Portfolio: Pioneer Capital and Natural Pet Food Group

Pet ownership is no longer a hobby – it’s an emotional market in the same vein as mother-and-baby. Pioneer Capital knows that grain-based kibble will not do

In the early 2010s, New Zealand's Pioneer Capital could sense that premium pet food was an almost bulletproof trend. That instinct appears to be bearing out with the private equity firm's bet on Natural Pet Food Group (NPFG) as the company continues to expand during the COVID-19 downturn.

Pioneer acquired a 56% stake in NPFG in 2013 for an undisclosed sum from its second fund, which was mandated to write checks in a range of NZ$10-30 million ($6.8-20.3 million), and has built up to a 77% interest. The business is said to have grown tenfold to date.

The idea was to leverage a number of global social trends leading to higher pet ownership, including people living longer, smaller families, and younger demographics waiting longer to have children. These changes have overlapped with higher density urban living, meaning average pet size has decreased. It's easier for consumers to justify spending money on premium brands when their pets are smaller and therefore eat less.

Pet care, especially at the premium end of the market, is about discretionary spending, yet the pandemic has done virtually nothing to slow it down. On the contrary, interest in pets appears to have accelerated, with animal shelters in NPFG's core global markets reporting soaring adoption rates during the lonely months of lockdown.

"We're pet owners at Pioneer, and we could see the amount that was being spent on premium pet food, but the interesting thing was that we never really had a standout premium branded pet food company in New Zealand," says Craig Styris, an executive director at Pioneer who sits on the NPFG board. "That was really surprising considering the amount of protein we produce as a country."

This opening has allowed NPFG to leverage New Zealand's reputational advantages in agriculture and food safety in a specialized but fast-growing global market. "We could see that the main brand was very much about New Zealand in a bag," says Styris. "That resonated with us, and we could see it resonated with consumers."

Upward trajectory

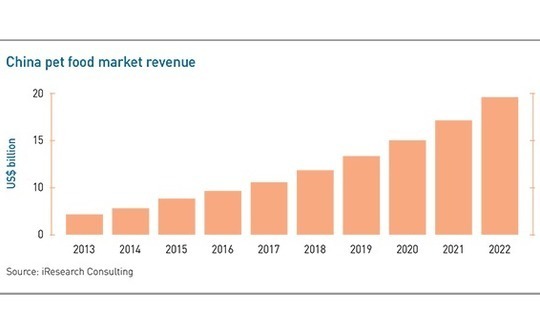

The global pet food industry was worth about $75 billion in 2019 and is expected to hit $130 billion by 2024. The market for segments labeled "natural" or "nutritional" is typically pegged at around $10 billion, with the high-meat niche said to be growing at 20% a year. China's overall pet food market is worth about $13 billion a year, according to iResearch Consulting. Styris estimates the country's high-meat segment is growing at 150% a year.

NPFG's core brands, K9 Natural and Feline Natural, are grain-free and composed of about 90% meat, 5% eggs and mussel, and 5% plant products, minerals and vitamins. They are touted as contributing to shinier coats, fewer allergies, and better weight management. Output was almost exclusively dog-focused at the time of acquisition, although cat products now represent about 50% of the offering.

K9 Natural and Feline Natural are marketed primarily in specialty brick-and-mortar shops, although a mass-market brand for both dogs and cats called Meat Mates has been introduced as a way of accessing supermarket and e-commerce channels without diluting the flagship offering. Across brands, the geographic split for sales is about 40% Asia, 30% Australasia, and 30% North America. China is the rising star and cat-driven.

Value-add initiatives under Pioneer ownership include streamlining the business model by outsourcing manufacturing and, most importantly, focusing strongly on governance and professionalizing sales, marketing, and management. After about 18 months, Neil Hinton, a food industry veteran with the likes of Vitasoy and Kirin-owned beverage maker Lion, was brought in as CEO.

"I was attracted by the opportunity to really disrupt a large category from a point of nutritional truth and establish a purpose around the business," says Hinton. "The carnivores we have in our houses as family members are being fed something that is not part of their natural diet."

Hinton's key contribution might be his background helping consumer brands go overseas. Skills sourcing was an important part of this agenda, with the sales and marketing teams significantly expanded and new roles introduced such as brand manager and capability manager. The priority was to inject fast-moving consumer goods knowhow into a dedicated but relatively inexperienced team.

"We had to work out whether we could fix or had to exit the things we weren't doing well to reduce the windage on the boat," says Hinton. "We were doing a lot of things but not necessarily well, and they weren't necessarily things we could do successfully in the long term. So we had to make some hard calls and focus on where we have the right to win."

At the time, NPFG was arguably overextended, with fewer than five sales professionals overseeing 20 foreign markets. Even in familiar Australia, there was only one person on the ground. The number of markets has now been pared to about 12, while the overseas distribution team has grown to 18, including seven in the US and a sizeable joint venture in Japan. The overall staff is now 45-strong.

Local credibility

The internal view is that adding sales resources in selective offshore markets to work alongside distributors helps elevate brands in the eyes of distributors by demonstrating a commitment to the market. It also provides companies with the flexibility to be more responsive to in-market opportunities or dealing with any local issues that may arise.

