The big C: China biotech start-ups get cutting edge on cancer

The evolution of cancer treatments in China is a bellwether for biotech development in the country and its capacity for genuine innovation. Most PE and VC investors aren’t shying away

"The core reason for the formation of tumors is the aging of the human body. As people live longer, the chances of getting tumors are greater. In addition, there is no method to completely cure tumors. Mainstream treatments only turn tumors into chronic diseases with super long treatment cycles," says Wei Fu, CEO and managing partner of CBC Group, a specialist healthcare private equity firm. "These challenges have created huge opportunities for therapy developers."

This explains why cancer is gradually surpassing cardiovascular disease as the leading cause of death in high-income countries. While China doesn't yet qualify as a high income, as it gets older and richer, proliferation of cancer is inevitable. This offers some interesting context to the country's efforts in cell-based immunotherapies, one of few healthcare treatment areas in which it is seen by some as a genuine innovative force.

CAR-T cell therapy has emerged as a particular area of focus. The treatment – which involves extracting immune cells from a patient, modifying them, and then returning them to the host to attack tumors – won US approval for use on humans in 2017. Later that year, Chinese cell therapy specialist Legend Biotech out-licensed its own CAR-T solution to Johnson & Johnson-owned Janssen for $350 million. Janssen secured global commercialization rights excluding Greater China.

The country's progress is a function of a supportive regulatory environment. "CAR-T is classified as a medical technology, not a drug. Doctors can initiate clinical trials with internal approval, which speeds up the process for testing on humans, facilitating data accumulation and verification of a CAR construct. That's one reason why some Chinese companies are ahead of their global peers," says Hans Yuan, an executive director at Loyal Valley Capital.

The GP has backed several local CAR-T players, including JW Therapeutics, which raised HK$2.33 billion ($300 million) through a Hong Kong IPO last month. Launched by Bristol Myers Squibb-owned Juno Therapeutics and China's WuXi AppTec, JW targets solid tumors while most CAR-T products in China are initiated for hematological cancers, but it's most advanced products are still in-licensed from the likes of Juno, Eureka, and Acepodia.

"About 600 CAR-T targets have been discovered worldwide and Chinese start-ups concentrated on five or six, making subtle technical adjustments or innovations. In that aspect, they are doing quite well," says Xiaoning Guo, chief medical officer at SciClone Pharmaceuticals. "However, we are still some distance from completely original innovation."

Of scale and cost

The global CAR-T market will be worth $18.1 billion by 2030, up from $734 million in 2019, with China accounting for RMB24.3 billion ($3.6 billion), according to Frost & Sullivan. Still, some China healthcare investors are giving it a miss for now. The sheer cost of scaling is a major issue. CAR-T treatments are personalized, coming in at up to $475,000 for a one-year course.

"We have been closely following cell therapies, but it's still at an early stage with higher uncertainty and higher cost comparing to biological drugs. We prefer to invest in drugs proven by the market," says Denise Chen, executive partner at GTJA Investment Group. Meanwhile, Nisa Leung, a managing partner at Qiming Venture Partners, expresses a preference for universal CAR-T, an allogeneic therapy that is both more versatile and easier to scale.

At least one Chinese company is targeting universal therapies. Gracell, which recently secured $100 million in Series C funding, has developed platforms that reduce the time spent cultivating T-cells and use gene editing to reduce the chances of rejection by the host. The goal is to create off-the-shelf products. US-based Allogene Therapeutics has its own universal Car-T treatment in phase-one clinical trials.

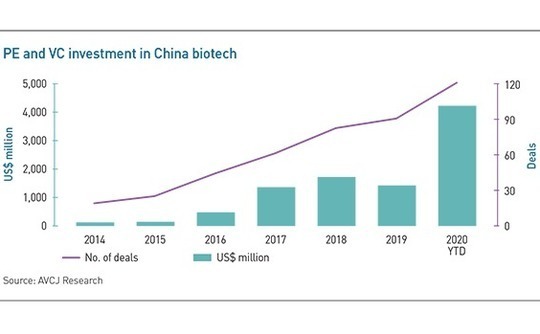

Divided opinion over the potential for true innovation by China in CAR-T mirrors wider incongruities in a domestic biotechnology industry that was red hot even before COVID-19 pricked investor enthusiasm for almost all things healthcare. Approximately $4.1 billion has deployed so far this year, almost equal to the combined total for the three previous years. The number of deals has increased steadily, reaching 120 year-to-date, twice the 2017 total.

The phenomenon becomes more worrisome when biotech companies fail to deliver on listing. Of the 20 or so listings in Hong Kong since the exchange permitted IPOs by zero-revenue biotech companies in 2018, nearly half have sunk below their offering prices. A few smash hits are counterbalanced by some drastic losses, with the likes of Ascletis Pharma and Kintor Pharmaceutical trading at deficits of 80% and 60%, respectively.

