China due diligence: Nightmare scenarios

Luckin Coffee’s precipitous rise and fall is a reminder of longstanding issues around corporate fraud in China. Failing to spot problems before they emerge remains a key concern for PE investors

Centurium Capital ended 2019 on a roll. Having closed its debut US dollar fund at $2 billion mid-year, 80% of the capital had been committed across seven investments, with two more deals pending. Moreover, a first liquidity event was locked in, following an IPO by Luckin Coffee in May.

Centurium launched Fund II in December, with a target of $2.5 billion, and made a partial exit from Luckin – at the time trading at a healthy premium to its IPO price – in January, taking nearly $232 million off the table. A $2 billion first close on Fund II was scheduled for the end of the first quarter.

Then disaster struck. In early April, Luckin admitted that RMB2.2 billion ($310 million) worth of sales booked in 2019 – equivalent to 75% of the total for the year through September – were fabricated. The company had risen from nothing to become China's second-largest coffee shop chain within 18 months, dismissing concerns about near-term losses with assertions that scale and technology would bring down unit costs. This new economy narrative collapsed as quickly as the share price.

With the launch of an internal investigation that ultimately confirmed the initial findings, Centurium quietly postponed its fundraise. This wasn't just any deal: Luckin was the firm's first and highest-profile investment, a showcase of how it works with companies. "At best, we will have to re-underwrite the entire investment thesis before we go back in," says one LP. "At worst, there won't be a Fund II."

It is too early to pass definitive judgment on Centurium as a franchise (the firm declined to comment for this story). There is much around the Luckin that has yet to be resolved, not least the future of the now delisted company, a class-action lawsuit, and who knew what and when. These would be top of mind for LPs deciding whether Luckin is an aberration that can be forgiven – and thanks to the partial exit, one that won't lose them money – or a fundamental obstacle to recommitment.

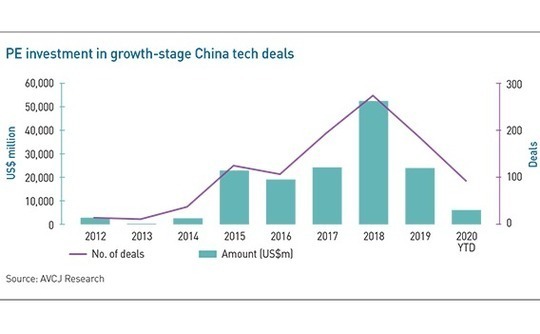

The situation has also reopened the debate on corporate fraud in China and whether private equity firms do enough to protect themselves. There is a sense that investors are pursuing moving targets, trying to keep up to speed with companies or individuals who find new ways to conceal their subterfuge. The shift towards technology investments – younger companies with asset-light business models, which means there is less to conduct due diligence on – further complicates this process.

"The sophistication of companies when it comes to obfuscating assets or conducting transactions offshore has gone through the roof. They also have a much better understanding of international accounting principles and what short sellers will look for," says Greg Hallahan, a senior managing director at FTI Consulting. "At the same time, so much is moving away from the sale of tangible goods and services and payment methods are moving online, so it's harder to track flows of money."

Track and trace

Nearly a decade ago, Hallahan participated in the first China investigation conducted by short-seller Muddy Waters. A small team rented a room in the hotel opposite the gate of the manufacturing plant, set up a camera, and tracked the trucks coming in and out. From these data, they came up with production volume estimates and compared them with what Orient Paper was reporting.

Financial frauds still leave a trace, but finding it is seldom so straightforward. At Luckin, sales were fabricated by having third parties masquerading as corporate customers make bulk purchases of discounted coffee vouchers. Payments for raw materials and delivery services needed to satisfy these supposed orders were made to fictitious suppliers. While the counterparties were fake, the corporate entities used to process these transactions were genuine.

"The core fraud issues are the same – generating sales that don't exist or there is a high possibility they unwind and not paying taxes – but the way cash is extracted from businesses has become more convoluted. It used to be fixed-asset purchases and related-party loans, which are obvious on the balance sheet. Hiding it within what looks like legitimate business expenses has become the new norm," says Xuong Liu, a managing director at Alvarez & Marsal (A&M).

