China guidance funds: Money monsters

Government guidance funds are the policy-driven big beasts in China’s renminbi-fundraising landscape. While GPs may have little choice but to engage, they can do so judiciously

Hefei, a city of approximately six million and the capital of Anhui province, is an unlikely star in China's private equity firmament. But in April the municipal government turned around the fortunes of leading electric vehicle manufacturer Nio, pumping RMB7 billion ($1 billion) into the cash-strapped company and helping breathe new confidence into the wider industry.

Nio's US-listed shares were trading below $3 prior to the bailout. They are now around $28. As part of the deal, the company agreed to establish its headquarters in Hefei. It also transferred core assets to a government-backed entity.

This is not an isolated example. In 2007, Hefei supported BOE Technology, promising substantial funds for new production lines. At the time, BOE was a loss-making company. Today, it is the world's largest manufacturer of liquid crystal display (LCD) panels and generated a net profit of RMB1.9 billion last year.

In 2016, the Hefei Industrial Investment Fund teamed up with Shanghai-listed GigaDevice Semiconductor to form Changxin Memory Technologies, committing about RMB220 billion. The company became China's first and only producer of DRAM, a type of random-access semiconductor memory critical for data storage.

"There has been an interesting debate recently as to whether government-backed funds should adopt the Hefei model which is similar to gambling, or the sprinkling approach which spreads the risk," says Liyong Zhou, a general manager in the VC unit of Shanghai STVC Group, one of China's earliest government guidance fund in venture capital.

There is little debate about the significance of government guidance funds to private equity managers raising renminbi-denominated pools of capital. But they are a polarizing force. These vehicles follow a policy agenda – such as stimulating inbound investment in a certain city or province – that takes precedence over financial returns. Many industry participants do not regard them as a health commercial force.

"The fundamental purpose of a guidance fund is to support the objectives of the government: promoting local GDP development, creating jobs, increasing tax revenues, and attracting new industries like electric vehicles or biotech. As a result, they are not entirely market-oriented in the way they administer the fund", says Teck Yong Heng, founder of C2 Partners who previously worked for QianhaiFoF, a renminbi fund-of-funds set up by the former chairman of Shenzhen Capital Group.

Hobson's choice?

While guidance funds make direct investments, they primarily act as LPs, leveraging GPs to amplify the impact of their capital. Some GPs might be willing to be leveraged, given the lack of other capital providers in the renminbi space.

Local currency fundraising in China peaked at $97.9 billion in 2016, buoyed by a string of huge guidance funds, according to AVCJ Research. A total of $85.6 billion went to renminbi vehicles the following year, though the number of closes doubled as financial institutions, listed corporates, and high net worth individuals piled in.

The tide turned in 2018, notably because of restrictions on how financial institutions could participate in the asset class. Since then, annual fundraising hasn't surpassed $50 billion; it stands at $24.7 billion so far this year. Guidance funds aren't as big as in 2016, but they still represent the largest LP constituency. By the end of 2019, their aggregate target scale exceeded RMB10 trillion, with RMB4.69 trillion actually raised.

"Guidance funds are not the best choice for GPs but there is no other choice. To meet the government's non-financial requirements is a greater challenge," says Frankie Fang, founding managing partner of China-focused fund-of-funds Starquest Capital.

There is no suggestion that the imbalance might be redressed. Indeed, a recent report by the China FOF Alliance, an industry association for fund-of-funds in China, concluded that most independent fund-of-funds are becoming more like government-guided managers. It is a logical response to reduced demand from other LPs.

"The money is concentrated at two ends. Government guidance funds and high net worth individuals have deep pockets, while independent fund-of-funds have run out of dry powder," says Wayne Shiong, a partner at China Growth Capital, which is currently raising a renminbi fund.

There is considerable variety within the guidance fund community. On a basic level, there is national versus local. The National SME Development Fund, which achieved a first close of RMB35.8 billion in June against a target of RMB100 billion is an example of the former. It was initiated by the Ministry of Industry & Information Technology (MIIT) and received a substantial commitment from the Ministry of Finance.

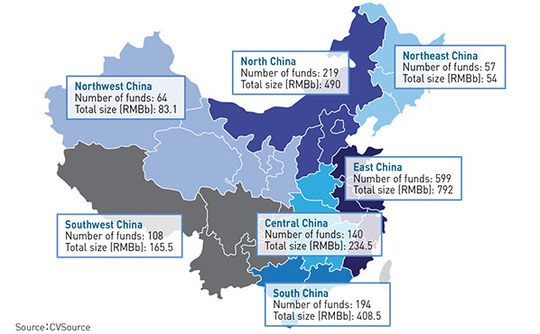

Local guidance funds from specific cities or provinces tend to source capital from government agencies and local state-owned enterprises. This group can in turn be subdivided based on sophistication. One tech-focused GP tells AVCJ that guidance funds from eastern and southern China have more experience with market-oriented fund-of-funds. As a result, strategies and internal procedures are clear and performance is good.

