China autonomous driving: Dimension jump

There are no arguments about the transformational potential of autonomous driving in China, but investors have different ideas about where to find value

Cixin Liu, a best-selling Chinese science fiction writer, describes in "Three Body" an attack by a four-dimensional civilization on a three-dimensional counterpart. The outcome is swift and deadly. Investors in the autonomous driving space – one of the most vivid examples of how technology is expected to redefine accepted norms – are mindful of similar scenarios.

For the uninitiated, the self-driving taxis of Google's Waymo are the most readily available image. And that's certainly where most of the money is flowing. Pony.ai, a Chinese robotaxi start-up, secured a $462 million funding round led by Toyota Motor Corporation in February. It was said to be the single largest investment in China's autonomous driving space – until SoftBank's second Vision Fund pumped $500 million into a division of Didi Chuxing in June.

However, these large-check deals are relatively few and far between. Most recent investments have targeted niches rather than the mainstream: applying autonomous driving technology to trucks in mining facilities and delivery vehicles in industrial parks.

"I've looked at many projects in the past year, but I haven't invested yet because I'm wary of dimension reduction attacks by leading robotaxi players," says Wayne Shiong, a partner at China Growth Capital.

John Li, a partner of Cathay Capital's China automobile fund, puts the dilemma in more practical terms: "Investors want to see more landing scenarios. We take autonomous driving as part of automation, but ultimately, all automation solutions must turn a profit."

Breeding grounds

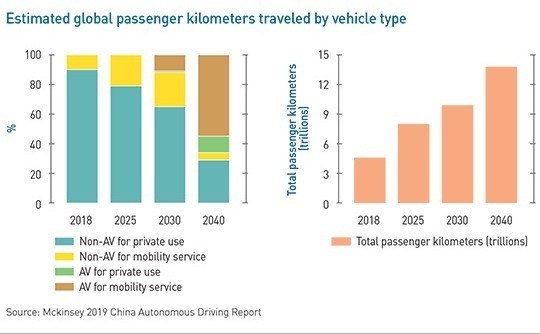

There is no denying the size of the opportunity. McKinsey & Company projects that autonomous vehicles could account for 66% of the passenger kilometers traveled by 2040, with the industry generating $2 trillion in annual revenue. And concerns about robotaxi start-ups consuming all in front of them are real. In the US, the likes of Waymo and Aurora Innovation have expanded into the truck business. In China, Pony.ai and AutoX – which is backed by Dongfeng Motor and SAIC Motor – are doing the same.

But the market will be carved up in different ways, giving investors a multitude of options. It is by no means a foregone conclusion that a handful of strategic giants be all things to all passengers.

Autonomous driving is very much the US and China show. They account for almost all deals in the space and for most of the kilometers traveled. Waymo is the clear leader, accumulating more than 20 million miles (32.2 million km) on public roads since its inception in 2009. According to the record of the California Department of Motor Vehicles, Waymo represents half of all autonomous vehicle mileage in the state.

The company is not seen as a competitive threat within China – "This kind of data is too sensitive, especially given current US-China tensions," says Yipin Ng, founding partner at Yunqi Partners – and investors are bullish about the opportunity for local start-ups to thrive within a somewhat protected ecosystem. The country has several perceived advantages.

Second, Chinese people seem to be open-minded about the new technology. When WeRide launched its robotaxi pilot scheme in Guangzhou last year, it completed 8,396 rides within the first month, but this didn't even satisfy two-thirds of demand. Nianqiu Liu, a vice president at Deeproute.ai, contrasts China's ready acceptance with US resistance.

Third, difficult driving conditions make road tests more efficient, with Li Zhang, COO of WeRide, observing that China's roads are 30 times harder to navigate than US highways. Vehicles encounter more incidents during tests, which means there's more data for the algorithms to work from, and this leads to better technology.

China's Waymo equivalents are Pony.ai and WeRide. Both are leaders in level four (L4) autonomous driving – the car is fully autonomous in certain environments, but it still needs a driver in the seat – and both were spin-outs from Baidu in 2016 and 2017, respectively.

"When we did due diligence for our investment in 2017, we realized that Baidu had been completely hollowed out by Pony.ai and WeRide," one investor tells AVCJ. "At that time, Baidu's most senior staff was a postgraduate who was only three years out of university."

Having lots its talent and its first-mover advantage, Baidu repositioned itself as service provider to the entire industry, developing an open-source autonomous driving platform called Apollo. Tencent Holdings has adopted a similar strategy and recently released a new simulation platform for autonomous driving.

