2020 in review: Surprise guest

The coronavirus pandemic has played havoc with Asian private equity, contributing to a resurgence in IPOs, increased bifurcation in fundraising, a rush for healthcare, and a generally staggered revival

IPOs: Shanghai's rising star

It has been a bumper year for PE-backed China IPOs, despite the Ant Group offering being pulled

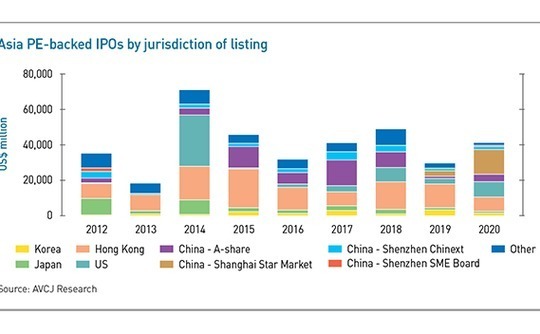

In terms of IPOs, 2020 might be remembered for the big one that didn't happen – which is perhaps unfair to the plethora of offerings that made it to their respective bourses. With public markets rebounding aggressively from first-quarter lows, spurred by investors pursuing alpha wherever they could find it, private equity-backed companies in Asia had raised $41 billion as of mid-December, compared to $29.6 billion in 2019. The number of IPOs – 237 – is the highest in three years.

Still, had Ant Group completed its dual listing in Hong Kong and Shanghai last month, aggregate IPO proceeds from the region would have doubled. The company, Alibaba Group's financial services affiliate, was primed to raise $35 billion and achieve a market capitalization of around $313 billion. This is more than double the valuation of its most recent private funding round.

According to most accounts, the Ant IPO was brought to a halt by the actions of Jack Ma himself. The Alibaba co-founder publicly admonished regulators for stifling innovation in financial services. They duly torpedoed the offering, citing "changes in the financial technology regulatory environment." At the same time, draft rules were introduced that threaten to curb the activities of online lenders. When Ant returns to market, it might not look – or be worth – the same as before.

As such, Shanghai's Science & Technology Innovation Board – also known as the Star Market – was denied the crowning glory in what has already been a record-breaking year. The bourse is barely 12 months old, but its willingness to overlook losses among candidates of a certain scale and its smooth registration-based listing system have proved popular with financial sponsors. More than 70 companies with PE and VC backers have raised $13.9 billion in 2020 to date; this represents 30% and 35%, respectively, of the Asia-wide total.

Of the 34 IPOs of $300 million or above, 12 happened on the Star Market, including five of the top 10. Even as markets like Australia and Japan show signs of increased activity, following a trend apparent in the US, Asia remains a China story. Only three of those 33 offerings did not involve China-based companies and they are relative outliers in their markets: SBI Cards & Payment Services is India's second-largest PE-backed IPO on record; Big Hit Entertainment – best known for managing boyband BTS – ranks fourth in Korea; and mushroom producer Yukiguni Maitake is 19th in Japan.

In 2014, when Alibaba listed in the US, the China share of Asia IPO proceeds hit 75%, up from 53% the previous year, and it stayed at roughly that level through 2019. For 2020 to date, it is 90%. Calculations include offerings by PE-backed Chinese companies in Hong Kong and on the New York Stock Exchange and NASDAQ as well as the mainland. The mainland-only share for 2020 is 49%, versus an average of 26% for the preceding six years.

The rise of the Star Market notwithstanding, it's worth noting that two of the three largest Asia IPOs of the year – and four of the top 12 – were by Chinese businesses on US bourses. Online real estate platform Ke Holdings and electric vehicle manufacturer Xpeng together raised $3.6 billion, about the same as the five largest Star Market offerings.

Ant would have been a huge statement of intent for the mainland's newest exchange and in the future more Chinese companies will likely list closer to home, spurred by reforms in the domestic market as much as geopolitical tensions. However, it will take time for the US to lose its allure as a listing destination for those with the right business model.

