GP profile: GTJA Investment Group

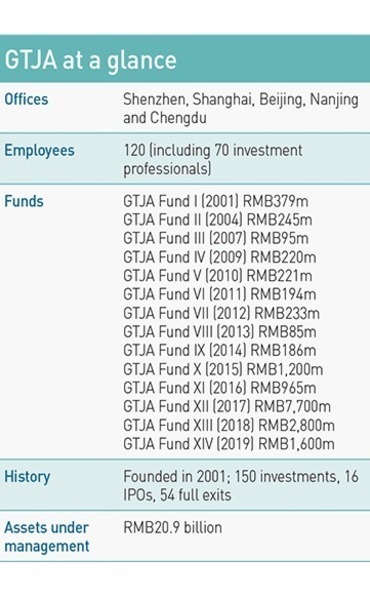

Having established itself as a leading player in the renminbi space, China healthcare sector specialist GTJA Investment Group now wants to prove its worth to overseas LPs

GTJA Investment Group fully exited Mindray Medical, China's leading medical device manufacturer, last December. Few would complain at the result: an IRR of 44%.

Yet the private equity firm's RMB358 million ($50 million) investment in Mindray three years earlier was controversial. It bought in at a valuation of RMB56 billion, more than twice what the company was worth on being delisted in the US a few months previously. But China's public markets were bullish. By the time the lock up for per-IPO investors expired, Mindray's market capitalization was RMB220 billion. Now the company is valued at RMB286 billion.

"We were the third-largest investor after two funds backed by China Life Insurance and HTSC, respectively. As a private firm, our financial resources were limited compared to those state-backed funds. If I had more capital, I would have invested more," says Dajian Cai chairman of GTJA.

In fact, this was the firm's second investment in Mindray. GTJA committed RMB20 million to Mindray in 2003 and exited two years later with a 22% IRR. Cai met the founder in 2002 at business school in Shanghai, while pursuing an EMBA. He had turned to education amidst a global bear market, but ended up convincing Mindray to delay its IPO and securing what would become a significant deal for both parties.

Goldman Sachs soon picked up on Mindray's rapid growth, made an investment and ended up taking the company public on the New York Exchange in 2007. GTJA sold its stake to offshore investors in the run-up to this event.

Without the first deal there certainly wouldn't have been a second – which followed management deciding to delist the business after several years of disappointing trading in the US. The trust that GTJA established with Mindray was rooted in a deep understanding of the alignment of interest between investor and management and how it can drive growth

"In this kind of management buyout, the founding team borrows money to buy all the shares. They are therefore motivated to take the company to a higher level. The MBO helps establish better incentive mechanisms with broader participation," says Cai.

This resonates especially strongly with GTJA as the product of a management buyout itself. The firm was established in 2001 by state-owned brokerage Guotai Junan Securities, which contributed RMB50 million in capital and became the largest shareholder. However, regulators then barred brokerages from the private equity space, prompting the team to spinout. Cai led the deal and ultimately became the major shareholder as all the existing investors were taken out.

Evergreen approach

GTJA's early activities were inspired by Warren Buffett's value investing approach: the firm's first two funds comprised internal capital, so there was no need to deliver returns within a specific cycle.

Consequently, in 2007 GTJA paid RMB85 million for 85% of blood products business Boya Bio-Pharmaceutical. Today, it remains the largest shareholder with 36% - having seen Boya's valuation grow 150-fold. It was not an investment made by chance. China's Ministry of Health wanted to standardize the industry, so Cai saw potential in backing an emerging leader.

Buyouts were unusual among domestic GPs at the time. However, Cai and his team studied past investments by the likes of The Blackstone Group and The Carlyle Group and took a similar, operations-led approach. In the four years post-acquisition, Boya's revenue tripled and it listed on Shenzhen's Chinext growth board in 2012.

Xiaoming Liang, Boya's president, tells AVCJ that GTJA helped the company take its management to a new level – all while retaining the original founding team.

"Without the introduction of standardized systems and a proper governance structure, there's no way Boya could have listed or achieved rapid growth in the latter stages," says Liang. "The core management team and key technical personnel haven't changed and the average length of service is more than 15 years. They hold shares in the company, which has helped us overcome the common problems of talent leakage and instability."

Finding success with healthcare investments like Mindray and Boya, GTJA chose to focus solely on that sector in 2013. It claims to be the first Chinese asset manager to employ a "theme-based industry investment approach."

This wasn't part of the initial plan. Guotai Junan entered the PE space to become a technology investor. However, the birth of the new business coincided with the dotcom bubble bursting. The experience offered Cai a valuable insight: technology is in a perpetual state of motion, which makes it hard to build a 100-year business.

"The evergreen performers on the stock market are usually consumer products and healthcare companies," he says. "It is difficult for a technology company to retain a leading position. Even the most influential players like IBM and Intel have lost some of their impact with the advent of new technologies."

