2Q analysis: Numbers that deceive

Asia has seen remarkable revivals in private equity investment and fundraising – though not in exits – over the past three months. A handful of large-cap situations mask a weak environment

1) Investment: The Jio exception

India is among the Asian countries most severely impacted by the coronavirus outbreak. It ranks first by confirmed cases, with around half of these concentrated in six cities. A three-week nationwide lockdown was imposed in late March and then extended several times, before staged easing measures began in June. The scale of economic disruption is likely unprecedented, but it didn't stop investors plowing $9.5 billion into Jio Platforms between April and June.

In all, about a dozen groups are expected to commit INR1.1 trillion ($15.5 billion) for one-quarter of the company. This includes Facebook's purchase of a 9.9% stake and a few private equity deals that bled into the third quarter. Qualifying second-quarter investments feature the likes of Vista Equity Partners, KKR, Silver Lake, General Atlantic, TPG Capital, L Catterton, Mubadala, Saudi Arabia's Public Investment Fund, and Abu Dhabi Investment Authority.

These deals were announced separately, which means Jio Platforms bizarrely accounts for eight of the 16 largest private equity investments in Asia over the three months. (Taken together as a single growth capital fundraising exercise, they top Ant Financial's $14 billion Series C round from 2018.) And then India, despite its COVID-19 troubles, saw aggregate deployment of $12.5 billion, an all-time quarterly record.

Jio Platforms is exceptional in several respects. Formed last year as the embodiment of Reliance Industries' digital ambitions, its existing interests stretch from India's largest mobile carrier with 387.5 million subscribers to a nascent app ecosystem that will facilitate social networking, stream content, process payments, and enable e-commerce. JioMart alone could be transformative for lower-tier cities with its online-to-offline infrastructure for groceries.

Meanwhile, Jio Platforms also wants to achieve preeminence in broadband services and cable television. If it works, the PE investors could own a piece of one of the most diverse and influential digital media companies in the world. If it doesn't – and the execution risks are huge – they will hold shares in a mobile carrier with some value-added services. The recent deals value Jio Platforms at $65 billion. There are reportedly plans for a US listing next year at a valuation of $90-95 billion.

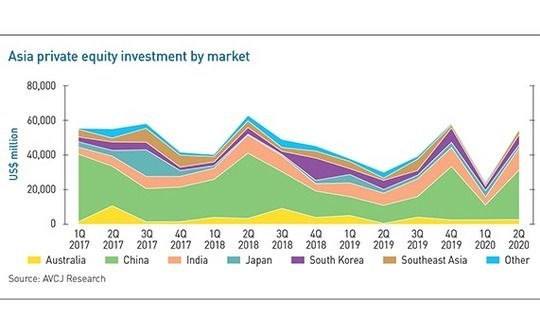

Jio Platforms was not the only exceptional case to emerge in the second quarter. Private equity investment region-wide rebounded from $24.4 billion in January-March – a six-year low to $54.9 billion in April-June. This total has been bettered only four times, and AVCJ Research's numbers are provisional, so more deals might well be disclosed over the coming weeks.

China was just as responsible as India for this fillip, with investment rising to $28.7 billion from $8.4 billion in the first quarter, but once again activity was concentrated in a relatively small number of companies. The $8.7 billion take-private of online classifieds marketplace 58.com, is poised to become the country's second-largest PE-backed buyout.

A further $4.75 billion came from Sky Solar Holdings, a take-private in Hong Kong, and Semiconductor Manufacturing South China Corporation, a growth capital deal involving several state-owned investors and a subsidiary of Shanghai-headquartered Semiconductor Manufacturing International Corporation (SMIC). Even without this deal, more than $600 million was deployed in semiconductor assets, the third-largest quarterly total. It underlines how domestic manufacturers are benefiting from supply chain shifts in response to tensions between China and the US.

The way in which China and India dominate the top 25 private equity transactions from the second quarter – they account for 18 of them – reflects how mid to large-cap deal flow in other geographies remains intermittent.

KKR's purchase of a majority stake in wealth manager Colonial First State for $1.1 billion is only the second $400 million-plus deal in Australia this year. Bain Capital's $1 billion pursuit of care provider Nichii Gakkan, which is ongoing, is one of four Japan transactions to cross this threshold, but the other three pre-date Tokyo declaring a state of emergency.

Korea has six, all announced from March onwards, which might be linked to the less severe impact of COVID-19 compared to some parts of Asia. Four came in the second quarter, but they weren't necessarily straightforward. IMM Private Equity, for example, had to observe stringent health and safety standards when negotiating the $413 million acquisition of a drug outsourcing business from Korea Kolmar Holdings. Even LP co-investors had to step outside their comfort zone, conducting management interviews by Zoom and watching video footage of factory sites.

2) Fundraising: A concentrated rebound

Just as investment in the second quarter was underpinned by a handful of very large deals, the same can be said for fundraising. About $24 billion was committed to Asia-focused funds, more than twice the first-quarter total. However, the number of partial and final closes was down on the previous three months – 76 versus 87 – representing a seven-year low.

