China semiconductor: The chips are up

Excluded from US supply chains, China is looking to satisfy its semiconductor appetite from within. Domestic start-ups can command huge valuations, but are they sustainable?

China is a country with no heart. This saying entered public discourse a couple of years ago in relation to the relative paucity of the country's semiconductor manufacturing capacity. Chip and heart are pronounced the same in Chinese.

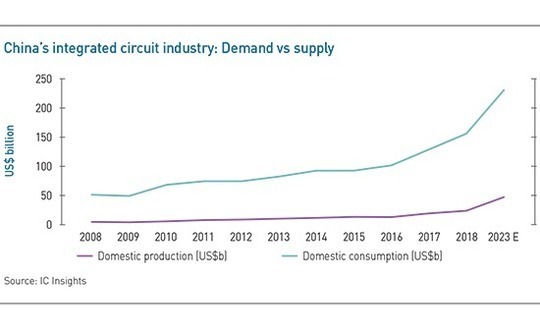

More than 60% of the world's semiconductors end up in China, many of them installed in handsets produced by smart phone manufacturers. It is home to nine of the world's top 12. Last year, imports of these hearts – electronic circuits that comprise one part of a semiconductor, otherwise known as chips or integrated circuits (IC) – amounted to $305 billion. This represented 15% of the country's overall import value. China's IC trade deficit was $203 billion, according to customs statistics.

It was a generally accepted reality of global supply chains; something China wanted to change, but in the long term. The equilibrium shattered in 2018 when the US banned domestic companies from selling components to ZTE Corporation, a state-controlled telecom equipment manufacturer.

This created an opportunity for Chinese chipmakers to fill the supply void, but VC investors who started tracking the industry long before that say they found little worth backing. David Yuan, founder of Redpoint China Ventures, recalls that none of the companies he visited in 2005 had real growth potential. "When device manufacturers can easily purchase chips from established US companies, why would they bother with a domestic brand they've never heard of?" he says.

However, calls for a "Chinese heart" became louder last year as Huawei Technologies was added to the US blacklist. Suddenly, securing supply chains by identifying local replacement partners became a priority for all Chinese high-tech manufacturers.

"Before that, we mainly looked at overseas high-tech projects and focusing on bringing them to domestic giants. But when the trade tensions started getting worse, they were looking for domestic substitutes even though the quality wouldn't be a 100% match," says Guang Yang, founder of Glory Ventures.

A torrent of start-ups and spin-offs have since emerged, many of them receiving VC backing. Mulong Gong, a Beijing-based managing partner in law firm King & Wood Mallesons, observes that investment started to accelerate in 2019 and the industry has never been hotter. There have been 38 VC funding rounds in China's semiconductor space so far this year, AVCJ Research's records show. This compares to 12-month totals of 44 and 32 in 2019 and 2018, respectively. Between 2012 and 2017, there were fewer than 50.

"Sequoia Capital and IDG Capital are both increasing their allocations to chipmakers. We've seen many other consumer-focused firms investing in chips recently," says Eric Gao, CEO of Winsoul Capital, a financial adviser specializing in technology. Hing Wong, a partner at Walden International, adds that it is hard to find an investor that isn't betting big on chips.

A rising tide

The big picture scenario is that a decoupling of China and the US extends from trade into technology, leading to the creation of independent ecosystems served by their own supply chains. Then there is the more immediate lure of Shanghai's Science & Technology Innovation Board, also known as the Star Market.

Since April, an average of two semiconductor companies have listed on this bourse every week. Semiconductor Manufacturing International Corporation (SMIC), China's biggest chip maker, provided the crowning glory by raising RMB53.2 billion ($7.6 billion). It was the mainland's largest offering in 10 years. The stock ended its first day of trading at a 246% premium to its IPO price, giving SMIC a price-to-earnings ratio of 300.

"The return on investments in the past two years is better than for investments made much earlier and held for a decade," says Hong Yin, a principal at Huaxing Growth Capital.

However, the Star Market has also changed the way in which domestic investors assess companies: profit is no longer a hard requirement. As a result, public market excitement has filtered through into private market valuations, creating what many regard as an IC bubble. "Investors who follow traditional investment philosophy should not buy in at sky-high valuations, but they don't want to miss out," says Lidong Zhao, founder and CEO of Enflame, an AI chip start-up backed by Tencent Holdings. "They believe that making a wrong bet is not as bad as missing a huge opportunity."