"The sophistication of the distribution has increased massively since we invested. In the early days, the company might get an email or a call from somebody who wanted a container, so they'd send and hope they came back in six months to place another order," says Styris.

"Now, we're doing forward-orders, planning alongside all the distributors, and we understand the sales plans a lot better. We know the demand in other markets and communicate with them ahead of introducing new products. It's a much more scalable network."

The US, which accounts for about 25% of the global pet food market, was NPFG's first foreign entry about 10 years ago and set the company's template for building out overseas teams across a target country's sub-regions. This approach is being replicated in Australia, where there are three fulltime sales representatives currently – the pandemic has paused further expansion – and the plan is to have one in every state.

NPFG hopes similar penetration can be achieved in China over time and parlayed into a wholly foreign-owned enterprise (WFOE) structure. "If you want to get deep into markets, you have to be prepared to invest and put some boots on the ground," says Hinton.

It will be an ambitious play, but Pioneer and NPFG believe the company's New Zealand heritage will do much to pave the way. Historically warm trading arrangements between the two countries – New Zealand became the first developed country to have a free trade agreement with China in 2008 – allowed NPFG to sell into the market before formal pet food import protocols were in place.

There have been other access advantages. In 2017, NPFG joined an entity associated with New Zealand Trade & Enterprise Shanghai that employs sales people on NPFG's behalf. This channel, seen as an intermediate step to a WOFE, allows the company to stay in contact with Chinese distributors and agencies while executing brand and sales activities without an official trading presence.

"There's no reason for us to worry about going through a gray market and the issues that that creates," Hinton explains. "We've been able to go in through the front door with a very strong reputation and say, ‘We'll do this by the book.' Once you achieve your registrations, you have a much clearer, open access to the market."

Community spirit

Good relations are also part of the growth story at the industry level, with NPFG leveraging a supportive environment among its fellow pet food operators. To some extent, this can be attributed to the neighborly intimacy of New Zealand as an ecosystem, but Styris notes that even in an international context, pet food benefits from a rare sense of community.

"It's quite a collaborative industry, and it's refreshing. In other industries, you can't step foot in another company's booth at a conference, but in pet food, we're all talking to each other," says Styris. "In New Zealand, all the competitors know each other and are all quite friendly."

Indeed, Hinton hesitates to refer to any other domestic players as competitors because the market is so small and segments such as premium and natural are poorly delineated. The philosophy is more around lifting the profile of the national brand.

"We don't focus on growing market share in our category because the numbers are just not accurate enough to go out there and say we got an extra share point this year," he adds. "We focus on communicating the benefits of high-meat to as many people as we can to ensure that the segment continues to grow strongly. Then you do your best to convince people your product is the best and hopefully grow your share inside it."

NPFG has been increasingly active on this front, with Mike Wilson, the company's head of operations, serving as chairman for the New Zealand Pet Food Manufacturers Association. The organization's latest conference was dedicated to new markets, technology, sustainability, and value.

"There's a huge amount of work in trying to set really high standards across the industry and make sure we're all looking out for each other," says Styris. "At the end of the day, we're all very small in a global market, and we rely so much on New Zealand's reputation, so if one of us has a problem, it impacts us all."

This is not to say NPFG has been slow to roll out products. In addition to the Feline Natural and Meat Mates brands, NPFG has explored new formats, such as cans and pouches of frozen or freeze-dried food. It has introduced a broader range of supplements – lamb and beef-based tripe as well as snacks made entirely from chicken or mussel – and eight varieties of "topper," which are designed to be sprinkled onto other foods to enhance flavor or entice finicky eaters.

Pets as people

The biggest change at the customer level, however, has been the shift to online consumption. This is perhaps especially true for Meat Mates in North America, and it is seen as a snowballing trend in the COVID-19 era. According to Nielsen, online pet food sales rose 77% year-on-year in March compared to only 26% for in-store retail. NPFG has tried to mitigate the impact on its mom-and-pop retailers by helping them set up their own online platforms.

Panic buying, the conveniences of e-commerce, and improved product variety online all play a role in this kind of behavioral change, but the broader takeaway is a change in the nature of pet ownership, or as the industry increasingly frames it: pet parenting. Whether markets are characterized by aging or youthful demographics, the digital age has tended to create more sedentary and solitary citizenries.

In marketing terms, animal companionship as a substitute for family can be seen in some supermarket chains, where pet and baby items are shelved side by side. This is product positioning based on emotional reaction, not the end-user. The common element between baby food and pet food is the satisfaction the buyer gets when feeding their loved one.

Hinton notes that from a product launch perspective, pet food makers can gain meaningful insights by observing dietary and innovation themes in the food industry for people. The caveat is that foods that are bad for people are usually even worse for animals.

"There's definitely a trend around humanization, but we have to be wary because we always want to stand for nutrition first and make sure that we're feeding out pets what they need," says Hinton. "You can overlay that with the emotional drivers that help pet parents feel really good about it, connect with their animals, and see that they're enjoying it. That's one of the wonderful things about what we do – we create a special moment around the pet food bowl."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.