Portfolio: Anacacia Capital and Duncan Solutions

Following its investment in Duncan Solutions in 2018, Anacacia Capital is helping the parking management systems provider tap into demand arising from Australia’s smart city movement

Central Melbourne has 45,000 square meters of curb space dedicated to on-street parking. The city's population is expected to grow by about one-third over the next 10 years, which means more competition for a limited amount of space. Transport congestion – not helped by drivers cruising around in search of places to park – already costs Greater Melbourne A$4.6 billion ($3.1 billion) a year. By 2030, it will be A$10 billion.

At the same time, the city's 2030 transport strategy study found that the supply of off-street parking massively exceeds demand. There are 23,500 on-street berths in the municipality, while off-street berths number 193,600. One-quarter of the latter are tied to residential properties, which means residential parking spaces in Melbourne exceed the total vehicles owned by 40%. Little wonder the city has turned to technology in a bid to manage parking more efficiently.

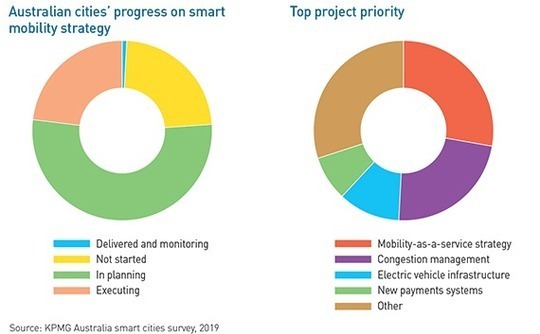

Traffic and transportation are an integral part of smart city projects, whereby urban planners leverage internet of things (IoT) technology to capture data and use the insights to improve people's lifestyles. Mobility-as-a-service (MaaS) is typically associated with fundamental changes in the way we live, work and travel: think smart cars, autonomous vehicles, telecommuting, and telemedicine. But smart parking – and smart payment for parking – is also part of the equation.

"A smart city does more with less and gives citizen stakeholders a better experience. Adapting and streamlining new parking technology fits in well with that," says Trent Loebel, CEO of Duncan Solutions. "You can give people parking availability information while they are driving to their location, so they don't have to circle the block looking for a space; you can offer more convenient payment methods; and you make life easier for people who manage parking within a council."

Demand for data

Melbourne's plans for its curb space include identifying areas that can be put to alternative use, reviewing commercial loading and residential parking permits, and introducing demand-responsive pricing. Capturing and making effective use of data will be crucial to the success of these initiatives. Other municipal and state authorities take a similar stance in their own transport development plans. After all, the Australian government's latest infrastructure audit estimates that road congestion will cost the country A$39 billion by 2031, up from A$19 billion in 2016.

Duncan Solutions, which claims to be unique in how it integrates different elements of the parking lifecycle from providing meters and payment processing to delivering usage reports and data analysis, is well-positioned to meet this demand. The Anacacia Capital-owned company has built up a strong client base of city councils, state agencies, and federal government bodies, primarily through payment services. Now it is trying to upsell them to broader, more sophisticated systems.

Duncan Solutions was formed in 2005 through the merger of four businesses: Duncan Parking Technologies, Enforcement Technology, Reino International, and Professional Account Management. The objective was to create a vertically integrated services provider for city parking solutions across the US and Australia, encompassing front-end technology, meter management, and back-end processing of fees, fines, and taxes. Ultimately, they wanted to secure long-term concessions from local authorities to manage parking operations. They failed.

"There are differences between Australian councils and US authorities in terms of parking management systems. Basically, Australia is far more advanced. In terms of outsourcing back-office processing and collection of payments, Australia is very mature while the US is immature. There was not a great deal of synergy between the two markets," Loebel explains.

In 2015, the majority shareholder decided to sell, and the business was broken up into three pieces: two parking technology providers, based in the US and Australia, respectively, and a group that handled back-office processing for government agencies. Loebel, who had been with the company for seven years as general manager for Asia Pacific, initiated a management buyout of the Australian part. Alpin, a Sydney-based investment and advisory firm, ran the process and ended up taking a stake in the business alongside Loebel. It also brought in a family office as a third investor.

Anacacia approached Duncan Solutions in 2017 and invested in September of the following year. This was the first deal out of the firm's third fund, which had closed at A$300 million a few months earlier. It targets profitable companies with annual revenue of A$20-300 million. Loebel and Alpin remained as shareholders, with a few other executives taking equity stakes as well.

One of Anacacia's first contributions was helping Duncan Solutions recruit a CFO. They put forward Mark Byrne, who had previously fulfilled the same function at language technology specialist Appen, which Anacacia took public in 2015. "We said Mark would be a great candidate and let Trent and his managers interview him and make sure that they were comfortable with him. We even put him up against some other candidates," says Jeremy Samuel, founder of Anacacia. "It took a few months to get him in place, but he has been very successful in that role."

