India SaaS: Global first

India’s enterprise software start-ups have traditionally ceded the spotlight to their consumer-facing peers, primarily because of their outlook – and their VC backers – are US-oriented. That is now changing

India's software-as-a-service (SaaS) industry saw two windfalls within a fortnight at the tail end of 2020. First, cloud-based customer relationship management (CRM) platform Gainsight was acquired by Vista Equity Partners for $1.1 billion; then advertising software provider PubMatic listed on NASDAQ with a market capitalization of around $950 million.

Both were founded by Indian teams and retain substantial teams in India, yet they are US-domiciled, primarily serve US clients, and on the outside seem like US companies. At least PubMatic has some Indian VC firms in its shareholder register, with Nexus Venture Partners and Helion Venture Partners having got in early. Gainsight, by contrast, was backed by global or US funds managed by Battery Ventures, Bessemer Venture Partners, Insight Partners and Lightspeed Venture Partners.

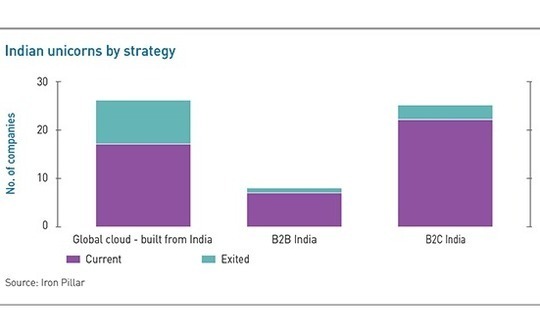

PubMatic is the exception to the rule. According to local VC firm Iron Pillar, 26 of India's 59 technology unicorns are SaaS providers that hit big by targeting global markets. Nine have achieved liquidity events in the past four years – compared to three exits among the country's 25 B2C unicorns. However, Indian VC firms are investors in only a handful of these businesses.

The disparity has come into focus at a time when enterprise software is on a tear globally, in part driven by accelerated adoption of cloud-based solutions in the wake of COVID-19. Indian companies are still minor players on the international stage, but the recent exits have been accompanied by sizeable funding rounds for the likes of Postman and Druva. The irony for LPs tracking the India angle is that most of the gains – realized and unrealized – are coming through their US GP relationships.

"For a long period, follow-on capital for SaaS start-ups did come from the Valley. Most India-founded companies were doing global SaaS and the knowledge, network, and talent needed to build a global sales organization came from global VCs," says Sunil Mishra, an Asia-based partner at Adams Street Partners. "In recent years, there has been a dramatic change in terms of new company formation and initial funding for SaaS start-ups. Almost every Indian VC now has a partner dedicated to SaaS."

While developed markets remain the most lucrative targets for software providers, the cloud revolution is not a wholly Western phenomenon. SaaS is growing faster in Asia than anywhere else in the world – albeit from a relatively low base – as corporates that were previously unwilling to pay for software review their habits. Indian start-ups are emerging to cater to these new sources of demand, fueled by talent emerging from the country's cohort of established global players.

"There is a trend of companies selling into Asia with the basic thesis that Asian businesses have different requirements from those in the West, so you need different types of software. We are strong believers in this," says Dev Khare, a partner at Lightspeed India Partners. "Asia is home to 60% of the world's population and many markets are dominated by conglomerates. There is an opportunity for Asian software companies to do better than SAP and Oracle."

SaaS by numbers

Half of Lightspeed India's portfolio compromises B2B technology companies, and pure SaaS – start-ups selling multi-tenant software on a subscription basis – amounts to half of the B2B segment. This sub-segment can, in turn, be divided into three go-to-market strategies. Two of them are Asia-first approaches: start-ups that sell to Indian corporates and expand into Southeast Asia; and businesses that target domestic small and medium-sized enterprises (SMEs).

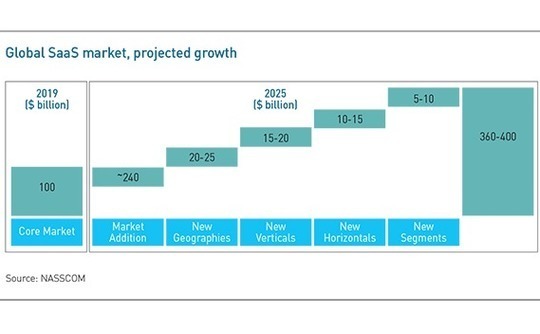

Bain & Company estimates that India's SaaS industry will generate $18-20 billion in annual recurring revenue (ARR) in 2022 for a global market share of 7-9%. This compares to $5-6 billion, or 3-4%, in 2019. There is no question where the bulk of the money will come from: the third category of start-ups that supply software to a global customer base, led by the US.

PE and VC investment in India SaaS hit $1.3 billion in 2019, taking the total number of funded companies to around 1,200. Around 40 have raised Series C rounds or above. As recently as five years ago, 500 had received VC backing and 10 had reached Series C. This underlines the relative youth of the market, even among global SaaS players of Indian origin.

US-based Sapphire Venture – previously a unit of SAP – started looking for enterprise opportunities in the country in 2007. It backed Newgen Software Technologies, a provider of business process outsourcing (BPO) software to banks that eventually went public in 2018.