Detecting fraud, therefore, means digging a few layers deeper. The offenders at Luckin left a string of other anomalies that might have registered with someone who knew what they were looking for. For example, the length of time it took to convert inventory into sales fell by more than half during the first nine months of 2019. Most retailers find this figure rises in tandem with sales because their business is becoming larger and more complex.

Luckin was also posting significant improvements in working capital and operating cash flows due to an increase in outstanding advertising expenses. At the same time, the number of days required to settle these debts rose from nine to 90 in the space of six months, versus and industry standard of 15 days. This raises the suspicion that cash is being round-tripped through expenses. "Someone at the PE firm should be looking at that and asking questions of the company," Liu says.

A separate, alleged fraud from earlier this year involving online education player GSX Techedu demonstrates the challenges posed by technology-related business models. Based on an analysis of attendance records, Muddy Waters suggested the company was inflating student numbers by using bots and facilitating multiple logins from single IP addresses. GSX Techedu has refuted the claims.

"It wasn't a classic cash-in-an-envelope real estate industry situation; it was a very technical issue that the fraud sat in," says FTI's Hallahan. "You can't detect it by looking through financial statements, it's more complicated. It's about understanding coding and online activity."

Several investors note that the problems at Luckin appear to be specific to the company rather than the business model or industry. However, there is a danger that governance gets overlooked in fast-growing segments – by companies competing for market share and by investors moving quickly to get into the best deals – and a lack of reliable data points exacerbates this.

"Arguably it's harder with asset-light business models, but when you work with the big four accounting firms or with advisors familiar with these business models, there are tools that can be used to verify the numbers," says one China-focused GP. "I think it's more difficult not so much because of the online element, but because there aren't a lot of historical numbers. Some of these companies have only existed for a year; you don't have multiple years of audited financials."

Getting comfortable

Investigation and advisory firms attest that the level of rigor applied to pre-deal due diligence varies considerably within the private equity industry. The same applies to oversight during the holding period, although getting access to information is always harder as a minority investor.

Any investor underwriting or re-underwriting a commitment to Centurium would need to review the firm's due diligence and governance practices. Digging into the specifics of Luckin would be part of this. However, there are limits on how much Centurium or founder David Li – previously a Luckin board member – can divulge given public shareholders are involved. Luckin's immediate priority is coming to an arrangement with bondholders. That will dictate what happens next.

One LP would like an answer to a specific question. Muddy Waters circulated an anonymous report on the last Friday in January that drew on WeChat conversations and hours of video footage recorded at branches to allege Luckin was inflating sales. The company issued a rebuttal the following Monday. "How could the board, over a weekend, get to the bottom of 100 pages of allegations, some of which were wrong and some of which turned out to be true?"

According to a source familiar with the situation, the board asked the company to provide relevant financial data and this didn't tally with the contents of the report. Luckin was asked to engage a third party to investigate further but the annual audit began soon after and discrepancies emerged.

Winning over existing investors – which include the likes of GIC Private, Ontario Teachers' Pension Plan, and Washington State Investment Board – is crucial. They have first-hand knowledge of the GP and how it operates, which means it might be easier for them to get comfortable with a re-up, while new investors struggle to look past Luckin. GIC is identified as especially important because it co-invested in Luckin in addition to committing capital to the fund.

Working on the assumption of a $2 billion target for Fund II, one placement agent suggests that if existing LPs are willing to put up $1.5 billion, the fundraise would be viable. If they won't go to $1 billion, it would be challenging.

"In an environment where you don't have to do China given the current geopolitical risk, why out of all the China funds, would you pick this one as a new investor?" the agent adds. "Going to your investment committee, knowing what has happened before and not knowing how you would explain yourself if it happened again – that's a big risk."

What might count in Centurium's favor is the strong conviction among LPs on Li from the first fundraise. He previously spent 14 years with Warburg Pincus, establishing the China business and building what is generally described as an impressive track record. A second LP recalls talking to several peers and being somewhat surprised by their willingness to look past Luckin, though they wanted any potential legal issues to be resolved before committing capital.

Another investor agrees that Centurium has assembled a high-caliber team in a relatively shallow China market but warns that some of the dialogue around fundraising could be fraught: "[Li] was positioned as a hands-on deal guy, someone who rolls up his sleeves and gets involved in companies. He has lost some rep in the market."

In this context, picking the right business partners is as important as picking apart financials. Noting the challenges presented by young, asset-light companies – and the reality that if a founder is determined to perpetrate a fraud, there is only so much that can be done to stop it – several China GPs emphasize the importance of management integrity and track record. "These checks aren't done by third parties," says one. "The deal team must look at management quality."

