Coronavirus in China: Back from the brink

China GPs are trying to navigate the coronavirus uncertainty and help portfolio companies pick up the pieces, whether that means cutting costs or realizing new revenue streams

Images of empty streets, shopping malls and restaurants across China during the weeks following Lunar New Year told a story that economic statistics are now only beginning to capture. Facing the prospect of negative growth in the first quarter, Beijing plans to spend big on securing a rebound, but reviving factories that have lain idle and enticing reluctant consumers to venture from their homes is no easy task.

The China Hospitality Association estimated that restaurant revenues dropped over 90% year-on-year in January and February. Xibei Restaurant Group, a popular outfit serving northwest China cuisine, was among the first to reveal its troubles. Revenue fell more than RMB700 million ($100 million) during the month of Lunar New Year, leading to the closure of 400 stores and 20,000 job losses. "Our cash won't last for three months if it continues this way," Guolong Jia, the company's chairman, remarked last month.

Other businesses across hospitality, tourism and retail have already gone under. Baicheng.com, an online travel booking platform backed by Alibaba Group and CBC Capital, announced its closure at the end of February. A few have secured PE bailouts. Xband, a designer and operator of hotels in rural areas, received RMB200 million from TrustBridge Partners – 33 days after its establishments were temporarily closed and nine days after employees' wages were delayed.

Such is the impact of coronavirus disease, or COVID-19, which emerged in Wuhan at the end of December and has since infected more than 80,000 people nationwide and claimed over 3,000 lives. Just as China appears to be bringing it under control – daily new infections have fallen from 2,000 at the end of January to below 50 – other parts of the world are entering crisis.

The Dow Jones Industrial Average endured its worst day since the global financial crisis on March 9 amid fears of widespread outbreak. Howard Marks, co-chairman of Oaktree Capital Management, recycled a memo title – "Nobody knows" – last used after Lehman Brothers went under. "If I said anything about the coronavirus, it would be nothing but a guess," he observed.

Cash is king

But private equity and venture capital investors in China must try to navigate a path through the uncertainty and help portfolio companies pick up the pieces. There are anecdotes of management teams receiving face masks – a rare commodity – so they could continue working, but ultimately it all comes down to a question of cost and cashflow.

Like most of its peers, the post-Chinese New Year priority for Lunar, a middle-market consumer-focused buyout firm, was establishing the financial and operational state of its businesses. Derek Sulger, Lunar's founder, stresses that the long-term investment thesis is unchanged, but it is necessary to enter "survival mode" to ride out the immediate storm.

"We are using every tool and our control as buyout managers to protect value. We are tapping into new and lower-cost borrowing," he says. "We see this environment as an opportunity to reduce costs. We have used our presence across many brands in babywear, kidswear and luxury to partner with landlords who are willing to cut rents, while closing shops in locations where landlords refuse to respond to reality."

Sequoia Capital, a VC firm that made its name in China partly by backing consumer-facing start-ups willing to burn through cash reserves voraciously in the pursuit of market share, has also emphasized cost controls. Among other things, it asked founders and CEOs to think about how they could trim expenses without crippling growth prospects, reining in spending on customer acquisition, altering capital expenditure plans, and whether productivity could be increased by reducing headcount.

"Your employees are all aware of COVID-19 and are wondering how you will react and what it means for them. False optimism can easily lead you astray and prevent you from making contingency plans or taking bold action. Avoid this trap by being clinically realistic and acting decisively as circumstances change," Sequoia added.

Rodney Muse, a managing partner at Navis Capital Partners, which has some China exposure in a largely Southeast Asia-focused portfolio, identifies cost controls, conserving cash flow and reassuring important employees as the key steps. The private equity firm owns Imperial Treasure a Chinese fine dining establishment with 20-plus outlets. Six are in China and all are currently closed. The problem with survival mode is predicting how long it might last.

"There is no point in ad spend, no point in discounting," Muse says of restaurants. "The levers you might pull to create demand are predicated on elasticity, and given it's a virus-driven event, I don't think there is a lot of elasticity."

New money, new ideas

Plenty of businesses are in a similar position to Imperial Treasure, including many with much larger physical footprints and cost overheads. The longer this downturn persists, the greater the chance that some will never open their doors again. If conservative budgeting alone doesn't do enough, another option is securing new credit lines or equity infusions.