Broadcom, Qualcomm, Nvidia, MediaTek and AMD are the global leaders in design. Their concepts are cast in silicon – or fabricated – by the foundries, with specialist packaging and testing companies completing the final step in the production process. "The foundry is the infrastructure of the whole industry," explains Jie Yuan, an associate professor at Hong Kong University of Science & Technology (HKUST), who leads the mixed-signal and sensory IC lab.

Government-backed funds are largely responsible for providing this infrastructure. Names like Tsinghua Unigroup and Sino IC Capital became internationally recognizable for attempts to buy assets overseas that were thwarted by US regulators. But they are also active in domestic construction and doubled down in this area when international acquisitions became politically unpalatable.

The National Integrated Circuit Industry Investment Fund (IC Fund) - managed by Sino IC - is at the forefront of these efforts. The first iteration of the fund closed at RMB138 billion in 2014, of which 65% was deployed in foundries, 17% in chip design, 10% in packaging and testing, and 8% in materials. A second iteration launched last year with initial capital of RMB200 billion.

The IC Fund usually partners with other government guidance funds on foundry deals. In May, it pumped $1.5 billion into a subsidiary of SMIC, with Shanghai Technology Venture Capital Group contributing $750 million. Other investments include two foundries focused on memory cards, Yangtze Memory Technology Corp, and Changxin Memory Technologies. The governments of Hubei province and Wuhan city supported those deals, reflecting where the infrastructure will be located.

Yuan expects IC Fund II to allocate more capital to equipment and materials than its predecessor. With several large foundries now well-established – though Taiwan Semiconductor Manufacturing Corporation, US-based GlobalFoundries, and Samsung remain the global leaders – the industry bottleneck has shifted. Restrictions on imports of equipment from the US, such as lithography machines, are a key contributor to this new bottleneck.

Demand and supply

Private equity and venture capital interest in the semiconductor space stretches from new materials to equipment to chip design. However, design is considered the most attractive segment – it has the highest technology content and is the least capital intensive – so most of the recent deals have happened there.

While Walden, a semiconductor specialist, argues that chip investment has a very high entry bar and is only suitable for those with extensive industry knowledge, there are ways to make appropriate judgments. Vision Knight Capital leverages its industry networks to help companies find customers and relies on the judgment of those customers. Although best-known as a consumer-internet investor, it backed four chip players last year.

"Bosheng Guangdian designs chips that can be used for facial recognition in payment systems, so we brought in Alipay," says David Wei, founder of Vision Knight and a former CEO of Alibaba.com. "Alipay believes it is advanced technology and will use the chip in its devices." By the same logic, Hisense Broadband, a leading equipment provider for cable TV and communication networks, validated a start-up focused on transmission chip design.

Bringing the supplier to the end-customer makes sense given many Chinese device manufacturers are looking for domestic substitutes. Vertilite, a Glory Ventures portfolio company that develops lasers commonly used in facial identification, has become Huawei's largest supplier following the US-China tensions. Huawei recently invested in the company.

While domestic replacement is an inevitable investment theme, some investors are betting on emerging industry segments where they feel Chinese companies can compete directly with global leaders. Artificial intelligence (AI) chips – designed to support deep-learning networks and algorithms – are perhaps the best example.

"Since 2012, the amount of compute used in the largest AI training runs has doubled every three-and-a-half months. These improvements have been a key component in AI progress," says Alex Zhou, a partner at Qiming Venture Partners. "AI could allow semiconductor companies to capture 40-50% of total value from the technology stack, compared to 10% in more mature industries. It's the best opportunity they've had in decades."

Unlike the first silicon boom which centered on the Bay Area, this latest wave of AI chip development spans the US, China, Europe, and Israel. As of mid-2019, VC firms had invested more than $2.6 billion across 40 start-ups until mid-2019, with China leading the way. In 2018, investments in AI chip companies in China eclipsed those in the US, according to a report by US-based Ark Investment Management.

This trend is accelerating. A string of substantial AI chip deals were announced in the first half of 2020. They include a RMB1.1 billion Series A round for Biren Technology that featured Qiming, IDG and Walden. It is said to be the largest ever Series A in the chip design space.

Biren was founded by Wen Zhang, a former president of AI technology developer SenseTime. A source close to the company told AVCJ that Biren's technology team is a spinout from Huawei's US research team and the company is now valued at $800 million.

Others have made forays into areas barely out of the prototype stage. These include AI processing, where electronic chips are being replaced by optical chips in the expectation that processing information using light will lead to higher speeds, lower latency, and lower power consumption. In April, CICC Capital and Matrix Partners provided Series A funding for US and China-based Lightelligence, a specialist in this area.