They follow strict due diligence guidelines when picking up GPs, looking at criteria such as assets under management, IRR, and distributions. In some cases, professional investors wrote the rules. Shenzhen Venture Capital has assisted numerous local guidance funds.

"Sometimes, there are strange requirements, such as a minimum three IPO exits from the GP. There might also be requirements for investee companies, such as limits on the number of employees or on annual revenue. These conditions are intended to encourage investment in early-stage companies, rather than pre-IPO arbitrage plays," a fund-of-funds that sources capital from guidance funds explains.

Giving back

Another quirk of guidance funds is that even though governments are happy to serve as anchor investors, they always want to be the last money in. This is linked to the relative size of their commitments. Typically, guidance funds want to be no more than 30% of a fund. It is lower for new GPs, with the Hangzhou government capping exposure at 10%.

Moreover, a commitment might only get signed off once capital from financial investors is in place. This is to ensure that guidance funds serve their purpose of attracting non-government capital to target geographies and industries, according to STVC's Zhou. A senior executive at a fund-of-funds adds there is also a desire to leverage the judgment of other LPs. "If you can't raise enough money from the market, they won't back you," he says.

Once a GP has raised money from a municipal or provincial guidance fund, investing it back into local businesses can be a challenge. The standard arrangement is that for every $1 raised from the fund, $1.50 must be deployed in the target area.

However, Yong Zhang, a partner at Inspiration Capital, claims the number ranges from $0.50 to $3. Inspiration, formed following a spin-out by the cleantech team at Qiming Venture Partners, recently closed its debut fund at RMB500 million. LPs include three local government guidance funds and the State Development & Investment Corporation's National Guidance Fund.

GPs are not necessarily restricted to sourcing investments locally. It is standard practice to encourage portfolio companies from other locations to move to the target area. There are also structural workarounds to the restrictions. A company based in the target area might establish subsidiaries in other locations and transfer capital to them. The parent's revenue is included in local GDP numbers even though investment happens elsewhere, a researcher at a fund-of-funds explains.

Another typical requirement is for the GP to establish a presence in the guidance fund's home city. Yipin Ng, a founding partner at Shanghai-headquartered Yunqi Partners, notes that his firm is registered in Nanjing "according to the requirements of the renminbi LP," but its office remains in Shanghai.

It is suggested that guidance funds are becoming less rigid. There is a school of thought among these LPs that relatively open investment policies and positive interaction with GPs leads to better performance.

"We need to fully understand the strengths and weakness of local industries and adopt appropriate supporting measures," says STVC's Zhou. "The development of these industries can therefore happen in tandem with GPs generating profits. If there is no flexibility, your GPs will lose money, local businesses won't develop, and you will have failed in your guidance role."

He adds that STVC doesn't attach a specific ratio for local investment to its commitments, but Shanghai must receive more of the overall fund than any other provincial administrative region. STVC normally invests RMB60-70 million in VC funds below RMB1 billion in size.

Other cities are loosening up as well. In January, Qingdao reduced the minimum local investment for every $1 from its guidance fund from $2 to $1.10. In August, Zhuhai's Hengqin New District went as low as $1. Dalian typically asks portfolio GPs to invest a certain portion of their funds locally, but it has halved the minimum threshold to 30%.

Meanwhile, Xiaoxiong Yao, chairman of a Shenzhen Angel FOF, a government-backed angel-round fund-of-funds, told an investor summit in August that he was willing to contribute up to 40% of individual funds. The overall government contribution, from multiple vehicles, can be as high as 70%. This is intended to solve the recent fundraising difficulties. At the same time, leading GPs will no longer have to register management companies in Shenzhen.

There are also examples of governments accepting broader definitions of local. In Jiangsu province, a local subsidiary of a non-local portfolio company – such as an R&D office or a production branch – now fulfills the invest-back criteria. Inner Mongolia Autonomous Region is happy to include investments in companies with major suppliers in the region.

"Ningbo's Zhenghai District is one of the few areas in the Yangtze River Delta to classify chemicals as a pillar industry. My portfolio companies engaged in new materials fit well into the local supply chain, so it's a win-win situation for the local guidance fund and for us," says Inspiration's Zhang.