Pan-regional plays, China venture and Japan buyout emerged as winners in a difficult environment

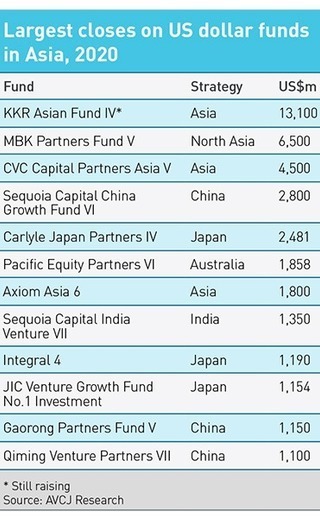

The relatively weak showing from pan-Asian players in fundraising last year was always going to be an aberration. Even as 2019 ended, KKR had launched its fourth regional fund with a target of $12.5 billion, while MBK Partners was seeking $6.5 billion for its latest North Asia buyout offering. They were fortunate to get started before COVID-19 led to the imposition of travel restrictions, effectively curtailing LP due diligence efforts. Equally, they might well have raised capital swiftly anyway.

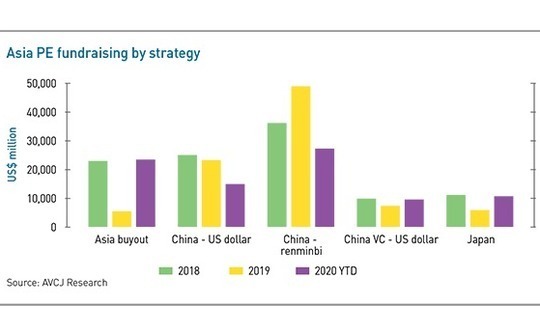

A flight to perceived quality has been a hallmark of Asia private equity fundraising for several years. COVID-19 has prompted LPs to find comfort in names they know well – re-upping with existing managers, backing GPs that they've been tracking for several years, or making commitments to funds launched by global firms. A total of $92.4 billion has been raised in 2020 to date, trailing the 2019 figure of $122.5 billion, though not by as much as might have been expected. But the number of incremental and final closes tells the real story: from 884 in 2018 to 811 in 2019 to 355 in 2020.

Established pan-regional players are beneficiaries of this trend. KKR hit a first close of $10 billion at the end of June and had accumulated $13.1 billion by September. Hillhouse Capital was on course to raise buyout and growth funds of $9.5 billion and $2.5 billion, respectively. MBK and CVC Capital Partners both completed fundraising in the first quarter, the former hitting its hard cap and the latter closing on $4.5 billion.

With Asia private equity fundraising likely to fall below $100 billion for the first time in six years, pan-regional buyout is one of three mainstream strategies to confound the slowdown. The others are China venture capital and Japan buyout.

Given the general appetite for technology among LPs, a China VC revival is not surprising. Across private equity and venture capital, China managers have fared poorly, with commitments falling to $42.7 billion from $73.1 billion in 2019. The renminbi-denominated space remains treacherous, with much of the $27.6 billion raised – it was $49.6 billion last year – going to government guidance funds. GPs with US dollar PE funds have raised $15.1 billion, down from $23.5 billion.

Meanwhile, their VC brethren on the US dollar side have attracted $9.7 billion, bettering the 2019 total of $7.4 billion and nearly matching the 2018 figure. Once again, though, fortune favors the few. Three China VC managers appear in Asia's top 12 closings: Sequoia Capital's latest growth fund at $2.8 billion (part of a $3.68 billion fundraising spree that features separate seed and venture pools); Gaorong Capital with $1.15 billion and Qiming Venture Partners with $1.1 billion.

Japan's popularity has various contributing factors: local LPs reconnecting with the asset class; local GPs becoming more experienced raising capital from international investors; local company owners losing their inhibitions about selling to private equity; and local economic tailwinds.

Commitments to Japan funds stand at $10.8 billion for the year, up from $5.9 billion in 2019. This is underpinned by growing interest in buyouts – the result of a gradual re-engagement by investors as opposed to something more sudden or COVID-19 related – with $4.4 billion raised to date, surpassing the previous record of $4 billion.

There hasn't been an influx of new managers, rather the incumbents are raising larger funds to capitalize on what they see as a growing investment opportunity. The Carlyle Group closed its fourth Japan vehicle at JPY258 billion ($2.45 billion), more than twice as large as its predecessor. Integral Capital also raised a larger sum, becoming the second local GP since the global financial crisis to surpass $1 billion in fund size. Polaris Capital Group is expected to do the same.