"The market forecast of innovative drugs are in many cases over-estimated. They are based on current scientific assumptions, but new therapies are constantly appearing, and traditional therapies may have a second life. When a product gets to market, there may be a big gap between the original estimates and reality. That can have a negative impact on the confidence in the entire industry," says Hong Zhao, CEO of Sciclone.

Indeed, some veteran healthcare investors are now avoiding innovative drugs in a bid to escape unrealistic valuations. Steven Wang, founding partner of HighLight Capital, notes that the capital required to develop a new drug is significant but the retail price set for treatments that qualify for reimbursement under government-backed insurance plans might not be that high. "The book value doesn't matter; it matters how much cash you get on exit. In China, the new drug investments have not yet been verified on large scale," he warns.

Beyond chemo

For those that want to engage in new drug development, chronic diseases like diabetes and lung and liver cancer are logical places to start, given their prevalence in China. The emerging frontline treatments for cancer are immunotherapy - of which CAR-T therapy is an example - and molecular interference, whereby specific molecules are targeted to stymie the spread of disease. This is distinct from chemotherapy, which involves interfering with all rapidly dividing cells.

Molecular targeted drugs are considered more effective and less harmful than chemotherapy. Between 2006 and 2016, their share of all anti-cancer drugs rose from 78% to 90%, according to IMS statistics. Development is ongoing because drugs can be designed to target different gene mutations, thereby widening the potential patient pool.

Chinese players perform well with certain targets. Earlier this year, Jacobio Pharmaceuticals Group, which is backed by Qiming and Hillhouse Capital, struck an out-licensing deal with US-based Abbvie regarding its SHP2 inhibitors, which target a key node in cancer and immune cells. Suzhou-based GenHouse Pharmaceuticals reached a similar arrangement with Huya Biosciences International with upfront and milestone payments of up to $282 million.

Another emerging frontline treatment widely pursued in China and globally is immune checkpoint inhibitors, a kind of immunotherapy best exemplified by PD-1 inhibitors. Immune cells, or T-cells, distinguish between normal cells and abnormal cells, but when a specific protein on the surface of a cancer cell binds with a protein on the T-cell, this detection system is impaired. PD-1 inhibitor prevents the proteins from interactions, so the cancer cannot evade the immune system.

The world's first PD-1 inhibitor was approved by US regulators in 2014 and China quickly followed suit. In 2018, two leading US products from Bristol Myers Squibb and Merck entered the China market, coinciding with local players Innovent Biologics and Junshi Biosciences achieving PD-1 new drug approvals.

Junshi, which earlier this year become the first Chinese biotech to list in the mainland and Hong Kong, received backing from Loyal Valley in 2016. PD-1 was a key consideration. "The first and most important product in immunotherapy is PD-1, and the key in choosing a specific PD-1 treatment is drug efficacy. We looked at a lot of clinical data and consulted many clinicians, and we concluded that Junshi had the best PD-1 product," Andy Lin, founding partner at the firm, told AVCJ in July.

Innovent – another PE-backed player that went public in Hong Kong in 2019 – is the first and only company to have a PD-1 inhibitor included in the reimbursement list. This widens its potential use but the company was forced by regulators into a price cut of more than 60%.

Price competition is accelerating. While Bristol Myers Squibb and Merck offer the best value for money, with courses of RMB30,000-60,000 per year, Junshi's product is available for RMB187,200. Hengrui Medicine, a traditional pharmacy and a late arrival in the market, won approval for its PD-1 drug last year and recently launched a promotion priced at RMB39,600.

The sales push worked, with Hengrui reporting revenue of RMB2 billion for the first half of 2020. This compares to RMB921 for Innovent, RMB426 million for Junshi, and RMB343 million for BeiGene, the fourth local player in the PD-1 space.

"The traditional pharmacies have stronger sales channels and marketing capabilities. I think they will take a large part of the new drug market," says Sean He, Vice President responsible for investments in healthcare in China at Advent International, "A lack of skill in commercialization is the start-ups' shortcoming."

This ability to minimize costs and be competitive on pricing could open the door to overseas markets. In August, Innovent secured an out-licensing contract with Eli Lilly for its PD-1 inhibitor with an upfront payment of $200 million and a further $825 million in milestones. However, beyond the four leading domestic PD-1 players, the market lacks quality.

"Product homogeneity is a serious issue," says Gaoguang Song, head of healthcare investment at Northern Light Venture Capital. "Their products are so similar, you might change the name on the packaging and not be able to tell the difference. Companies lagging behind have no chance of commercialization because the incumbents are dominant."