The underlying rationale made sense. India was home to some of the world's largest IT outsourcing companies, which meant there was plenty of talent that knew how to service corporate clients across different verticals in an asset-heavy context. They were well-positioned to develop asset-light solutions. Moreover, if Newgen could sell in cost-sensitive India, it could sell anywhere.

The investment failed to play out as expected in two respects. First, Newgen established a presence in Eastern Europe, the Middle East, and Latin America, but it struggled to penetrate the US due to strong local competition. This was the era before product-led growth, where customers experiment with a product and then buy it, transacting virtually. Salespeople would make site visits to customers, so longstanding account relationships often held sway.

Second, the talent wasn't mature enough. "In product management, 80% of what you do is understanding the customer and building something that they want, and 20% is figuring out something the customer doesn't articulate but needs. The DNA wasn't there in India because most product managers grew up in BPOs and just took orders," says Jai Das, a co-founder and partner at Sapphire. "They weren't building products that customers would buy."

It took 10 years for Sapphire's vision to come to fruition, and in the last five years the firm has seen the market take off. Sapphire invested in two of India's global SaaS unicorns, enterprise cloud platform developer Nutanix and business analytics software provider Thoughtspot. Nutanix went public on NASDAQ in 2016.

Getting fresh

Several industry participants point to Freshworks as the success story that made everyone take notice. Zoho, which has never received external funding, is the oldest of the unicorns. Freshworks - set up by two former Zoho executives - was in the first batch to achieve $1 billion status, and arguably the first to do so with local support in the form of Accel India and Sequoia Capital India. The company has a global customer base but was quick to locate its headquarters in the US.

The economics of the US front office-India back-office approach are alluring. Iron Pillar estimates that 70-90% of the workforce is based in India, typically the product developers and customer support staff. There is a 4x cost differential between the two markets, with most of the savings coming in the form of cheaper talent. A developer in Bangalore might make one fifth the salary of his US equivalent but work to the same quality – and do so from home anyway.

Speed is another consideration, whether it's a large team of developers reducing the time-to-market or an in-house implementation capability reducing time-to-value.

"Once you have product out there you can implement faster because companies can do professional services internally rather than rely on Accenture or Infosys," says Lightspeed's Khare. "They can provide support on a 24/7 basis at a much lower cost than companies in the US as well. But it's not just cost. There is a ton of experience in the Indian entrepreneur ecosystem, people who have worked at software companies globally and know how to build products to Western needs."

US-based VCs have found favor with Indian SaaS companies because they can assist in recruitment, business planning, and customer introductions. It is no coincidence that Nexus is one of few local players with access to these start-ups given three senior team members are based in Silicon Valley. Iron Pillar is taking a similar approach, locating partners in Silicon Valley, India, and the Middle East.

"It is an essential piece for building global businesses out of India," says Adam Street's Mishra. "When a company moves to the US, it is setting up an office, finding the first couple of hires or introductions – basic things, but if a VC doesn't have anyone there looking out, it takes a lot more time and effort.

When Norwest Venture Partners, which was investing out of a global fund but had executives based in India, backed Zenoti in 2016, international expansion was on the agenda from the outset. The company, which provides CRM and enterprise resource planning (ERP) tools for spas and salons, derived most of its revenue from India at the time. Now, the US accounts for 60%. Zenoti became a unicorn last December with a $160 million Series D led by Advent International.

"We talked to the founder about the size of the addressable market in Asia and it was double that of India alone. No one expects to get into China, at least not to begin with, but we figured that Asia and the Middle East would be 2-3x India. And then the US, Western Europe and Latin America is a huge market. After the fundraise they moved aggressively in the US," says Mohan Kumar, founder of Avataar Venture Partners and formerly of Norwest.

Comfort in stability

There is always a technology risk with SaaS investments – the possibility that a product will be surpassed in its early stages by a nimbler competitor – and this is addressed by targeting segments where there is customer stickiness with multi-year contracts. Focusing on an underserved market like Zenoti or developing an entirely new product category can help, but it's not essential.

"Every four or five years, there is a platform change and people sell the same thing in a different way," says Das of Sapphire. "Software for managing sales commissions has been around for 15 years. A second generation came in about seven years ago and we are into the third. The concept is the same, but products have to work on mobile phones."

Sapphire bet on successive generations in content management software, investing in Alfresco and then Box. It expects to do the same in newly emerging segments such as revenue operations management, which brings together sales, marketing, and customer support for B2B companies.

Once a company identifies the right product-market fit and puts a team in place, revenue came relatively swiftly. Investors have different preferred entry points. These are based on various performance metrics – such as ARR, the time it takes to make back the money spent acquiring a customer, gross margins, and customer attrition rates – as well as competitive dynamics.

Iron Pillar's sweet spot is companies with $4-10 million in ARR; from when there is sufficient data to conduct meaningful analysis to when global investors get interested. That was traditionally Sapphire's Series C starting point, but it has retreated to earlier rounds – and ARR of as little as $2-3 million – in response to rising valuations in the mid-stages.

