Portfolio: CBC Group and I-Mab Biopharma

CBC Group’s stewardship of I-Mab Biopharma brings an intensely hands-on platform-based approach to a booming China biotech space often characterized by relatively passive strategies

China's I-Mab Biopharma has received no shortage of advice in its four-year history. At least 13 institutional investors appear in the company's cap table, including outsourced drug developers WuXi Biologics and Tigermed, immune-therapeutics specialist Genexine, and traditional Chinese medicine stalwart Tasly.

It may therefore come as some surprise that a private equity firm – CBC Group – has remained I-Mab's most essential partner, co-developer, and strategic sounding board.

"CBC is a more strategic than a pure financial investor because they tend to take a long-term view on a company like us and work closely to share resources to help companies grow," explains Jingwu Zang, founder, honorary chairman and a director at I-Mab. "Among all our investors, I rank CBC the highest in terms of strategic value."

Indeed, I-Mab is largely a creation of CBC's platform approach to investing. The Shanghai-based healthcare specialist – formerly known as C-Bridge Capital – effectively established the company in 2016 by merging two existing portfolio companies under its early-stage affiliate I-Bridge Capital: Third Venture Biopharma and Tasgen Bio-tech.

Third Venture's strength in early-stage R&D was regarded as globally competitive but not yet advanced to the point of clinical trials. Tasgen mainly handled in-licensed products from Genexine that were well de-risked but limited in commercial scope given they only entailed ownership rights within China.

"The pipelines were very complementary with a full spectrum of products and different risk-return profiles," says Wei Fu, CBC's CEO and an I-Mab board member. "It's also synergistic from a leadership perspective. They had complementary experience and a very united, unified leadership. It was different from other mergers where you need to arrange two CEOs, who will compete with each other and probably cause unclear leadership."

People power

CBC provided a $100-150 million seed investment alongside Tasly at the time of the merger, but the GP's key contribution at the time was its leadership support. About two months prior to the deal closing, CBC invested $10 million in Simcere, a pharmaceuticals developer where Zang was chief science officer and president. It quickly parlayed this relationship into the founding talent of the I-Mab platform concept.

Zang brought six years of experience as head of China R&D at GlaxoSmithKline and a reputation as a leading immunologist globally. He initially served as I-Mab's CEO, a role he held until October last year, when the company brought in Joan Huaqiong Shen, formerly head of development for a division of Johnson & Johnson. This followed the appointment of Jielun Zhu, previously head of Asia healthcare investment banking at Jefferies Hong Kong, as CFO.

CBC facilitated introductions for both Shen and Zhu, and Fu notes that talent acquisition is the firm's number one priority. Much of I-Mab's team-building success has been attributed to going large in the initial establishment of the company, rather than a networking effort.

"When you're attracting talent, you need to be sizeable. You need to give people promising career development opportunities," he explains. "The more successful companies will get the talent. The talent, the resources, and the capital are concentrated in the leading businesses, and I-Mab is definitely one of them. They have the deepest bench in the market."

"One of the reasons we're in a better position to attract top talent is that we only focus on innovative best-in-class drug development," says Zang. "That attracts people who spend most of their lives dreaming of discovering and developing globally innovative drugs. I-Mab is that kind of platform."

CBC holds monthly meetings with I-Mab to discuss portfolio construction and asset targeting strategy. The goal is to foster a tiered development pipeline bringing together a range of de-risked late-stage assets and innovative early-stage products. This work includes scouting assets to identify the best fits in terms of I-Mab's capabilities as well as commercialization potential. Zang says that CBC's market analysis of assets has been critical to decision making around whether or not to add them to the product suite.

Meanwhile, R&D expenditure has surged, coming to about $121 million in 2019 compared to $60.7 million the prior year. I-Mab now has 11 clinical and pre-clinical products, variously focused on cancers and inflammatory diseases.

Product-market fit

Five assets have been in-licensed from global operators for use in China, two of which were made possible by CBC. These include the company's most advanced project to date, a drug candidate based on a protein associated with immune cells that targets a type of bone marrow cancer called multiple myeloma (MM). It was in-licensed in December 2017 and entered phase-three trials earlier this year.

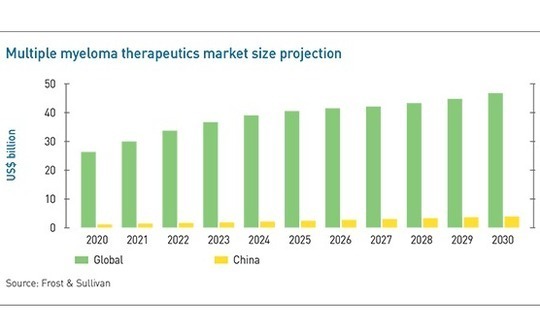

This is where CBC's asset targeting input comes into focus. There were more than 30,700 new cases of MM in 2018 in the US alone, and according to Frost & Sullivan, the global treatment market in terms of sales revenue is set to grow from $23 billion in 2019 to $47.3 billion in 2030.

