organically, although there was limited scope for those seeking acquisitions. At the time, independent alternative investors raising European credit funds that might make for attractive targets were few; the space was dominated by banks.

"The only way you could build a platform was organically. We were hiring people from banks and training them to become investors; holding and managing risk over a longer period of time rather than underwriting to then sell," says Vimont. "You also had to promote the asset class to investors. They had to be convinced that private debt could become an important part of their allocation because it was an uncorrelated asset, which if done well, could deliver stable returns and regular cash distributions."

Vimont lists several reasons for this. First, there is little uniformity across the region in terms of language, culture, and market access, which means a well-resourced infrastructure and multiple local presences are essential to pan-regional origination. Second, there is less intermediation than in Western markets. Many companies are still founder-led, so relationships must be cultivated carefully. Third, the talent pool isn't as deep, which puts a premium on recruitment and retention.

"SSG had infrastructure, market access, and people. Retention rates were also high, suggesting a cohesive culture," Vimont adds. "Another part we valued was that the team had been through cycles together. Asia has seen a lot of volatility and in credit, if your downside protection and ability to understand risk is not robust, you will lose money rapidly. You have to be knowledgeable and experienced about creditor rights, enforcement, and making sure you align interests with company owners."

In terms of post-merger acquisitions, Ares SSG recently announced the purchase of assets held by Altico Capital India, a real estate-focused NBFC for approximately $380 million. It marks the first rescue of a stressed NBFC before it could slide into bankruptcy. Wong describes it as a positive outcome for Ares SSG, Altico's borrowers, and India in general, given the disruption and realignment that has characterized the NBFC space in recent years.

However, the firm's more notable forays have arguably been in Australia. John Knox, who used to run Credit Suisse's credit business in the country was recruited as chairman of Australia and New Zealand towards the end of last year. Then in February Ares SSG concluded its protracted pursuit of AMP with an agreement to buy a 60% stake in the firm's private markets business – which includes infrastructure equity and debt, as well as real estate – for A$1.3 billion ($1 billion).

Australia may also be the starting point for a new iteration of fund products, with unitranche – a popular structure in leveraged financing that combines senior and mezzanine facilities into a single debt piece – on the agenda. This represents a logical expansion, taking SSG into a market and a product type it hadn't previously addressed to any great extent, and leveraging Ares' global experience in that segment.

"Unitranche was very much something they created, and we can bring it to this part of the world as well," says Wong. "Australia will be the first part of it because the market is proven. But over time the product will become more widely accepted. Big sponsors aren't just investing in Australia, they want our support in other markets in the region as well."

Size matters?

For those seeking inflection points in Asian private debt, growth in sponsor-led financing and openings created by banks withdrawing from traditional lending are potentially powerful change agents. Ares SSG believes it is the right time to tackle these opportunities at scale. Even before the Ares tie-up, SGG was gravitating towards the upper end of the market, with investments starting at $50 million and extending beyond $100-200 million. Anything smaller becomes hard to underwrite.

There is a case to be made for finding comfort in scale. Wong says that SSG has learned from experience that smaller companies, especially in emerging markets, are riskier. There is a preference for larger businesses with better governance and access to different types of capital. He claims that a fair number of the firm's Asia-based portfolio companies are listed and have access to bond markets as well as banks. It's a matter of offering the right solution at the right time.

Size may also allow an investor to control its risk by leading transactions or being the sole owner of the debt. This removes the prospect of situations in which a company runs into trouble and multiple creditors – each representing different stakeholders and sets of interests – try to thrash out an optimal outcome.

"It is important to be able to create financing solutions that allow your customers to achieve their ambitions but then equally as important, continue to support these investee companies as they grow. You might only start doing $50 million, but you want to be there with $200 million and above as companies require additional flexible lines of funding to sustain their growth," says Vimont.

"And then scale brings differentiated information flow. The more you can do, the more you learn from your portfolio, from what you are seeing in the market, and from the interactions you have."

SSG is already finding that the Ares name buys significant goodwill from banks, with global heads putting in calls to the Asia team and asking what they can do to be more supportive. It allows the firm to be increasingly ambitious in terms of deal size – one transaction currently in process could be worth as much as $1 billion – and complexity.

"We are being shown things that are hard for other managers to handle. For example, if it's a portfolio covering China, India, and Southeast Asia assets, you would struggle to find managers who can price that risk," Wong adds. "Because of our scale and ability to provide a total solution, we can dictate better terms on pricing and downside protection. We've always focused on direct origination, being at the forefront of putting a deal together rather than financing based on someone else's term sheet."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.