Healthcare: More than a COVID-19 play

Technology still dominates Asia deal flow, but healthcare investment is building up momentum

Takeda Pharmaceutical is significant in several respects. At JPY242 billion ($2.3 billion), it is the largest healthcare buyout completed in Japan and the fifth largest in Asia as a whole. It also represents a second buyout and first corporate carve-out for The Blackstone Group's relatively young Japan team. Moreover, this transaction sits at the head of a long line of healthcare deals, with a tail that reaches deep into China's emerging biotech space.

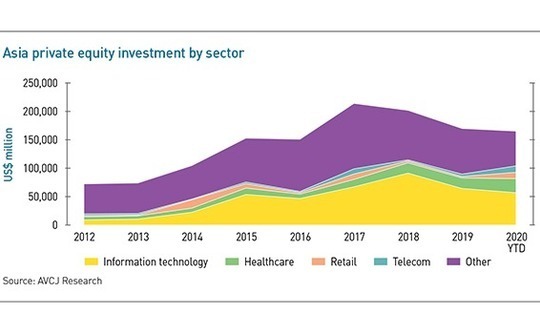

Information technology surpassed financial services as Asia's most active sector by private equity capital deployed in 2014 and it hasn't looked back. Indeed, the gap between tech and the rest has widened: having accounted for 21% of investment in 2014, its share grew steadily, peaking at 45% in 2018. This coincided with the rise of growth-stage technology deals, which accounted for more than two-thirds of the $91 billion put to work in the sector in 2018. There were 29 deals of $500 million or more that year, up from 13 in 2017.

However, starting in 2019, growth-stage tech began to lose its edge, likely driven by a wariness of pre-IPO rounds for unicorns with high-cash-burn business models and no clear path to profitability or liquidity. Growth-stage investment dropped to $35 billion in 2019 and stands at $22 billion in 2020 to date; the number of $500 million-plus rounds dropped to 20 and then eight. With large-ticket deals lacking, the technology sector's share of Asia deal flow has fallen to 38% and now 34%.

Meanwhile, healthcare has come charging through to take second place. For most of the past decade, it has barely scraped into the top five. Then it took second in 2018, third in 2019 and is currently second in 2020. The amount of capital deployed is a record $24.7 billion, beating last year's total of $18.5 billion. It topped $10 billion for the first time as recently as 2015.

More than twice as much money still goes into technology as healthcare, but the latter is responsible for 15% of the $164 billion invested across Asia so far this year, up from 11% in 2019 and 9% in 2018. There is also an increasingly long tail of smaller transactions. Approximately 630 have been announced in 2020 – nearly twice the 2015 level – and only three are $500 million or larger.

Takeda is joined in that triumvirate by two China growth-stage deals involving MGI Tech, a manufacturer of gene sequencing devices, and JD Health, an online-to-offline healthcare business that spun-out from JD.com. Two-thirds of PE and VC investments in the sector are below $200 million in size and half are below $50 million. Nearly half of the sub-$50 million contingent are China-based companies.

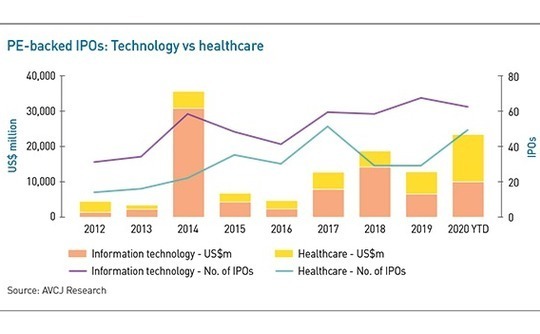

Another compelling reason to invest in healthcare is exits. Asia-based companies have raised a combined $13.3 billion through IPOs this year, more than twice the 2019 total. For the first time, the proceeds from healthcare offerings exceed those from information technology. Healthcare still trails IT in terms of number of IPOs, but even there the gap is closing with 62 versus 49 in 2020.

JD Health alone contributed $3.48 billion to the sector total as it completed the largest IPO by any PE-backed Chinese company in two years, facilitating liquidity events for Hillhouse Capital, CPE, Baring Private Equity Asia, CICC Capital, and China Life. But it is one of a dozen healthcare representatives among the 33 companies that have raised $300 million or more through IPOs in 2020. Seven of them listed in Hong Kong.

The cautionary tale lies in secondary market performance. Hong Kong has seen 13 financial sponsor-supported healthcare offerings this year, according to AVCJ Research's records, and eight of them listed under provisions permitting IPOs by zero-revenue biotech companies. Their relative immaturity lends itself to trading volatility – half are currently below their IPO prices.

