Japan fundraising: Middle-market machine

Buoyed by strong macro fundamentals and robust returns, Japan’s buyout managers continue to attract capital while most other strategies across Asia struggle. Will this popularity be sustained?

Annual Asia private equity fundraising first surpassed $100 billion in 2014 and hasn't looked back. That streak could be broken in 2020, with approximately $80 billion raised to date and COVID-19 travel restrictions continuing to play havoc with due diligence efforts. For most LPs, if a manager isn't already in the portfolio or in the pipeline, making a commitment becomes that much harder.

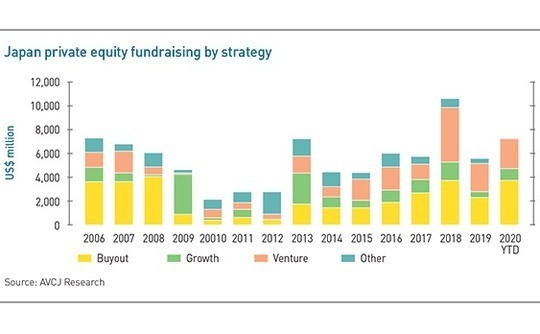

Only two strategies confound this trend. Chinese venture capital managers and Japanese buyout managers have already accumulated more capital this year than they did in the entirety of 2019.

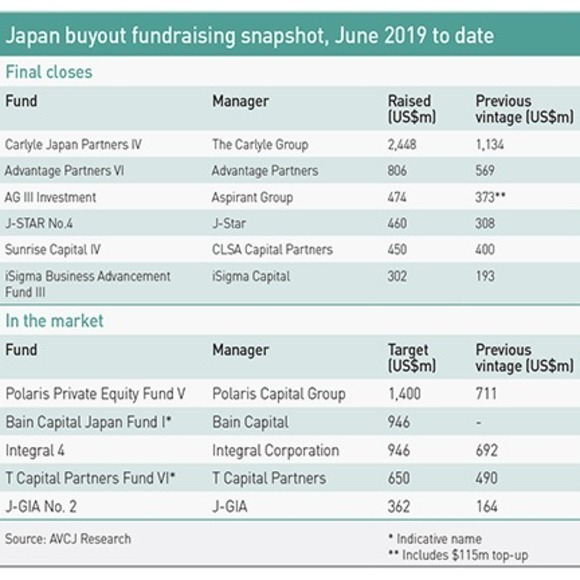

Indeed, Japan looks set for a record fundraising year. Local buyout managers have received $3.7 billion to date, according to AVCJ Research. The $4 billion raised in 2008, marking a pre-global financial crisis high point, is within touching distance. Excluding capital already committed to first closes, five GPs currently in the market could add $3 billion to the headline number by year-end.

There are various contributing factors, from local LPs rediscovering their appetite for the asset class to local GPs becoming more experienced raising capital from international investors to local company owners losing their inhibitions about selling to private equity.

However, the most compelling reason is arguably economic. Monetary easing and fiscal stimulus policies introduced in 2012 by then Prime Minister Shinzo Abe – which are likely to be retained under his successor – have turbocharged the economy. They offer helpful tailwinds to a Japan middle-market investment thesis typically underpinned by relatively low entry valuations, modest leveraged financing, and the scope for operational improvement.

"Since 2012, it's been a benign macro environment with monetary easing, readily available loans, and stock market strength. Corporates are flush with cash so there are plentiful exit options as well," says Jun Tsusaka, a managing partner of NSSK. "LPs might ask why they should invest in Japan when they can get good returns in North America. Well, those returns have been challenged because pricing has gone up. In Japan, pricing is lower than in North America, Europe, and Asia. Net-net, you are now seeing consistent and attractive returns out of Japan, and deal flow is strong."

It is a theory that exists in anecdote rather than in hard numbers – while commitments to US dollar-denominated China funds are down, VC is flying – but investors with heavy China exposure in Asia might want to diversify their portfolios. And Japan is perhaps the antithesis of China: slower growth, smaller scale, and fewer start-ups on steroids; but traditional buyouts, conservative valuations, and a reputation for stability. Japan's economy is also less correlated to China than others in Asia.

"We are seeing greater interest from overseas investors and it is synchronized with increasing tensions between China and the US," says Greg Hara, a managing partner at J-Star. "Western investors have made so much money in China, mainly from VC and growth capital. Now they appear to be more cautious. If they are managing portfolios geographically, with a certain allocation to Asia, when they look at Asia ex-China maybe Japan middle market buyouts come up."