Virtuous cycle

Having focused its attention on healthcare, GTJA has built Boya into an industry platform. Since 2013, the company has used M&A to transition into a comprehensive pharmaceutical company. Last year, blood products accounted for just one-third of Boya's RMB2.9 billion in revenue.

According to Yidan Chen, head of GTJA's international division, Boya represents a prized calling card. It makes other healthcare companies reach out and seek to engage with GTJA, while industry expertise accumulated in developing the asset helps the firm's internal efforts to construct a pipeline of new deals.

For example, GTJA was the sole participant in a RMB130 million round for pathology test business Huayin Health in 2017. Haijiao Wang, GTJA's VC head, recognized the company's potential in 2014 and started making quarterly visits. When Huayin needed capital to support growth, founder Chunbo Huang knew who to call. A term sheet was drawn up within four days and the deal closed not long after.

Several months later, a five-strong delegation from GTJA's post-investment team began spending a couple of days every month on site over a period of 10 months. They participated in detailed discussions covering all aspects of the business. This led to several alterations in strategy, notably a more concentrated product portfolio as certain business lines were terminated.

A referral platform that helps cancer patients access medical care in foreign countries was among the closures. It looked like a logical expansion of the pathology test business, but there were only a handful of customers each year.

GTJA currently manages RMB20 billion in assets. Of the 140 companies it has backed to date – securing 81 full or partial exits, including 16 IPOs in the process – 70 are in the healthcare space. Even within this sector, the firm's priorities have evolved. Drug development is the newest vertical, but now the one occupying 60% of the team's time, followed by medical devices and services.

"This area has the highest barrier to entry, carries the highest risk, and has a long cash withdrawal cycle," Chen says. "Our investments in devices and services are intended to counterbalance that."

Several of GTJA's initial forays into drug development have paid off. It led a RMB730 million round for Henlius Biotech in 2017 and saw the company go public in Hong Kong last September. Akeso Biophama is looking to follow suit, having filed for an IPO in February. GTJA is the largest institutional shareholder.

As the firm's investment scope has widened, so has its scale. In 2017, GTJA raised a record RMB7.7 billion for its 12th fund, which serves as an umbrella for multiple vehicles closed during that year. These included dedicated project funds for investments in Henlius and medical device manufacturer United Imaging Healthcare.

Cai notes that project funds are much harder to operate than conventional blind pool vehicles: "You are under pressure to find new funding channels. Once you've locked up the target company, you must mobilize the team to quickly raise the capital needed."

The overseas angle

GTJA has yet to top the 2017 total – it raised RMB2.8 billion and RMB1.6 billion in the next two years – largely due to a sharp deterioration in local fundraising conditions. The response has been to launch a US dollar-denominated fund. For GTJA, it is not purely a matter of convenience. Many Chinese healthcare companies have bases at home and overseas, which makes them a natural fit for Hong Kong and US listings. Renminbi funds cannot participate in the underlying offshore structures.

Chen was recruited last year to help GTJA bridge the cross-border gap. Educated in the US, she worked as a senior scientist at Harvard Medical School before establishing the Asian operation for a US medical device manufacturer. This was followed by a move back to Boston to launch a healthcare-focused VC firm.

Chen says she was in part drawn by GTJA's independent research team, one of few in China's private equity industry. "We are the only private investment firm with a mobile station [whereby researchers come into work on specific projects]. We have recruited three postdoctoral candidates and they normally stay for two years. Some of them focus on small molecules, some on large molecular biomedicine, and others medical devices," Chen says.

An independent research team provides a holistic view of the market, but more importantly, it helps the investment team make sense of fragmented information streams. This can lead to better decision making. "Without research, senior investors go wherever they feel like," Cai adds. "Research can screen out companies in advance as we wait for investment opportunities."

He also credits the research team for leading GTJA into PIPE deals. Citing Hillhouse Capital as an example, Cai believes PE firms should not restrict themselves to pre-IPO investments because there are plenty of attractive listed Chinese healthcare companies. GTJA claims that its PIPE strategy has found favor with overseas LPs, with Chen arguing that institutional investors will look to deploy more capital in Asia as equities markets – and economies – in the West struggle.

GTJA is in the process of recalibrating its operations so they are more in line with international standards – in order to further its US dollar fundraising ambitions. Last year, the PE, VC, PIPE and international strategies were placed into independent silos to mitigate risk and KPMG was hired to conduct an audit. A Hong Kong office and a due diligence data room, with all documentation translated into English, will come next. Once these processes and infrastructure are in place, they will form a template for the future.

That said, GTJA is trying to avoid unnecessary haste. It took the firm 20 years to become a leader in the domestic market and Chen doesn't mind spending another 20 building an international reputation. "If you are in a hurry to raise a US dollar fund, you are not acting with a long-term vision," she says. "This vision leads to a corresponding plan, which can create value for the companies you invest in."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.