Taiwan & tech tensions: Silicon island

Taiwan’s technology sector must play an awkward balancing game amid US-China tensions. This could be a surprisingly favorable position for opportunistic investment and global diversifications

A forced operational shakeup at the world's largest independent chipmaker might normally be seen as a sign that the US-China decoupling phenomenon is destabilizing Taiwan's technology investment opportunity. But by dialing back some of the ambiguity that defines and restrains this market, it might be doing just the opposite.

Taiwan Semiconductor Manufacturing Corporation (TSMC) became a symbol of tech war collateral damage this year when US export regulations required the company to cut off trade with Huawei Technologies, its second-largest customer after Apple. This coincided with an announcement that TSMC would construct a new chip factory in the US. TSMC stock has boomed this year, giving the company a market capitalization of NT$12.8 trillion ($448 million), or about one-third of the entire Taiwan Stock Exchange's market capitalization.

To some extent, the episode helps illustrate how the impact of US-China tensions on Taiwan has been less costly than initially feared. By being obliged to choose sides, tech companies are starting to defuse some of the political murkiness that has made Taiwan a questionable investment destination in recent years. This is especially true in areas like 5G and artificial intelligence (AI), which are enabled by the dominant local semiconductor industry. COVID-19 and the US election are the biggest wildcards in this story but not expected to be long-term spoilers.

Taiwan's attempts to diversify its trade relations away from mainland China have not been stalled by the advantages of cross-strait economic ties during the pandemic. At the same time, work-from-home policies in other countries have supported more geographically diversified exports related to 5G and digital infrastructure. A lockdown-driven surge in demand for computers and consumer electronics may level off in 2021 since these are seen as one-off purchases, but cloud and data services demand will remain strong as countries push for digital transformation post-pandemic.

"The outlook for Taiwan's tech sector should still be positive in 2021. So far, Huawei is the only really big company the US has sanctioned, and it is only 10-15% of TSMC's revenue," says Tieying Ma, a Taiwan-focused economist at DBS Bank. "Before and after the tech war, China has always accounted for more than 50% of Taiwan's tech exports. That hasn't changed, and we don't expect it to change, especially in semiconductors."

Meanwhile, there is little expectation that a more measured China policy from incoming US president Joe Biden will translate into substantive changes in terms of tech protectionism. There is, for example, cross-party support in the US for the recently mooted "CHIPS for America" act, which would feed the Taiwanese economic diversification narrative by providing $22 billion in incentives over the next 5-10 years to encourage more of TSMC's counterparts to follow in its footsteps.

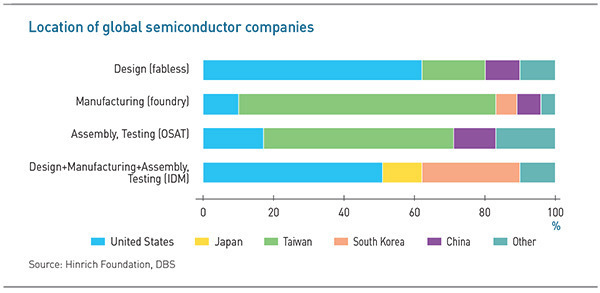

"Taiwan is pivotal because it's going to be a litmus test of Biden's approach to Asia and its semiconductor capabilities are crucial to both the US and China," says Stewart Paterson, a research fellow at the Hinrich Foundation and founder of Capital Dialectics. "If US export controls are going to have any impact, they have to extend to Taiwan. There's no point banning equipment companies in the US from exporting to China and then allowing TSMC to use that same equipment to manufacture and export to China.

"The agenda on China has moved on from the Obama era, and we're not going back to that even if some of the personnel with Biden are the same."

Expansion plans

The question remains what all this means for private equity. Global GPs are attracted to the production efficiency in Taiwanese tech but seldom see an unmissable opportunity in terms of patentable intellectual properties that cannot be found anywhere else. This has made it difficult to overcome hurdles related to the smallness of the companies themselves as well as the market's fluid political and regulatory risk factors.

The Taiwanese government has a history of nixing tech buyouts, and that does not appear likely to change. This has proven true with mainland and global buyers alike, as evidenced by The Carlyle Group's $6 billion bid for Advanced Semiconductor Engineering in 2007 (withdrawn in the face of opposition) and KKR's $1.6 billion move for electronic components manufacturer Yageo in 2011 (rejected).

The impression is that delisting homegrown champions is still considered a matter of face, resulting in an essentially intractable situation for would-be buyers regardless of developments in the macro backdrop. As one investor puts is: "A very experienced lawyer here in Taiwan advised me to avoid the global number one or number two if it happens to be a Taiwanese company. If that's your target, it's likely a ‘no' for the regulators."

Still, the geographic diversification of operations among Taiwanese tech companies in light of rising Chinese labor costs and the standoff with the US does present an opening for private equity in the form of overseas M&A support. This approach gives investors access to the sector's pandemic-related upside without having to be in the driver's seat in a market with too much policy uncertainty.

Investor interest in these deals will be mostly associated with smaller companies. Deals such as TSMC's US expansion, for example, will remain unfeasible or unpalatable to most. Pure downstream manufacturing and mid-stream assembly expansions in Southeast Asia will likewise be less attractive.