Others subscribe to the notion of Japan as anthesis without necessarily tying it to US-China issues. The economy is developed and stable and the private equity industry has a track record of delivering returns with no venture-style risk. Niklas Amundsson, a partner at placement agent Monument Group, suggests that these characteristics are appealing to international investors during times of global insecurity. There might be some truth to this, but Japan is also a slow-burn story.

Return to form

The tide began to turn in 2013. During the three years to 2008, $20 billion was committed to country-focused across all strategies. Buyout managers received $11 billion – nearly twice what they had raised in the entire history of Japanese PE to that point. A few blow-ups and generally dispiriting returns followed, prompting many LPs to pull back and some GP to drop out.

Adams Street Partners made its first commitment to a Japanese manager in 2013, when fundraising recovered to $1.7 billion after four years of sub-$1 billion totals. Yar-Ping Soo, a partner at Adams Street, describes a market that had gone through a period of consolidation as the weaker players were rooted out, resulting in reduced competition for deals. Abenomics had yet to make its mark.

"Nobody was interested in Japan, but we had been tracking the market and we started to see valuations dropping and the number of competitors going down," she says. "It used to be every bank was investing in private equity, but they were shutting their businesses, and global funds that had set up shop in Japan went away. The prices were low, we thought it would be good to step into the market and that call was proven right. I just wish we had done more."

Middle-market managers as a group have raised more in every vintage since then. This was most visibly demonstrated in 2017 when six final closes – at their respective hard caps – were announced in the month of April alone. There were four more by the end of the year, taking the aggregate to $2.7 billion. It hit $3.7 billion in 2018 with the addition of some larger-cap funds.

The rich vein in fundraising coincided with a surge in local investor sentiment. There were approximately 80 buyouts in Japan in each of 2016 and 2017, compared to an average of 50 for the preceding four years. Activity was concentrated towards the smaller end of the spectrum – during the two-year period, two dozen buyouts of $100 million and above accounted for 90% of capital deployed – and local GPs were expecting more of the same.

Deal flow has since dropped off, but managers remain bullish. "In the last 4-5 years, founder-succession has been 60% of the market and 75% of what we have done. We're now seeing another wave of carve-outs coming through and they are more accessible to PE than in previous cycles," says Richard Folsom, a representative partner at Advantage Partners. "Carve-outs are somewhat cyclical, but succession deals are not. There's an ongoing underlying demographic theme there."

Advantage is a prime example of how fortunes turned. Having raised a bridge vehicle in 2013 to restate its middle-market credentials following a troubled previous cycle, in 2017 the firm's closed a full-size fund at JPY60 billion ($569 million). Local LPs accounted for 65% of the corpus as insurers, pension funds, trust banks and regional banks returned to the asset class.

For the current vintage, J-Star and CLSA CP saw no change in their foreign-domestic LP ratios, but they were already skewed towards foreign investors. Advantage, meanwhile, closed Fund VI in April at JPY75 billion, with a 50-50 split. Aspirant Group completed fundraising for its third vehicle last November with JPY50 billion and the overseas LP share went from zero to 45%.

T Capital Partners is looking to perform the same feat with a target of JPY70 billion for its sixth fund, having spun out from local insurer Tokio Marine. The firm closed its fifth vehicle at JPY51.7 billion in 2017. Integral Corporation's fourth fund is expected to close at JPY100 billion with as much as 50% of the money coming from overseas, compared to 25% out of JPY73 billion in the previous vintage.

Collecting capital

These shifts are partly driven by necessity: the pool of domestic capital might be growing, but it is still finite, so an increase in fund size might involve a wider marketing effort. Polaris Capital Group raised JPY75 billion for its fourth fund with a 50-50 split. Seeking up to JPY150 billion for Fund V, the overseas share may grow – as suggested by Pennsylvania Public School Employees' Retirement System and Canada Pension Plan Investment Board writing large checks.

At the same time, Japanese GPs and international LPs appear better equipped to deal with one another. On the manager side, domestic PE firms have strengthened their investor relations and back-office functions in recent years, and they are generally more comfortable engaging with foreign investors. However, it is debatable how widely reforms reach.

"Even if the track record is good enough for a global audience, the presentation style often is not. We are pulling teeth trying to get information from them because they are not used to presenting," says one placement agent. "More managers are now good at marketing, but it's a small cadre, maybe two handfuls."

Fashioning a story for an international audience is time-consuming. A different agent, Monument, ran the most recent Aspirant fundraise. Three dozen reference calls conducted before taking on the mandate were transcribed and translated into English and placed in the data room. Fundraising documentation was translated into English and revised to meet international criteria, while due diligence calls involving team members with limited English had to be simultaneously translated.

