Alternative fund structures: Alternate universe

Irregular fund structures, including single-asset platforms, are often the most appropriate inroad for investors in developing Asia. But it has taken a pandemic to bring them to the fore

Asian private equity appears to be on the cusp of a practical shift in terms of its widely adopted protocols for structuring investments. Unfortunately, the improvement may be more motivated by desperation than enlightenment.

Fund formation professionals are observing an evolution whereby GPs are more open to modifications of traditional limited partnership structures and LPs are more demanding of them. In the long term, this can be charted in the rise of co-investment and continuation funds that expand optionality around extended holding periods. In the more immediate term, the trend has been colored by strong growth in evergreen funds, club deals, listed deal-by-deal structures, special purpose and single-mandate vehicles, and fund-of-one platforms.

The US has been the leading jurisdiction for these changes thanks to the depth of the domestic private equity industry and its sheer scale; a larger population of multi-strategy GPs has proven conducive to proactive and creative fundraising. The wave has not come to Asia, but it will soon. This is perhaps especially true for China, where alternative GP-LP structures have already gained significant traction, and Southeast Asia, where investor demand for these strategies is highest and intraregional economic treaties could accelerate proliferation.

The fundamental problem with this development is that it has been mostly inspired by a disruption of the status quo rather than new awareness about the merits of flexible approaches to markets with underdeveloped private equity industries.

The difficult fundraising environment fostered by geopolitical tensions and COVID-19 is by far the biggest driving factor. Muted market confidence and travel restrictions have weakened appetite for blind pool funds and encouraged investors – GPs and LPs alike – to get closer to assets via single-deal formats. But an argument can be made that this was always the way to go in Asia, especially in markets defined by first-time funds and intense local strategic competition.

"It's one thing when you've got thousands of GPs all selling companies to one another and creating an ecosystem of activity. But when private equity professionals take the 5-10 year partnership structure used by mainline funds in the US and copy that in developing economies, it makes no sense," says Mounir Guen, CEO of placement agent MVision. "In smaller markets, the competition for private equity is really the local families, which have their own private equity firms that are already using alternative structures because they allow you longer holds."

Against the grain

Alternative fund structures are not new to private equity; the earliest practitioners in the 1980s and 1990s were known for hybrid strategies that featured 12-year holding periods and the organization of each investment as its own independent partnership. The brand name GPs that can trace their histories to this era are among the least likely to embrace its flexibility once again. As much as COVID-19 has sparked a renaissance for irregular vehicles, it has also led to a flight to safety in the form of conventional, US dollar mega-funds.

For the sturdiest GPs, the pandemic has not yet lasted long enough to force many of them out of the traditional blind pool model, but expectations for extended uncertainty are hardening. Numerous investors tell AVCJ they expect COVID-19 disruptions to private equity activity to reach well into 2022, and few have high hopes that trade war-related issues will abate following the US election.

In this light, some changes coming to the industry are probably here to stay. Creative fund formation, like the digitization of due diligence, could become one such outcome of the current climate.

COVID-19 is accentuating the benefits of this approach, especially at the deal level. Companies that might be ready to target large growth rounds or engage potential buyers are scaling back their ambitions, conscious of wariness around valuations. Patchy deal flow – though not everyone would attest to it – is perhaps the best justification for framing deal-by-deal structures as opportunistic rather than a necessity. As a result, alternative structure strategies are gradually expanding beyond their usual milieu of first-time managers.

BDA Capital Partners is tracking these themes with interest. The firm was set up about a year ago by M&A advisory BDA Partners and Bert Kwan, previously a managing director at Northstar Group. The plan is to leverage experience across private equity and merchant banking to go deal-by-deal in Southeast Asia, especially Vietnam, using single-LP vehicles or warehousing facilities. There are no immediate plans to raise a fund.

"If you have an interesting investment opportunity with a specific thesis, there's an increasingly wide range of investors that would like to take a look, especially in Asia. That was not so much the case 10 years ago," Kwan says.

"These investors often have private equity exposure already and they're comfortable taking an asset level view, as opposed to just a manager level view, so what we're doing resonates with them. They're set up organizationally to look at what asset level exposure makes sense in the broader context of their strategy – and that's different from how many blind pool investors will look at portfolio construction."

Many brews

There are myriad ways to configure hybrid funds and deal-by-deal platforms, some more in tune with local regulations or counterparty expectations than others. Pledge funds, for example, which involve pre-negotiated fund commitments but give LPs the option to review individual deals, have proven unpopular in Asia due to diligence capacity restraints. Check size flexibility and more attractive fee terms are core incentives for managers and LPs, respectively, but the commonality among the most in-demand structures is the potential for longer holds.

"What we have seen more of which is slightly irregular is large LPs asking for the GP to set up a specific sidecar structure that will only invest alongside the main fund on certain deals, which are regulated under the co-investment agreement between the main fund and the sidecar," says Mark Davies, a Japan-based partner at King & Spalding.

Further tailwinds for these kinds of plays in the context of COVID-19 could come down to their more tightly defined, asset-level nature. Davies adds that some LPs have recently proven willing to back new GPs having done exclusively online diligence. "[Virtual GP-LP relationships are] generally more feasible for deal-by-deal platforms as the capital outlay is less and the due diligence exercise is more specific," he says.

The biggest boom by far has been in the use of special purpose acquisition companies (SPAC), also known as blank check companies. These single-deal vehicles, which go to market as listed, GP-sponsored entities with no existing business, have seen a dramatic spike in uptake this year as managers look to seize opportunities in COVID-19 dislocation.

