Coronavirus & fundraising: Caught in a bind

The coronavirus outbreak has implications for PE fundraising well beyond China. Many Asia-based managers are either unable to go and see LPs or LPs are not permitted to visit them

"Every single AGM I had booked overseas in March and April has been canceled in the last week – full stop, canceled. But the bigger focus is looking through the underlying investees and figuring out what if any impact there might be under various scenarios, and obviously there is a wide band of scenarios depending on where you are and what kind of business you have. We are in constant dialogue, trying to figure it out in real-time, just like everyone else. There is a lot of work going on behind the scenes. We prepare for worst-case scenarios and hope for the best."

Will MacAulay, an investment manager in HESTA's private capital team, captured the mood among LPs at the recent AVCJ Australia & New Zealand Forum. His remarks also underscore how what was initially viewed as a China problem has escalated within the space of a few weeks into a global crisis, heightening the sense of uncertainty and fears of contagion.

As of March 9, there were more than 109,000 cases of coronavirus disease – COVID-19 – across 104 territories, with 3,809 lives lost, according to the World Health Organization. Set against the disruptive and destructive power of this highly virulent virus, a slowdown in fundraising seems a rather innocuous byproduct, but the seizing up of private capital flows reflects broader challenges facing stakeholders in all economies as they try to keep the money moving.

Industry events are useful bellwethers of sentiment. Within Asia, they are often accompanied by annual general meetings (AGMs), fundraising roadshows and general catchups as local GPs take advantage of the fact that institutional investors are in town. And four weeks ago, China was uppermost in people's minds. Could a mainland-based manager get an audience with an LP, even if he hadn't been home in a fortnight? Would anyone be brave enough to attend due diligence meetings in China, even for hard-to-access funds?

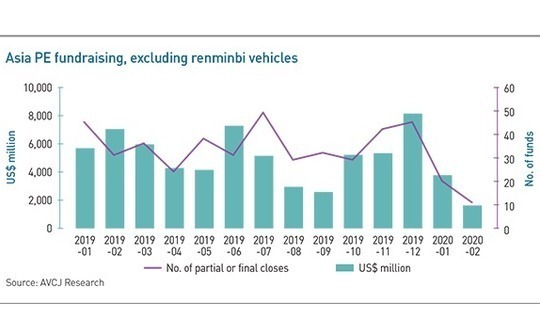

As corporate protocols kicked in regarding who you could meet and where you could meet them, the answer to these two questions soon became self-evident. One placement agent disputed the notion that China fundraising had stopped, preferring to say it had slowed down, but added that what was already likely to be a challenging year would be truly brutal.

"We have LPs that refused to take any meetings in January and February," the agent told AVCJ at the time. "We heard from one LP that they aren't going to make any decision on a China fund until the end of the year. The investment committee in New York said they want to wait for it to die down, then wait two quarters, then reassess. The minimum is probably year-end."

Mixed fortunes

Others are not so willing to write off China, although there is a logical inclination to prioritize re-ups over new relationships. Sunil Mishra, a managing director at Adams Street Partners, notes that several portfolio GPs indicated they would be fundraising in the first quarter and so preparations continue. Physical contact might be limited, which means Adams Street decides on a case-by-case basis whether it is comfortable to proceed or would prefer to wait and do more work on the ground.

"We are not taking the view that something coming from China is not of interest. We have sizeable exposure there and some high-quality people expecting to come back," he says. "We are continuing with our work, hoping that if things do go as swiftly as planned we will be in a position to come in. Others may have prolonged their fundraising schedules and we will stick to those."

PAG is said to have canceled a US roadshow in February for its second Greater China growth fund, which has a target of $500 million, and it is unclear when the official launch will come. Maison Capital is also in a holding pattern over the timing for its second US dollar fund, according to sources familiar with the situation, while Hosen Capital is eyeing a series of small rolling closes – focusing on LPs that have already done on-site due diligence – as it works towards $500 million. The target for the firm's fourth food and agriculture fund is $750 million.

"We have China funds that were in the third or fourth quarter of fundraises, where because of the virus situation, investors are not traveling to China right now, so there's a delay. Then there's a fund that we had intended to launch this quarter and will continue to pre-market, but we had to cancel on-sites with new and existing investors," another placement agent adds. "Anything that isn't a highflier we are in no rush to bring out."

Indeed, certain GPs appear to be less impeded, which suggests the gap between large-cap and small-cap players, fast closers and slow closers is growing. Few industry participants that spoke to AVCJ doubt Centurium Capital's ability to bring its second fundraise to a swift conclusion at the $2.5 billion target. Similarly, Qiming Venture Partners may have canceled on-site due diligence for its seventh fund last month, but the process is not expected to be impeded.

Thwarted wanderlust

As the China debate escalated, reluctance within the LP community to travel spread to other geographies. When BGH Capital held its AGM in Melbourne last month, Hong Kong-based executives from two Canadian pension funds, as well as representatives from Singapore's GIC Private, were unable to attend. Some other LPs are said to have expressed concerns about investors from those territories attending at all. In the end, BGH had 50 people – including multiple parties from individual organizations – participate by video conference.

While video remains an option for AGMs – although this doesn't rule out postponements – other investor engagements have been canceled across the region, with obvious consequences for planned fundraising efforts. Restrictions tend to come in three forms: LPs are unable to meet GPs from certain jurisdictions, they are unable to travel to certain jurisdictions, or they are unable to attend gatherings with more than a certain number of participants (whether or not those participants are also from forbidden jurisdictions).

Other investors might not be subject to incredibly stringent limitations, but they are just wary of getting caught up in situations beyond their control. "My biggest concern is being somewhere that has an outbreak and the government there decides you are quarantined. I'm not nervous about catching the virus, I'm nervous about not being able to do my job," says Sam Robinson, a Singapore-based managing partner for Asia private equity at North-East Family Office.

There are instances of managers going to see LPs in their home markets and getting a warm welcome. Two Japanese GPs recently visited Australia and a clear majority of their meeting requests were accepted. Meanwhile, Wei Zhou, founder of China Creation Ventures, is said to have been in the US since late December and gained traction in his fundraising process. It remains to be seen what happens if the coronavirus begins to spread more aggressively in the US and Europe. Adams Street's Mishra observes that the next 30-45 days will be crucial.

However, none of these recent obstacles to fundraising necessarily signify a change in long-term outlook. Hamish Blackman, portfolio manager responsible for investments and partnerships at NZ Super Fund, told the forum that there should be opportunities for any investor able to ride out the immediate volatility. These sentiments were echoed by HESTA's MacAulay, who noted that the average age of his membership is 43, which means the investment horizon extends beyond 20 years.

"We are looking for technologies that can create new markets, we are looking for businesses and products that can expand and change the way consumers and businesses interact with each other," he said. "Yes, those things will be impacted by supply chain shutdowns in China and by consumer sentiment in the US. But to generate the returns we want, the people we partner with are looking for opportunities that will grow irrespective of those economic conditions."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.