CLSA CP and J-Star are to some extent fortunate that they were set up to accommodate foreign investors from the outset. Most funds comprise a Japan limited partnership and a Cayman Islands feeder vehicle for foreign investors, but CLSA CP was always unusual in its preference for a Cayman limited partnership. "We seem very foreign to domestic investors," says Megumi Kiyozuka, a managing director at the firm, adding that all internal and external documentation is in English.

J-Star's first fund was backed by Secured Capital Japan, which in turn drew on commitments from California Public Employees' Retirement System (CalPERS) and Pacific Life Insurance. Broadening the LP base for Fund II was difficult, but at least there was some momentum. Hara questions whether smaller managers starting out from scratch can justify the cost of targeting overseas LPs. It is not just a matter of hiring English-speaking IR professionals.

"We end up managing four parallel offshore funds – it would be much more cost-efficient to have a single fund, domiciled in Japan," he says. "From a GP perspective, it's not worthwhile unless you are at least $200-300 million in fund size. New guys normally cannot start at $200-300 million because they don't have the track record."

If managers can invest in establishing a platform that is structurally and commercially appealing, they might find an increasingly receptive audience. One GP drily observes that "LP perceptions often lag what's happening in the market by 2-3 years," but investors appear to be reengaging with Japan at different speeds.

Several firms have succeeded in attracting new investors despite the limitations imposed by COVID-19, although in almost all cases these are LPs that have previously met the GPs. One fund – sources requested that it not be named – received commitments from two new investors that had considered participating in the previous two vintages and ultimately declined. As such, they have been conducting off-and-on due diligence for 10 years. A third LP hasn't set foot in Japan but made a substantial investment based on video calls and work done by its advisor.

"In 2016-2017, the interest was from fund-of-funds and consultants, mainly international investors with Asian offices. Today we see more direct interest from investors that don't have offices in Asia," says Monument's Amundsson. "It helps that in the last few years global investors have stepped up their activity in Japan. When they come around marketing their Japan story, LPs think they should get some exposure to the middle market as well."

For sub-$1 billion funds, these tend to be endowments and foundations, insurance companies, family offices and gatekeepers, rather than US public pension funds and sovereign wealth funds. One local advisor recently provided counsel to the Harvard endowment on opportunities in Japan's middle market.

Sustainable alpha?

This interest is undoubtedly returns-driven and there is a sprinkling of individual highlights: CLSA CP, J-Star and T Capital defying the global financial crisis to deliver gross multiples of 3x or more on 2005-2006 vintage funds; Advantage's return to form with its bridge vehicle; T Capital never losing money on a single deal; NSSK achieving top decile status within the global middle-market buyout category based on distributions from its 2017-vintage second fund.

However, performance is not uniformly strong across the segment. Net multiples for funds raised between 2010 and 2014 range from 1x to 3.3x, according to data pertaining to eight middle-market managers shown to AVCJ. Nevertheless, several industry participants have observed a halo effect in the market, with unfulfilled demand for heavily oversubscribed funds spilling over into perceived "next best options."

There aren't necessarily more managers in the market but most of the incumbents are raising larger funds. A frequent observation in recent years is that increased intermediation and rising competition has pushed entry valuations from 5-7x EBITDA into double-digits.

"Aggregate dry powder in Japan exceeds the potential investment opportunities at this moment. It is most excessive in the large-cap space, but it's still excessive in mid-cap and slightly excessive in small-cap," says CLSA CP's Kiyozuka. "It is harder to identify non-negotiated deals, even in the lower mid-cap space. More sellers are retaining advisors and arranging auctions, so you have to pay a higher price."

For this reason, the GP sanctioned a relatively modest $50 million increase in fund size to S450 million for the current vintage. Others are not being so restrained, to the point that the existing middle-market structure – Advantage and Unison Capital in the upper segment, everyone else in the lower segment – is fragmenting. The likes of Polaris and Japan Industrial Partners have the capacity to challenge for deals in the lower reaches of the pan-regional buyout fund range.

"The opportunity set is there and continues to grow and private equity as a group is underpenetrated in overall M&A in Japan. More PE capital will lead to more penetration, which is still plus or minus 10% of the market," says Folsom of Advantage. "If a single GP raises too large a pool of capital that could put pressure on them to do something outside of scope or outside of where the market opportunity really is. That is a continuous dialogue we've had with LPs."

For all the current interest in Japan, concerns about a potential demand-supply mismatch, are causing some to question the implications for future performance. "Fundraising is great right now, which is justified," says one advisor. "Will this be a good vintage? I don't know, ultimately."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.