Several industry participants point to Didi Chuxing as the most threatening newcomer. The ride-hailing giant established its autonomous driving unit as an independent entity last year and plans to operate more than one million self-driving vehicles by 2030. It claims to be the only company globally with more than 100 billion kilometers of autonomous driving data.

The next step

WeRide is the first to offer L4 robotaxi services to the public. Working with Baiyun Taxi Group, the largest taxi company in south China, and Science City Group (SCG), it service operates across 144 square kilometers in Guangzhou's Huangpu district. Baiyun Taxi is responsible for operating and managing the vehicles, while SCG handles government relations and provides financial support. WeRide is the technology supplier.

Zhang tells AVCJ that WeRide has established around 200 drop-off points within the district while customers are encouraged to suggest additional locations. "This is to prepare for a future in which we don't have a human safety driver and robotaxis can't decide whether dropping off in a certain location would be safe or a violation of traffic laws," he explains.

The company has accumulated 2.8 million km to date and is adding nearly 100,000 km each week. Pony.ai has reached the 2 million km mark, with more than half completed in 2019.

Such is the level of development that investors have started discussing vehicle specifications like power consumption, trunk arrangement, and noises – these weren't even vague considerations last year. "Car regulation-related issues have become important: whether you can run at minus 20 degrees, whether the battery will explode if you are hit. This may be the final step to get ready for business," says China Growth Capital's Shiong.

In many cases, the trunk of a robotaxi is fully occupied by computing units and cooling equipment. DeepRoute is one of few that gives the entire trunk space back to customers.

According to Liu, this is possible because other functions have been integrated to make the whole system smaller. Meanwhile, the computing platform operates with only 45 watts of power – with almost no impact on mileage – which means there is no audible noise. "We pay attention to details that are critical for real passenger experience," he says.

Regardless of these investments in user experience, robotaxis cannot turn a profit until the human safety driver is removed. On the contrary, the more robotaxi a company operates, the larger its losses. Some progress is being made in the US. Waymo has removed safety drivers in Phoenix, Arizona, while AutoX is only the second company to be granted a California permit for driverless testing with passengers on public roads in a limited area.

"When you hit that blast-off point, when the first batch of robotaxis remove safety drivers in China, the industry will suddenly break through the commercialization threshold. It is not a linear development but a step function," says Zhuo Li, COO of AutoX.

The cost of a robotaxi varies. Didi's vehicles come in a RMB1 million ($150,000) apiece and are equipped with nearly 20 sensors, including three LiDARs. The cost of modifying a conventional taxi to use AutoX's technology is nearly equivalent to one year's salary for a driver. It is falling by about 50% a year as equipment becomes cheaper, Li says. Modification costs will drop significantly when robotaxis achieve mass scale.

Both WeRide and AutoX are optimistic that an entirely unmanned robotaxi ride will be possible within three years. The 2022 Asian Games in Hangzhou are expected to be the first large-scale pilot program.

Niche strategies

During the race to mainstream commercialization, robotaxi players are expected to pursue more immediate returns in other market segments. Trucking is a logical target. The addressable market is large, highways are easier to navigate than downtown roads, and most importantly, there is no need for a safety driver when transporting goods.

Last month, Waymo signed an agreement with Fiat Chrysler Automobiles to deploy its L4 technology in minivans. Aurora's first commercial product will be in truck transportation. Tiancheng Lou, founder of Pony.ai, offered insights into his approach to the space during a recent Q&A forum: "The key parts of passenger cars and trucks are common rather than independent. Therefore, I don't treat truck technology as a separate technology stack."

Pony.ai and AutoX may find their forays into trucking are hindered by some innate disadvantages. For example, trucks often reach speeds of more than 80 km per hour on highways, much faster than robotaxis, and this delivers valuable data. "If your robot has never learned about it, how can you directly apply your solution?" says Li Rong, general manager of Plus.ai, a Chinese autonomous driving specialist focused on trucks.

Similarly, when a truck is carrying a full load, its driving behavior can be very different from an empty one. Again, this translates into more information and better algorithms.

Deeproute.ai is one of several L4 technology players looking at specific applications. The company has developed a self-driving container truck for Xiamen Port in Fujian, which is able to load and unload cargo. It is a joint project with COSCO Shipping, Dongfeng Commercial Vehicle Technology Center, China Mobile, and Huawei Technologies.

"We don't aim at any specific scenes, like airports or ports, because the ceiling is relatively low. Our aim is the productization of our core technology," says Liu of Deeproute.ai.