This is perhaps best illustrated by Postman, which closed a $150 million Series C round at a valuation of $2 billion last July, a sixfold increase on the Series B, according to NASSCOM. Another source indicates that the deal valued Postman at 100x ARR. Investors targeting earlier-stage global SaaS companies out of India claim to be paying mid-single-digit ARR multiples.

Avataar was formed last year when Kumar won support from HarbourVest Partners to acquire positions in six SaaS companies from Norwest, among them Zenoti and Capillary Technologies. The firm is focused on the $10 million ARR space, but with a twist. First, it not only focuses on in-demand, top-tier companies, but also those with slower growth and a need for more operational support. Second, Kumar believes there is a gap in the market for growth-stage India specialists.

"I would say we are the only late-stage SaaS specialist in India," he says. "If I had created Avataar in 2012 there might not have been anything to invest in. Now, no one asks if the market is deep enough. Every global fund wants to invest in late-stage SaaS in India, but they are looking for a certain kind of company. Businesses in India are different to what global investors do in the US."

Local appeal

This notion of a proliferation of SaaS start-ups entering the growth phase is reflected in the deal pipeline at Gaja Capital Partners, which relies heavily on the country's venture capital ecosystem. A Series B for CRM software provider LeadSquared in December was preceded by investments in Educational Initiatives, a K-12 tuition platform, and Xpressbees, an e-commerce logistics business.

Both companies are software-driven, according to Gopal Jain, the firm's co-founder and managing partner. He sees this as symptomatic of an overall digitalization of the Gaja portfolio and of a newfound maturity in India SaaS. The LeadSquared opportunity was identified because the firm's portfolio companies in the traditional education space were using its products.

"COVID-19 has acted as a lightning rod to induce business and consumer demand for cloud-based software," Jain says. "We are looking for companies that can serve global markets – and cloud has leveled the playing field in terms of serving US customers – but one of the early signs is domestic leadership. We think the domestic market for cloud-based software has achieved critical mass."

The market remains nascent, and to some industry participants, fundamentally unappealing. Iron Pillar's Prasanna points to the impact of currency depreciation on rupee-denominated investments and the stress placed on working capital reserves by Indian customers taking 60 days to process payments. Neither of these are problems when targeting companies offshore.

"If you have a 60-day payment cycle, you are always cash flow negative and playing catch up. You need to raise more money to become cash flow positive," he says. "It is more mathematically efficient to build from India for the global market. The pricing is better as well. You can sell the same product for 3x the price in the Middle East compared to India."

However, some companies have prospered with domestic and regional strategies. Capillary Technologies might be considered an Asia-centric equivalent of Freshworks, with headquarters in Singapore and customers in multiple markets, including China. Acknowledging that contracts in South and Southeast Asia are smaller than in the US, but the volume of SMEs is much larger, Das of Sapphire believes there is a scope for a Shopify clone in the region.

It is a telling observation that offers insights into the nature of the opportunity set in emerging Asia. The US market is multi-tiered, with five dominant players at the top – led by Microsoft and Salesforce – accounting for half the revenue. Below them sit hundreds of companies with horizontal platforms offering specific functionality to multiple industries or with vertical offerings. India isn't developed enough for verticals and perhaps not enough for subscription revenue either.

Monetization matters

Lightspeed India's portfolio features several "Shopify for X" start-ups that offer low-cost technology enablement solutions to SMEs across different functions much like Shopify does in e-commerce. Another SaaS category is marketplaces, such as Zetwerks in manufacturing and Udaan in retail trade. SMEs receive the software for free but give up a portion of the additional revenue generated by virtue of being on a technology platform that connects them with new customers.

Khare compares emerging Asia today to the US in the 2000s, when the first SaaS companies to take off were those that sold to all industries. Darwinbox, a human resources software specialist that has expanded from India into Southeast Asia is Lightspeed's big bet in this context. The hope is that these start-ups can outmaneuver global competitors through the deployment of modern, mobile-friendly architecture and products that are attuned to Asia's cultural quirks and practical needs.

In a minority of cases, regional SaaS players are working in new categories and have the potential to go global. Yellow Messenger, for example, is developing chatbot technology in India, where the messaging culture is more ingrained than in the US. "There's no global market leader and Yellow Messenger could be it," says Khare. "They can build for messaging-centric requirements and when they go to the US, they will be way more sophisticated for that use-case than domestic companies."

It is difficult to envisage a timeframe in which the emerging Asia SaaS opportunity comes close to matching that of the US – certainly beyond the lifespan of the current vintage of funds and perhaps beyond the next vintage as well. However, the combination of macro fundamentals, a COVID-19 booster, a deepening pool of local talent, and support from first-generation entrepreneurs is prompting investors to reexamine the landscape.

As exits emerge from the established core of global Indian SaaS start-ups and the region's untapped internal potential is increasingly acknowledged, enterprise may supplant consumer as the dominant theme in domestic VC.

"It was overlooked because the right people weren't there, both founders and VCs, and the market wasn't deep enough. No one knew what was going to happen to these companies without a domestic market and if they could scale outside India," says Mishra of Adams Street. "Meanwhile, the consumer internet story was easy to understand and easy to explain."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.