Still inhibited

Drug developers have responded to challenges in PD-1 by looking for other opportunities in immune checkpoint inhibitors. According to GTJA's Chen, a certain inhibitor is only effective in 20-30% of cancer patients, so there is plenty of scope for new treatments.

CD47 and CD48 are seen as the natural successors to PD-1. They inhibit "don't eat me" signals sent by cancer cells to specialized immune system cells that destroy bacteria and other harmful organisms. As with PD-1, the key is disrupting lines of communication. In September, I-Mab Biopharma, a drug developer established by CBC that listed in the US at the start of the year, out-licensed its anti-CD47 monoclonal antibody to US-based AbbVie for $180 million upfront and milestone payments that could reach up to $1.74 billion.

Local players looking to source CD47 rights from overseas are picking their targets carefully. SciClone has in-licensed a small molecule immunotherapy currently undergoing phase-three clinical trials in the US for small cell lung cancer from San Diego-based EpicentRx. The upfront payment is undisclosed while EpicentRx will receive up to $120 million in milestones.

"We looking for differentiation. While most CD47 are big molecule antibodies, ours is a very safe small molecule, safer than any antibody. Large molecule antibodies may focus on hematomas, and we focus on solid tumors," says SciClone's Guo.

The drug is also a good fit for China, given small cell lung cancer is relatively common in the country compared to the US. "China will contribute 80% of patients, so the US only needs to conduct 20% of its original clinical trials. They can leverage the data we accumulate," Guo adds. "Such collaboration speeds up the whole process and makes it cost-efficient for EpicentRx. The drug might be approved by China and the US at the same time."

Another branch of immunotherapy attracting interest is antibody-drug conjugates (ADCs), which combine the targeting capabilities of antibodies with tumor-killing drugs. The antibody identifies a cancer cell, binds to it, and a toxic agent kills it. Healthy cells are spared, so the side effects of treatment are limited.

RemeGen, a Chinese drug developer, secured a $100 million round led by Lilly Asia Ventures and Lake Bleu Capital in March to accelerate development of RC48, the first ADC to enter clinical trials in China. It has completed phase-two trials for gastric and urothelial cancers.

Other local players are in-licensing. Everest Medicines, a company seeded by CBC that went public in Hong Kong in October, has secured rights to the first US-approved ADC for breast cancer. Cstone Pharmaceuticals – another PE-backed drug developer that listed in Hong Kong last year – has reached an agreement with Korea's LegoChem Biosciences for a pre-clinical ADC drug. It paid $10 million upfront for global rights ex-Korea.

While ADCs effectively weaponize antibodies using anti-cancer drugs, virotherapy reprograms viruses to destroy cancer cells. China's Virogin Biotech received $62 million in Series C funding in September led by CDH Investments and State Development & Investment Corporation (SDIC) to support the development of its lead asset in this area. Phase-one trials are taking place in Australia and due to begin in China later this year.

Dan Liu, the healthcare executive director at CDH's Venture and Growth Capital, tells AVCJ that his team spent an entire year tracking 70 virotherapy start-ups and studying the technological evolution of the treatment over decades. He also drew a treemap that tracked relationships between the key figures – who is from which laboratory, who founded which company, which tech route an individual company was taking. Ultimately, this led to the selection of five target companies, two of them China-based.

"I am highly confident that virotherapy will be the next wave. Some investment organizations may offer a term sheet tomorrow after reading it today, but my method is a better guarantee of a good return," Liu says.

Permanent evolution

Arguments over innovation and concerns about valuations notwithstanding, the evolution of cancer therapies in China offers insights into how domestic drug developers are progressing as an industry. They may start with low-tech generics, then move on to biosimilars, and then "me too, me better" drugs, which refers to treatments already verified in overseas markets but developed independently in China. The structure and effect of these drugs can be different to the originals.

"If you look at Hengrui, you can see the development path of Chinese drug developers. Hengrui earned its first pot of gold in generics, then it launched PD-1, and now it is beginning original innovative drug development," says Advent's He.

Even the window for "me too, me better" is closing, according to Loyal Valley's Yuan. Start-ups in China are moving so quickly, some are working on new targets that are still in early-stage clinical trials overseas. A few are developing first-in-class novel drugs. Meanwhile, these companies are no longer confined to a single role. "We license-in to serve China's unmet needs, we also develop in-house drugs for tomorrow. You should walk with both legs, right?" says CBC Group's Fu.

He believes that the country's innovative drug market has yet to fully show itself – as little as 10% is currently visible. And it still lags the US, despite the huge progress made in cancer treatments in recent years. "It is precisely because of the backwardness that there are investment opportunities. When it really matures, those opportunities shrink," Fu adds.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.