India venture capital: Local largesse

India’s venture capital industry is entering a new decade with a growing pool of local early-stage managers, a wider variety of funding sources, and a host of new risks and opportunities

Arkam Ventures is the new name for Unitary Helion, a VC firm established by Rahul Chandra, who previously co-founded Helion Ventures. The name was chosen because Arkam means limitless in Sanskrit, an Indo-Aryan language considered an ancestor of Hindi. Earlier in the year, the firm achieved a first close of INR3.25 billion ($43.5 million) on its debut fund, which has a target of INR7.25 billion.

Chandra is getting back to investment management after a year spent chronicling the early history of Indian venture capital in a book titled "The Moonshot Game." He still has a healthy appetite for VC, while conceding much has changed since he cut his teeth with Walden International more than 20 years ago.

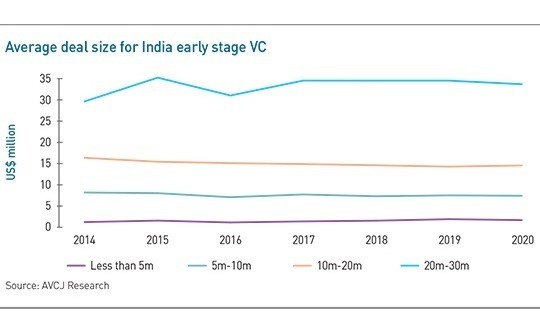

A notable development is an explosion in seed and micro VC players over the last six years, which has increased funding options for start-ups. "The rules of the game have certainly changed. Access to institutional capital has been democratized – start-ups can get capital from micro VC firms and local family offices are contributing to VC funds too," Chandra says.

"It is easier to judge a start-up now as they have a longer runway at the seed stage to create proof points reducing Series A risk."

Aggressive investment and operational support by the Small Industries Development Bank of India has played a key role in fostering growth of these local funds. But they are not alone in the early-stage space. Last year, Singapore-based incubator Antler decided to launch operations in India, with a view to investing up to $50 million in 40 start-ups. It joins a foreign contingent that already features Y Combinator, Entrepreneur First and Techstars.

Generation next

When the first wave of local venture capital firms emerged circa 2006, many operated as affiliates of US players that took the lead on fundraising. The founders were often India returnees who had previously worked in finance abroad. A second wave formed in the 2010s, most of them spinouts. It was difficult for founders to get traction with LPs if they didn't have at least a decade of investing experience.

Now, it seems that the newest breed of VCs can get started without a track record, provided they have a clear thesis or relevant experience.

"Those of us that are new are very specific about what we do," says Pranav Pai, who established 3one4 Capital with his brother Siddharth. "The newer breed of firms grow very quickly because the start-ups we back are growing faster as well. The same revenue target in 2012 can be achieved faster in 2020 and we will probably raise new funds sooner."

Both in their 20s, the Pai brothers are sons of T. V. Mohandas Pai, a former CFO of IT services giant Infosys. They launched their debut fund in 2016 and have since raised a successor vehicle. This implies a set of connections among India's nouveau riche, a group that is also growing in size.

According to Capgemini's latest global wealth report, India is home to more than 263,000 high net worth individuals (HNWIs) – defined as those with investable assets exceeding $1 million. China has five times as many, but the Indian contingent is increasingly turning to venture capital for wealth preservation.

At the same time, more venture capital firms are being launched by entrepreneurs who are building on experience as personal investors in start-ups founded by their peers. In June, Ambarish Gupta, the former CEO of cloud telephony solution provider Knowlarity, launched Basis Vectors, a software-as-a-service-focused firm, and raised $50 million for his debut fund. Oyo founder Ritesh Agarwal recently established Aroa Ventures in Singapore.

Kumar believes only a handful of local investors are willing to invest in Indian start-ups beyond the Series B stage and he wants to fill this gap. "The number of early-stage deals has increased exponentially but how many of those start-ups raise Series A rounds or beyond?" he asks. "The mortality rate of Indian start-ups is increasing and that's not a good sign. Specialization and focus are needed within the ecosystem."

A91 Partners, a spinout from Sequoia Capital India, and Iron Pillar Ventures operate slightly earlier but the duo made their debuts in the last two years as well.

However, late-stage investors observe that their space is more challenging because of unreasonable valuation expectations. "Overall, valuations have been okay for Series A deals," says one growth equity investor. "At the B and C stages, they have gotten out of whack. Some businesses are overvalued and oftentimes unjustifiably so."

With global VC firms specializing in early-stage deals raising larger pools of capital and their local peers expected to follow suit, Kumar warns that the Series A space could soon become more crowded.

His advice is that early-stage players should restrict themselves to two focus areas if they do not have a large team. "There is no need for another fund saying I'm going to do multi-sector early stage," Kumar says. Further, niche areas like climate change and sub-categories within healthcare and education are not being explored as too many investors pursue diversified portfolios.

A Hong Kong-based fund-of-funds LP stresses that Indian venture capital investors with generalist strategies need to nurture field specialists. This requires a decade-long commitment to a certain area of expertise, and while some Indian investment professionals don't have sufficient patience, the message is beginning to sink in among the firms launched in the earlier part of the previous decade.

"In China, there's almost no such thing as a generalist anymore. At successful venture capital firms, they have honed people with very strong skills in enterprise or healthcare investing or whatever the case may be," says the LP.

For emerging Indian venture capital firms that want to look beyond family office and HNWI funding sources, development finance institutions (DFIs) are a frequent port of call. However, investment theses must be tailored to social as well as economic gains, for example improving living standards by introducing technology that makes goods and services more accessible and affordable.

"We want to focus on venture capital firms that do not just invest in e-commerce, consumer-based technology, software-as-a-service or financial technology start-ups," says Alagappan Murugappan, a managing director for Asia funds at CDC Group, a UK-headquartered DFI. "Venture capital can help economies become more inclusive and produce services that cater to the lower-income segment of the population."

While investing experience remains an important consideration, CDC is willing to back first-time managers.

Risk factors

New entrants must also be mindful of the profligacy of their predecessors and concentrate on sustainable business models. The implosion of WeWork was damaging for the VC industry globally, with Karthik Reddy, a co-founder of Blume Ventures, noting that investors are now obliged to be more sharply focused on the bottom line.

In this sense, COVID-19 is a double-edged sword. It has accelerated existing digitization trends across multiple industries, but start-ups will struggle to meet financial performance targets in an economic downturn. "Everyone who became a unicorn in the last five years focused on growing their valuation without focusing on bottom line but there has been a shift," says Reddy. "It doesn't matter who is on your cap table. You need to build a sustainable path towards profitability."

CDC's Murugappan adds that venture capital firms able to mentor start-ups and help them develop responses to the changing conditions will be seen in a favorable light next year.

A failure to appreciate that what worked pre-COVID-19 might not be a viable business model going forward could be harmful to all managers. But less experienced players who are keen to boost their exposure to a popular sector like education are especially vulnerable. "Whatever the VC flavor of the month that's where you'll see more start-ups forming," says Avaatar's Kumar. "However, the past is not a predictor of the future."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.