In Greater China, new MM cases reached 20,500 in 2018 and are expected to top 28,300 by 2030. Much of the increase will be driven by the fact that the disease is prevalent among the elderly, a rapidly growing demographic locally. The size of the China MM therapeutics market is expected to grow from $900 million in 2019 to $3.9 billion in 2030.

CBC helped identify how products in this category could bridge from the laboratory to the market and played a significant role in assessing their viability and attractiveness early on. This work has not only been done from an investor position; the GP also demonstrated sufficient expertise to assess the drugs from a scientific perspective, even if lab-level activity is limited.

"On the business development side, CBC really contributed a lot, especially in the beginning," says Zang. "We're still talking with their business development people in the US and Europe. We share information on what assets they're aware of and what they can recommend us."

CBC attributes its ability to offer this level of operational support to a concentrated portfolio. The firm claims to have raised some $2 billion in the past five years, but has limited its portfolio to 10 companies. Nevertheless, the CBC team includes 30 investment professionals, 20 portfolio management professionals, and about 20 back office and middle office support staff. About 80% of the 70-strong team is in Asia. Fu claims to spend about 25% of his time working on I-Mab.

Expansion traction to date reflects this attention. I-Mab has raised more than $500 million since 2016, including a $220 million extended Series C round that attracted Hony Capital, Hillhouse Capital, Hopu Investments, CDH Investments, Ally Bridge Group, and EDBI. At the time, it was said to be the largest private funding round yet for a Chinese biotech company.

This has been positive reinforcement for I-Mab's profile as a global player. The company, which is headquartered in Shanghai and has bases in Beijing and Hong Kong, followed the round with the opening of a US office in Rockville, Maryland. Rockville is part of a multi-town technology corridor near Washington with a strong focus on biotech. Neighbors include the likes of AstraZeneca, GeneDX, Emergent BioSolutions, and MacroGenics, a drug developer that licensed to I-Mab a phase-two candidate targeting head and neck cancers.

Half of the product pipeline is now being developed in the US, a presence CBC is further expanding by helping advance plans for I-Mab to open San Diego branch. The private equity firm already has an office in the city headed by Jason Brown, a managing director with 20 years of experience in healthcare investing and biopharmaceutical R&D.

Brown's team is expected to offer support in terms of identifying talent in the San Diego area, which is considered an emerging biotech hub. But most of CBC's heavy lifting in terms of value-add was done in the first couple of years of development. As Fu puts it: "We use all our resources, including capital and operational support to quickly get start-ups up to critical mass. After that, they grow automatically."

Which bourse?

One major example of later-stage operational involvement stands out, however, in the lead-up to I-Mab's $114 million US IPO in January. The company knew NASDAQ, Hong Kong and Shanghai's Star Market were its main options, but there was much unfamiliar work to be done deciding between the three. Zang notes that CBC provided invaluable insights, including helping I-Mab set prices and moot valuations with US and Chinese banks. Most of the discussions with bankers happened at CBC's headquarters.

"You have to take a much longer strategic view as to how your company's going to grow, what are your strengths and weaknesses, and what capital markets really suit you," Zang says. "We had a lot of discussions on balancing the pros and cons and how this company is going to grow in the next 5-10 years. It's been a critical contribution to the growth of the company."

The IPO was eventually priced at $14 per share and became the first listing in the US by a Chinese biotech company in more than two years. The stock closed at $27.46 on July 6, representing a 96% increase in value. I-Mab has a market capitalization of about $1.6 billion.

CBC held 38% of the company prior to the IPO and controlled 35.3% immediately after. It currently maintains an approximately 35% stake, making it the largest investor ahead of Tasly, which has about 10%. Fu attributes much of the success so far to his firm's hands-on approach, which is intended to not only deliver higher returns but also foster ecosystem expertise and create barriers to entry for competing investors.

"It's hard to make sustainable, outsized returns just doing value discovery and being a passive investor," Fu says. "We generate very predictable returns through our continuous operational support."

The key to CBC's operational strategy may ultimately be in the platform-building model, however. The firm has developed a significant track record in this regard, having realized a similar investment with AffaMed Therapetics, a biosimilars specialist, and Everest Medicines, a biopharmaceuticals developer active in oncology, immunology, and heart and kidney diseases.

The idea is that, by building companies from scratch, the firm can avoid the heady valuations that often come with hot markets like biotech while also not taking on too much additional risk. This process is made possible by accruing domain expertise, which implies a virtuous cycle for portfolio support and company creation capacity.

"The reason we can achieve this is we are really proactive in supporting our portfolio companies," Fu explains. "The participation and effort that we put into I-Mab as a minority investor is a different level compared to our peers. Our entry valuations, pre-money are zero because we put in the first dollar. Therefore we can achieve better returns than our peers."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.