The investment revival has been uneven across Asian markets; the exit revival hasn't happened at all

"We joined the prestigious – or maybe the safety-in-numbers – club for the two blockbuster transactions in India this year," Ganen Sarvananthan, co-managing partner for Asia at TPG Capital, told the AVCJ Forum in November. "They are once-in-a-generation opportunities to invest so we partook in these. Did we think we were going to see so much volume coming out of India? We've been pleasantly surprised."

The deals in question are Jio Platforms and Reliance Retail, subsidiaries of Reliance Industries, an Indian conglomerate that wants its future to be about retail, telecom, and digital services rather than oil. Jio Platforms is a holding company for a range of apps, some nascent broadband and cable services, and India's leading mobile carrier. Reliance Retail operates India's largest brick-and-mortar retail network with 12,000 points of sale nationwide.

The two companies are pursuing complementary "new commerce" strategies. JioMart, in which they both hold interests, is intended to serve as an online platform through which Jio Platforms customers order daily goods. An offline store network is already being built out. Reliance Retail, meanwhile, wants to drive supply-side digitization. Its goal is to help 20 million merchants apply technology solutions to their retail processes and supply chain infrastructure.

If executed properly, the strategy could be transformative, potentially creating technology-enabled Goliaths to match the likes of Alibaba Group in China. This is classic FOMO territory. Eleven private equity investors plowed $9.9 billion into Jio Platforms, following commitments of $5.7 billion and $4.5 billion from Facebook and Google. Eight groups then invested $6.4 billion in Reliance Retail. TPG is one of six global players that did both.

Taken in the broader context of Indian private equity, these two deals have completely skewed any notion of a rebound. Investment swung from $5.5 billion in the first quarter of 2020 to a record $12.8 billion in the second – but 75% of the capital put to work went into Jio Platforms. Into the third quarter, there was another $350 million for Jio Platforms and $2.5 billion for Reliance Retail. That amounted to 30% of investment in India.

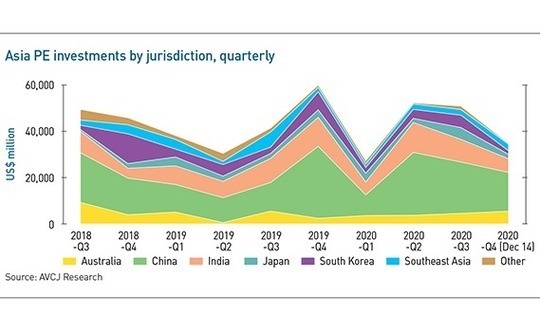

Across Asia, the slowdown in deal flow because of COVID-19 was staggered. Investment came to $27.1 billion in the first quarter, a six-year low. But with new infections under control and people emerging from lockdown, China emerged from relative stasis as other markets were entering it. The country received 55% of capital deployed in Asia in December 2019. This fell to 22% in January-February and rebounded to 61% in March-April.

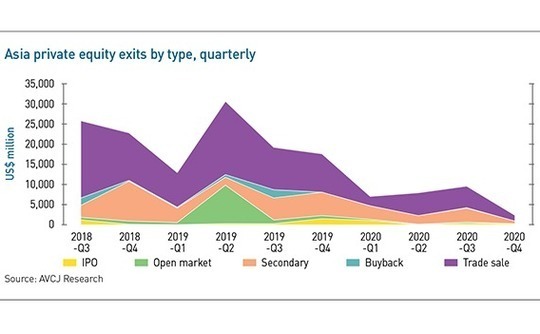

The same cannot be said of exits. The first quarter was Asia's worst since early 2010, with $7 billion generated from nearly 100 deals. Totals of $7.9 billion and $9.5 billion in the subsequent three-month periods represent a scant improvement, with the number of transactions actually falling.

Trade sales are the notable laggard. Buyers are increasingly willing to compromise on certain aspects of due diligence – relying on videoconferencing, virtual site tours, and relying on trusted third-party advisors in the absence of in-person interaction. That said, domestic buyers have advantages in terms of proximity and familiarity.

Of the around 30 announced deals in 2020 to date with disclosed valuations of $200 million or more, nearly half went to other financial sponsors. Only one involved a strategic investor acting outside of its home market or a neighboring geography: the sale of Softex Indonesia to US-based Kimberly-Clark for $1.2 billion. Kimberly-Clark went to great lengths to secure the asset, utilizing resources within the region as well as dispatching people from headquarters who were quarantined at either end of their trips.