Payments plus

Loebel also credits Anacacia with plowing more capital into the PEMS platform – now six years old – so that it can leverage the full range of tools available through cloud-based, artificial intelligence-enabled systems. This has enabled Duncan Solutions to continue its migration from relying on one-off sales of hardware to generating recurring revenue from contract-based software services.

The company's core business remains parking payments. It has agreements covering approximately 10,000 meters and other payment machines across Australia, which equates to a 70% market share. Ten years ago, these devices were coin-operated, but now almost all of them accept credit cards – 10 million transactions are processed each year – or are set up for contactless payment through Apple Pay and Google Pay.

Australia ranks highly globally in terms of parking management sophistication in part because it is so pricey. According to the 2019 Global Parking Index report, released by industry information portal Parkopedia, Australia is the most expensive country for parking globally. The average daily off-street rate is $29.71, ahead of Switzerland on $25.55. It also comes first for short-term parking, with an average two-hour rate of $15.65; the US is second on $9.68. Sydney, Melbourne, and Brisbane are among the top 10 most costly cities by both measures.

For local authorities interested in making their transportation systems more efficient – which could help rectify the supply-demand imbalance responsible for high parking fees – Duncan Solutions is a potential data goldmine. The company's IoT network of meters, on- and off-street vehicle sensors, and license plate recognition cameras collect real-time user information. This is fed into the parking enterprise management system (PEMS).

While the primary function of PEMS is to authorize and process parking payments, Loebel describes it as "a holistic parking management tool for activity, payments, enforcement, as well as asset management of all those technologies." Customers can use the system to launch parking navigation applications, track vehicle infringements, and run dynamic operational and financial control dashboards. It offers visibility into the business in areas such as budgeting and maintenance, while improving the driver experience by allowing flexible payment methods and additional information.

Duncan Solutions declined to give details as to its financial performance, but AVCJ understands the company generates more than A$20 million in annual revenue, while EBITDA has increased more than 30% since Anacacia's investments. Although increasing recurring revenue from software services has been a significant factor in this growth, there is scope to extract more revenue from existing customers by providing a wider variety of services through the PEMS platform.

While the coronavirus outbreak has severely curtailed travel and put local authority budgets under pressure, Duncan Solutions isn't necessarily suffering. "We've actually seen an increase in demand and queries on the parking side," Samuel notes. "Councils are concerned about their revenue base, and parking can help on that front. We've invested in a lot of technology that helps them use digital payments, which all of our parking meters can do now."

International initiatives

Geographical expansion is another strand in the company's development plans. It has a small footprint in New Zealand, a service contract covering Macau, and recently signed a deal with a city in Malaysia. Whereas in Australia, Duncan Solutions serves as technology provider and systems operator to city council clients, Macau and Malaysia appointed local operators through tender processes. These operators then sought out technology providers.

Asia is the primary target for the company's parking management solutions offering. However, there is a smaller affiliate business, CIC Technology, that focuses on the US market as well as Australia. The company specializes in key management, offering software that allows customers to track who has access to facilities, as well as implementing additional technological and physical security measures. Duncan Solutions provided the resources that enabled a small, family-run business to scale up.

"Most of the things needed to get on that growth trajectory were offered by Duncan Solutions – strong engineering and development capability, the ability to build cloud-hosted software platform that could provide more value to the customers and generate recurring revenue, and professional outsourcing of the equipment," Loebel explains.

CIC had carved out a reliable niche serving Australian federal government agencies. Duncan Solutions helped the company broaden its coverage of corporate clients, taking in healthcare, education, property management, hospitality, transportation, and mining. On university campuses, for example, CIC installs centrally managed electronic key cabinets, which makes it easier for administrators to keep tabs on multiple contractors. A sales office opened in the US last year.

For Duncan Solutions, which will remain reliant on clients at different levels of government, the key challenge is ensuring these counterparties remain engaged with technology as it evolves. One-third of all parking transactions in Australia are still paid in cash even though 97% of the population own smart phones. The company wants to continue converting meters from coins to credit cards, while also leading the way in ticketless systems, which typically involves entering the vehicle registration number into the meter. Fewer than 1,000 of Duncan Solutions' 10,000 machines have this capability.

These solutions are not necessarily difficult to sell to local authorities that recognize the importance of reliable, efficient, and secure parking technology. However, it is one of multiple needs competing for limited financial resources. And when it comes to pitching more complex modules available on the PEMS platform – Duncan Solutions is currently working on artificial intelligence and big data analysis options – customer education must step up a gear.

"It's really about automating a lot of what they would do using gut feel and anecdotal evidence, making it more data-driven," says Loebel. "With government it's never a quick sell, it's an ongoing consultation process."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.