Numerous investors tell AVCJ they are helping portfolio companies establish new banking relationships and sharing research on government policy. Dozens of financing-related webinars have been held by VCs in the past two months, where business leaders can absorb insights from bankers and other financial experts.

Wei Zhou, founder of China Creation Ventures (CCV), observes that national government guidance funds and banks have launched initiatives to support small and medium-sized enterprises (SMEs), while some government departments run subsidy programs. "It's too difficult for start-ups to screen all these policy changes. We pick the most workable ones and provide summaries," he says. "We've also assisted companies applying for subsidies and asked them to share these experiences with others. We try to make it as easy as possible."

In certain situations, GPs will give companies more runway through follow-on funding. "A lot of bridge loans are being made to portfolio companies in order to tide them over. Funds are either extending additional loans themselves, or if their fund documents don't allow them to do that, they have friendly banks help the portfolio companies get a loan. Alternatively, they make additional equity investments," says Marcia Ellis, a partner at law firm Morrison & Foerster.

In addition, investors are looking for ways that companies might realize new revenue streams, especially if their existing business lines are likely to suffer a protracted downturn. Some of these involve online operators who are looking to boost capacity in response to rising demand.

Hema, Alibaba's online-to-offline fresh produce supermarket chain, has absorbed staff from Beijing restaurant chain Xinzheng Yicheng to work on order fulfillment for the duration of the crisis. Meanwhile, online retailer JD.com allied with more than 100 well-known restaurants to make home deliveries of fresh, half-finished dishes, leveraging its robust logistics network.

Several money-making initiatives directly leverage COVID-19. MMC, an unmanned aerial vehicle operator that helps power grid operators with network inspections, moved into "epidemic control" – using mounted speakers to disperse crowds at the instigation of investor Plum Capital. Changxing Zhineng, a Green Pine Capital-backed autonomous driving start-up, has developed a self-driving truck to hose down Suzhou's streets and an unmanned delivery vehicle small enough to enter buildings through lifts.

Regardless of these innovations, CEO Zufeng Zhang observes that finances will be tight until core business activities rebound. Changxing Zhineng primarily serves port operators and mining contractors, which are likely to take at least a month to fully resume activities. In these situations, overseas expansion – if a realistic aim – can offer respite. Sino-French GP Cathay Capital is helping Waytous, another autonomous vehicle start-up that works with the mining industry, to enter Africa and North America.

"If the management team is unable to travel overseas, our international team can help contact local players and advance projects, especially where those projects are already in progress but have been halted by the epidemic. When we are involved, it is easier for our portfolio companies to win the trust of foreign partners," says Lanchun Duan, a managing partner at Cathay.

Reluctant to transact?

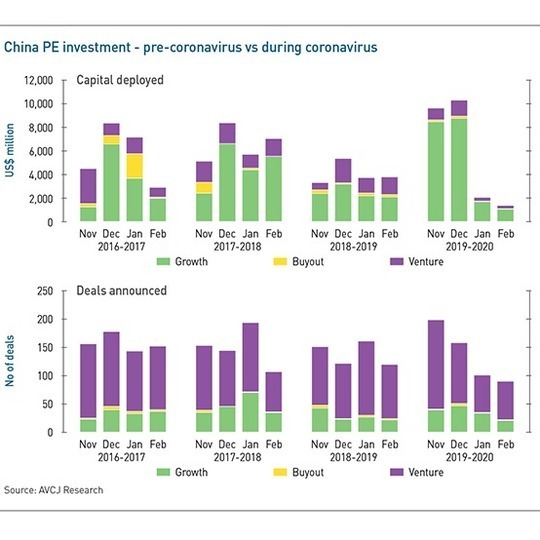

Needless to say, limited investor mobility, uncertainty over the near-term prospects, and the need to perform triage on existing portfolios, is hurting new deal flow. China often sees more activity in the final two months of the year than the first two months, largely because Lunar New Year falls in the latter period. However, the gap between November-December 2019 and January-February 2020 is remarkable.

According to AVCJ Research, $3.4 billion was deployed during the first two months compared to $19.7 billion in the last two of 2019. The number of transactions announced fell from 360 to around 190. For venture capital specifically, $2.4 billion across 270 deals in November-December became $600 million across 90 in January-February.

Investors are not predicting a second-quarter turnaround. Most of the deals announced in January and February were completed last year. Since COVID-19 emerged, new investment decisions have been put on hold due to physical obstacles. To close a typical China growth or VC transaction, once initial legal and financial due diligence work is completed, investors need to have face-to-face meetings with founders and conduct final checks on operations.