Indeed, $0.66 out of every dollar raised was concentrated on three funds: the latest pan-regional vehicles from MBK Partners and CVC Capital Partners, which closed at $6.5 billion and $4.5 billion, respectively; and the National SME Development Fund, a Chinese government guidance vehicle that achieved a first close of RMB35.7 billion ($5 billion), including RMB15.2 billion from the Ministry of finance. The overall target is around RMB100 billion.

LPs did most of their work on MBK and CVC before the coronavirus pandemic brought international travel to a standstill. MBK also enjoyed strong support from its existing investors, with a re-up rate above 90% among an approximately 80-strong LP base.

Only one manager on the second quarter list launched and closed a fund of meaningful size under the shadow of COVID-19. Qiming Venture Partners raised $1.1 billion for its latest China VC vehicle, having moved on-site due diligence from Shanghai to San Francisco in mid-February because at that point international investors were wary of coming to China. The senior team spent 14 days in quarantine on arrival in the US, did their meetings, and the fund closed in early April.

Nisa Leung, a managing partner with Qiming, acknowledged the timing was fortuitous. Within days of making visits to endowments in the US, campuses started to close, and in-person meetings were excised from schedules.

Admittedly, since then, LPs have started to adapt to the challenging conditions. Most re-ups are waved through, while a few blue-chip managers are attracting commitments from new investors based solely on desktop due diligence and video calls. But there is a general discomfort about backing a manager where there isn't a longstanding relationship with the team. Moreover, some LPs say they must adhere to strict requirements around on-site due diligence.

In the absence of capital raising activity by independent managers, governments have come to the fore. Thanks to the National SME Development Fund, commitments to renminbi-denominated funds exceeded those to China-focused US dollar vehicles – $6.5 billion to $2.9 billion – for only the second quarter in the last eight. The last time it happened, in July-September 2019, government guidance funds were also responsible.

Now, though, such activity is imbued with additional significance. The National SME Development Fund is positioned as part of various government efforts to support small and medium-sized enterprises (SMEs), which account for 80% of China's urban jobs yet are among the worst hit by COVID-19. Similar initiatives are being launched in other Asian markets, with four of the 25 largest closes from the quarter achieved by funds that claim a coronavirus relief-related mandate.

Malaysia unveiled the MYR1.2 billion ($281 million) Penjana Nasional Fund that is intended to help drive the country's economic recovery by supporting business digitization. Meanwhile, two Singapore government agencies – EDBI and SEEDS Capital – were chosen to administer a S$285 million ($205 million) vehicle that will also support local start-ups, and Mizuho Capital closed a JPY10 billion ($93 million) fund targeting companies with post-coronavirus business succession issues.

Several other funds with similar agendas – including some that don't have government backers – have also been launched, notably in Southeast Asia. Providing capital to start-ups facing liquidity issues is a familiar theme.

3) Exits: Only the China IPOs

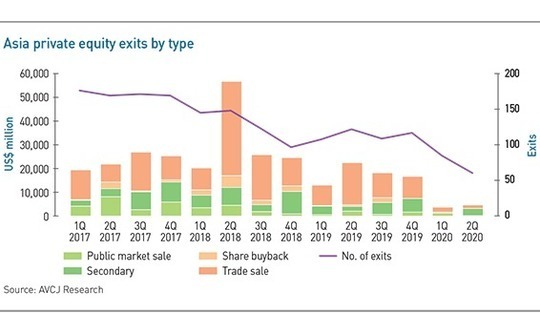

There has been no megadeal to shore up exits. The first quarter was Asia's worst since 2009, with $3.7 billion generated from approximately 80 transactions. While the $4.6 billion for April-June represents an improvement, it is still the second-lowest total from the past 10 years – and the number of exits fell to 60.

Trade sales once again bombed: they have plummeted from $9.2 billion across 68 deals in the last three months of 2019 to $2.1 billion across 56 in the first three months of 2020 to $1.5 billion across 38 in the most recent quarter. The reality is that few strategic investors can get close enough to a private equity-owned asset to conduct due diligence; and even if they could, uncertainty around valuations and recovery timelines is likely to stymie activity.

IPOs, on the other hand, held steady. The 70 private equity-backed offerings in the second quarter is the most since late 2017, while proceeds of $8.9 billion represent only a small decline on the previous three months. Shanghai's Science & Technology Innovation Board (the Star Market) remains the most active exchange, with proceeds of $2.6 billion from 18 offerings, but a further 10 companies listed on Shanghai's main board and 12 on Chinext in Shenzhen.

Remove China from the equation and a meager $500 million was raised in the second quarter. The China total includes five offerings apiece for NASDAQ and Hong Kong, of which half were healthcare companies. Eight of the 20 largest PE-backed IPOs completed between April and June came from that sector – compared to four in the previous quarter.

They represent a broad swathe of healthcare exposure, from genetic testing player Burning Rock Biotech to drug developer Akeso Biopharma. To some extent, investor appetite for the sector represents a generic post-COVID-19 bet on increased government investment and rising private spending on all kinds of services.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.