In most cases, some of the background work is outsourced. Jessica Pyman, regional head of business intelligence for Asia Pacific at Control Risks, notes her team is being asked to provide more of a blended service: anomalies in the commercial and financial due diligence are the starting point and these are reverse engineered to see if they can be traced back to integrity issues.

Red flags in this area include: a high proportion of transactions that involve related parties, intercompany lending or are anomalous to the usual scope of business; the use of unknown auditors or frequent changes in auditor; a history of contractual issues or litigation; and a high churn of senior executives or a tight cabal of family and friends as the major shareholders. While noting that it is easy to be wise after the event, Pyman notes that Luckin didn't have a clean bill of health.

"There was a people element: the founder's background and the cabal of investors whose attitude to the company and to value creation was dubious. They pledged their shares before the IPO, which in and of itself is not exceptional, but when you add in the aspirational nature of the business model and the fact that the barriers to entry were not high – they just had to do it bigger and faster than everyone else – you get a sense of why a lot of people turned down that deal," she says.

For Centurium, this might be the hardest part to explain. Jenny Qian, Luckin's founder, was formerly COO of China Auto Rental (CAR) and her main backer was Zhengyao Lu, CEO of CAR. Li invested in CAR and chauffeured car services spin-out Ucar while at Warburg Pincus and these relationships are said to have facilitated Centurium's role in the development of Luckin's business model. Joy Capital founder Erhai Liu also used his status as one of the earliest investors in CAR to get access to Luckin.

Qian and Jean Liu, Luckin's COO and previously an executive at CAR, were blamed for directing the fraud and dismissed. Another Ucar alumnus subsequently became CEO and chairman as Lu, Li and Liu all left the board.

Learning process

It is difficult to identify cases of fraud in China of such scale or scandal that they have damaged a private equity firm's reputation beyond repair. Tianhe Chemicals perhaps comes closest. Morgan Stanley Private Equity Asia (MSPEA) committed $300 million to the company in 2012 – its largest-ever deal – and an IPO came two years later. Three months after that, short-sellers accused Tianhe of making false statements in its prospectus. Despite a rebuttal, the company's stock price collapsed.

MSPEA closed its fourth fund on $1.7 billion a few months before the short-sellers attacked. Fund V is still in the market and LP sources say a final close of sub-$1 billion is likely by year-end. They point to Tianhe as one of several contributing factors to the firm's subsequent difficulties getting traction, although the performance of Fund III – which contains Tianhe – has been boosted by partially realized returns on China Feihe, a dairy business that listed in Hong Kong.

Investigators and advisors hoped that the sheer size of the Tianhe scandal would be a wake-up call for the industry, prompting greater investment in due diligence. They have to some extent been disappointed. While some clients are plugged in on the issue, others continue to take a more laissez-faire approach and minimize the amount of time and money spent in this area.

"There have been several mini versions of [Tianhe] along the way, almost every year, and each time I'm hoping it will be a catalyst for change in how companies approach pre-transactional due diligence and a commitment to the resources required to undertake a thorough review of a proposed investment."

A&M's Liu believes compliance in China will eventually improve, following in the footsteps of more developed markets like Europe and the US, where reforms were necessary to underpin confidence in capital markets. No system is perfect, but there must be buy-in from multiple stakeholders, including policymakers, regulators and LPs. Indeed, being held to account on the fundraising trail might rank among the most powerful incentives.

Several LPs sketch out potential outcomes for Centurium, assuming no further Luckin trouble, strong performance from the rest of the portfolio, and support from a bulwark of existing LPs. Raising a smaller second fund or delaying the fundraise by 12 months – both would allow time to reprove the thesis; the former might also appease LPs through co-investment – are prominent among them.

And then one LP takes a more holistic view, expressing the hope that Li emerges from the experience a better investor: "He is or was held in such high regard by partners and businesses he had invested in, by advisors, by colleagues. All of that coming together was partly why he was able to raise the money – and why what's happened since has probably been a humbling experience."

It chimes in with Liu's observation about change driven by a recognition of a lucky escape. "These things mean their existence is in jeopardy if it doesn't go well," he says. "Everyone looks at that situation and says I'm glad it wasn't me."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.