Yunqi is currently focusing on enterprise-facing – or 2B – investments of which there are plenty in Nanjing, so the invest-back requirement is easy to meet, Ng tells AVCJ. "If it's 2C, that would be more difficult," he adds.

Strategic objectives

This newfound flexibility comes with bigger ambitions as to what governments want from guidance funds. Angel FOF is an outlier in this respect, with Yao arguing that the government should embrace failure. He sees direct investment as the next step because many start-ups are so nascent that they represent too great a risk for commercial GPs. A guidance fund can absorb multiple losses in return for a few home runs.

Angel FOF has RMB10 billion in assets and already claims to compensate portfolio GPs for up to 40% of their losses on angel investments.

More conventional guidance funds compete fiercely for managers or direct investments because of the ancillary benefits they hope to accrue. Before Nio accepted the Hefei bailout, it had signed an agreement with Beijing-based Yizhuang State Investment. This deal was torn up when Hefei came in with a better offer.

China Growth Capital's Shiong saw similar dynamics at work when one of his portfolio companies, an early-stage artificial intelligence (AI) technology developer, was drawn from Wuhan to Suzhou. After the GP and its co-investors put in RMB15 million, the Suzhou government contributed RMB30 million.

"Entrepreneurs can apply for local talent programs and then get VC investments," he explains. "Local governments sometimes make matching investment alongside GPs and they don't even take any shares."

Other sweeteners offered to companies include free housing, getting children into good schools, cut-price commercial rents, and low-interest-rate loans, according the co-founder of a chip company that received pre-Series funding from a Beijing-based guidance fund.

Incentives are more likely to be dangled in front of a portfolio company than a GP because it represents a visible political win: new production plants, leading to more jobs, more demand for local services, and more tax revenue. However, private equity firms are a prized commodity for their ability to identify high-quality projects. Guidance funds are generally keen to co-invest, but this must be carefully managed.

"If we are forced to save co-investment quota for government LPs, we would be sacrificing the interests of other LPs," says Inspiration's Zhang. "What we do is the opposite: we volunteer to introduce our portfolio companies to local governments from day one. If they can add value, we welcome them to participate as co-investors."

That value-add often comes in the form of access to potential local customers. A well-placed guidance fund can make senior-level introductions that it might take sales executives years to achieve on their own. Licenses are another key area. One GP recalls having difficulty obtaining licenses for two financial technology start-ups, even though they were much larger than local competitors. Governments can make these problems disappear.

Reputation counts

In this way, guidance funds can achieve a level of recognition despite their fundamental differences from traditional LPs. Zhangjiang Hi-Tech Park and Shanghai Qingpu Industrial Zone have longstanding reputations as start-up hubs and both offer capital via dedicated investment funds as well as other forms of support.

"If you talking about biomedical, they are very well-known," says one GP. "In the deep technology field, the government's chip-focused ‘big fund' [the National Integrated Circuit (IC) Industry Investment Fund, currently in its second iteration] is a benchmark. They almost never lose money."

Other guidance funds are respected for the credibility of their managers. The IC Fund is run by Sino IC Capital and its investment committee includes Datong Chen, founder of WestSummit Capital and Omnivision Technologies. Several GPs say that they don't really distinguish between guidance and market-oriented funds. If the management team has a good track record, they will treat them as a serious investor.

Of the local guidance funds, those in Suzhou and Nanjing generally attract positive feedback for giving stronger policy support than their peers in Shanghai or Beijing. Suzhou National & Hi-Tech Industrial Development Zone recently launched a RMB10 billion IC fund with support from local government guidance funds, corporates, and financial institutions. An IC industry innovation center is being built to house 200 domestic and foreign companies.

"For the introduction of top talent, we will offer a personalized package, with no upper limit to the amount of capital support," said Wei Mao, mayor of Suzhou New District, Xinhua News Agency reported in July. "We will form a new high ground for the development of the IC industry."

Suzhou's vision is to offer turnkey solutions, providing services from chip design to wafer manufacturing. To this end, it is working with the likes of foundry operator Taiwan Semiconductor Manufacturing Corporation (TSMC). Start-ups will also get subsidies to cover IC tape-out costs and intellectual property purchases.

One manager tells AVCJ that he has applied for allocations from guidance funds in Shanghai and Beijing, but he would prefer Suzhou or Nanjing. In addition to local government support, accessible local supply chains are a consideration. "As GPs, we should follow our portfolio companies," the manager adds. "If they are happy to land in Suzhou, so are we."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.