Nevertheless, some investors are still aggressively pursuing opportunities. For example, Sequoia closed 25 investments in February – more than in the same month of last year – while Cathay and Lightspeed China Partners describe themselves as in shopping mode. "We want to accelerate our pace of investment in this challenging environment," says James Mi, Lightspeed's founding partner. He signed a term sheet on his first day back in the office.

Cathay has spent most of the past two weeks screening potential investee companies. Duan observes that the firm has more than $1.5 billion capital to deploy and it's easier to do this when other players are holding back.

"There might be good companies lacking cash flow in the short term, which will give us some valuation advantage. It also allows us more time to observe and communicate with these companies. Since the final decision can only be made after a face-to-face meeting, the early contact process is prolonged, which is beneficial for us," says Duan.

Both Cathay and Lightspeed are primarily interested in new economy businesses and it remains to be seen whether sustainable trends emerge on the back of the coronavirus outbreak. Investors readily draw comparisons with SARS in 2003 when a similar reluctance to congregate in public spaces prompted rapid adoption of e-commerce. Around this time, JD.com switched to a pure online platform and Alibaba launched Taobao, its B2C channel.

Now, the excitement is focused on a different set of services that can be delivered wholly or partially online, including education, healthcare consultation, and entertainment. "Increasing traffic [since the outbreak] has saved online education institutions RMB100 billion in promotional fees, while the amount of time it takes major players to move from large-class to small-class models will fall from three years to one year," says Yu Zhu, CEO of New Oriental Education & Technology Group's online business.

Inspiration vs execution

It is easy to map out broad growth trends in which digital supplants physical, but execution isn't necessarily so straightforward. In many of these verticals earmarked for rapid growth, aspiring contenders will come up against entrenched incumbents or entrants with significant strategic backers.

In early February, online education player Yuanfudao held its first mass-participation free class, attracting five million users. The system crashed. Meanwhile, enterprise communication and collaboration platform DingTalk is said to have proved its ability to handle capacity issues as users have soared in recent weeks, rising to number one in Apple's App Store. It helps that DingTalk was developed by Alibaba and managed to rent 10,000 servers from Alibaba Cloud at short notice.

In this way, the coronavirus outbreak has underlined the importance of internet infrastructure to online service providers. If a company cannot attract paying customers, each new user will add to the cost burden.

"When we talk about opportunities in difficult situations, giant players have an advantage in new customer acquisition and services. For a start-up, even if you've got new customers, do you have enough staff to service them? And what about the supporting hardware and server bandwidth needed to maintain quality?" notes Qi Wang, a partner at Vision Plus Capital.

A similar story is playing out in the software-as-a-service (SaaS) space. It seems well-positioned to benefit from an expected proliferation in remote working arrangements, but many small players are close to collapse. Xianghui Ren, founder of SaaS platform Mingdao, claims that companies like his are no safer than restaurants and KTV lounges, the classic coronavirus losers. If the epidemic persists for six months, they will be gone.

Inopportune strategies can be just as much of a problem. One pan-regional VC investor tells AVCJ that his SaaS portfolio company is in difficulty because it serves high-end hotels. Demand has collapsed because people aren't traveling, which means there is no revenue to offset rising operating costs.

"It's the same logic as online education. SaaS as an industry has yet to develop a profit-making model, it is still at the proof-of-concept stage," says CCV's Zhou. "Therefore, it faces greater pressure at times of uncertainty."

The only viable approach for investors that don't want to get dragged into an arms race with a well-funded rival is to identify relatively untapped sub-segments in which niche operators can thrive. Haizhuo Lin, a managing director at Green Pine, describes the all-too-familiar scenario whereby the second and third-largest players in a vertical raise a few rounds of funding, fail to close the gap on the runaway leader, and then struggle to survive.

While it might be too early to distinguish enduring shifts in the market from flights of fancy, COVID-19 has taught PE and VC players one immutable lesson. SARS was deemed a one-off, but the latest outbreak has rammed home the notion that others could – probably will – follow. As such, more attention will be paid to crisis management and downside protection.

"There will be more focus on business interruption insurance and business continuity plans," says Ellis of Morrison & Foerster. "And when they draft documentation with target companies, there will be detailed questions about plans for dealing with future uncertainty. Otherwise, the investor will want the right to set up a crisis management committee of the board that takes over management and makes quick decisions in the event of another crisis."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.