For some investors, these low entry barriers make specific applications less interesting. Many work to a basic logic that if a company targets a market of $100 million, its uppermost valuation might be $10 million. This isn't enough to validate a $10 million funding round. Ng of Yunqi – an investor in Deeproute.ai – sees it as a transitional strategy. Ultimately, the company must target for L4 open road tests, or its competitors will.

Shiong of China Growth Capital, meanwhile, identifies another competitive threat. "Top technology companies can standardize and productize their technology, and expand into a large number of industry verticals like mining trucks, garbage trucks, and even cleaning robots," he says.

But underestimating the cost might be a pitfall. Chibo Tang, a partner of Gobi Partners who manages the Alibaba Entrepreneurs Fund in Hong Kong, argues that L4 players have no advantage over incumbent specialists because the latter are using more basic technologies to solve problems. Any solution an L4 team develops would be costlier.

Indeed, some specialists offer broader product suites and don't rely on autonomous driving for the bulk of their revenue. Waytous, a mining specialist, positions itself as a one-stop solution for unmanned mining, bringing together transportation, excavation, and simulation. According to CEO Long Chen, only 30% of the business is autonomous driving.

"Waytous is an off-road scenario that addresses many new challenges," adds Li of Cathay Capital, an investor in the company. "For example, no high-precision maps are available of remote mining areas and then roads can change under the weight of heavy vehicles."

Customer acquisition is another barrier established by specialists, with most of China's largest mining operators under state control and difficult to penetrate. Waytous is also looking to expand overseas under the Belt & Road Initiative following existing customers.

Picking winners

A broader question that will ultimately shape the dimension reduction attack scenarios is which mainstream player will be first to commercialize autonomous driving, at L4 through L5, which represents full autonomy. In the US, it comes down to Waymo versus Tesla.

Tesla is currently operating in shadow mode, whereby the autonomous driving system is installed in vehicles driven by humans but takes no action, simply registering when it would have taken action. This allows the company to accumulate data and make improvements to its software on a continuous basis. Founder Elon Musk announced earlier this year that a L5 system would soon be ready.

Shadow mode clearly has the edge over safety drivers in terms of scale. Tesla can rack up millions of kilometers every day by shadowing drivers of its electric vehicles (EVs). In China, there are fewer than 1,000 L4-enabled cars nationwide. Tesla delivered more than 88,000 of its EVs in China in the first quarter alone.

Plus.ai is taking the same approach, albeit focusing on L2 and L3 solutions – partial or conditional automation with the driver able to override at any time – to speed up commercialization. The company wants to standardize driving behavior across its truck fleets, which can lead to 10% savings in fuel consumption. Plus.ai has produced a L3 autonomous truck through with FAW Jiefang, China's largest truck maker. Taking an L4 truck into mass production is a medium-term ambition.

Momenta, which is backed by Nio Capital and Cathay Capital, became one of China's first autonomous driving unicorns in 2018. The company primarily provides sensor systems for L2 and L3 driving, but now has an L4 offering. Trials or robotaxis without safety drivers are planned for 2022, with profitability on individual robotaxis to come in 2024, and mass production to start shortly thereafter.

"You should not mystify algorithm. The core offering comprises data and products. In other words, whoever can generate the most data in a particular scenario can realize commercialization earlier," says Mingming Huang, a founding partner of Future Capital.

Huang believes that EVs are the key to implementation of autonomous driving and this was a consideration in Future Capital's investments in EV manufacturer Li Auto. The venture capital firm is not interested in L4 start-ups, arguing that waiting 10 years for profitability isn't an option. Strategic players like Google behind Waymo, however, can afford to be patient.

Other industry participants question whether Tesla's shadow mode can deliver a truly sophisticated L4 algorithm. "It's a trap," says Dongmin Li, CEO of JueFX, a high-precision map provider for autonomous vehicles, "The accuracy of your data is determined by your sensor. No matter how many Tesla are sold, there's no LiDAR to collect data. How can you rely on these data to train an L4 vehicle equipped with LiDAR? It's physically impossible."

There is even some skepticism about a Tesla with LiDAR. Gobi's Tang claims shadow mode is too slow and Tesla may end up choosing to license an L4 solution from others. This sentiment is echoed by Yang Gao, an assistant professor at Tsinghua University who specializes in computer vision and robotics. He says it could take Tesla 5-10 years to develop an L4 vehicle under shadow mode even if LiDARs are added on its vehicles.

For every business model, there appears to be a different set of opinions – perhaps befitting an industry where there is so much expectation yet no clear development roadmap. Mingchen Zhang, a partner at Redpoint China Ventures, an investor in Pony.ai, claims the transition is just as significant as that from horse-drawn carriages to gas-powered cars. There should be opportunities for investors all along the value chain.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.