"We prefer areas with high technical barriers and rapid growth in the application market, while the industry structure still has room for adjustment. AI chips are still in the early stage of development, so there are many different technical routes being explored, which brings huge opportunities to start-up teams and investors. Some will become leading ones with huge market valuations in the future," says Qing Gao, a managing director at CICC Capital who leads the CICC Silicon Valley Fund.

Warning signs

Not all investors share this enthusiasm. China Growth Capital was an early mover in AI chips and has a sizeable exit to its name: DeePhi, a designer of deep learning accelerators, was acquired by US-based Xilinx in 2018 for $300 million. Wayne Shiong, a partner at the firm, says that AI chips have moved beyond the discovery stage to scaling and commercialization. Global players will therefore develop their own chips, squeezing out start-ups.

This corresponds to an observation in the Ark report that the addressable market even for large AI chip vendors is shrinking because Amazon, Google, Apple, and Tesla are developing chips in-house. "The key is your commercial resources. Is there a strategic investor among your shareholders who can place large orders?" says Shiong.

Enflame might be one of the lucky ones in this regard. While Alibaba Group and Huawei have already released AI chips, Tencent has kept silent. It has a more than 20% stake in Enflame and may regard the company as the best bet for AI chips. Martin Lau, Tencent's president, has said the company prefers to collaborate with partners in fields where it is not an expert.

When he launched Enflame in 2018, investors told Zhao he was already too late and the peak for AI chips was 12 months earlier. However, the trade tensions have provided a second chance.

"AI training chips are completely different from traditional CPU and GPU chips in terms of the technical barriers. So far, Nvidia is the only company with a commercialized solution, which means there are huge opportunities for newcomers," says Zhao. "Chinese companies even have some advantages. Not only is China the most developed country in terms of internet usage, but we are close to our customers and can therefore better support local needs."

Redpoint led Enflame's Series A round and Yuan believes it will be the first Chinese player to commercialize AI training chips. The company released its debut product last November and expects orders to come in soon.

It remains to be seen how Redpoint and its peers exit their positions, but the Star Market appears to be a logical choice. Cambricon Technology recently became the first Chinese AI chip manufacturer to complete an IPO, raising RMB2.58 billion. The stock tripled on its first day of trading, giving the company a market capitalization of RMB100 billion.

The problem is profitability. Cambricon's losses widened from RMB444 million in 2018 to RMB1.1 billion last year, and the company admits that the route to breakeven is unclear.

Cambricon was previously a key Huawei supplier, providing terminal processor intellectual property for many of the company's devices. Huawei accounted for nearly all Cambricon's revenue in 2017 and 2018. But last year, the electronics giant introduced its own terminal AI chip and terminated orders with Cambricon. The IP share of overall revenue fell to 15%.

"Cambricon's IP model is not sustainable, the existence of such a market itself is suspicious," an industry expert tells AVCJ. "Small and medium-sized enterprises will order an entire AI solution from a supplier like Arm rather than buy separate solutions. Meanwhile, giants like Huawei will always develop their own terminal chips. They won't let others control the core technology."

Cambricon responded by creating new business lines, but there are question marks regarding sustainability. Nearly half of its revenue came from the municipal government of Zhuhai in Guangdong and 14% derived from Sugon, a superpower computer manufacturer under the Chinese Academy of Sciences (CAS). Cambricon was founded by a professor at CAS.

Valuation vortex

On this basis, is the company worthy of a RMB100 billion valuation? It is a question being asked by many investors right now, and not just about Cambricon. "Valuations are hard to rationalize right now. If you look at it from an industry perspective, it's very different from a capital markets play," says a source familiar with Legend Capital, which operates a China semiconductor fund in conjunction with Korea's SK Corporation.

Escalating losses are now often viewed with trepidation as industry participants prioritize paths to profitability. Semiconductors appear to be the exception – for now, at least. Several investors tell AVCJ they assess companies based on potential revenue over the next few years, with a price-to-revenue multiple of 10x widely cited.

One manager calculates valuations according to how much money a start-up needs. "If it takes $20 million to reach the next milestone, say the tape-out [the final stage in the design process], its valuation will naturally be high," he explains.

Most investors expect at China's national passion for semiconductors to last five years or more, until 5G infrastructure is fully deployed. But even then, the industry represents a long-term play. "We've been investing in China's semi-conductor for 20 years. When I make a deal today, I think about what the company will look like in 10 years," says Walden's Hing.

Starting in 1980, the US semiconductor industry enjoyed 20 golden years and Winsoul's Gao suggests China could be set for a similar 10-year period of rapid development, during which hundreds of large-scale chipmakers are likely to emerge. It could prove lucrative for investors – provided they don't go chasing capital markets-inflated bubbles.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.