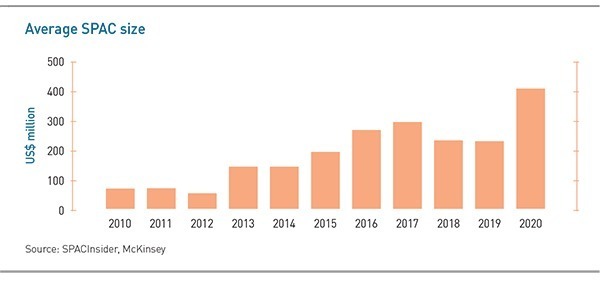

LPs, especially hedge funds, are attracted to the risk-reward profile. Their investments are essentially guaranteed by the SPAC until it acquires an asset, at which point they can redeem their principal plus interest and some upside on the relevant warrants or hold on in expectation of a larger pay day. There is also the option of voting down a deal. According to McKinsey & Company, the average SPAC has increased more than fivefold in size over the past decade, jumping from roughly $230 million in 2019 to more than $400 million in 2020.

Carl Wu, CEO and co-founder of New Frontier Group notes that much of this traction can be attributed to higher-profile investors embracing the strategy for the first time. This is prevalent in the US, but there is also evidence of it in Asia. For example, Peter Thiel, co-founder of PayPal and Founders Fund, recently teamed up with PineBridge Investments and Pacific Century Group on a SPAC targeting Southeast Asia.

"Before COVID-19, SPACs were an opaque investment product, but it's a more blue-chip phenomenon today," Wu says. "This is definitely a lot more institutions that previously wouldn't spend time on this kind of product, but they are now."

SPACs are just one tool in the deal-by-deal toolbox for New Frontier, which cites a number of advantages to its platform in resource allocation and governance. These include a smaller, operations-focused team without the need for compliance, accounting and legal capacities that come with fundraising. New Frontier also employs a portfolio oversight system that combines corporate and GP-LP structures, giving it disproportionate sway in investee company decision-making while also extending significant information rights to underlying investors.

Notably, the firm's investor base has taken only four years to graduate from family offices and high net worth individuals to large corporates and financial institutions, with Wu observing an especially strong surge of interest in the model this year.

Still skeptical

While managers of all stripes may be inclined to move toward alternative vehicle structures, it will not prove as appealing to all LPs. Although concepts involving more targeted exposure in sectorial terms and fees correlated to assets rather than fund commitments are attracting a broader range of institutional investors, the higher diligence demands of strategies such as deal-by-deal platforms can prove a challenge.

This is also true for family offices, which have historically been regarded as a natural fit for single-asset plays and various offbeat vehicles. Sam Robinson, a Singapore-based managing partner at family office North-East Private Equity Asia observes that simply because family offices are often run by a small number of individuals who can make a call without weeks of due diligence, they're often perceived as being able to do anything.

"The thinking is that if a GP with a deal-by-deal strategy has been turned down by everybody else, maybe there's a family office that will do it," Robinson says. "This is probably going to be a GP you haven't heard of or don't know very well, but I really want to be investing alongside someone I feel knows more than me, especially in the current environment. So, I'm not sure all family offices are natural buyers for these things."

Reliable existing networks will be the key to making alternative structures work in the COVID-19 era, with videoconferencing having proven useful for maintaining relationships but not for starting new ones. Relationship building headwinds will also be a key aggravator of one of the perennial criticisms of deal-by-deal strategies – that their fee structures and slower execution profiles make them difficult to scale to meaningful size.

The most conspicuous counterpoints here are the success stories to date, non-traditional fundraising stalwarts such as General Atlantic, Golden Gate Capital, and Crescent Point. These firms do not pursue identical strategies, but they validated their approaches by making good on their early bets. As a result, they built up loyal networks that now afford them all the advantages of traditional funds in terms of committed resources plus flexibility on size, tenor, and who participates in which deals.

More fundamentally, challenges around scaling these kinds of businesses in Asia come back to the feasibility of that vision in the first place. Most private equity activity in the region involves purchasing minority stakes and portfolios are diverse. It could be argued that most developing ecosystems cannot support funds in excess of $500 million in the foreseeable future.

"The way we're set up, I don't think we need to be in a position where, from day one our primary goal is to maximize the scale of our private equity platform," BDA's Kwan says. "We're in the business of finding the most attractive opportunities and backing them consistently. It's really about doing our best to ensure that every investment we pursue ends up being a good one on a risk-adjusted basis. If we're successful doing that, the market will tell us what the scale should be."

Cottage industry?

As the industry shifts toward more of alternative structure strategies, there must be increased awareness of risks such as GPs racking up costs related to sourcing deals that eventually get aborted or club fund participants pulling out to approach an asset independently. In addition to being slower, deal-by-deal models can also be more complex, requiring the mobilization of multiple partners each time around, especially for larger assets. This inefficiency may effectively limit the strategy to smaller mid-market opportunities.

For many investors, the longer term holds that come with alternative structures have always represented an elusive holy grail – a way of being able to constantly curate a portfolio to maximize exposure to the best assets without being forced to divest at an inopportune time. But despite growing interest in the current downturn, there remains little insight into how to crack the challenges that come with this type of investing such as IRR cash drags, delayed drawdown deployment, and the mass-marketing of bespoke products.

In some ways, even if alternative structures become a more widely adopted in Asia, they may always remain something of a cottage industry within private equity.

"Once you start considering unique or bespoke fund structures, a lot of the customary precedents and market practice largely go out the window and LPs may have very different views on how a particular product or structure should operate and look," says Justin Dolling, a funds partner at Kirkland & Ellis.

"There may be 20 variations of a particular structure and 20 different LPs may have 20 variations on that, so it can be difficult to market a highly bespoke product to a broad LP base. There are examples where GPs have successfully achieved this, but in practice it is difficult."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.