The key to the opportunity is that many Taiwanese strategics will be chasing more advanced assets with greater growth potential in the US, Europe, and to a lesser extent Japan. This will encourage participation by global investors that are likely to be more comfortable with those jurisdictions. Domestics investors going down this path include the National Development Fund.

Vincent Chang, head of private equity at KPMG Taiwan, estimates the number of Taiwanese companies he sees looking to acquire technology operations abroad has increased 20-30% this year. He describes these deals – most of which target the US – as a win-win: GPs get access to tech upside with the commitment of relatively minimal resources, while Taiwanese companies can reduce their risk exposure and receive support in areas like post-acquisition integration.

"PE firms must bring something other than money to the table for these kinds of deals because Taiwan's technology companies either don't need the money or they can easily source it," Chang says. "Those companies are really looking for someone who can either help them expand in another market or help them manage a company in a better way by doing things like finding new customers. Buying something and turning it around is the value driver for them too."

There is potential for a long game to be played here for GPs interested in eventually seeking a controlling in stake in either the parent company or the acquired subsidiary. These opportunities could multiply as pandemic-related pressures in certain overseas markets make assets more attainable targets for comparatively unscathed companies in Taiwan and as tech war-related sanctions keep mainland competition at bay.

Further support for the trend will come with the gradual improvement in corporate and government sentiment toward the asset class. The landmark deal on this front was a KKR-led consortium's acquisition of LCY Chemical for $1.6 billion last year. Gordon Shaw, a managing director at Baring Private Equity Asia, also sees outbound partnerships as a way for Taiwanese strategics to achieve vertical integration and better understand their downstream business.

"If you're a Taiwanese manufacturer for a branded customer in the US and your strengths are only in production as opposed to sales, marketing, or product development, then you should consider teaming up with private equity to acquire a minority stake in one of your customers overseas," says Shaw, who is on the committee for PE at the American Chamber of Commerce in Taipei.

"It will be easier for us to attract world class management for the target company than it will be for a family-controlled company in Taiwan. When we need to exit, you could become the controlling shareholder or piggyback and make some money by selling your stake."

Unicorn ambitions

C.Y. Huang, president of Taipei-based investment bank FCC Partners and chairman of the Taiwan M&A and PE Council, sees a bright future for local operators reaching out to global markets with a view to plugging internet-of-things (IoT), 5G, and AI-related technologies into new device concepts such as smart speakers and electric vehicles (EV). But he hopes this process will entail the creation of more innovation-oriented unicorns than traditional suppliers in the vein of TSMC.

"The difference between Taiwan and Israel is that Israel is shooting for the world from day one, while Taiwan is shooting for the world's biggest corporations as customers without thinking about end-markets in the US, China, and Southeast Asia," Huang says. "US-China tensions could help Taiwanese start-ups go abroad long term, but the challenge will be going from B2B to B2C. For example, they have correctly identified EV as the next area of growth, but they're not thinking about how to connect with people – they're just thinking about how to please Tesla."

AI and IoT appear to be sizing up as the most likely segments for Taiwan's unicorn ambitions following a flurry of ecosystem creation activity.

IBM was among the earlier movers, having set up its local R&D unit in 2011 and then expanded capacity in 2018 to include AI and blockchain. Microsoft established its IoT center in 2016 and committed to a major cloud skills buildout in 2020. In 2018, Google confirmed it would hire 300 people in Taiwan and train 5,000 more in AI, while Amazon teamed up with FCC Partners to launch a cloud, big data, IoT, and AI center.

Last August, construction began on what is being called Taiwan's first AI park. The $460 million project will cover 53,00 square meters and feature four 17-story building hosting AI start-ups and related companies.

There is much skepticism about how much projects of this kind will support the creation of independent consumer-facing unicorns. Nevertheless, the confidence in Taiwan demonstrated by US tech giants during an escalation in US-China decoupling bodes well for the market's continued viability.

"When high-tech companies choose their partners for next-generation developments, it's not just about cost and efficiency, it's about trust and security," says Roy Chun Lee, deputy executive director for the Taiwan WTO and Regional Trade Agreement Center at the Chung-Hua Institution for Economic Research. "That's not just trust company to company – it's the government's commitment to secure Taiwan as an environment to develop technology."

A fine line

There is a chance that further escalation of decoupling tensions in the years to come could ice Taiwan's plans for a start-up breakout, especially if the local government gets in on the act. Taiwanese AI companies looking to tap massive mainland opportunities in financial services, e-commerce, and healthcare, for example, could ultimately be hamstrung by the protectionism that helped them get incubated.

"There are no restrictions yet on Taiwanese AI start-ups engaging with Chinese counterparts, but I think it's likely in the next 12-24 months because it's becoming a trend for democracies to impose some kind of national security-based regulations on AI and data-based services," Lee adds. "It probably won't be 100% restricted, but there will be some limitation."

The comments come during a distinct warming trend for US-Taiwan relations, including high-level talks last week that outlined plans for a five-year technology cooperation agreement. For Taiwanese tech companies and their investors, the important point to keep in mind will be that while these kinds of developments may help expand global reach, they do represent substantial business and political risk.

"Taiwanese technology has a tremendous opportunity as a result of US-China tensions because it can enjoy very robust growth supplying both sides. But it must maintain the same distance between them," says FCC's Huang. "If Taiwan gets too close to one side and irritates the other, it will pay the price."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.