Import replacement proves popular as uncertainty clouds the opportunity set outside of China

A decoupling of the US and Chinese economies, leading to the formation of separate ecosystems across trade, technology and even finance remains a largely theoretical concept. The phenomenon will take years to play out and changes in the political winds may impact its intensity.

Forging a private equity investment thesis out of decoupling is, therefore, difficult. For example, there is plenty of anecdotal evidence of companies diversifying their Asia-based supply chains to ease reliance on China and minimize any tariff-based disruption – an ongoing concern despite the phase one trade agreement signed earlier in the year. Southeast Asia is the natural beneficiary of such moves, but this didn't figure meaningfully in private equity investment activity in the region.

Looking at the situation more broadly, US-China tensions are limiting the geographical scope of Chinese companies. The future of TikTok – an international short video platform controlled by private equity-backed ByteDance – remains unresolved after the US threatened to shut down the service. Other players could be dragged into the imbroglio. Meanwhile, India has taken aim at the global ambitions of Chinese tech start-ups by imposing bans on apps emanating from the country.

Twelve months ago, India was a key target for Chinese venture capital and strategic investors alike. Having received no VC attention at all until 2014, activity began to ramp up substantially from 2018. Chinese groups featured in funding rounds for 34 Indian tech start-ups that year and 35 the following year. In 2020 to date, there have just 17 and all but four were completed prior to the bans.

Wary of India, the expectation is that investors will double-down on Southeast Asia. Since 2016, there has been Chinese representation in at least 20 funding rounds each year, with more than 30 closing in each of 2018 and 2019. The running total for 2020 is 23, with the level of activity partly a function of which unicorns – logical targets for strategic investors that work hand-in-glove with certain VCs – are in the market.

This leaves domestic replacement as the preeminent decoupling theme. In May, President Xi Jinping first referenced a "dual circulation" strategy. The government later elaborated that China would rely on domestic production, distribution, and consumption to support its development, with innovation and industrial upgrades underpinning growth. It is the latest and clearest expression of the country's will to lessen dependence on overseas markets and technology.

For those in the semiconductor industry, the self-sufficiency imperative was already well understood. Imports of integrated circuits, otherwise known as chips, amounted to $305 billion in 2019, representing 15% of the country's overall import value. However, ever since Huawei Technologies was blacklisted by US regulators in 2019, putting the company on notice that US companies would cease to be suppliers, calls for a "Chinese heart" – chip and heart are pronounced the same in Chinese – have intensified. Local chipmakers are supposed to step up and fill the void.

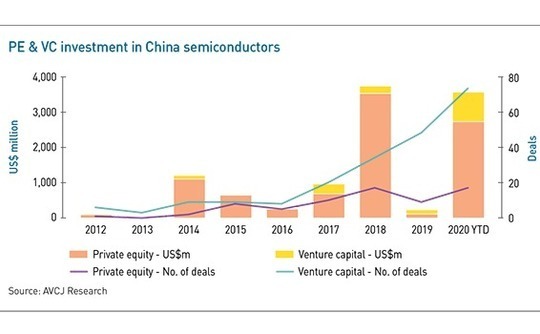

Private equity investment in semiconductors stands at $3.5 billion in 2020 to date, but the numbers are deceptive. Government-backed funds, notably the National Integrated Circuit Industry Investment Fund, are making huge commitments to industry infrastructure. One deal involving Semiconductor Manufacturing International Corporation accounted for nearly two-thirds of all capital deployed. The same thing happened in 2018, when investment reached a similar level.

Venture capital deal flow is more instructive. Between 2012 and 2016, there were 35 transactions. The total rose to 20 the following year and has increased steadily thereafter, with 73 investments announced in 2020. VCs are betting on emerging segments – such as the design and manufacture of artificial intelligence chips that support deep-learning networks and algorithms – where they believe Chinese companies can ultimately compete directly with global leaders.

Yunyinggu, for example, produces chips based on AMOLED (active-matrix organic light-emitting diode) technology, which is used in a specific type of thin-film display. It is the first domestic player to become a top-three supplier in a large-category driver chip segment, challenging the established Taiwanese powers. The company recently raised RMB300 million ($46 million) in Series D funding led by Sequoia Capital China.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.